Market Overview

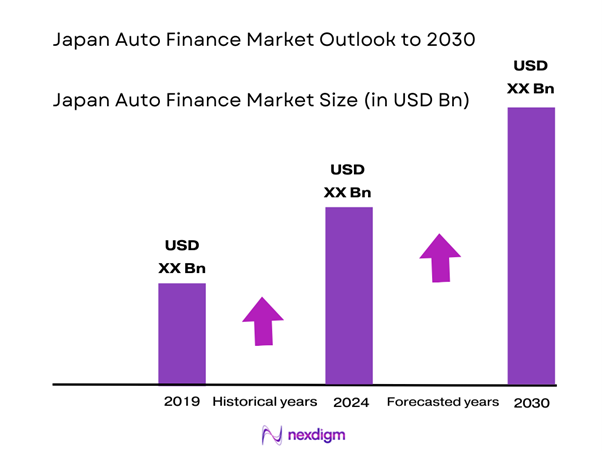

The Japan Auto Finance Market is valued at USD 11,410.0 million in 2024 with an approximated compound annual growth rate (CAGR) of 7.9% from 2024-2030, based on a comprehensive analysis of historical data and industry trends. This size is primarily driven by the increasing demand for vehicles among consumers and businesses alike, coupled with favorable financing options that make vehicle ownership more accessible.

Dominating cities in the Japan Auto Finance Market include Tokyo, Osaka, and Yokohama, which account for a significant share of vehicle sales due to their dense populations and robust economic activities. These metropolitan areas harbor numerous financial institutions, enabling efficient access to auto financing options. The presence of major automotive manufacturers in and around these cities also creates a conducive environment for a variety of financing services catering to individual and corporate customers alike, strengthening their dominance in the market.

The Japanese government is actively promoting initiatives to support electric vehicle (EV) adoption, with incentives reaching up to JPY 1 million (approximately USD 9,000) for EV purchases. As part of its broader environmental policies, Japan aims to have 20% to 30% of new car sales be electric by 2030. Such initiatives are designed to encourage not only the shift to electric vehicles but also the financing solutions that accompany them, resulting in an increased demand for auto finance services.

Market Segmentation

By Customer Segment

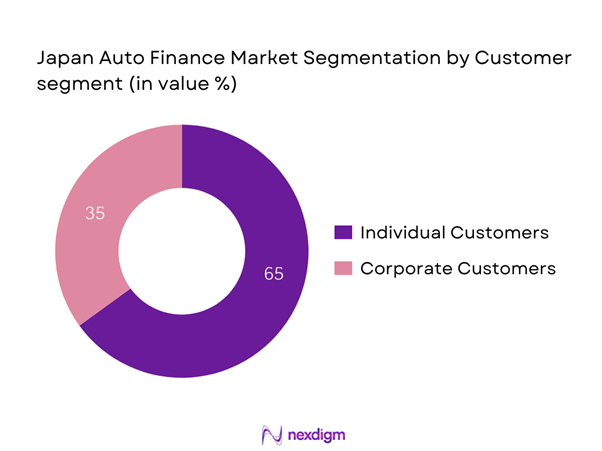

The Japan Auto Finance Market is segmented by customer segment into individual customers and corporate customers. The individual customer segment is experiencing a significant market share, primarily because of the growing middle-class population that increasingly opts for vehicle ownership. This demographic shift is coupled with the expansion of financing options—such as personal loans and leasing—that have made automobile purchases more feasible for a broader audience. Furthermore, marketing programs tailored to first-time buyers and the younger demographic further boost this segment’s growth.

By Finance Type

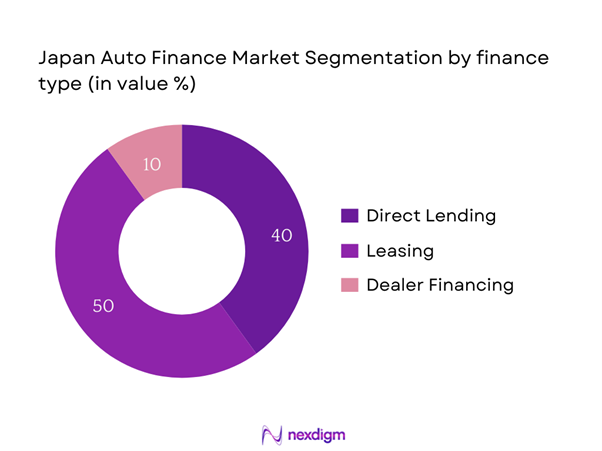

The market is also segmented by finance type into direct lending, leasing, and dealer financing. Leasing dominates this segment due to its appeal to consumers looking for flexibility and lower monthly payments compared to traditional financing. This segment is particularly favored among younger consumers and urban professionals who appreciate the benefits of driving new vehicles without the long-term commitment of ownership. As a result of attractive lease offers and the launch of new vehicle models, leasing is becoming an increasingly popular choice, driving its market share.

Competitive Landscape

The Japan Auto Finance Market is characterized by its competitive nature, where a few major players hold the majority of the market. Key companies include Toyota Financial Services, Honda Finance, and Sumitomo Mitsui Trust Bank. Their substantial market presence is bolstered by the expansive automotive market in Japan and a wide range of financing products tailored to meet diverse consumer needs.

| Company | Establishment Year | Headquarters | Revenue (USD) | Product Offerings | Market Share (%) |

| Toyota Financial Services | 1982 | Toyota City | – | – | – |

| Honda Finance | 1985 | Tokyo | – | – | – |

| Nissan Motor Acceptance Corporation | 1980 | Yokohama | – | – | – |

| Sumitomo Mitsui Trust Bank | 1992 | Tokyo | – | – | – |

| Mitsubishi UFJ Lease & Finance | 2000 | Tokyo | – | – | – |

Japan Auto Finance Market Analysis

Growth Drivers

Increasing Vehicle Sales

Japan has witnessed a steady growth in vehicle sales, with approximately 4.6 million passenger cars sold in 2022. This trend is fueled by rising consumer demand, particularly in urban areas where public transport may be inadequate. Additionally, the number of vehicles registered for the first time in Japan reached 1.7 million in 2022, reflecting significant consumer interest in personal mobility solutions. This increase in sales contributes directly to a greater reliance on auto finance options, as consumers seek financing solutions to accommodate their vehicle purchases.

Growing Middle-Class Population

Japan’s middle-class population is projected to be around 55% of the total population in 2023, showing significant growth driven by stable economic conditions and increasing disposable incomes. The growing middle class enhances demand for automobiles since this demographic usually favors vehicle ownership for convenience and flexibility. With median household income reaching approximately USD 60,000, families are more inclined to finance vehicle purchases through various lending options.

Market Challenges

Regulatory Constraints

Japan’s auto finance market faces various regulatory constraints, particularly concerning consumer lending practices. Regulatory bodies have implemented stringent measures to curb excessive indebtedness, including caps on interest rates for consumer loans. As per Japan’s Financial Services Agency, the cap on annual interest rates for unsecured consumer loans stands at 15% to 20%. While these regulations are aimed at protecting consumers, they can stifle competitiveness among lenders, limiting their ability to innovate and offer diverse financing products that appeal to consumers.

Economic Volatility

Japan’s economic landscape has been characterized by volatility, particularly due to the effects of global supply chain disruptions and fluctuating oil prices. In 2022, the inflation rate increased to around 2.5%, significantly impacting consumer purchasing power and automotive sales. This economic uncertainty can lead consumers to delay purchasing decisions, resulting in decreased vehicle sales and, consequently, a drop in demand for auto financing solutions. Such volatility affects both consumer and lender confidence in the marketplace, potentially hindering growth in the auto finance sector.

Opportunities

Rise in Digital Financing Solutions

Digital financing solutions are becoming increasingly prevalent in Japan, as over 50% of consumers prefer to conduct financial transactions online. As of 2023, the digital loan market has seen a strong uptake, with nearly JPY 1 trillion (approximately USD 9 billion) disbursed through online platforms. Such digital transformation is creating new opportunities for auto finance providers to develop user-friendly interfaces, streamline application processes, and enhance customer engagement. The shift towards digital solutions is projected to enhance convenience for consumers and can lead to a substantial increase in auto finance transactions in the future.

Expansion of Fintech Players

The fintech sector in Japan is rapidly expanding, with over 200 new startups emerging in the financial services landscape as of 2023. This expansion presents substantial opportunities for partnerships between traditional auto finance companies and fintech innovators, which can lead to the development of more flexible financing options tailored to diverse consumer needs. With the increasing integration of technology, features such as AI-driven credit assessments and streamlined mobile financing applications are expected to emerge, revolutionizing how consumers access auto financing. Such developments indicate a promising growth trajectory for auto finance in the coming years.

Future Outlook

Over the next five years, the Japan Auto Finance Market is anticipated to demonstrate steady growth, fueled by advancements in technology, the rise of electric and hybrid vehicles, and the implementation of government policies promoting eco-friendly transportation. Increased consumer awareness regarding financing options will likely contribute to market expansion, as digital solutions and online platforms make accessing loans and leases easier than ever before. The demand for more flexible financing arrangements will drive innovations among service providers and enhance competitive dynamics in the industry.

Major Players

- Toyota Financial Services

- Honda Finance

- Nissan Motor Acceptance Corporation

- Sumitomo Mitsui Trust Bank

- Mitsubishi UFJ Lease & Finance

- Credit Saison

- ORIX Auto Corporation

- JACCS Co. Ltd

- SBI Sumishin Net Bank

- Aozora Bank

- Resona Bank

- Mizuho Bank

- The Shizuoka Bank

- Japan Auto Finance Corporation

- Daiwa Lease Co., Ltd.

Key Target Audience

- Automotive Manufacturers

- Dealerships

- Bank and Financial Institutions

- Investments and Venture Capitalist Firms

- Insurance Companies

- Government and Regulatory Bodies (Ministry of Land, Infrastructure, Transport and Tourism)

- Fleet Management Companies

- Consumer Advocacy Groups

Research Methodology

Step 1: Identification of Key Variables

In this initial phase, we construct an ecosystem map that includes all significant stakeholders within the Japan Auto Finance Market. This involves utilizing extensive desk research, which employs a mix of secondary sources and proprietary databases to gather vital industry information. The primary objective is to identify and define the key variables influencing market dynamics, which include regulatory frameworks, economic indicators, consumer behaviors, and fintech innovations.

Step 2: Market Analysis and Construction

During this phase, we compile and analyze historical data related to the Japan Auto Finance Market. This includes assessing market penetration rates, consumer borrowing trends, and the prevalence of various financing options within the sector. A thorough evaluation of financial performance metrics enables us to ensure the reliability and accuracy of our revenue estimates. Analysis of service quality factors will also be undertaken to derive insights into customer satisfaction and preferences.

Step 3: Hypothesis Validation and Expert Consultation

In this phase, we develop market hypotheses and validate them through computer-assisted telephone interviews (CATIs) with industry experts drawn from various segments within the auto finance sector. These consultations enable us to gain operational and financial insights directly from industry practitioners, which are crucial for refining and corroborating the market data collected during earlier steps.

Step 4: Research Synthesis and Final Output

The final phase includes direct engagement with multiple auto finance providers and automotive manufacturers. This outreach aims to collect detailed insights on product offerings, sales performance, consumer behaviors, and emerging trends. These interactions serve to verify and complement the data gathered through our bottom-up research approach. Ultimately, the synthesis of this knowledge leads to a comprehensive, accurate, and validated analysis of the Japan Auto Finance Market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Market Dynamics

- Competitive Landscape

- Timeline of Major Players

- Supply Chain and Value Chain Analysis

- Growth Drivers

Increasing Vehicle Sales

Growing Middle-Class Population

Government Initiatives - Market Challenges

Regulatory Constraints

Economic Volatility - Opportunities

Rise in Digital Financing Solutions

Expansion of Fintech Players - Trends

Shift Towards Electric Vehicle Financing

Innovations in Financing Models - Government Regulation

Interest Rate Caps

Consumer Protection Laws - SWOT Analysis

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Interest Rate, 2019-2024

- By Customer Segment (In Value %)

Individual Customers

– Salaried Employees

– Self-Employed Professionals

– Students (Limited Programs)

– Senior Citizens (with co-guarantors)

Corporate Customers

– Small and Medium Enterprises (SMEs)

– Large Enterprises

– Government or Public Sector Entities

– Fleet Operators & Leasing Companies - By Finance Type (In Value %)

Direct Lending

– Through Banks

– Through Non-Banking Financial Institutions (NBFIs)

– Online Auto Loan Platforms

Leasing

– Operating Lease

– Finance Lease

– Subscription-Based Leasing Models

Dealer Financing

– OEM Captive Financing (e.g., Toyota Financial Services)

– Independent Dealer Financing

– Promotional/0% Interest Schemes - By Vehicle Type (In Value %)

Passenger Vehicles

– Sedans

– Hatchbacks

– SUVs

– Kei Cars (Mini vehicles)

Commercial Vehicles

– Light Commercial Vehicles (LCVs)

– Medium & Heavy Commercial Vehicles

– Pick-up Trucks & Vans

Electric Vehicles

– Battery Electric Vehicles (BEVs)

– Plug-in Hybrid Electric Vehicles (PHEVs)

– Hydrogen Fuel Cell Vehicles (FCEVs) - By Region (In Value %)

Kanto

Kansai

Chubu - By Loan Term (In Value %)

Short-Term

Medium-Term

Long-Term

- Market Share of Major Players on the Basis of Value, 2024

Market Share by Finance Type, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strength, Weakness, Organizational Structure, Revenues, Loan Portfolio Composition, Customer Acquisition Strategies, Geographic Presence)

- SWOT Analysis of Major Players

- Pricing Analysis Based on Loan Types for Major Players

- Detailed Profiles of Major Companies

Toyota Financial Services

Honda Finance

Nissan Motor Acceptance Corporation

Mitsubishi UFJ Lease & Finance

Sumitomo Mitsui Trust Bank

Credit Saison

Resona Bank

Aozora Bank

ORIX Auto Corporation

JACCS Co. Ltd

SBI Sumishin Net Bank

Rakuten Bank

Japan Auto Finance Corporation

Mizuho Bank

The Shizuoka Bank

- Consumer Preferences and Influence

- Purchasing Trends

- Regulatory and Compliance Factors

- Decision-Making Process

- Satisfaction and Loyalty Analysis

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Interest Rate, 2025-2030