Market Overview

The Japan Hovercraft Market is valued at approximately USD ~ million, based on the most recent data from legitimate sources such as the Japan Coast Guard and the Ministry of Defense. The market has been steadily expanding due to increasing demand for advanced amphibious vehicles in both commercial and defense sectors. The market is largely driven by government initiatives, such as the enhancement of border security and the development of coastal tourism, coupled with technological advancements in hovercraft design and propulsion systems.

Japan is one of the leading countries in the hovercraft market due to its strategic geographic location surrounded by water and its ongoing investments in defense and transportation infrastructure. Cities such as Tokyo, Osaka, and Okinawa are major hubs for hovercraft operations, mainly due to their proximity to coastal regions and the growing demand for efficient maritime transportation. The dominance of these regions can be attributed to their critical infrastructure, investment in technology, and government policies promoting marine mobility.

Market Segmentation

By Craft Type

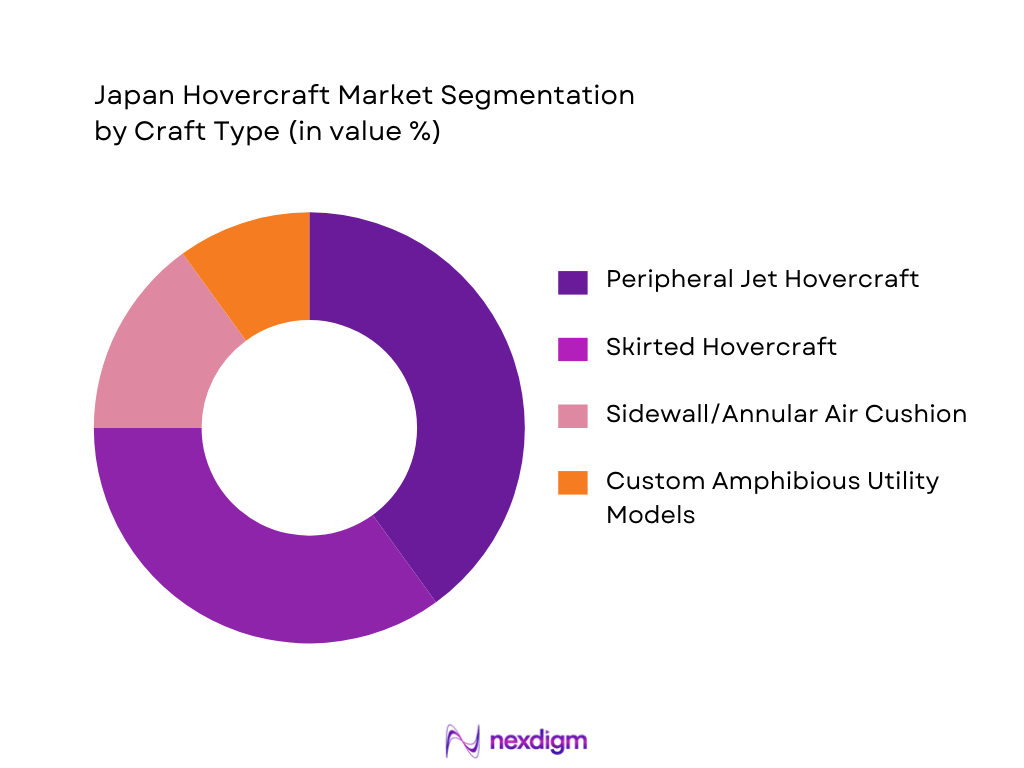

The Japan Hovercraft Market is segmented by craft type into peripheral jet hovercraft, skirted hovercraft, sidewall/annular air cushion craft, and custom amphibious utility models. Among these, peripheral jet hovercraft hold a dominant share in the market. These hovercraft are widely used for their ability to operate efficiently over both water and land surfaces, making them ideal for defense and rescue operations. Their operational versatility and the ability to maintain higher speeds over rough terrains make them preferred by Japan’s Self-Defense Forces and emergency response teams.

By Propulsion System

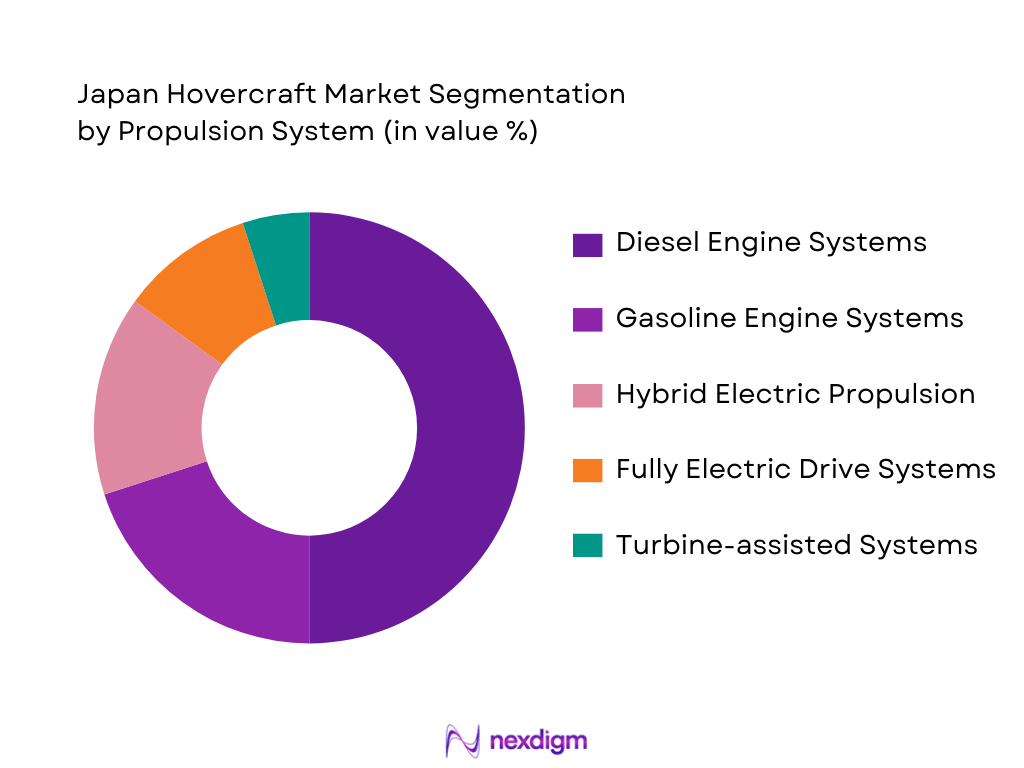

The market is also segmented by propulsion system into diesel engines, gasoline engines, hybrid electric propulsion, fully electric drive systems, and turbine-assisted systems. Diesel engines are leading the propulsion system segment due to their established reliability, high power output, and cost-effectiveness for military and commercial applications. These systems have proven their effectiveness in demanding environments, particularly in amphibious operations where speed and stability are crucial.

Competitive Landscape

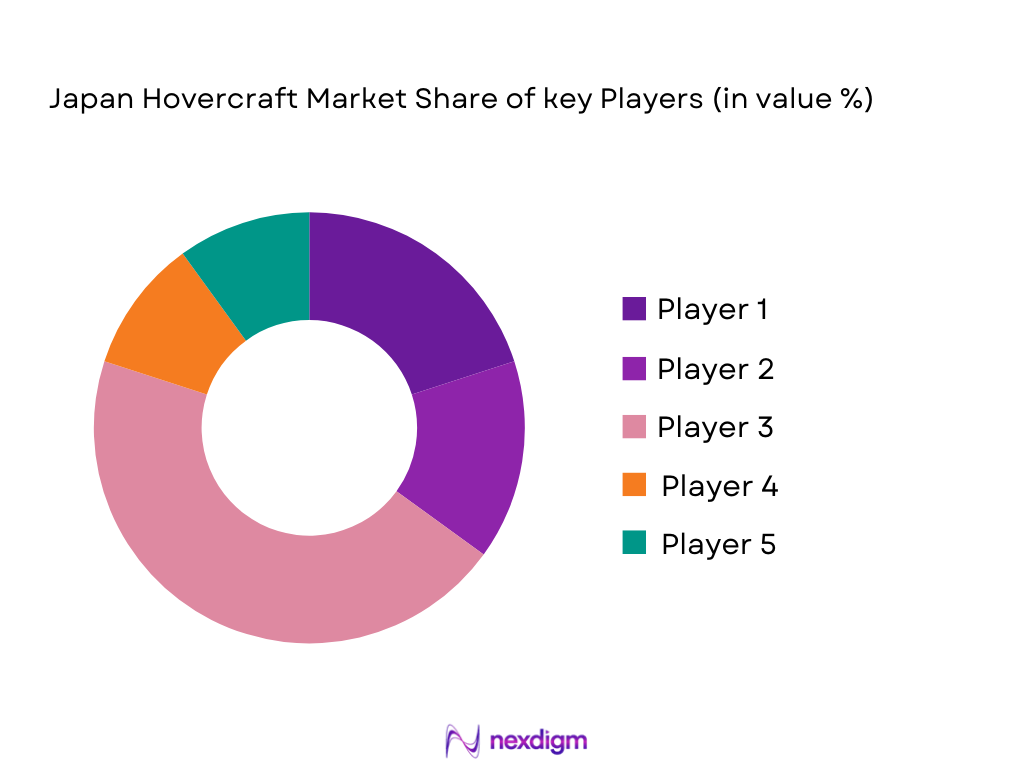

The Japan Hovercraft Market is dominated by a mix of local and international players, with companies like Mitsubishi Heavy Industries, Kawasaki Heavy Industries, and Griffon Hoverwork Ltd. leading the charge. These firms are not only involved in manufacturing hovercraft but also in providing advanced propulsion systems and maintenance services. Japan’s strategic focus on maritime security and the commercial ferry industry has fostered a competitive environment where both technological innovation and cost-effectiveness are crucial. The consolidation of major players such as Kawasaki Heavy Industries and Mitsubishi reflects the industry’s importance in both defense and commercial sectors.

| Company Name | Establishment Year | Headquarters | Product Specialization | Core Operations | Market Reach | Technological or Innovation Strength | Market Focus or Distribution | Financial or Operational Strength |

| Mitsubishi Heavy Industries | 1870 | Tokyo, Japan | ~ | ~ | ~ | ~ | ~ | ~ |

| Kawasaki Heavy Industries | 1896 | Kobe, Japan | ~ | ~ | ~ | ~ | ~ | ~ |

| Griffon Hoverwork Ltd. | 1951 | UK | ~ | ~ | ~ | ~ | ~ | ~ |

| Neoteric Hovercraft Inc. | 1992 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

| Textron Inc. | 1923 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

Japan Hovercraft Market Analysis

Growth Drivers

Demand for Amphibious Mobility

The demand for amphibious mobility has surged in Japan due to the country’s complex geography, which includes extensive coastlines and numerous islands. Hovercrafts offer unparalleled flexibility, allowing them to navigate both water and land, making them ideal for regions with challenging terrains. They are particularly valuable for military, rescue, and disaster response operations. As Japan faces rising natural disasters such as floods and typhoons, the ability to reach isolated areas quickly is critical, further increasing the demand for amphibious mobility solutions. The Japanese Self-Defense Forces have significantly invested in hovercrafts to enhance their amphibious assault capabilities, while civilian sectors, including coastal tourism, have also adopted hovercraft for efficient transportation.

Flood Mitigation Response

Hovercrafts play a vital role in flood mitigation efforts by providing rapid, flexible transport over flooded areas where traditional vehicles and boats may struggle. Japan’s vulnerability to natural disasters, particularly flooding, has led to the increasing adoption of hovercrafts by disaster response teams. Hovercrafts can traverse both land and water, making them effective in accessing flood-stricken regions. Their ability to transport people, equipment, and supplies quickly and efficiently is a significant factor in enhancing the country’s disaster preparedness and response systems, especially in remote and coastal areas.

Market Restraints

High Capital Expenditure (CapEx)

One of the main barriers to the widespread adoption of hovercrafts in Japan is the high capital expenditure associated with their purchase and maintenance. Hovercrafts require advanced engineering, specialized materials, and high-performance engines, which lead to higher initial costs compared to traditional marine vessels or amphibious vehicles. For government agencies, military forces, and private enterprises, the high upfront cost is a significant consideration, limiting the ability to purchase these vehicles in large numbers. Additionally, maintenance, operational expenses, and specialized infrastructure further add to the overall cost, making it a challenge for smaller operators to enter the market.

Infrastructure Needs

Hovercrafts require specialized infrastructure, including landing pads, maintenance facilities, and ports, which are often not readily available in all regions. This lack of infrastructure, especially in remote or less-developed coastal areas, poses a significant challenge to their widespread adoption. The high cost of establishing such infrastructure can be prohibitive for local governments and businesses. Moreover, existing ports and harbors may need modifications to accommodate hovercrafts, further driving up the overall cost of operation. Without a robust network of infrastructure to support these vehicles, their potential remains limited in many areas.

Opportunities

AI Navigation Systems

The integration of AI navigation systems into hovercraft technology presents a transformative opportunity for the industry. AI-powered systems can optimize hovercraft operations by improving route planning, collision avoidance, and real-time decision-making. These systems can significantly enhance the safety and efficiency of hovercrafts, particularly in environments with high traffic or challenging conditions. Additionally, AI navigation can reduce the reliance on human operators, making hovercrafts more autonomous and reliable. As Japan continues to embrace smart technologies in transportation, AI integration is likely to become a key feature in hovercrafts, driving further adoption across defense, commercial, and emergency response sectors.

Autonomous Operations

The development of autonomous hovercrafts represents a significant opportunity for the industry, particularly in defense and commercial sectors. Autonomous operations would reduce the need for crewed vehicles, lowering operational costs and enhancing safety. Autonomous hovercrafts could be deployed for critical missions such as border patrol, disaster relief, and coastal surveillance, where human presence may be difficult or dangerous. Japan’s ongoing investments in autonomous technologies, such as self-driving vehicles and drones, provide a strong foundation for integrating similar technologies into hovercrafts. The growth of autonomous systems in the transportation and defense industries offers significant potential for the future of the hovercraft market, particularly in terms of efficiency, cost reduction, and mission success.

Future Outlook

Over the next 5 years, the Japan Hovercraft Market is expected to experience considerable growth, driven by continued technological advancements, especially in hybrid and electric propulsion systems. This will be further propelled by the increased focus on amphibious mobility solutions within both the defense and commercial sectors. Additionally, Japan’s strategic geographical positioning, coupled with its government’s focus on bolstering its maritime security and coastal transport infrastructure, is expected to create substantial market demand. Technological innovations, including AI-powered navigation and autonomous hovercraft, are likely to revolutionize the market, making it more efficient and cost-effective.

Major Players

- Mitsubishi Heavy Industries

- Kawasaki Heavy Industries

- Griffon Hoverwork Ltd.

- Neoteric Hovercraft Inc.

- Textron Inc.

- AEROHOD Ltd.

- Airlift Hovercraft Pty Ltd.

- Hovertechnics LLC

- Ivanoff Hovercraft AB

- Bill Baker Vehicles Ltd.

- Mitsui E&S (Japan OEM Integration)

- Oita Hovercraft Services (Japan Passenger Operations)

- Maritime Systems Japan (Defense Integrator)

- JRH Hovercraft (Japan Specialist Builder)

- Kawasaki Heavy Industries (Hover Systems & Marine Division)

Key Target Audience

- Investors and Venture Capitalist Firms

- Government and Regulatory Bodies (Japan Coast Guard, Ministry of Defense)

- Military Procurement and Defense Agencies

- Hovercraft Manufacturers

- Maritime and Coastal Transportation Companies

- Tourism and Passenger Ferry Operators

- Logistics and Cargo Operators

- Emergency Response and Rescue Teams

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Japan Hovercraft Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we will compile and analyze historical data pertaining to the Japan Hovercraft Market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple hovercraft manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the Japan Hovercraft Market.

- Executive Summary

- Research Methodology (Market Definitions and Hovercraft Technical Specifications, Assumptions and Japan Maritime & Transport Sector Context, Data Sources (Japan Coast Guard, Defense Procurement, Industry OEMs & Operators), Market Sizing & Forecasting Approaches (Value, Volume, Unit Deployments), Primary Research Framework (Manufacturer, Operator, Defense & Commercial User Interviews), Limitations and Validation Logic)

- Definition and Scope

- Industry Genesis & Evolution in Japan

- Japan Maritime Mobility Ecosystem & Value Chain (Design, Manufacturing, Systems Integration, Aftermarket)

- Supply Chain Dynamics

- Growth Drivers

Demand for Amphibious Mobility

Flood Mitigation Response

Advancements in Defense Mobility

Urbanization and Coastal Development

Increase in Commercial Tourism - Market Restraints

High Capital Expenditure (CapEx)

Infrastructure Needs - Regulatory Challenges

Limited Range & Speed

Maintenance and Operational Costs - Opportunities

AI Navigation Systems

Autonomous Operations

Energy Efficiency

Noise Reduction Technologies

Advanced Skirt Design - Environmental & Emission Compliance Pressure

Government Regulations on Emissions

Sustainability in Marine Transportation

Ecosystem Protection

Noise and Air Pollution - Porter’s Five Forces Analysis

Competitive Rivalry

Threat of New Entrants

Bargaining Power of Suppliers

Bargaining Power of Buyers

Threat of Substitutes

Ecosystem Map

OEMs

Tier-1 Suppliers

Operators

Regulators

- Market Value, 2020-2025

- Volume Consumption Across Subsegments, 2020-2025

- Composite Adoption Intensity, 2020-2025

- By Craft Type (In Value %)

Peripheral Jet Hovercraft (Lift & Thrust Systems)

Skirted Hovercraft (Multi‑Skirt / Single‑Skirt)

Sidewall / Annular Air Cushion Craft

Custom Amphibious Utility Models

High‑Speed Tactical Hovercraft - By Propulsion System (In Value %)

Diesel Engine Systems

Gasoline Engine Systems

Hybrid Electric Propulsion

Fully Electric Drive Systems (Battery Energy Density & Emissions)

Turbine & Gas Turbine Assisted Systems - By End‑User Vertical (In Value %)

Defense & Maritime Security (Japan Self‑Defense Forces)

Coastal Patrol & Border Security

Commercial Passenger Ferry Operations

Logistics & Cargo Hover Operations

Disaster Response & Search & Rescue (S&R) - By Payload / Capacity Class (In Value %)

Small (≤5 t)

Medium (5–15 t)

Large (>15 t)

Passenger Capacity (Seat Based)

Custom & Heavy Load Configurations - By Region in Japan (In Value %)

Northern Island & Arctic Coastlines

Kanto & Metropolitan Waterways

Western Islands & Inland Sea Routes

Southern Coastal Archipelagos

Special Economic / Test Zones

- Market Share by Value & Unit Deployments (Defence vs Commercial)

- Cross‑Comparison Parameters (Company Overview, Global & Japan Sales Mix, Design & Powertrain Capabilities, Order Backlogs, Aftermarket Support Network, R&D Investment, Autonomous Tech Adoption, Regulatory Certifications, Environmental Compliance Score, Export Footprint, Service Network Reach, Pricing Matrix, Strategic Alliances)

- Key Competitor Profiles

Griffon Hoverwork Ltd.

Textron Inc. (Hovercraft & ACV Units)

The British Hovercraft Company Ltd.

Universal Hovercraft Inc.

AEROHOD Ltd.

Airlift Hovercraft Pty Ltd.

Hovertechnics LLC

Neoteric Hovercraft Inc.

Ivanoff Hovercraft AB

Bill Baker Vehicles Ltd.

Mitsui E&S (Japan OEM Integration)

Oita Hovercraft Services (Japan Passenger Operations)

Maritime Systems Japan (Defense Integrator)

JRH Hovercraft (Japan Specialist Builder)

Kawasaki Heavy Industries (Hover Systems & Marine Division

- Defense Procurement Priorities and Lifecycle Utilization Patterns

- Commercial Operator Adoption Patterns (Passenger, Tourism)

- Operational Cost Economics (Fuel, Maintenance, Lifecycle)

- Decision Making Criteria (Payload, Range, Reliability)

- Forecast by Value & Growth Scenarios, 2026-2035

- Forecast by Volume & Composite Penetration, 2026-2035

- Future Demand by Aircraft Segment, 2026-2035