Market Overview

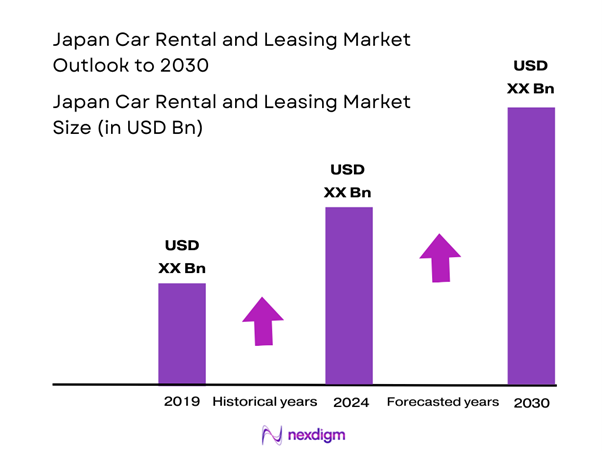

The Japan Car Rental and Leasing Market is valued at approximately USD 8,560.5 million in 2024 with an approximated compound annual growth rate (CAGR) of 11% from 2024-2030, driven by increasing tourism and a growing urban population. The demand for flexible transportation solutions is fueling market growth, alongside an expanding base of corporate clientele requiring vehicle leasing services. Additionally, the rising trend of eco-conscious commuting has led to an uptick in rentals focusing on electric and hybrid vehicles.

The dominant cities contributing to the Japan Car Rental and Leasing Market include Tokyo, Osaka, and Nagoya. Tokyo’s status as a major metropolitan hub and its connectivity through public transport make it a focal point for rental services. Osaka, with its vibrant tourism industry and business centers, ranks high in demand, while Nagoya benefits from a substantial automotive industry, which promotes the leasing of vehicles. Together, these cities provide a robust market environment for car rental and leasing operations.

Japan’s urban population is projected to account for over 91% of the total population by end of 2025, highlighting a significant trend toward urbanization. As city life evolves, so does the necessity for flexible transport options without the burden of vehicle ownership. Urbanization is leading to increased demand for car rentals as residents opt for services that cater to their varied mobility needs. This shift underlines a preference among younger demographics for shared mobility solutions, supported by the rising costs of car ownership.

Market Segmentation

By Vehicle Type

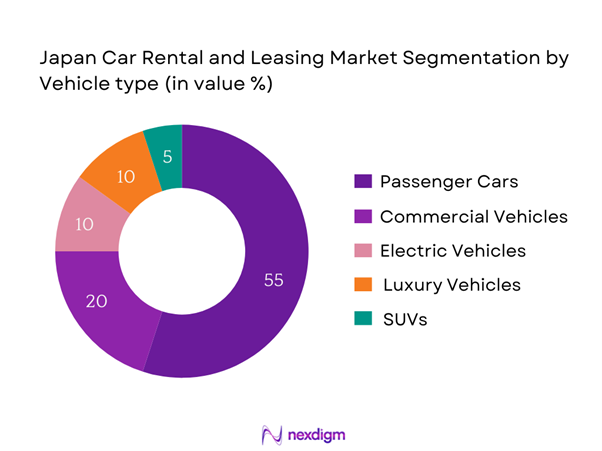

The Japan Car Rental and Leasing Market is segmented by vehicle type into passenger cars, commercial vehicles, electric vehicles, luxury vehicles, and SUVs. Among these sub-segments, passenger cars hold a dominant share due to their widespread usage and accessibility. The demand for sedan and compact cars is led by individual consumers, including tourists seeking convenient transportation, as well as corporate clients who prefer these options for business needs. Brands like Toyota and Nissan further bolster the popularity of passenger cars through competitive pricing and extensive service networks.

By Service Type

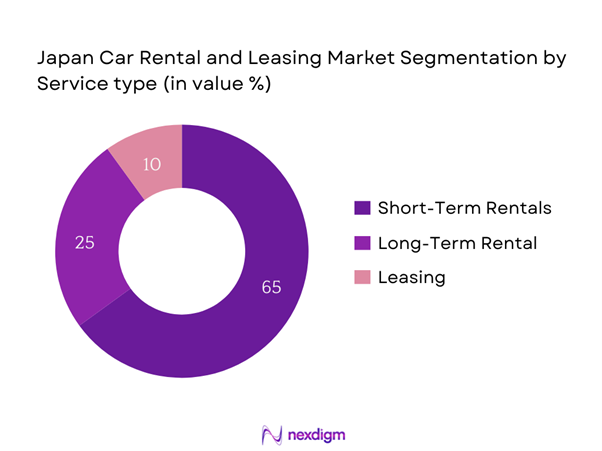

The market is further segmented by service type into short-term rentals, long-term rentals, and leasing. The short-term rental sub-segment dominates the market due to its appeal to both tourists and business travelers who seek flexibility. This popularity is enhanced by the availability of platforms that facilitate easy bookings and quick service retrieval. Moreover, promotional offers and the growing trend of experience-based travel continue to drive short-term rentals, making them the preferred choice for many consumers.

Competitive Landscape

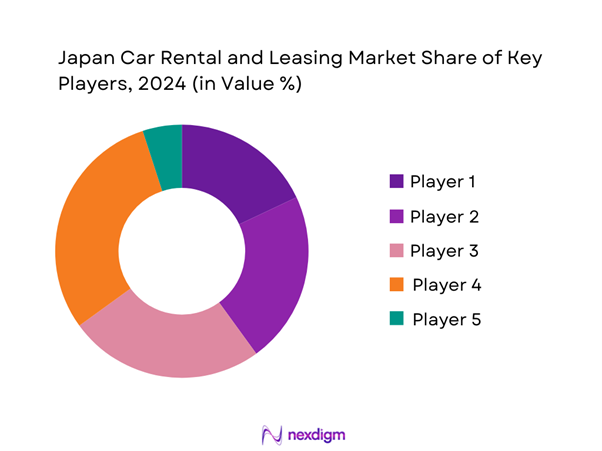

The Japan Car Rental and Leasing Market is characterized by strong competition among key players, including both domestic and international brands. Leading companies in the market include Nippon Rent-A-Car, Toyota Rent a Car, Times Car Rental, Orix Auto, and JR Rental Car. These major players continually adapt their offerings and services to meet the changing demands of consumers and leverage digital platforms for operational efficiency. Their established presence, strong brand loyalty, and comprehensive service networks reinforce their market positions.

| Company | Establishment Year | Headquarters | Vehicle Fleet Size | Fleet Composition | Revenue (USD) | Digital Platform |

| Nippon Rent-A-Car | 1959 | Tokyo | – | – | – | – |

| Toyota Rent a Car | 1979 | Toyota City | – | – | – | – |

| Times Car Rental | 1972 | Tokyo | – | – | – | – |

| Orix Auto | 1981 | Tokyo | – | – | – | – |

| JR Rental Car | 2006 | Tokyo | – | – | – | – |

Japan Car Rental and Leasing Market Analysis

Growth Drivers

Increasing Tourism

Japan’s tourism industry has seen a remarkable increase in visitor arrivals, with foreign tourists reaching approximately 31.88 million in 2022. This surge has significantly propelled the demand for car rental services, as tourists often prefer self-driving options to explore Japan’s diverse regions. Notably, the government has set a target to attract 60 million visitors by 2030, further boosting prospects for the car rental sector. Additionally, the easing of COVID-19 travel restrictions is expected to lead to a resurgence in international travel, reinforcing the reliance on car rentals as a means of transportation for tourists.

Rising Demand for Flexible Transportation

The demand for flexible transportation solutions in Japan has intensified, driven by changing consumer behavior and lifestyle dynamics. For instance, about 70% of surveyed individuals have indicated a preference for flexible mobility options such as car rentals or shared services over traditional ownership. This inclination is further underscored by statistics showing that the population of individuals aged 20-39, a significant segment of potential renters, has grown to 11.93 million in 2023. The rise in remote work trends has also contributed to this flexibility, as workers seek transportation that fits irregular schedules and travel patterns, making car rentals a preferred choice.

Market Challenges

Competition from Ride-Hailing Services

The rise of ride-hailing services has created substantial competitive pressure on the car rental market in Japan. Companies like Uber and local ride-share services have gained considerable traction, with rides reaching approximately 1.6 billion in 2022 alone. This has led many consumers, particularly in urban areas, to opt for on-demand rides rather than traditional rentals. The competition is intensifying, as consumers increasingly appreciate the convenience and lower upfront costs associated with ride-hailing compared to car rentals. The growing preference for these services poses a distinct challenge for rental companies, compelling them to innovate and enhance their offerings.

Regulatory Hurdles

Regulatory constraints pose significant challenges for the Japan Car Rental and Leasing Market, particularly in urban areas. The government mandates stringent licensing and operational compliance for car rental operators. As of 2023, there were nearly 600 registered car rental companies, each navigating complex rules regarding vehicle safety inspections, insurance agreements, and customer data protection laws. Compliance with these regulatory standards demands considerable resources and can limit the operational flexibility of smaller players attempting to enter the market. Additionally, the ongoing evolution of regulations concerning emissions and environmental standards necessitates further adaptation within the industry, influencing operational costs and strategizing.

Opportunities

Expansion in Rural Areas

There is significant potential for car rental expansion in rural areas of Japan, where public transportation options may be limited. Currently, rural regions account for almost 18% of Japan’s population, presenting a burgeoning customer base for car rental services. In 2022 alone, rural tourism contributed to a 5% increase in rental demand as travelers seek to explore Japan’s countryside. Furthermore, initiatives aimed at enhancing infrastructure, such as improved road connectivity and increased accessibility, are likely to support the growth of car rentals in these areas, bridging gaps where traditional transport is sparse. This trend could be pivotal in tapping new markets and diversifying the rental offerings beyond urban confines.

Technological Advancements in Fleet Management

Technological advancements in fleet management present lucrative opportunities in the Japan Car Rental and Leasing Market. The adoption of AI-driven software for fleet optimization is on the rise, enhancing operational efficiencies and reducing costs for rental companies. As of 2024, approximately 90% of major rental firms are expected to implement advanced fleet management systems powered by IoT technologies, enabling real-time tracking and maintenance monitoring of vehicles. This shift not only streamlines operations but also improves customer satisfaction by reducing wait times and ensuring vehicle availability. Furthermore, the growing trend of integrating electric vehicles into rental fleets aligns with technological progress, addressing consumer demand for environmentally friendly transportation options, thereby fostering sustainable practices within the market.

Future Outlook

Over the next five years, the Japan Car Rental and Leasing Market is expected to experience steady growth driven by increased investments in electric and hybrid vehicles, evolving consumer behaviors, and rising preferences for eco-friendly transportation. Furthermore, partnerships between car rental companies and technology firms will enhance user experiences through innovative digital solutions, making rental processes more convenient and efficient. The focus on sustainability will continue to open up new avenues for growth as more consumers seek environmentally conscious travel options.

Major Players

- Nippon Rent-A-Car

- Toyota Rent a Car

- Times Car Rental

- Orix Auto

- JR Rental Car

- Rakuten Car Rental

- Sapporo Rental Car

- Budget Rent a Car Japan

- Enterprise Rent-A-Car

- Avis Budget Group

- Alamo Rent a Car

- Hertz Japan

- Europcar Japan

- Sixt Rent a Car

- Car Rental Japan

Key Target Audience

- Automotive Manufacturers

- Private Transportation Firms

- Investors and Venture Capitalist Firms

- Government and Regulatory Bodies (Ministry of Land, Infrastructure, Transport and Tourism)

- Corporate Clients

- Tourism Boards

- Fleet Management Companies

- Rental Aggregators

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Japan Car Rental and Leasing Market. This step is supported by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables influencing market dynamics, including consumer behavior, regulatory impacts, and technological advancements.

Step 2: Market Analysis and Construction

In this phase, historical data related to the Japan Car Rental and Leasing Market is compiled and analyzed. This includes assessing trends in market penetration, examining the ratio of rental marketplaces to vehicle service providers, and evaluating the resultant revenue generation. Moreover, an assessment of service quality metrics will be conducted to ensure the accuracy and reliability of the revenue estimates, considering both internal and external influences on the market performances.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATI) with industry experts from various verticals within the car rental and leasing sector. These consultations are crucial for gaining insights from industry practitioners, helping refine and corroborate the market data derived from previous analyses, and ensuring that emerging trends and consumer preferences are accounted for.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagements with multiple car rental companies to illuminate critical insights regarding product offerings, sales performance metrics, consumer preferences, and significant operational factors. This direct interaction ensures the verification and enrichment of statistical data gathered, facilitating a comprehensive, accurate, and validated analysis of the Japan Car Rental and Leasing Market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Market Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Increasing Tourism

Urbanization Trends

Rising Demand for Flexible Transportation - Market Challenges

Competition from Ride-Hailing Services

Regulatory Hurdles - Opportunities

Expansion in Rural Areas

Technological Advancements in Fleet Management - Trends

Shift Towards Sustainable Mobility

Integration of Digital Platforms - Government Regulation

Licensing and Compliance Standards

Policies on Urban Mobility - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces

- By Revenue, 2019-2024

- By Rental Fleet Size, 2019-2024

- By Average Rental Rates, 2019-2024

- By Vehicle Type (In Value %)

Passenger Cars

– Compact Cars (Kei Cars)

– Sedans

– Hatchbacks

Commercial Vehicles

– Light Commercial Vehicles (LCVs)

– Heavy-Duty Trucks

– Delivery Vans

Electric Vehicles

– Battery Electric Vehicles (BEVs)

– Plug-in Hybrid Electric Vehicles (PHEVs)

Luxury Vehicles

– Executive Sedans

– Sports Cars

– High-End Imported Brands (e.g., Mercedes, Lexus, BMW)

SUVs

– Compact SUVs

– Mid-size SUVs

– Full-size SUVs - By Service Type (In Value %)

Short-term Rentals

– Hourly Rentals

– Daily Rentals

– Weekend Packages

Long-term Rentals

– Monthly Plans

– Quarterly Plans

– Annual Subscription-Based Rentals

Leasing

– Operational Leasing

– Financial Leasing

– Lease-to-Own Models - By Distribution Channel (In Value %)

Online Platforms

– Company-Owned Portals

– Aggregator Platforms

– Mobile Applications

Travel Agencies

– Domestic Tour Operators

– International Travel Agents (linked to car booking services)

Direct Rental Services

– Walk-in Rental Desks

– Airport Counters

– Hotel-Based Rentals - By Region (In Value %)

Kanto Region

Kansai Region

Chubu Region

Northern Region - By Customer Type (In Value %)

Corporate Clients

– Multinational Companies

– Domestic Enterprises

– SME Fleet Users

Individual Customers

– Domestic Travelers

– Tourists

– Business Professionals

Government Contracts

– Municipal Transport Leases

– Emergency Vehicle Leasing

– Departmental Fleet Rentals

- Market Share of Major Players on the Basis of Revenue, 2024

- Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strengths, Weaknesses, Revenue Growth, Geographic Reach, Number of Rental Locations, Fleet Composition, Customer Satisfaction Ratings, and others)

- SWOT Analysis of Major Players

- Pricing Analysis by Vehicle Segments

- Detailed Profiles of Major Companies

Nippon Rent-A-C

Times Car Rental

Orix Auto

JR Rental Car

Rakuten Car Rental

Sapporo Rental Car

Budget Rent a Car Japan

Enterprise Rent-A-Car

Avis Budget Group

Alamo Rent a Car

Hertz Japan

Europcar Japan

Sixt Rent a Car

Car Rental Japan

- Market Demand and Utilization

- Customer Behavior Insights

- Needs and Pain Points

- Decision-Making Process

- By Revenue, 2025-2030

- By Rental Fleet Size, 2025-2030

- By Average Rental Rates, 2025-2030