Market Overview

The Japan c4isr market current size stands at around USD ~ million, reflecting steady demand for integrated command, control, communications, computers, intelligence, surveillance, and reconnaissance capabilities across defense and security operations. Investment flows remain concentrated in secure communications backbones, ISR sensor fusion, and mission command software modernization. Program funding prioritizes network resilience, cyber-hardened architectures, and interoperability across domains. Long-term sustainment contracts and platform lifecycle support further anchor procurement commitments within defense modernization pathways.

Demand is concentrated around metropolitan defense command nodes and coastal operational hubs where naval and air assets converge, supported by dense industrial clusters supplying electronics, avionics, and secure networks. Urban regions with advanced digital infrastructure enable faster deployment of data fusion platforms and edge computing nodes. Mature integrator ecosystems around technology corridors accelerate program delivery, while policy frameworks emphasizing alliance interoperability and multi-domain readiness guide adoption across operational commands and joint units.

Market Segmentation

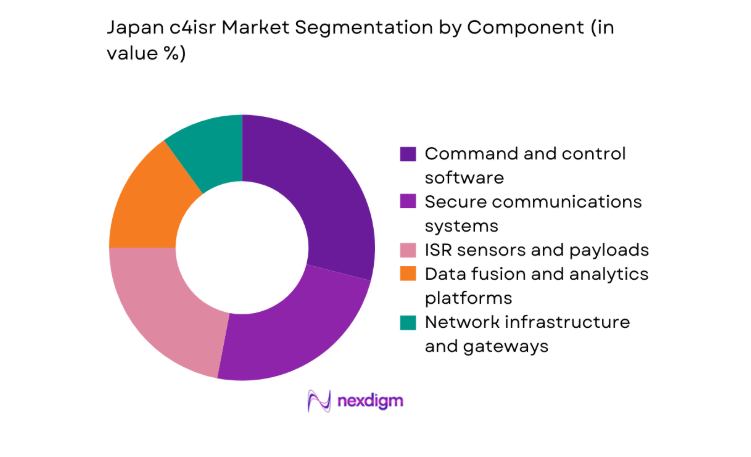

By Component

The component mix is dominated by command and control software, secure communications, and ISR sensors due to modernization programs targeting networked operations and data fusion. Software-defined architectures are prioritized to enable rapid capability upgrades, while encrypted communications remain essential for joint operations across land, sea, air, space, and cyber domains. ISR payloads benefit from expanding unmanned and space-based deployments, driving demand for sensor integration and analytics layers. Network gateways and tactical data links gain traction as forces pursue open standards and modular interoperability, reducing integration friction across legacy and next-generation platforms.

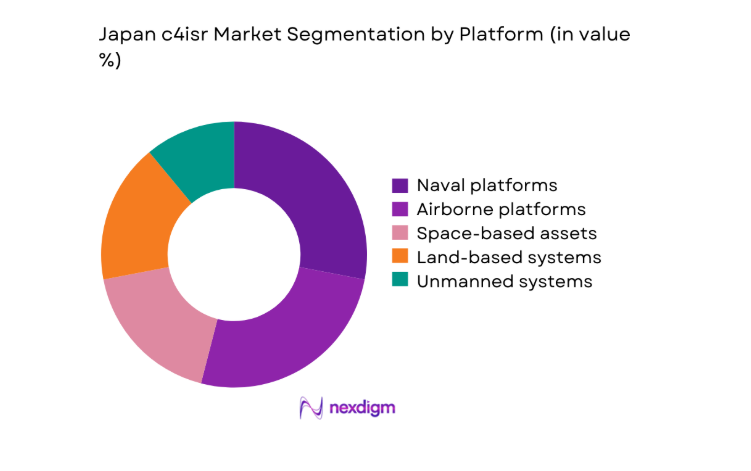

By Platform

Platform demand is led by naval and airborne systems given maritime domain awareness priorities and air defense modernization. Space-based assets are expanding as satellite-enabled ISR and secure communications mature, while land-based systems remain foundational for joint command nodes. Unmanned platforms increasingly integrate with C4ISR networks to extend sensing and relay coverage. Cross-domain interoperability requirements elevate the importance of common data standards and edge computing across platforms, enabling synchronized operations and faster decision cycles in contested environments.

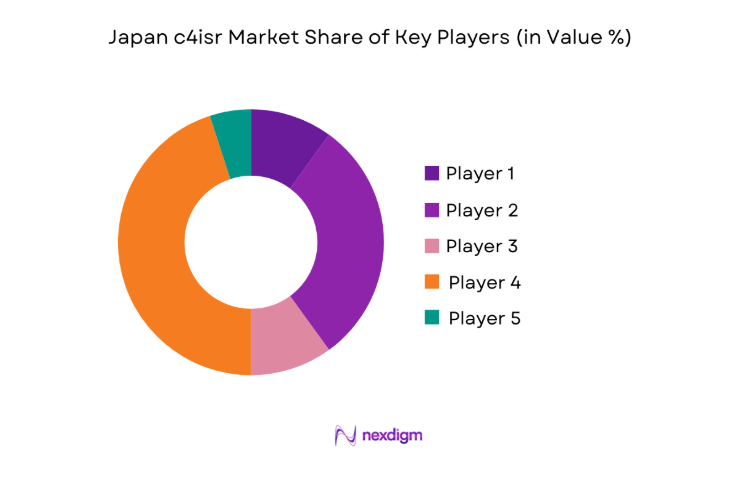

Competitive Landscape

The competitive environment features domestic system integrators collaborating with global technology providers to deliver interoperable C4ISR architectures. Differentiation centers on integration depth, cyber resilience, and lifecycle support for complex, multi-domain deployments aligned with national acquisition frameworks.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Mitsubishi Heavy Industries | 1884 | Tokyo, Japan | ~ | ~ | ~ | ~ | ~ | ~ |

| NEC Corporation | 1899 | Tokyo, Japan | ~ | ~ | ~ | ~ | ~ | ~ |

| Fujitsu Limited | 1935 | Tokyo, Japan | ~ | ~ | ~ | ~ | ~ | ~ |

| Mitsubishi Electric | 1921 | Tokyo, Japan | ~ | ~ | ~ | ~ | ~ | ~ |

| Toshiba Corporation | 1875 | Tokyo, Japan | ~ | ~ | ~ | ~ | ~ | ~ |

Japan c4isr Market Analysis

Growth Drivers

Rising regional security threats and Indo-Pacific tensions

Regional security dynamics intensified following 2022 defense policy revisions, with 2023 recording 9 new joint exercises and 2024 hosting 11 multinational drills, increasing interoperability requirements. Maritime domain awareness expanded with 6 new ISR tasking centers operational by 2025, supported by 14 additional data links across naval and air commands. Cross-domain coordination accelerated as 3 new joint command nodes reached initial operating capability in 2024. Cyber incidents recorded 212 reported intrusions against defense networks in 2023, prompting 18 resilience upgrades by 2025. Satellite-enabled ISR tasking cycles shortened from 72 hours to 24 hours during 2024 operations, reinforcing networked command adoption.

Increased defense budget allocations and modernization programs

Defense planning cycles approved 27 modernization programs during 2023 and 2024, with 8 focused on networked command systems and 6 on ISR integration across platforms. In 2024, 19 legacy command nodes underwent digital upgrades, while 2025 introduced 4 new multi-domain coordination centers. Personnel training expanded with 3,200 operators certified on joint C2 systems in 2023 and 4,100 in 2024. Procurement schedules compressed by 18 months for priority programs following revised acquisition guidelines in 2022. Test and evaluation cycles increased to 46 system-level trials in 2024, accelerating fielding readiness.

Challenges

Legacy system integration complexity

Heterogeneous legacy systems span 23 platform variants fielded before 2015, creating interface fragmentation across 41 data standards in active use during 2023. Integration testing cycles averaged 14 months in 2024 due to incompatible middleware across 9 major subsystems. Interoperability incidents logged 67 mission-impacting faults in 2023 exercises, declining to 49 in 2024 after partial remediation. Maintenance backlogs affected 312 network nodes in 2024, delaying upgrades across 5 command echelons. Documentation gaps across 18 legacy programs hindered software refactoring efforts, while certification timelines extended by 120 days for systems requiring cross-domain accreditation.

Cybersecurity vulnerabilities in networked defense systems

Network expansion increased attack surfaces across 128 connected enclaves in 2024, with 276 high-severity alerts recorded in 2023 and 241 in 2024. Patch deployment cycles averaged 21 days in 2024 due to air-gapped environments across 37 critical nodes. Zero-trust pilots covered 9 operational units by 2025, leaving 24 units pending implementation. Penetration testing identified 54 critical vulnerabilities in 2023, with remediation rates reaching 71 percent by 2024. Supply-chain risk assessments flagged 16 components requiring redesign, delaying certification across 4 mission systems and extending authorization timelines by 90 days.

Opportunities

Deployment of AI-enabled ISR and decision-support tools

AI pilots across 5 ISR units in 2023 reduced analyst workload by 38 tasks per mission cycle and cut imagery review time from 6 hours to 2 hours in 2024. Automated target recognition trials processed 1,200 frames per minute in 2024, enabling faster cueing across 7 operational scenarios. Data labeling pipelines expanded to 9 repositories by 2025, improving model training throughput. Edge inference deployments across 12 nodes lowered latency by 180 milliseconds during field exercises. Institutional guidance issued in 2024 standardized model validation across 4 agencies, enabling scaled deployment under controlled operational frameworks.

Upgrades of legacy C2 and tactical data link systems

Modernization roadmaps scheduled 17 command node refreshes during 2024 and 2025, replacing 9 legacy data links with open-standard interfaces. Interoperability tests across 2024 exercises demonstrated message delivery improvements from 84 to 96 successful exchanges per 100 transactions. Software-defined radios deployed across 1,140 terminals in 2025 enhanced spectrum agility across 6 frequency bands. Certification throughput improved with 28 systems cleared in 2024 compared to 19 in 2023. Training curricula updated in 2024 supported 2,600 operators transitioning to modular C2 interfaces, accelerating adoption across joint units.

Future Outlook

The Japan c4isr market will continue prioritizing multi-domain interoperability, cyber-resilient architectures, and modular upgrades across land, sea, air, space, and cyber operations. Policy alignment with alliance frameworks will shape procurement roadmaps through 2030 and beyond. Integration of AI-enabled ISR and cloud-edge computing will expand. Modernization of legacy command nodes will proceed in phased programs, emphasizing open standards and rapid certification cycles to sustain operational readiness in contested environments.

Major Players

- Mitsubishi Heavy Industries

- NEC Corporation

- Fujitsu Limited

- Toshiba Corporation

- IHI Corporation

- Kawasaki Heavy Industries

- Hitachi Ltd.

- Mitsubishi Electric

- Northrop Grumman

- Lockheed Martin

- RTX (Raytheon)

- BAE Systems

- Thales Group

- L3Harris Technologies

- Elbit Systems

Key Target Audience

- Ministry of Defense procurement divisions

- Joint Staff Office program management units

- Japan Ground Self-Defense Force capability directorates

- Japan Maritime Self-Defense Force acquisition offices

- Japan Air Self-Defense Force modernization teams

- Defense prime contractors and system integrators

- Secure communications and ISR subsystem suppliers

- Investments and venture capital firms

Research Methodology

Step 1: Identification of Key Variables

Core variables included platform integration readiness, secure communications interoperability, ISR sensor performance, cyber resilience maturity, and certification timelines across operational units. Program scope was mapped to joint command nodes and cross-domain data exchange requirements.

Step 2: Market Analysis and Construction

Operational deployments, program milestones, and institutional capability roadmaps were synthesized to structure component, platform, and application layers. Field readiness indicators and accreditation pathways informed deployment feasibility across contested environments.

Step 3: Hypothesis Validation and Expert Consultation

Assumptions were validated through structured consultations with defense program managers, systems engineers, and cyber assurance specialists. Iterative reviews stress-tested interoperability, sustainment capacity, and integration risk across phased modernization cycles.

Step 4: Research Synthesis and Final Output

Findings were consolidated into coherent market narratives linking operational demand, institutional priorities, and technology readiness. Outputs were refined to ensure alignment with policy frameworks, acquisition cycles, and multi-domain operational doctrines.

- Executive Summary

- Research Methodology (Market Definitions and C4ISR scope in Japan, Ministry of Defense procurement data analysis, SDF program and capability roadmap mapping, primary interviews with integrators and primes)

- Definition and Scope

- Market evolution

- Operational doctrine and mission use cases

- Ecosystem structure

- Defense supply chain and acquisition channels

- Growth Drivers

Rising regional security threats and Indo-Pacific tensions

Increased defense budget allocations and modernization programs

Joint all-domain command and control initiatives - Challenges

Legacy system integration complexity

Cybersecurity vulnerabilities in networked defense systems

Lengthy procurement cycles and compliance requirements - Opportunities

Deployment of AI-enabled ISR and decision-support tools

Upgrades of legacy C2 and tactical data link systems

Expansion of secure satellite communications capacity - Trends

Shift toward cloud-enabled tactical edge computing

Adoption of software-defined radios and open architectures

Growth of space domain awareness capabilities - Government Regulations

- SWOT Analysis

- Porter’s Five Forces

- By Value, 2020–2025

- By Shipment Volume, 2020–2025

- By Active Systems, 2020–2025

- By Average Selling Price, 2020–2025

- By Component (in Value %)

Command and control software

ISR sensors and payloads

Secure communications systems

Data fusion and analytics platforms

Network infrastructure and gateways - By Platform (in Value %)

Land-based systems

Naval platforms

Airborne platforms

Space-based assets

Unmanned systems - By Application (in Value %)

Battlefield management

Intelligence, surveillance and reconnaissance

Cyber and electronic warfare integration

Joint operations coordination

Disaster response and homeland security - By End User (in Value %)

Japan Ground Self-Defense Force

Japan Maritime Self-Defense Force

Japan Air Self-Defense Force

Joint Staff Office

- Market share of major players

- Cross Comparison Parameters (product portfolio depth, systems integration capability, cybersecurity compliance, domestic production footprint, alliance interoperability, after-sales support capability, R&D investment intensity, program delivery track record)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

Mitsubishi Heavy Industries

NEC Corporation

Fujitsu Limited

Toshiba Corporation

IHI Corporation

Kawasaki Heavy Industries

Hitachi Ltd.

Mitsubishi Electric

Northrop Grumman

Lockheed Martin

RTX (Raytheon)

BAE Systems

Thales Group

L3Harris Technologies

Elbit Systems

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- By Value, 2026–2035

- By Shipment Volume, 2026–2035

- By Active Systems, 2026–2035

- By Average Selling Price, 2026–2035