Market Overview

The Japan Defense market current size stands at around USD ~ million, reflecting sustained procurement momentum driven by modernization programs, platform lifecycle extensions, and capability upgrades across air, maritime, land, space, and cyber domains. Demand is shaped by force posture recalibration, interoperability requirements with allied forces, and increased emphasis on readiness, sustainment, and systems integration. The ecosystem spans primes, tier suppliers, software integrators, and testing agencies, with procurement pipelines supporting long-cycle programs and continuous upgrades across platforms and mission systems.

Demand concentration is anchored in metropolitan and industrial clusters with dense defense manufacturing and testing infrastructure, including Tokyo–Yokohama, Nagoya, Kobe, and Kitakyushu corridors. These hubs benefit from proximity to policy institutions, acquisition authorities, shipyards, airframe assembly, electronics fabrication, and system integration capabilities. Mature supplier networks, certified testing facilities, and secure logistics enable rapid program execution. Policy alignment, export controls, and domestic production incentives reinforce cluster advantages and concentrate demand around established industrial ecosystems.

Market Segmentation

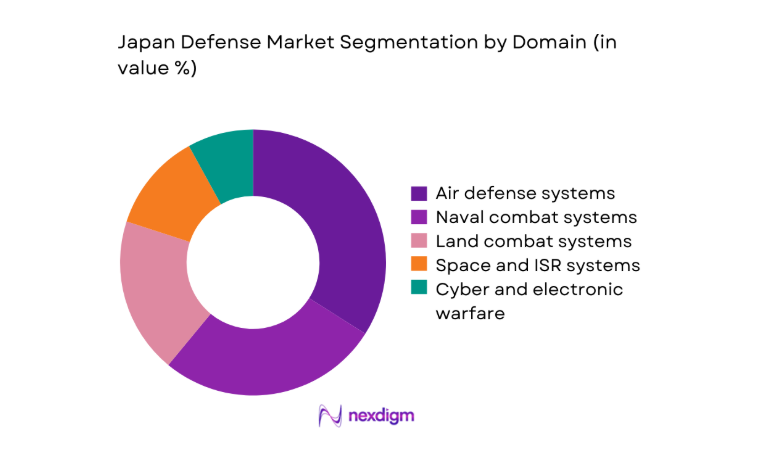

By Domain

Air defense and integrated missile defense programs dominate spending due to heightened emphasis on layered protection, networked sensors, and interceptor modernization. Maritime capabilities follow closely, driven by anti-submarine warfare, fleet sustainment, and surface combatant upgrades aligned to sea-lane security. Land systems remain focused on mobility, fires, and survivability upgrades, while space and ISR gain traction through secure communications, early warning, and resilient sensing architectures. Cyber and electronic warfare investments expand across services to enable contested-spectrum operations, data fusion, and joint command networks. Cross-domain integration increases as programs prioritize interoperability, digital architectures, and multi-domain tasking.

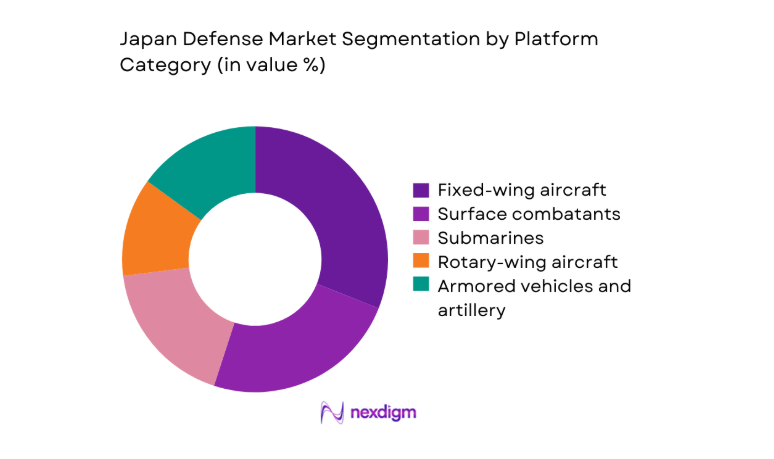

By Platform Category

Fixed-wing aircraft modernization leads platform allocations due to fighter replacement cycles, mission avionics refresh, and sustainment depth. Surface combatants and submarines remain prominent as naval recapitalization advances through propulsion, combat systems, and sonar upgrades. Rotary-wing aircraft sustain operational mobility and ISR, while armored vehicles and artillery upgrades focus on survivability, networked fires, and mobility packages. Unmanned systems expand across air and maritime roles for ISR, logistics, and perimeter security. Platform choices increasingly embed open architectures to accelerate upgrades, reduce integration risk, and support software-defined capabilities across service branches.

Competitive Landscape

The competitive environment is shaped by domestic primes with deep manufacturing depth and system integration capabilities, complemented by international partners for advanced subsystems, sensors, propulsion, and mission software. Procurement frameworks prioritize compliance, security clearances, lifecycle support, and domestic industrial participation, reinforcing long-term partnerships and program continuity.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Mitsubishi Heavy Industries | 1884 | Tokyo | ~ | ~ | ~ | ~ | ~ | ~ |

| Kawasaki Heavy Industries | 1896 | Kobe | ~ | ~ | ~ | ~ | ~ | ~ |

| IHI Corporation | 1853 | Tokyo | ~ | ~ | ~ | ~ | ~ | ~ |

| Mitsubishi Electric | 1921 | Tokyo | ~ | ~ | ~ | ~ | ~ | ~ |

| NEC Corporation | 1899 | Tokyo | ~ | ~ | ~ | ~ | ~ | ~ |

Japan Defense Market Analysis

Growth Drivers

Rising defense budget aligned to GDP targets

Defense outlays expanded through multi-year plans aligned to alliance commitments and capability priorities, supporting sustained procurement cycles across air, maritime, land, space, and cyber domains. Parliamentary approvals enabled increased allocations to missile defense, fleet recapitalization, and networked C4ISR programs. Institutional indicators include annual appropriations growth across 2022, 2023, 2024, and 2025, rising personnel end-strength targets, and expanded base infrastructure projects. Procurement pipelines advanced with multiple platform contracts executed across 2023 and 2024, while testing and certification throughput increased in 2025. Budget execution rates improved through streamlined contracting rules, accelerating delivery schedules and sustainment readiness.

Heightened regional security threats in East Asia

Elevated regional tensions intensified readiness postures and accelerated acquisition timelines for integrated air and missile defense, maritime patrol, and undersea warfare. Operational tempo rose across 2022–2025, with increased joint exercises, patrol days, and multi-domain drills. Defense ministry directives expanded ISR coverage through additional satellite tasking windows and persistent maritime surveillance sorties. Institutional metrics show growth in forward deployments, expanded basing agreements, and higher maintenance cycles to sustain availability. Command reforms in 2024 improved joint coordination, while contingency planning frameworks updated in 2025 emphasized resilient communications, redundancy, and rapid reconstitution capabilities across contested domains.

Challenges

Complex procurement cycles and lengthy approval processes

Procurement pathways involve multilayer approvals, compliance audits, and security reviews that extend program timelines across 2022–2025. Institutional checkpoints include capability requirement validation, budget committee clearance, technical conformity assessments, and export control vetting for partnered programs. Program initiation-to-contract award intervals stretched across multiple fiscal cycles, constraining responsiveness to emerging threats. Schedule slippage increased testing backlogs at accredited facilities in 2024, while certification queues persisted into 2025. Governance reforms advanced digital documentation and parallel reviews, yet legacy workflows continue to limit rapid prototyping transitions into production, delaying fielding of urgently required subsystems and software updates.

Technology transfer and export control constraints

Stringent security controls limit access to sensitive subsystems and source code, constraining integration speed across 2022–2025. Co-development frameworks require case-by-case approvals, extending lead times for avionics, propulsion controls, and secure communications modules. Institutional compliance audits increased in 2024, adding documentation cycles for supply chain vetting and end-use assurances. Engineering teams faced delays integrating foreign-origin components due to licensing timelines that spanned multiple quarters. Mitigation measures advanced domestic substitution programs in 2025, yet qualification cycles for indigenous alternatives require extended testing hours and certification milestones before operational deployment at scale.

Opportunities

Next-generation fighter and cooperative development programs

Multinational fighter development frameworks expanded collaborative engineering, digital twin adoption, and shared testing protocols across 2022–2025. Program governance introduced synchronized design reviews, enabling concurrent subsystem maturation and accelerated integration cycles. Institutional indicators include expanded joint working groups, increased cross-border engineering exchanges, and standardized interface controls. Test flight campaigns scaled through additional sorties in 2024, while systems integration labs increased capacity in 2025 to validate mission software and sensor fusion. These pathways enable domestic suppliers to upskill across advanced materials, propulsion controls, and secure avionics, supporting long-term industrial capability growth and export-compliant co-production.

Indigenous unmanned and autonomous systems development

Unmanned systems programs advanced from concept validation to operational trials across 2022–2025, with expanded maritime and aerial test corridors approved by authorities. Institutional support included dedicated ranges, spectrum allocations, and safety certification pathways. Trial deployments increased endurance hours and sortie counts in 2024, while autonomy software iterations accelerated through government-backed testbeds in 2025. Integration with command networks improved through standardized data links and secure edge processing. These developments enable scalable ISR, logistics resupply, and perimeter security use cases, reducing operational risk to personnel and enhancing persistent coverage across remote and contested environments.

Future Outlook

Capability priorities will continue to emphasize integrated air and missile defense, resilient maritime presence, and multi-domain command networks. Policy alignment and industrial participation will favor domestic production depth, open architectures, and lifecycle sustainment. Cooperative development programs will shape advanced platforms, while autonomy, cyber resilience, and space-based ISR mature into core operational enablers across service branches.

Major Players

- Mitsubishi Heavy Industries

- Kawasaki Heavy Industries

- IHI Corporation

- Mitsubishi Electric

- NEC Corporation

- Fujitsu

- Toshiba

- Hitachi

- Subaru Corporation

- Japan Steel Works

- Boeing

- Lockheed Martin

- Northrop Grumman

- BAE Systems

- RTX

Key Target Audience

- Ministry of Defense acquisition offices

- Acquisition, Technology and Logistics Agency

- Japan Self-Defense Forces procurement commands

- Prime defense contractors and system integrators

- Tier-1 and Tier-2 defense component suppliers

- Cybersecurity and ISR solution providers

- Investments and venture capital firms

- Government and regulatory bodies including National Security Secretariat

Research Methodology

Step 1: Identification of Key Variables

Program pipelines, capability priorities, platform lifecycles, supplier readiness, certification pathways, and sustainment requirements were mapped across domains. Policy directives and acquisition frameworks were reviewed to define scope boundaries. Demand signals from readiness posture and modernization cycles informed variable selection.

Step 2: Market Analysis and Construction

Platform-level program mapping structured the market by domain and platform categories. Capability layers including sensors, networks, and sustainment were aligned to procurement workflows. Scenario constructs reflected policy alignment, industrial participation, and interoperability requirements shaping deployment pathways.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses on adoption pathways, integration risks, and supply chain constraints were tested with domain specialists across operations, certification, and sustainment. Iterative reviews validated assumptions on readiness drivers, platform modernization sequencing, and subsystem qualification timelines.

Step 4: Research Synthesis and Final Output

Findings were synthesized into coherent narratives linking policy, operations, and industrial capability. Cross-domain linkages and lifecycle considerations were integrated to ensure internal consistency. Final outputs prioritized decision relevance, program sequencing clarity, and actionable insights.

- Executive Summary

- Research Methodology (Market Definitions and capability domains for Japan’s defense sector, Primary interviews with MoD, ATLA, and JSDF procurement officials, Analysis of Japanese defense budget lines and MTDP allocations)

- Definition and Scope

- Market evolution

- Usage and operational deployment pathways

- Ecosystem structure

- Supply chain and prime–subcontractor channel structure

- Growth Drivers

Rising defense budget aligned to GDP targets

Heightened regional security threats in East Asia

Modernization of legacy JSDF platforms - Challenges

Complex procurement cycles and lengthy approval processes

Technology transfer and export control constraints

Limited domestic production scalability for advanced subsystems - Opportunities

Next-generation fighter and cooperative development programs

Indigenous unmanned and autonomous systems development

Space-based ISR and secure satellite communications - Trends

Shift toward multi-domain integrated defense architectures

Increased emphasis on standoff and counterstrike capabilities

Localization of critical components and supply chains - Government Regulations

- SWOT Analysis

- Porter’s Five Forces

- By Value, 2020–2025

- By Volume, 2020–2025

- By Active Systems and Platforms, 2020–2025

- By Unit Economics, 2020–2025

- By Domain (in Value %)

Air defense systems

Naval combat systems

Land combat systems - By Capability Type (in Value %)

Combat platforms

Sensors and radars

Weapons and munitions

Sustainment, MRO and upgrades - By Platform Category (in Value %)

Fixed-wing aircraft

Rotary-wing aircraft

Surface combatants

Submarines

Unmanned systems - By Procurement Type (in Value %)

New acquisition

Mid-life upgrade and modernization

Sustainment and spares

R&D and prototyping - By Source of Supply (in Value %)

Domestic prime contractors

Joint development programs

Foreign direct military sales

- Market share of major players

- Cross Comparison Parameters (portfolio breadth, platform coverage, indigenous manufacturing depth, R&D intensity, JSDF contract wins, international partnerships, lifecycle support capability, compliance with Japan export controls)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

Mitsubishi Heavy Industries

Kawasaki Heavy Industries

IHI Corporation

NEC Corporation

Fujitsu

Toshiba

Subaru Corporation

Mitsubishi Electric

Hitachi

Japan Steel Works

Boeing

Lockheed Martin

Northrop Grumman

BAE Systems

RTX

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- By Value, 2026–2035

- By Volume, 2026–2035

- By Active Systems and Platforms, 2026–2035

- By Unit Economics, 2026–2035