Market Overview

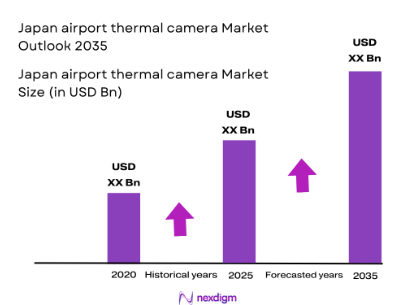

The Japan airport thermal camera market is valued at approximately USD ~ million in 2025, driven by heightened security needs and the country’s ongoing efforts to enhance airport infrastructure. Thermal cameras are critical for non-intrusive monitoring and temperature detection, especially in the wake of the COVID-19 pandemic. The market is expanding due to government and private investments in airport security technologies, ensuring a safer travel experience for passengers while boosting operational efficiency. Japan’s advanced technological landscape also supports the adoption of these systems for efficient surveillance at high-traffic airports like Tokyo Narita and Osaka Kansai.

Japan, with its highly developed aviation sector and globally renowned airports like Tokyo Narita, Haneda, and Osaka Kansai, dominates the thermal camera market in the Asia-Pacific region. These airports are at the forefront of adopting innovative security technologies due to their large passenger volumes and international connectivity. Japan’s stringent regulations on passenger safety and security, combined with its commitment to smart city and smart airport technologies, ensure the widespread use of advanced thermal camera systems to meet both security and health screening requirements.

Market Segmentation

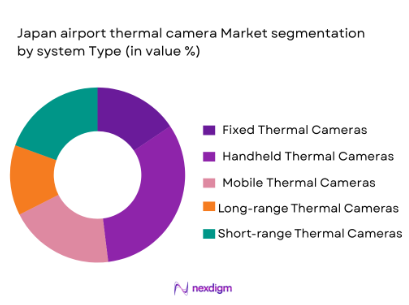

By System Type

The Japan airport thermal camera market is segmented into handheld thermal cameras, fixed thermal cameras, mobile thermal cameras, long-range thermal cameras, and short-range thermal cameras. Fixed thermal cameras hold the largest market share, primarily due to their widespread use in permanent installations at security checkpoints, baggage handling areas, and passenger terminals. These cameras offer real-time temperature detection, which is crucial for health screenings and security surveillance. Their ability to provide continuous, unobstructed monitoring makes them a preferred choice for large-scale airports like Narita and Haneda, where monitoring high passenger volumes is critical.

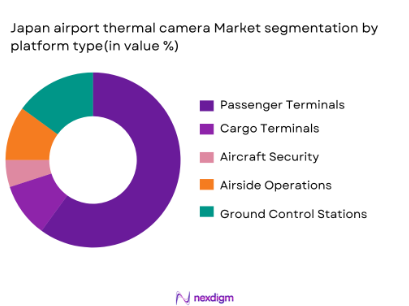

By Platform Type

The market is also segmented by platform type, which includes passenger terminals, cargo terminals, aircraft security, airside operations, and ground control stations. Passenger terminals dominate the market due to the growing demand for non-intrusive, high-efficiency security measures. Airports such as Tokyo Haneda and Narita handle millions of passengers annually, creating a significant need for effective screening solutions. Thermal cameras provide a reliable way to monitor large crowds for temperature irregularities, ensuring safety and compliance with health regulations. The trend toward non-contact temperature screenings in passenger terminals further boosts the demand for thermal cameras in these areas.

Competitive Landscape

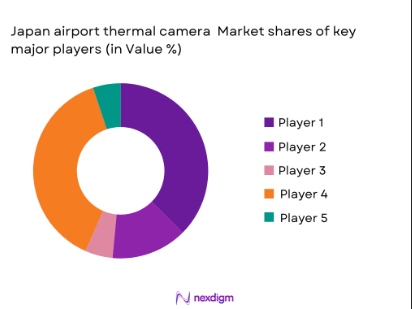

The Japan airport thermal camera market is characterized by the presence of a few key global players that provide high-quality, reliable thermal imaging solutions. Companies such as FLIR Systems, Axis Communications, Bosch Security Systems, Honeywell International, and Vivotek dominate the market, offering cutting-edge technology tailored to meet the specific needs of airport security. Their strong market presence is driven by their ability to provide advanced thermal cameras that can seamlessly integrate with existing airport security infrastructure. These companies lead the way due to their extensive product portfolios, global reach, and constant innovation in response to the increasing security demands of Japan’s airports.

| Company Name | Establishment Year | Headquarters | Product Offering | Market Reach | Innovation Focus | Major Partnerships | Revenue | Product Quality | R&D Investment | Certifications |

| FLIR Systems | 1978 | United States | – | – | – | – | – | – | – | – |

| Axis Communications | 1984 | Sweden | – | – | – | – | – | – | – | – |

| Bosch Security Systems | 1886 | Germany | – | – | – | – | – | – | – | – |

| Honeywell International | 1906 | United States | – | – | – | – | – | – | – | – |

| Vivotek | 2000 | Taiwan | – | – | – | – | – | – | – | – |

Japan Airport Thermal Camera Market Dynamics

Growth Drivers

Increasing Focus on Passenger Safety and Security Driving Demand for Thermal Camera Systems at Airports

Japan’s airports, including Tokyo Narita and Osaka Kansai, are witnessing a heightened emphasis on passenger safety, with thermal cameras becoming an integral part of security measures. The Japanese government has implemented policies to improve airport security infrastructure, allocating funds to enhance public safety through advanced monitoring systems. In 2023, passenger traffic at Japan’s airports exceeded 100 million people, reinforcing the need for efficient screening technologies like thermal cameras, which allow for non-intrusive monitoring of large crowds. This drive toward increased safety and security systems is expected to push the market further.

Expansion of Airport Infrastructure and Modernization Initiatives Increasing the Need for Surveillance Systems

The ongoing modernization and expansion of airports in Japan are contributing to a growing need for advanced surveillance systems. Airports like Tokyo Narita and Osaka Kansai are undergoing massive infrastructure upgrades to manage the increasing passenger traffic. In 2023, Japan allocated approximately ¥100 billion for the development and modernization of airport terminals. This includes investing in advanced surveillance and security systems, such as thermal cameras, to ensure seamless operations and heightened safety standards in the face of rising international travel. The increased focus on automation and smart airport technology accelerates the adoption of thermal imaging solutions.

Market Challenges

Integration Complexities with Existing Airport Surveillance Infrastructure

The integration of thermal cameras with existing airport surveillance systems presents significant technical and logistical challenges. Many Japanese airports were built with older security systems that do not easily accommodate modern technologies like thermal imaging. Retrofitting these airports with thermal cameras often involves extensive infrastructural changes and system updates, resulting in high costs and extended installation timelines. This integration complexity also requires extensive testing and validation to ensure the systems work cohesively, which further delays the deployment of thermal cameras at some airports in Japan.

Regulatory Hurdles Related to the Certification of Thermal Camera Systems for Airport Security Use

The regulatory landscape in Japan can pose challenges for the certification and deployment of thermal camera systems. Japan’s Civil Aviation Bureau (JCAB) requires all surveillance equipment to meet strict national and international safety standards, including data protection and operational reliability. The certification process can take several months, which delays the rollout of new thermal imaging technologies. Furthermore, compliance with global aviation safety regulations, such as those set by ICAO, adds another layer of complexity, hindering the adoption of new technologies in Japanese airports.

Market Opportunities

Growing Adoption of Smart Airports in Japan, Creating Demand for Advanced Surveillance Systems

Japan’s commitment to transforming its airports into smart hubs presents a significant opportunity for thermal camera systems. As part of Japan’s “Smart Airports” initiative, the government and private sectors are heavily investing in digital and automated technologies. The integration of thermal cameras is crucial in these developments, as they align with the smart airport vision of enhancing security while improving operational efficiency. In 2023, ¥15 billion was allocated specifically for digital upgrades in airport security systems, which include the installation of thermal camera systems for better monitoring and passenger safety.

Increased Passenger Flow Post-Pandemic, Necessitating More Advanced Safety and Monitoring Equipment

Japan’s airport passenger traffic has rebounded strongly post-pandemic, with major airports such as Narita and Haneda exceeding 100 million annual passengers in 2023. As passenger volumes continue to rise, there is a growing need for more advanced safety and health monitoring solutions. Thermal cameras are playing a critical role in ensuring health safety by identifying individuals with elevated body temperatures without causing delays at security checks. This rising demand for seamless health monitoring during passenger screening is providing significant growth opportunities for the thermal camera market in Japanese airports.

Future Outlook

The Japan airport thermal camera market is expected to grow significantly over the next few years. The increasing passenger traffic, coupled with Japan’s focus on smart airport technology, will drive the demand for advanced surveillance systems. With the adoption of AI and machine learning to enhance thermal camera capabilities, the market will continue to evolve, with airports looking for more efficient, cost-effective solutions. The ongoing investment in infrastructure modernization and safety regulations ensures a strong demand for thermal cameras, positioning the market for long-term growth. As health screening and security concerns remain paramount, thermal imaging systems will continue to be integral to Japan’s airport operations.

Major Players

- FLIR Systems

- Axis Communications

- Bosch Security Systems

- Honeywell International

- Vivotek

- Dahua Technology

- Hikvision

- Teledyne FLIR

- L3Harris Technologies

- Zebra Technologies

- Thermoteknix Systems

- Irisity AB

- Bosh Security and Safety Systems

- Seek Thermal

- Panasonic Corporation

Key Target Audience

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies

- Airport Authorities

- Airlines

- Airport Security Services

- Ground Handling Services

- Military and Defense Contractors

- System Integrators and MRO Providers

Research Methodology

Step 1: Identification of Key Variables

The first phase focuses on identifying the major stakeholders involved in the Japan airport thermal camera market. This includes manufacturers, airport authorities, and security agencies responsible for airport safety regulations. The goal is to gather data on the critical variables that impact the market, such as government security policies and technological advancements in thermal camera systems.

Step 2: Market Analysis and Construction

This phase involves collecting historical data on the adoption of thermal camera systems in Japanese airports. This includes analyzing trends in passenger traffic, security demands, and government investments in airport infrastructure. The aim is to build a comprehensive model that forecasts the future growth of the market based on current trends.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be tested through consultations with key stakeholders, including representatives from Japanese airports, manufacturers, and security professionals. These expert consultations will provide deeper insights into operational challenges and specific requirements for thermal camera adoption in Japanese airports, ensuring the accuracy of the market projections.

Step 4: Research Synthesis and Final Output

The final phase synthesizes all gathered data and expert feedback to create a comprehensive report on the Japan airport thermal camera market. This includes an analysis of the market’s growth drivers, challenges, and opportunities, as well as a detailed competitive landscape and future growth potential.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing focus on passenger safety and security driving demand for thermal camera systems at airports.

Expansion of airport infrastructure and modernization initiatives increasing the need for surveillance systems.

Government policies and investments in smart airport technology to improve security systems. - Market Challenges

High initial investment cost of thermal camera systems for smaller airports.

Integration complexities with existing airport surveillance infrastructure.

Regulatory hurdles related to the certification of thermal camera systems for airport security use. - Market Opportunities

Growing adoption of smart airports in Japan, creating demand for advanced surveillance systems.

Increased passenger flow post-pandemic, necessitating more advanced safety and monitoring equipment.

Rising demand for contactless passenger screening solutions driving thermal camera adoption. - Trends

Integration of AI and machine learning with thermal camera systems to enhance security monitoring.

Rising use of non-contact temperature screening solutions at airports due to health safety concerns.

Development of more compact and cost-effective thermal camera solutions for broader airport deployment.

- By Market Value 2020-2025

- By Installed Units 2020-2025

- By Average System Price 2020-2025

- By System Complexity Tier 2020-2025

- By System Type (In Value%)

Handheld Thermal Cameras

Fixed Thermal Cameras

Mobile Thermal Cameras

Long-range Thermal Cameras

Short-range Thermal Cameras - By Platform Type (In Value%)

Passenger Terminals

Cargo Terminals

Aircraft Security

Airside Operations

Ground Control Stations - By Fitment Type (In Value%)

Linefit

Retrofit

Aftermarket

OEM Channels

Maintenance and Overhaul - By End User Segment (In Value%)

Airlines

Airport Authorities

Airport Security Services

Customs and Border Protection

Ground Handling Services - By Procurement Channel (In Value%)

Direct Purchase from Manufacturers

Aftermarket Suppliers

Government Procurement

Airport Tendering Process

Online Retail

- Market Share Analysis

- Cross Comparison Parameters (Product Innovation, Market Reach, Supply Chain Efficiency, Regulatory Compliance, Technological Leadership)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Detailed Company Profiles

FLIR Systems

Axis Communications

Bosch Security Systems

Honeywell International

Vivotek

Dahua Technology

Hikvision

Teledyne FLIR

L3Harris Technologies

Zebra Technologies

Thermoteknix Systems

Irisity AB

Bosh Security and Safety Systems

Seek Thermal

Panasonic

- Airports seeking advanced monitoring and security solutions to manage increasing passenger traffic.

- Airlines investing in cutting-edge security technologies for better passenger experience and safety.

- Government bodies focusing on modernizing airport security infrastructure.

- Ground service providers seeking efficient, accurate, and non-invasive security equipment.

- Forecast Market Value 2026-2035

- Forecast Installed Units 2026-2035

- Price Forecast by System Tier 2026-2035

- Future Demand by Platform 2026-2035