Market Overview

The Japan Green Airport market is witnessing a robust growth trajectory due to increased investments in sustainable airport infrastructure and energy-efficient technologies. The market is valued at USD ~billion in 2025 and is poised to continue its growth, driven by the country’s commitment to achieving carbon neutrality by 2050. The government’s initiatives, such as tax incentives and subsidies for green technologies, alongside increasing consumer demand for eco-friendly airport operations, play a pivotal role in the market’s expansion.

Japan’s key market players are predominantly concentrated in urban hubs like Tokyo, Osaka, and Fukuoka, which host some of the busiest airports in the country. These cities lead the green airport market owing to their advanced infrastructure, high air traffic, and the adoption of sustainable practices in line with Japan’s environmental goals. Additionally, the government’s push for sustainable aviation, combined with significant airport infrastructure developments, supports the dominance of these cities in the market.

Market Segmentation

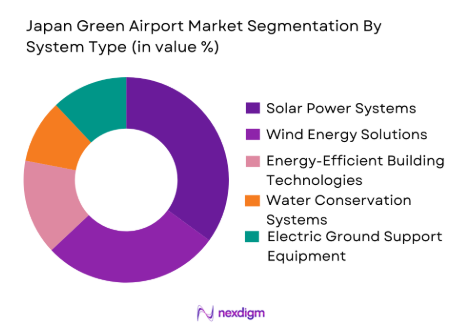

By System Type

The Japan Green Airport market is segmented by system type, which includes renewable energy systems, energy-efficient technologies, and eco-friendly infrastructure solutions. Among these, renewable energy systems dominate the market due to Japan’s commitment to reducing its carbon footprint and reliance on fossil fuels. Solar power, wind energy, and energy storage solutions are increasingly deployed in airports to meet sustainability goals and reduce operational costs. Airports in Japan are integrating these renewable systems, primarily solar panels and wind turbines, into their infrastructure to ensure energy independence, lower emissions, and cost savings. As these technologies become more cost-effective and reliable, their adoption across Japan’s airports is expected to grow, further cementing their dominance.

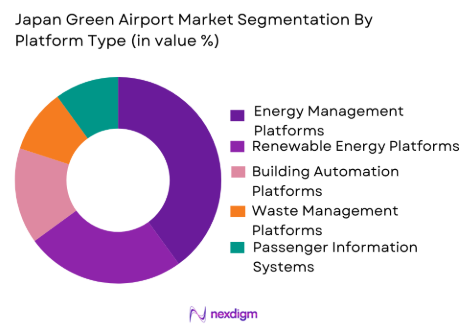

By Platform Type

The platform type segmentation focuses on energy management, building automation, and waste management systems. Energy management platforms are the most dominant in the market, reflecting Japan’s emphasis on optimizing energy consumption and reducing waste. These platforms are integrated with sensors and real-time monitoring systems to manage power use across airport terminals and facilities efficiently. The continuous advancements in IoT technologies and AI-based solutions have contributed to the widespread adoption of these platforms in Japan’s airports. As the market moves toward smart airports, energy management systems will continue to lead the market, allowing airports to track energy consumption, adjust power usage, and reduce operational costs.

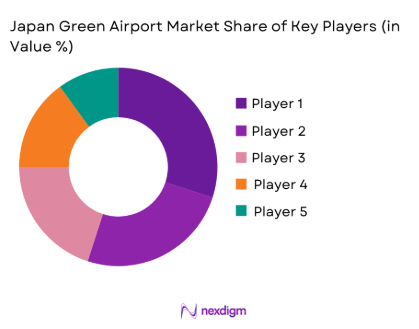

Competitive Landscape

The Japan Green Airport market is dominated by several key players that focus on implementing green technologies and infrastructure. Major players in the market include Hitachi, Mitsubishi Electric, and Panasonic, who contribute significantly to energy management systems and sustainable airport solutions. The competitive landscape is characterized by the integration of cutting-edge technologies, such as AI-driven energy systems, renewable energy solutions, and advanced building materials. These companies are shaping the market through strategic partnerships with airport authorities and governments, as well as continuous innovation in eco-friendly infrastructure.

| Company Name | Establishment Year | Headquarters | Key Products/Services | Sustainability Initiatives | Technological Innovations | Market Focus |

| Hitachi Ltd. | 1910 | Tokyo, Japan | ~ | ~ | ~ | ~ |

| Mitsubishi Electric | 1921 | Tokyo, Japan | ~ | ~ | ~ | ~ |

| Panasonic Corporation | 1918 | Osaka, Japan | ~ | ~ | ~ | ~ |

| Daikin Industries | 1924 | Osaka, Japan | ~ | ~ | ~ | ~ |

| Siemens AG | 1847 | Munich, Germany | ~ | ~ | ~ | ~ |

Japan Green Airport Market Analysis

Growth Drivers

Government Initiatives and Sustainability Goals

Japan’s strong commitment to sustainability and carbon neutrality by 2050 plays a crucial role in driving the green airport market. The government has introduced several initiatives such as tax incentives, subsidies, and policies that encourage airports to adopt green technologies and energy-efficient solutions. These measures are not only financially beneficial for airports but also align with global environmental commitments. Japan’s airports are increasingly investing in renewable energy sources like solar and wind power to reduce their carbon footprint. As part of this, regulatory bodies such as the Japan Civil Aviation Bureau (JCAB) have started enforcing sustainability guidelines, ensuring that all new developments meet strict environmental standards. This regulatory push, combined with financial incentives, accelerates the adoption of green technologies in airport infrastructure, making it a key growth driver for the market.

Technological Advancements in Energy Efficiency

The rapid development and implementation of energy-efficient technologies have significantly contributed to the growth of the Japan Green Airport market. Innovations in smart building systems, such as IoT-based energy management platforms and advanced energy storage solutions, allow airports to optimize energy usage, minimize waste, and reduce operating costs. These technologies offer real-time monitoring of energy consumption and help airports make data-driven decisions to improve efficiency. Additionally, the integration of renewable energy sources such as solar power into airports’ energy grids ensures a steady, eco-friendly power supply. With these advancements, airports can reduce their dependency on traditional energy sources, align with global sustainability trends, and meet increasingly stringent regulations. The ongoing development of these technologies promises substantial cost savings, energy independence, and environmental benefits, making them a key driver of market growth.

Market Challenges

High Initial Investment Costs

One of the primary challenges in the Japan Green Airport market is the high initial investment required for the implementation of green technologies. While long-term cost savings and environmental benefits are clear, the upfront capital needed for infrastructure upgrades, including renewable energy systems, energy-efficient buildings, and smart technologies, can be significant. Many airports face financial constraints, especially during periods of economic uncertainty or when the expected return on investment is not immediately visible. The integration of these technologies often requires considerable planning, significant investments in new systems, and training for staff to manage and operate them effectively. For smaller airports or those with limited budgets, such high costs can delay or hinder the adoption of sustainable solutions. Consequently, finding financial solutions, such as government subsidies or public-private partnerships, is crucial to overcoming this challenge.

Regulatory and Certification Complexities

The complexity of regulatory frameworks and certification requirements is another challenge that airports face when transitioning to greener operations. Japan’s aviation industry is governed by strict environmental standards set by both domestic and international regulatory bodies. The process of meeting these standards, such as achieving carbon neutrality or complying with energy-efficient construction certifications, can be time-consuming and resource-intensive. Airports need to invest significant effort in ensuring that all green initiatives are fully compliant with these regulations, which often vary depending on the airport’s location, size, and type of operations. Furthermore, the certification process can involve lengthy audits, costly documentation, and continuous monitoring. These complexities may discourage smaller airports from pursuing green upgrades, as they may lack the expertise or resources to navigate the regulatory landscape effectively. Thus, simplifying and streamlining these processes could help accelerate the adoption of green technologies.

Opportunities

Partnerships and Collaborations in Infrastructure Development

The increasing demand for sustainable infrastructure presents a significant opportunity for collaboration between airports, technology providers, and government agencies. As Japan continues to push for greener airports, there is a growing opportunity for public-private partnerships (PPPs) and collaborations between local and international players. By pooling resources, knowledge, and expertise, stakeholders can develop large-scale green infrastructure projects that drive market growth. For instance, airports can partner with renewable energy companies to integrate solar, wind, or hydrogen power into their operations. Such partnerships not only help airports meet their sustainability goals but also foster innovation in energy management, waste reduction, and eco-friendly building practices. Additionally, airports can collaborate with tech companies to develop smart systems that optimize energy use, improve air quality, and enhance passenger experiences, all while ensuring regulatory compliance. These opportunities can create a mutually beneficial ecosystem that accelerates the green transformation of Japan’s airport sector.

Increased Passenger Demand for Sustainable Practices

Another opportunity for growth in the Japan Green Airport market lies in the increasing consumer preference for sustainability. Modern travellers are becoming more environmentally conscious and increasingly prefer eco-friendly services when choosing airlines and airports. This shift in consumer behaviour has pressured airports to prioritize green initiatives such as waste reduction, sustainable building materials, and the use of renewable energy sources. Airports that prioritize sustainability can differentiate themselves in a competitive market, attracting eco-conscious travellers who prioritize environmental practices. Additionally, passengers are increasingly looking for airports that offer green amenities such as electric vehicle (EV) charging stations, energy-efficient terminals, and waste reduction programs. By embracing these sustainability measures, airports can not only meet the growing expectations of travellers but also attract positive media attention and strengthen their brand image as eco-friendly leaders. This growing consumer demand presents a significant opportunity for market players to invest in green technologies and enhance their offerings.

Future Outlook

Over the next decade, the Japan Green Airport market is expected to experience significant growth, driven by advancements in energy-efficient technologies, increasing demand for sustainable infrastructure, and a strong government push towards carbon neutrality. The market will continue to evolve as airports embrace more renewable energy solutions, such as solar and wind power, to achieve sustainability goals and reduce operational costs. Additionally, advancements in IoT and AI technologies will enable smarter energy management systems, further enhancing efficiency and reducing energy consumption.

Major Players

- Hitachi Ltd.

- Mitsubishi Electric Corporation

- Panasonic Corporation

- Daikin Industries, Ltd.

- Siemens AG

- Honeywell International Inc.

- ABB Ltd.

- Schneider Electric

- Yokogawa Electric Corporation

- Johnson Controls International Plc

- Kone Corporation

- Schneider Electric

- GE Renewable Energy

- Emerson Electric Co.

- Sanyo Electric Co.

Key Target Audience

- Government and Regulatory Bodies

- Airport Authorities

- Airport Operators

- Energy Providers

- Investments and Venture Capitalist Firms

- Airport Construction Companies

- Sustainability Consultants

- Environmental NGOs

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map, identifying all major stakeholders in Japan’s Green Airport market. This step leverages both primary and secondary research, utilizing databases and government reports to gather in-depth industry data, enabling a clear understanding of critical market variables that drive growth.

Step 2: Market Analysis and Construction

This phase focuses on compiling historical data and identifying key metrics that influence market growth. Market penetration rates, technology adoption trends, and overall market revenue will be analyzed to develop an accurate and reliable forecast for the green airport market in Japan.

Step 3: Hypothesis Validation and Expert Consultation

The market hypotheses formed during the analysis will be validated through expert consultations. These consultations will provide operational and financial insights, ensuring that the hypotheses are in line with real-world dynamics and are reflective of current trends in green airport development.

Step 4: Research Synthesis and Final Output

The final step consolidates data gathered from multiple sources, including direct engagement with industry players. Insights from these engagements are integrated with quantitative market data to produce a comprehensive, validated report on the Japan Green Airport market.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Government push for sustainable airport operations

Increased focus on reducing carbon emissions in aviation

Technological advancements in energy efficiency and renewable energy - Market Challenges

High initial investment for green technology implementation

Regulatory challenges and complexity in airport certification

Lack of awareness and technical expertise in airport green initiatives - Market Opportunities

Increased demand for green airports due to passenger preference for sustainability

Opportunities for partnerships in infrastructure development

Growing government incentives for eco-friendly airport projects - Trends

Integration of smart technologies for airport energy management

Rise of net-zero energy airports

Increased focus on sustainable passenger experience

- By Market Value 2020-2025

- By Installed Units 2020-2025

- By Average System Price 2020-2025

- By System Complexity Tier 2020-2025

- By System Type (In Value%)

Solar Power Systems

Wind Energy Solutions

Energy-Efficient Building Technologies

Water Conservation Systems

Electric Ground Support Equipment - By Platform Type (In Value%)

Energy Management Platforms

Renewable Energy Platforms

Building Automation Platforms

Waste Management Platforms

Passenger Information Systems - By Fitment Type (In Value%)

New Installations

Retrofits/Upgrades

Modular Systems

Custom-Fit Solutions

Integrated Systems - By End User Segment (In Value%)

Airport Authorities

Government Agencies

Private Airport Operators

Ground Handling Companies

Maintenance & Service Providers - By Procurement Channel (In Value%)

Direct Purchase from Manufacturers

Third-Party Distributors

Government Contracts

Public-Private Partnerships

E-Commerce and Online Platforms

- Market Share Analysis

- Cross Comparison Parameters (Market Share, Technology Adoption, Cost Efficiency, Environmental Impact, Government Compliance)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Key Players

Hitachi Ltd.

Mitsubishi Electric Corporation

Toshiba Corporation

Daikin Industries, Ltd.

Schneider Electric

Siemens AG

Honeywell International Inc.

ABB Ltd.

Johnson Controls International Plc

Yokogawa Electric Corporation

Panasonic Corporation

GE Renewable Energy

Sungrow Power Supply Co.

Kone Corporation

Emerson Electric Co.

- Airport authorities seeking cost-effective, energy-saving technologies

- Government agencies pushing for regulatory compliance

- Private operators looking to improve airport sustainability and operational efficiency

- Maintenance providers focusing on green solutions for retrofit and upgrade projects

- Forecast Market Value 2026-2035

- Forecast Installed Units 2026-2035

- Price Forecast by System Tier 2026-2035

- Future Demand by Platform 2026-2035