Market Overview

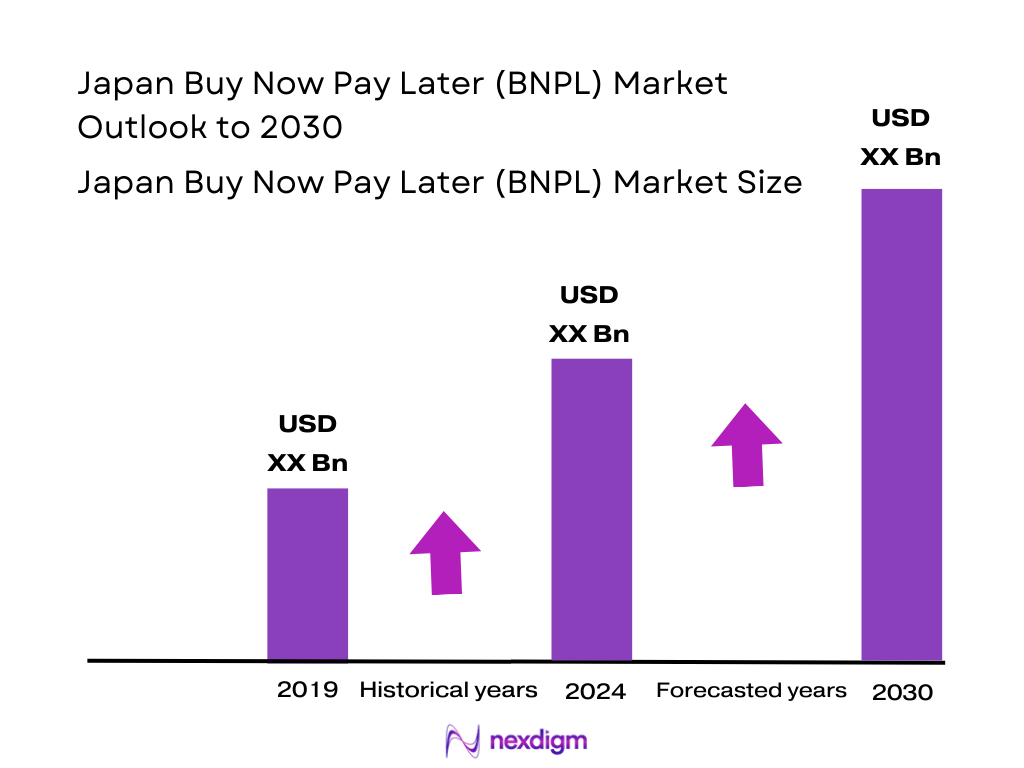

The Japan BNPL market is valued at USD 3.28 billion, based on historical data and validated by credible industry research. This figure reflects comprehensive tracking of gross transaction volumes in the BNPL ecosystem, encompassing online and POS channels, which principally drive market growth.

Japan’s BNPL adoption is particularly strong in Tokyo, Osaka, and Nagoya, where high digital adoption, dense e‑commerce usage, and a robust fintech infrastructure create favorable conditions. Urban consumer behavior in these cities, paired with strong merchant readiness and local fintech innovation, underpins their leading influence.

Market Segmentation

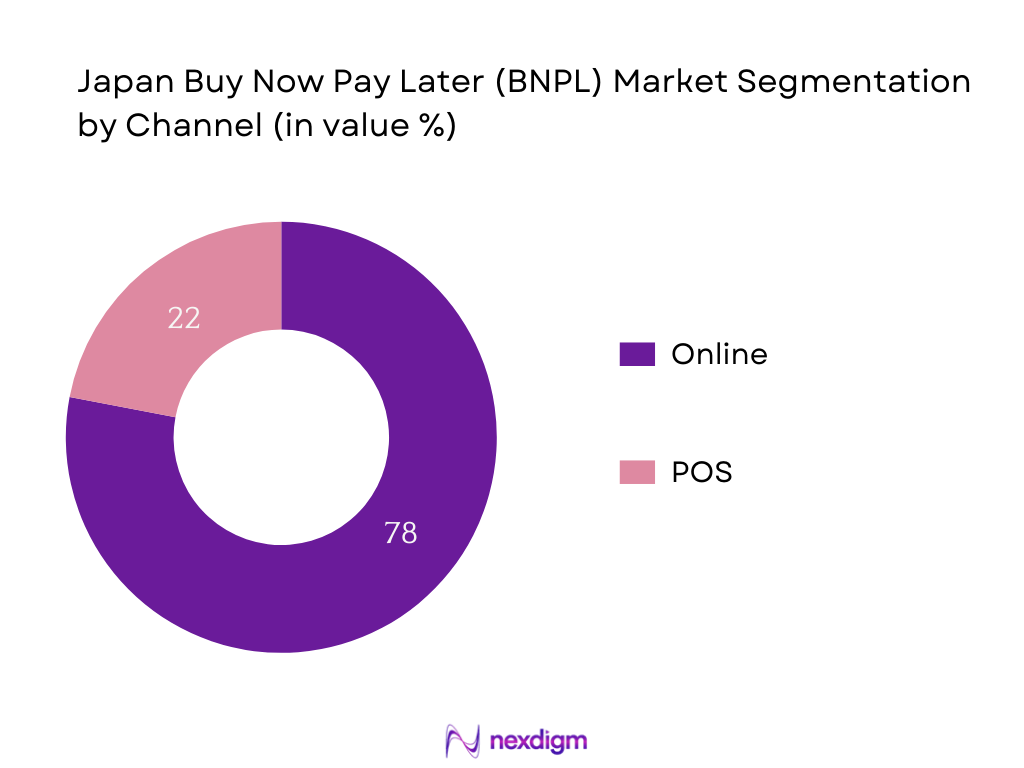

By Channel

The Online BNPL segment commands the largest share, driven by extensive e‑commerce penetration, seamless integration with checkout flows, and high smartphone usage. Consumer preference for frictionless digital experiences and widespread mobile shopping push this channel’s dominance. Merchants benefit from reduced cart abandonment and increased average order values. Meanwhile, POS BNPL is growing, but online remains the dominant force due to its reach, convenience, and integration with Japan’s mature e‑payment infrastructure.

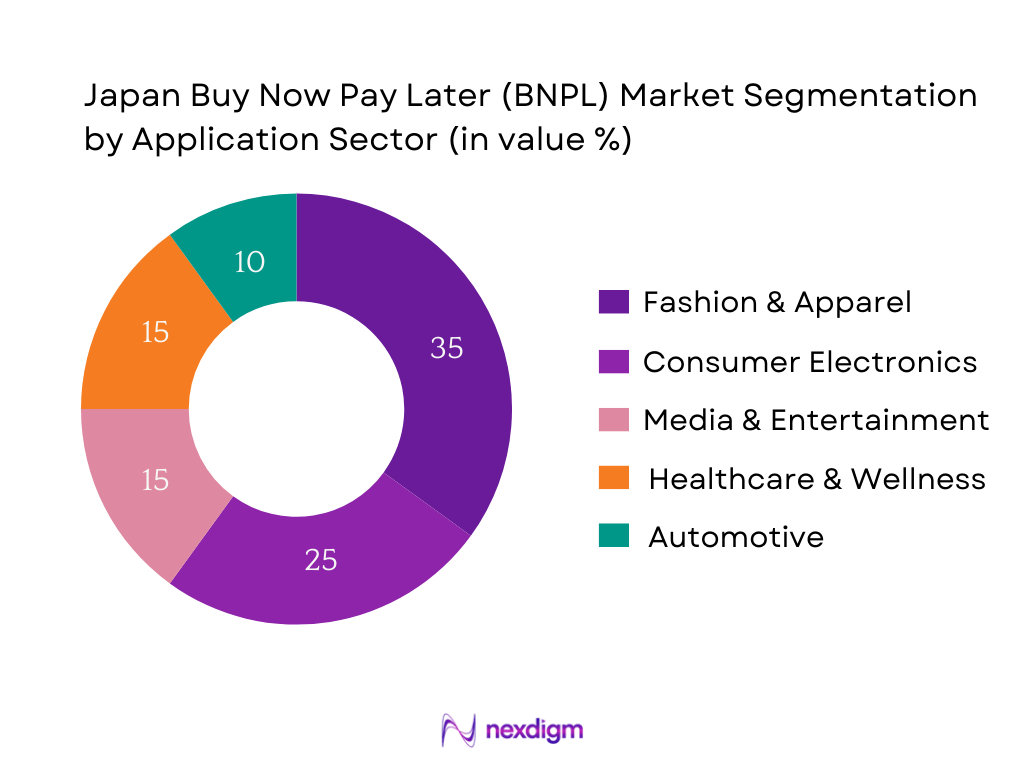

By Application Sector

Within applications, Fashion & Apparel leads significantly due to high-frequency purchases and lower average ticket sizes, encouraging consumers to use installment options. The high turnover and appeal of trendy items further reinforce its dominance. Meanwhile, Consumer Electronics is a close second—large-ticket items like smartphones and laptops often benefit from flexible payment methods, but due to higher average prices, eligibility screening may temper share.

Competitive Landscape

Japan’s BNPL market is dominated by a mixture of domestic innovators and international fintech entrants, reflecting both local consumer preferences and global payment trends. This blend illustrates consolidation around key players with strong brand recognition, localized offerings, and deep merchant networks.

| Provider | Est. Year | Headquarters | Business Model Type | Channel Reach | AI Credit Scoring | Fee Structure |

| Paidy (PayPal) | 2008 | Tokyo, Japan | — | — | — | — |

| atone (Net Protections) | — | Tokyo, Japan | — | — | — | — |

| ZOZO “Tsuke‑Pay” | — | Tokyo, Japan | — | — | — | — |

| Mercari BNPL | — | Tokyo, Japan | — | — | — | — |

| JACCS Co. Ltd. | — | Tokyo, Japan | — | — | — | — |

Japan BNPL Market Analysis

Key Growth Drivers

High Smartphone Penetration Enabling BNPL

Japan has approximately 97.44 million smartphone users, equating to 78.6% of its total population of around 124 million, establishing a broad digital-first consumer base supportive of mobile‑based BNPL growth. Simultaneously, there are 104.4 million internet users, representing 84.9% internet penetration, providing further digital infrastructure that favours seamless BNPL adoption across online and app channels. These figures demonstrate a widespread digital readiness, enabling BNPL providers to integrate services efficiently and meet consumers where they increasingly transact—on smartphones and connected networks.

Rising Demand from Gen Z and Millennials

Japan’s demographic structure shows roughly 74.6 million individuals aged 15–64, forming the active labor and consumption cohort likely to embrace BNPL, especially younger adults. With a median age of 49.5 years, Japan has fewer younger consumers proportionally, yet younger cohorts still represent millions of digitally native, smartphone-reliant users—ideal for BNPL traction. This sizeable and digitally adept population segment fuels BNPL demand, as Gen Z and Millennials prefer flexible, installment-based payment solutions aligned with their spending patterns, particularly online.

Key Market Challenges

Stringent Regulatory Scrutiny and Licensing Framework

Japan’s Installment Sales Act and associated guidelines require BNPL providers to adhere to detailed consumer protection standards and licensing protocols. Whilst specific numeric regulatory thresholds are not publicly summarized, Japan’s rigorous compliance environment, including registration and oversight by the Financial Services Agency, poses operational complexity and time for BNPL providers to launch or expand services in the market.

Lack of Standardized Credit Risk Evaluation

Japan’s BNPL market lacks a unified credit risk framework, requiring providers to deploy individual scoring models. Given that Japan had approximately 74.6 million people aged 15–64, providers must invest significantly in developing AI or internal risk assessments—especially since regulatory constraints limit traditional credit model sharing, increasing complexity and cost for BNPL firms operating in such a decentralized evaluation landscape

Emerging Market Opportunities

Integration with Japan’s Digital Wallet Ecosystem

Japan’s high smartphone (97.44 million) and internet (104.4 million) user bases indicate strong infrastructure for digital wallets and fintech integration. BNPL providers can partner with dominant wallets to embed installment options directly within payment flows, tapping into existing user engagement and simplifying adoption. This synergy presents an opportunity to broaden BNPL reach by leveraging wallet user bases already accustomed to swift, app-based payments.

BNPL for Cross‑border E‑Commerce

Japan’s strong connectivity (internet and smartphone penetration near 85% and 79% respectively) supports robust cross-border e-commerce activity. BNPL integration into Chinese or other international platforms popular in Japan could allow consumers to defer payment on imported goods, expanding BNPL usage beyond domestic retailers. With millions of connected users, this presents a gateway for BNPL providers to capture foreign retail opportunities and enhance transaction flexibility for cross-border shoppers.

Future Outlook

Over the coming years, the Japan BNPL market is primed for substantial growth. The combination of evolving consumer preferences, fintech innovation, and expanding merchant ecosystems will continue to propel the market upward. With the forecasted CAGR of 30.8%, expanding digital retail infrastructure, and rising consumer comfort with deferred payments, BNPL is expected to penetrate new verticals like education and healthcare, broaden SME adoption, and gain traction in physical retail environments.

Major Players

- Paidy (PayPal)

- atone (Net Protections)

- ZOZO (“Tsuke‑Pay”)

- Mercari BNPL

- JACCS Co. Ltd.

- Smartpay K.K.

- Afterpay (via Shopify/Shop Pay)

- Shop Pay (Shopify)

- Klarna

- Sezzle

- Splitit

- PayPal BNPL

- Affirm (Asia-Pacific entry)

- Net Protections (NP Atobarai)

- LINE BNPL (wallet service)

Key Target Audience

- Retail and E‑commerce CFOs

- FinTech Partnerships & Strategy Heads

- Digital Transformation Leads at Large Retailers

- Investments and Venture Capitalist Firms

- Merchants’ Payment & Operations Directors

- Central Bank of Japan (financial innovation division)

- Financial Services Agency (payments regulation)

- Ministry of Economy, Trade and Industry (consumer payments policy)

Research Methodology

Step 1: Market Definition & Ecosystem Mapping

The initial phase involved mapping Japan’s BNPL ecosystem—including consumers, merchants, fintech providers, and regulators—through secondary data sources and proprietary databases to accurately define ecosystem variables.

Step 2: Historical Data Compilation & Channel Analysis

We aggregated 2023–2024 transaction volumes by channel and application, leveraging industry reports and fintech disclosures to construct a bottom‑up model of GMV and user‑base dynamics.

Step 3: Expert Interviews & Hypothesis Validation

Hypotheses regarding growth drivers and consumer behavior were validated through interviews with BNPL provider executives, merchant payment leads, and fintech analysts, providing real‑world insights into adoption and risk management.

Step 4: Forecasting & Future Scenario Modeling

Finally, we synthesized the data and interviews into trend‑based forecasting, validating projections against macro retail growth and fintech expansion metrics to ensure robust and plausible future outlooks.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Overview Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain and Value Chain Analysis

- Key Growth Drivers

High Smartphone Penetration Enabling BNPL

Rising Demand from Gen Z and Millennials

Growth of Online and App-based Retailing

Credit Card Aversion and Convenience Seeking Behavior - Key Market Challenges

Stringent Regulatory Scrutiny and Licensing Framework

Lack of Standardized Credit Risk Evaluation

Low BNPL Adoption in Rural Regions

Merchant Reluctance due to Commission Fees - Emerging Market Opportunities

Integration with Japan’s Digital Wallet Ecosystem

BNPL for Cross-border E-Commerce

BNPL Financing in Healthcare and Education

AI-Driven Risk and Credit Assessment Models - Market Trends

Growing Tie-ups Between BNPL Providers and Fashion Retailers

Shift Toward Embedded Finance Solutions

Rise of White-Label BNPL Solutions - Government Regulation (Installment Sales Act, AML & KYC Norms)

- SWOT Analysis

- Stake Ecosystem (BNPL Providers, Regulators, Merchants, Tech Enablers)

- Porter’s Five Forces Analysis

- Competition Ecosystem (Market Share, Product Comparison, Pricing Strategies)

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Transaction Value, 2019-2024

- By Number of BNPL Users, 2019-2024

- By BNPL Penetration in Retail Transactions, 2019-2024

- By Channel (In Value %)

Online BNPL

Point-of-Sale (POS) BNPL

Mobile Wallet Integrated BNPL

QR-code Based BNPL - By End-User Generation (In Value %)

Gen Z

Millennials

Gen X

Baby Boomers - By Application Sector (In Value %)

Consumer Electronics

Fashion and Apparel

Healthcare and Wellness

Media and Entertainment

Furniture and Home Decor - By Enterprise Size (In Value %)

Large Retail Chains

Medium-sized Enterprises

SMEs and Individual Sellers - By BNPL Model Type (In Value %)

Zero-Interest Merchant-Funded

Consumer-Fee Based

Subscription-Based BNPL

Embedded BNPL via Digital Wallets

- Market Share of Major Players on the Basis of Value/Volume

Market Share by Type of BNPL Model - Cross Comparison Parameters (Company Overview, Business Model Type, GMV, Merchant Network, Credit Scoring Model, Regulatory Status, Handling Fees, User Base, App Downloads)

- SWOT Analysis of Major Players

- Pricing Analysis Basis BNPL Terms for Major Players

- Detailed Profiles of Major Companies

Paidy (PayPal)

atone (Net Protections)

Atokara

Smartpay

NP Atobarai

JACCS Co. Ltd.

Mercari BNPL

ZOZO “Tsuke Pay”

Shop Pay (Shopify BNPL)

Afterpay

Klarna

Sezzle

PayPal

Splitit

Affirm

- Market Demand and Utilization Behavior

- Age-wise and Income-wise Adoption Patterns

- Digital Literacy and Technology Use

- Influencers of Decision-Making

- BNPL Repayment Discipline and Defaults

- Consumer Expectations and Preferences

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Transaction Value, 2025-2030

- By User Base Growth, 2025-2030

- By Retail BNPL Adoption Rate, 2025-2030