Market Overview

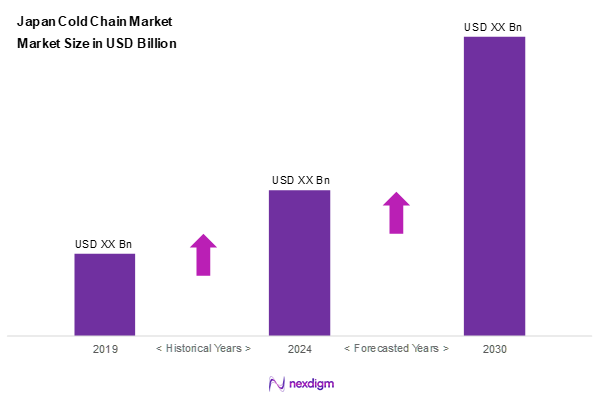

As of 2024, the Japan cold chain market is valued at USD ~ billion, with a growing CAGR of 5.4% from 2024 to 2030, reflecting a robust growth trajectory primarily driven by the increasing demand for fresh produce and a shift towards online food shopping. The market is supported by advancements in logistics infrastructure and technology, which enhance efficiency in handling perishable goods. Projections for the upcoming year highlight a continuous trend towards health consciousness among consumers and expanded e-commerce in the food sector as pivotal factors in market growth.

Tokyo, Osaka, and Nagoya are the dominant cities in the Japan cold chain market, largely due to their roles as economic hubs with advanced logistics capabilities. These cities benefit from significant urban populations, which drive demand for perishable goods and efficient supply chain systems. Moreover, the concentration of major retailers and innovative food service providers in these metropolitan areas fosters competitive dynamics that further strengthen cold chain operations.

Market Segmentation

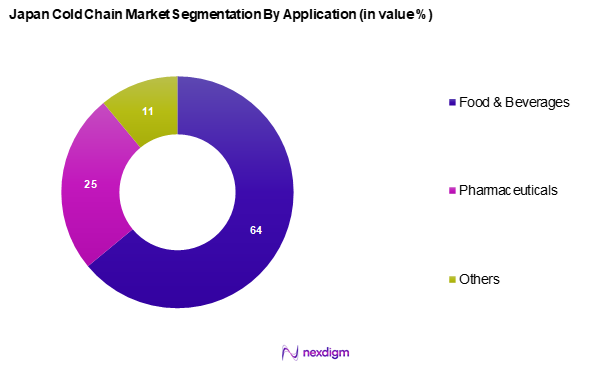

By Application

The Japan cold chain market is segmented into Food & Beverages, Pharmaceuticals, and Other sectors. Food & beverages segment is dominant this market due to the rising consumer preference for fresh and high-quality food products. The food and beverage sector accounted for 64% of the cold chain market in 2024. Within this application, segments such as fruits, vegetables, dairy products, and frozen foods play a crucial role, benefitting from trends towards convenience and healthfulness. The strong brand loyalty established by large players that ensure quality and compliance with health regulations has further solidified this segment’s lead.

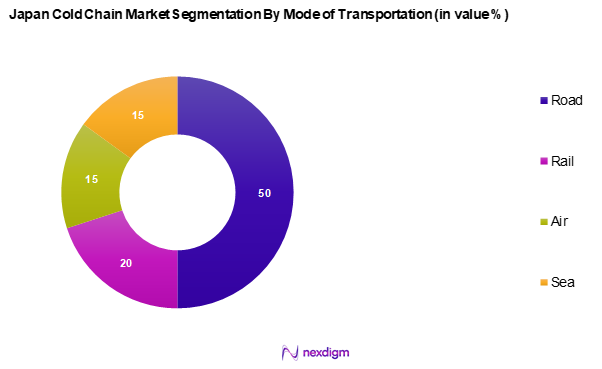

By Mode of Transportation

The Japan cold chain market is segmented into includes road, rail, air, and sea. Road transport segment dominate due to its flexibility and widespread network, allowing quick and efficient delivery of perishable goods across metropolitan areas and remote locations. The growing focus on last-mile delivery paired with the expansion of urban infrastructure supports road transport’s continued prominence in meeting consumer demands for expedited service.

Competitive Landscape

The Japan cold chain market is dominated by several key players, including both local firms and international companies. This consolidation underscores the competitive nature of the market, with major companies continually innovating and improving their operational efficiencies to capture greater market share.

| Company | Establishment Year | Headquarters | Revenue (USD) | Market Focus | Key Technology |

| ITOCHU Logistics Corp. | 1961 | Tokyo, Japan | – | – | – |

| Mitsubishi Logistics Corp. |

1887 |

Tokyo, Japan | – | – | – |

| Nippon Express Co., Ltd. | 1937 | Tokyo, Japan | – | – | – |

| Sankyu Inc. | 1918 | Tokyo, Japan | – | – | – |

| Yamato Holdings Co., Ltd. | 1919 | Tokyo, Japan | – | – | – |

Japan Cold Chain Market Analysis

Growth Drivers

Rising Demand for Fresh Food Products

The rising demand for fresh food products in Japan is a significant driver for the cold chain market, correlating with a notable increase in per capita income, which stands at approximately USD 43,000 in 2022, according to the World Bank. As consumer preferences shift towards high-quality, fresh produce, the demand for effective cold chain solutions becomes essential. Furthermore, Japan’s urban population, which exceeded 126 million people in 2023, emphasizes the necessity of robust supply chains to ensure the availability of fresh goods year-round. These factors underline the importance of maintaining high-quality storage and transportation systems for perishables.

Increasing E-commerce in Food Sector

The surge in the e-commerce sector, particularly in food distribution, significantly enhances the need for cold chain logistics. As of 2023, e-commerce sales in Japan reached approximately USD 132 billion, with food and beverage categories reflecting strong growth. Reports indicate that over 85% of Japanese consumers have used online grocery services at least once, showcasing a substantial shift in buying behaviour. With the expansion in online grocery shopping, ensuring the integrity and quality of perishable items during transport further propels investments in cold chain technologies and infrastructures.

Market Challenges

Infrastructure Limitations

Infrastructure limitations pose considerable challenges to the cold chain industry in Japan, particularly in rural areas where logistical support lacks sophistication. According to a 2023 report by the Ministry of Internal Affairs and Communications, Japan’s rural regions, which account for 72% of the land area, have significantly fewer cold storage facilities. This creates vulnerabilities in supply chains for fresh food products and weakens the overall efficacy of cold chain logistics. Efficient transportation networks are essential in mitigating these limitations, yet less urbanized locales often experience logistical bottlenecks that hinder market growth.

Competition from Emerging Markets

Competition from emerging markets adds pressure on Japan’s cold chain sector, particularly as countries like Vietnam and Thailand invest heavily in their logistics infrastructures to capitalize on global demand for fresh produce. In 2022, Japan’s agricultural exports amounted to USD 10 billion, but with the increasing capability of emerging economies to offer competitive pricing and improving supply chain efficiencies, market leaders must navigate the rising threat of imported goods from these regions. This competition influences pricing strategies and could potentially compress profit margins for existing cold chain operators in Japan.

Opportunities

Technological Innovations (IoT, Automation)

Technological innovations such as IoT and automation present significant growth opportunities for the Japan cold chain market. By 2023, the adoption of IoT applications in logistics is set to drive more efficient inventory management and monitoring systems, enhancing the operational capabilities of cold chain providers. Japan’s focus on advancing smart technologies is evident in its national strategy for digitalization, which allocates approximately USD 4.5 billion towards integrating AI and automated solutions. Investments in these technologies are crucial for improving traceability, minimizing spoilage, and optimizing overall efficiency within the cold chain logistics framework.

Expansion in Rural Areas

The potential for cold chain market expansion in Japan’s rural areas offers lucrative prospects, particularly as the government focuses on revitalizing local economies. Reports indicate that approximately 30% of Japan’s food production occurs in these areas, yet access to cold storage and transportation remains insufficient. With increasing government initiatives aimed at enhancing rural infrastructure, investments in cold chain systems can significantly improve access to fresh products and empower local farmers. Enhanced cold chain solutions can also improve supply reliability and quality, thereby fostering local agricultural growth and sustainability.

Future Outlook

Over the next five years, the Japan cold chain market is expected to experience substantial growth driven by technological advancements in logistics, an increasing emphasis on food safety, and the ongoing rise in e-commerce. The shift in consumer behaviour towards online grocery shopping and the demand for high-quality perishable goods are set to further propel market expansion. Additionally, government initiatives aimed at enhancing supply chain resilience in response to climate dynamics will shape the industry’s future.

Major Players

- ITOCHU Logistics Corp.

- Mitsubishi Logistics Corporation

- Nippon Express Co., Ltd.

- Sankyu Inc.

- Yamato Holdings Co., Ltd.

- Kagome Co., Ltd.

- Nichirei Corporation

- Kintetsu World Express, Inc.

- Kuroneko Yamato

- Logistics Group Inc.

- Sagawa Express Co., Ltd.

- Kamigumi Co., Ltd.

- Panasonic Corporation

- GLP

- Kagoshima Transport Co., Ltd.

Key Target Audience

- Retailers

- Food and Beverage Manufacturers

- Pharmaceutical Companies

- Logistics Providers

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (Ministry of Health, Labour and Welfare; Ministry of Agriculture, Forestry and Fisheries)

- Supply Chain Management Firms

- E-commerce Platforms

Research Methodology

Step 1: Identification of Key Variables

This initial phase involves developing a comprehensive ecosystem map that captures all key stakeholders within the Japan cold chain market. Utilizing extensive desk research, we compile data from both secondary sources, such as industry reports and trade publications, and proprietary databases, which allows us to identify the critical variables influencing market dynamics.

Step 2: Market Analysis and Construction

In this step, we compile and analyze historical and present data related to the Japan cold chain market. This analysis includes assessing market penetration, examining the ratio of different segments, and evaluating revenue generation across various applications. A careful examination of service quality indicators is also conducted to ensure the accuracy and reliability of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are formulated and subsequently validated through consultations conducted via computer-assisted telephone interviews (CATIs) with industry experts across various companies and sectors. These dialogues provide valuable operational insights and financial viewpoints from industry practitioners, essential for refining and corroborating our market data.

Step 4: Research Synthesis and Final Output

The final phase includes engaging directly with multiple cold chain service providers to gain in-depth insights into product segments, sales performance, consumer preferences, and operational challenges. This direct interaction serves to corroborate and enhance the statistics retrieved from the bottom-up analytical approach, ensuring a comprehensive, validated analysis of the Japan cold chain market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Overview Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Rising Demand for Fresh Food Products

Increasing E-commerce in Food Sector - Market Challenges

Infrastructure Limitations

Competition from Emerging Markets - Opportunities

Technological Innovations (IoT, Automation)

Expansion in Rural Areas - Trends

Growth of Multi-Temperature Warehousing

Focus on Sustainability Practices - Government Regulation

Food Safety Regulations

Environmental Compliance - SWOT Analysis

- Stake Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Application, (In Value %)

Food & Beverages

Dairy Products

Fish, Meat, and Seafood

Pharmaceuticals

Others - By Temperature Range, (In Value %)

Chilled

Frozen

Ambient - By Mode of Transportation, (In Value %)

Road

Rail

Air

Sea - By Market Structure, (In Value %)

Organized

Unorganized - By Service, (In Value %)

Storage

Transportation

Value-added Services - By Technology, (In Value %)

Blast Freezing

Evaporative Cooling

Vapor Compression

Cryogenic Systems

Programmable Logic Controller

- Market Share of Major Players on the Basis of Value/Volume, 2024

Market Share of Major Players by Type of Application Segment, 2024 - Cross-Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strength, Weakness, Market Share, Technological Capabilities, Customer Base, Revenue, Distribution Networks, and Others)

- SWOT Analysis of Major Players

- Pricing Analysis Basis SKUs for Major Players

- Profiles of Major Companies

ITOCHU Logistics Corp.

Kagome Co., Ltd.

Kagoshima Transport Co., Ltd.

Kintetsu World Express, Inc. (KWE)

Kuroneko Yamato

Mitsubishi Logistics Corporation

Nichirei

Logistics Group Inc.

Nippon Express Co., Ltd.

Sankyu Inc.

Yamato Holdings Co., Ltd.

Sagawa Express Co.,Ltd.

Panasonic Corporation

GLP

Kamigumi Co., Ltd.

Others

- Consumer Demand and Behaviour

- Industry-Specific Requirements and Budget Allocations

- Needs Assessment of Key Stakeholders

- Decision-Making Processes in Procurement

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030