Market Overview

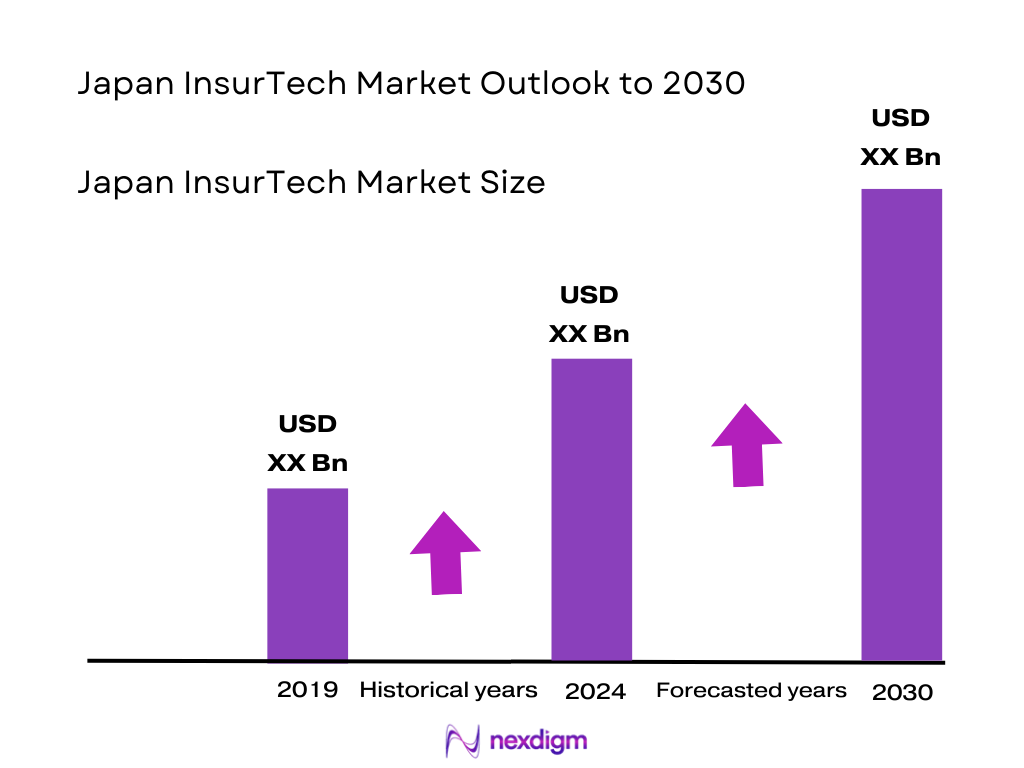

The Japan InsurTech market, valued at USD 432.6 million in 2024, reflects strong recent growth from USD 377.5 million in 2023, driven by rapid digitalization in insurance operations including underwriting, policy issuance and claims management. Key drivers include increasing consumer demand for digital and on‑demand insurance products, adoption of AI/ML and cloud technologies by incumbents and startups, and regulatory encouragement (e.g. sandbox initiatives) that lower barriers to innovation. These factors combine with rising smartphone and internet penetration to support expanding adoption of InsurTech services across both life and non‑life lines.

Japan’s InsurTech market is dominated by metropolitan centres such as Tokyo (in the Kanto region) and Osaka (in Kansai region), due to their concentration of headquarter functions of major insurers, higher disposable incomes, dense population, advanced digital infrastructure, and access to skilled tech talent. Also, these urban regions have early adopters of InsurTech products—both individuals and SMEs—spurring product innovation and partnerships. Beyond domestic geography, Japan leads in East Asia insurtech adoption because of its mature insurance market, strong regulatory oversight from the Financial Services Agency (FSA), and established capital markets that facilitate investment in insurance technology.

Market Segmentation

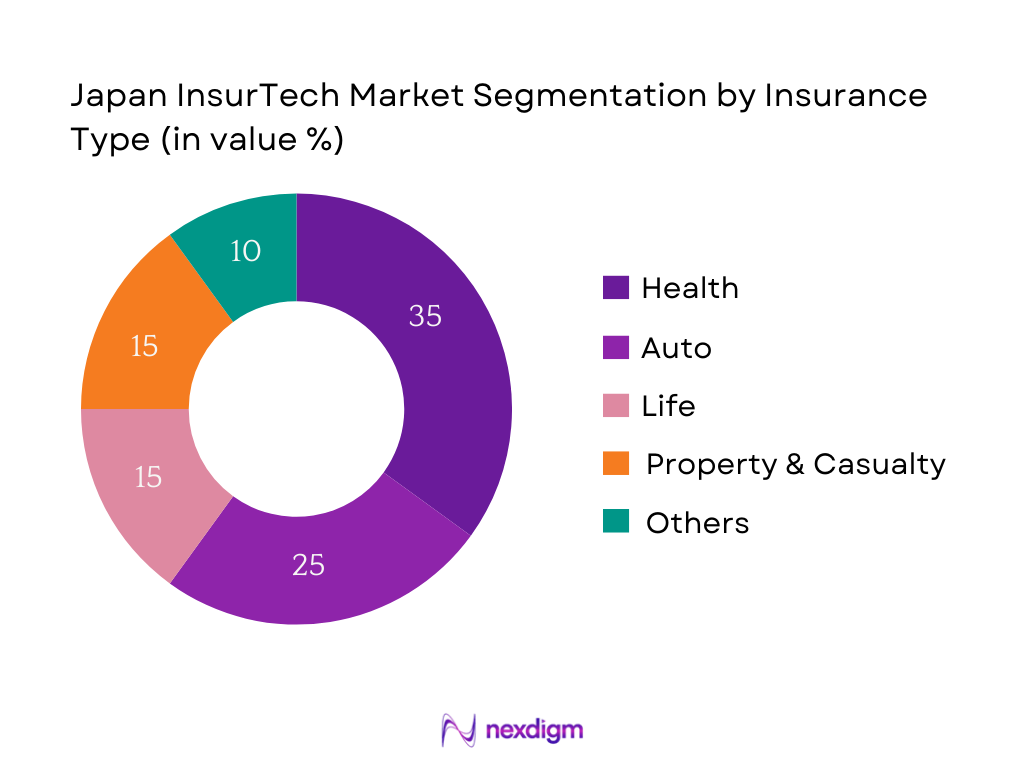

By Insurance Type

The Japan InsurTech market is segmented by insurance type into Auto, Health, Life, Property & Casualty, Specialty, Travel, and Others. Health is the dominant sub‑segment in 2024, because rising healthcare costs among ageing consumers and demand for digital health platforms (including telemedicine, wellness tracking, preventive care) have driven major insurers and InsurTech startups to focus investment there. Also, regulatory encouragement for digital health services and integration with public health schemes has boosted uptake. While Auto and P&C remain important, Health’s growth in both revenue and innovation has outpaced them in many recent reports. Grand View Research confirms Health was the largest revenue‑generating type in 2023, making it natural that Health continues to lead into 2024.

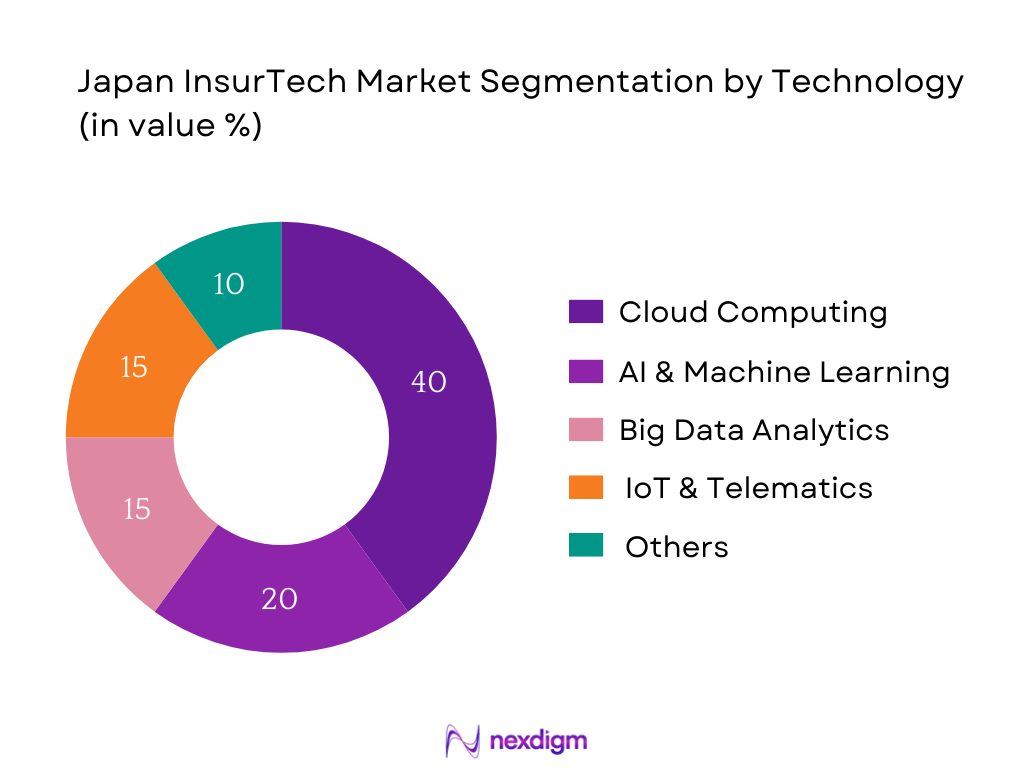

By Technology / Innovation Leveraged

The Japan InsurTech market is segmented by technology into AI & Machine Learning; IoT & Telematics; Blockchain; Cloud Computing; Big Data & Advanced Analytics; Robo‑Advisory; and Others. Cloud Computing is the dominant technology used in 2024, because insurers and InsurTech firms are rapidly migrating legacy systems to cloud‑native infrastructure, which offers scalability, cost savings, and agility in product launches. Also, cloud platforms enable the deployment of AI/ML models more efficiently, facilitate remote and digital customer interactions, and support data storage and analytics at scale. The regulatory framework has become more supportive of cloud use, with compliance and data privacy standards evolving to accommodate this. IoT / Telematics are growing, especially in auto and home segments, but cloud remains foundational.

Competitive Landscape

The Japan InsurTech market exhibits a competitive landscape where a handful of traditional large insurers are collaborating with or acquiring InsurTech startups, while dedicated InsurTech firms are emerging in niche areas (health, specialty covers, embedded insurance). Incumbents benefit from strong brand, high trust, deep distribution networks, and regulatory licenses; meanwhile startups drive innovation in product structuring, customer experience, and digital service delivery. The result is a hybrid competitive environment in which both legacy players and new entrants must adapt rapidly.

| Company | Establishment Year | Headquarters | Key Product/Service Focus | Digital Distribution Strength | Technology Innovation Capability | Strategic Partnerships / Ecosystem Activity | Regulatory Licensing & Compliance Readiness | Claims Processing Speed / Customer Experience |

| Tokio Marine Holdings, Inc. | 1879 | Tokyo, Japan | – | – | – | – | – | – |

| Sompo Holdings / Sompo Japan | 1888 | Tokyo, Japan | – | – | – | – | – | – |

| MS&AD Insurance Group Holdings | 2008 (merger) | Tokyo, Japan | – | – | – | – | – | – |

| JustInCase (Startup) | ~2016‑2018 | Tokyo, Japan | – | – | – | – | – | – |

| Rakuten General Insurance / Rakuten group | ~1997 for parent, digital push later | Tokyo, Japan | – | – | – | – | – | – |

Japan InsurTech Market Analysis

Growth Drivers

Aging Population & Rising Health Consciousness

Japan has among the highest share of elderly in its overall population: people aged 65 years or older account for 29.3% of Japan’s population, based on 2023 demographic data showing age 65+ group being 29.3 percent. This aging cohort is increasing demand for health‑ and wellness‑related insurance offerings and digital health services that reduce friction in accessing care. In 2024, Japan recorded 686,061 births, the lowest number since records began, while deaths numbered approximately 1.60 million, contributing to population shrinkage and higher dependency ratio. Reflecting rising health consciousness, current health expenditure per capita in Japan was US$ 3,889 in 2022. Meanwhile, the proportion of health expenditure relative to GDP has been among the highest for developed economies. These demographic and health expense statistics drive demand for InsurTech solutions in preventive care, wellness apps, telemedicine, chronic disease management, and supplementary insurance, all of which are increasingly viewed as essential by older cohorts seeking quality and convenience.

Smartphone Penetration and App Ecosystem Growth

Smartphone adoption in Japan is high: as of 2023, there were approximately 97.44 million smartphone users, representing about 78.6% of the total population of approximately 124 million. Use of smartphones spans all adult age groups under 60; for example, in 2023 the smartphone usage rate among those aged 13‑19 was 85.5%, among 20‑29 was 90.5%, 30‑39 was 92.0%, 40‑49 was 89.6%, and 50‑59 was 88.3%. This broad penetration enables digital delivery of insurance products—apps for purchasing, claims submission, policy management, wellness tracking etc. The number of cellular mobile connections in early 2024 was 188.9 million, representing 153.6% of the population, meaning many users have more than one mobile connection (personal, work etc.), which reflects high digital engagement. Also, internet use via smartphone is widespread: the Statistical Handbook reports smartphone usage rate of 72.9% across total population aged 6 and over via devices (end of August 2023). These numbers show infrastructure and consumer readiness for mobile‑first insurance apps, embedded insurance through mobile ecosystems, and usage‑based insurance (telemetry, IoT sensors), all of which are levered by high smartphone penetration.

Market Challenges

Stringent Compliance Norms by FSA

Insurance firms in Japan are constrained by strict regulatory requirements under the Insurance Business Act and associated regulations. For instance, the Financial Services Agency (FSA) mandates a minimum capital of ¥1 billion (≈ USD 6.8 million) for an insurance company license. Foreign insurers forming a branch must deposit at least ¥200 million to commence operations. Additionally, insurers must maintain a solvency margin ratio of at least 200 percent, under FSA monitoring, failing which the FSA can require corrective actions. The number of registered general insurers was approximately 55, and life insurers about 44, indicating a relatively small number of players who must all meet these high regulatory standards. These regulations ensure financial stability and policyholder protection but raise entry barriers, slow down product approval, and stiffen compliance costs. For InsurTech startups especially, assembling capital, reserves, and compliance capabilities to match FSA expectations becomes a significant burden, limiting speed to market and scale.

Limited Risk Appetite Among Japanese Consumers

Japanese households tend to favor stable, well‑known insurance brands and conventional products, rather than newer or riskier offerings. Although precise survey numbers specific to InsurTech adoption are sparse, a Reuters / Nikkei survey of 506 companies in 2024 showed more than 40 percent of Japanese companies had no plan to use artificial intelligence (AI), reflecting broader risk aversion toward newer technological/financial innovations. On the consumer side, Japanese culture emphasizes reliability and trust, and any perceived lack of track record for newer InsurTech offerings (on‑demand, usage‑based, parametric) slows uptake. Coupled with demographic trends like shrinking working‑age population (≈ 59.4% of total population as of latest data) and high proportion of elderly (≈ 29% aged 65 and over), there is lower risk appetite among older consumers for experimental insurance models. Thus, even when regulatory and technological conditions are favourable, consumer conservatism and preference for legacy insurer brands represent a challenge for newer InsurTech entrants.

Opportunities

Growth in Embedded Insurance via Mobility, Retail & Health Ecosystems

Japan’s consumer and digital ecosystem is highly sophisticated: per capita GDP of US$ 32,475.90 in 2024 indicates substantial purchasing power. Urbanization rate is around 92.1% as of latest reports, implying most citizens live in densely connected environments with frequent use of mobile apps and digital services. There were approximately 97.44 million smartphone users in 2023 in Japan. These stats indicate that embedded insurance (insurance integrated into mobility apps, retail checkout, health/wellness platforms) has large potential reach. Consumers already engage with digital platforms for travel, retail, health services; adding insurance as an embedded feature can leverage existing digital customer journey without requiring separate onboarding. Startups and incumbents can partner with mobility providers, e‑commerce / retail tech firms, health tech ecosystems to distribute insurance seamlessly. The regulatory environment is increasingly supportive making embedded models less frictional than before.

Expansion in Parametric and Disaster Insurance Models

Japan is a country with high exposure to natural disasters: typhoons, earthquakes, heavy rainfall, etc. While I did not locate exact 2024 numbers of parametric insurance policies, government statistics show frequent issuance of disaster claims and strong government/regulator interest in improving catastrophe resilience. The FSA and government policy reviews (e.g. FSAP assessment) have identified disaster risk as a systemic concern requiring innovative risk transfer tools. In the Financial Sector Assessment Program (FSAP) for Japan in 2024, part of analysis focuses on insurance supervision with respect to natural disaster risk, including the need for parametric triggers and faster claims resolution. Also, the government’s investment in disaster mitigation infrastructure remains high (billions of yen annually) and there is strong consumer awareness—given past disasters—of loss events, which supports demand for parametric or index‑based covers. Thus parametric / disaster insurance models represent opportunity for InsurTechs able to design products with clear event triggers, fast payout, and lower administrative costs, especially given frequent natural disaster exposure in Japan and supportive regulatory interest.

Future Outlook

Over the next several years, the Japan InsurTech market is expected to continue its rapid expansion, driven by strong investments in digital infrastructure, increasingly favorable regulation toward innovation, and growing consumer preference for convenience, transparency, and personalized coverage. Insurers and startups alike will increasingly target underserved segments—older age groups, rural areas, SMEs—while pushing innovation in risk‐pricing (telematics, parametric), embedded insurance, wellness‑linked health policies, and AI‑based automation. Forecasts suggest that from 2024 through 2030, the Japan InsurTech market will grow from USD 432.6 million toward several billion USD in revenue, with CAGR estimates in the range of 50‑55%, based on Grand View Research’s estimate of USD 7,606.3 million by 2030. Key technological trends such as cloud adoption, AI/ML, data analytics, embedded insurance, and regulatory sandboxes will shape which players emerge as leaders. Also, external factors like demographic shifts (aging population), climate risk (natural disasters), and cybersecurity/regulatory demands will heavily influence product innovation and market structure.

Major Players

- Tokio Marine Holdings, Inc.

- Sompo Holdings (Sompo Japan)

- MS&AD Insurance Group Holdings

- Nippon Life Insurance Company

- Dai‑ichi Life Insurance Company

- Meiji Yasuda Life Insurance Company

- JustInCase (InsurTech startup)

- iChain Japan

- Global Mobility Service

- Rakuten General Insurance / Rakuten group

- SBI Insurance / InsurTech initiatives under SBI group

- Line Financial / LINE Insurance

- Credit Engine Inc.

- Green Reach

- Specialty insurers / parametric InsurTechs (emerging niche players)

Key Target Audience

- Large & mid‑size insurance carriers in Japan planning digital transformation or InsurTech partnerships

- Technology providers / InsurTech vendors aiming to penetrate or scale in the Japanese market

- Investments and venture capitalist firms (e.g. VC funds focused on FinTech & InsurTech)

- Embedded finance platforms and e‑commerce / mobility companies seeking to integrate insurance products

- Healthcare providers and health tech firms exploring health insurance / wellness tie‑ups

- SME associations / chambers of commerce interested in risk & insurance innovation for small business coverages

- Government and regulatory bodies (Japan Financial Services Agency (FSA), Ministry of Health, Labour and Welfare)

- Reinsurers and global insurance groups evaluating exposure and partnership potential in Japan

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves defining the scope of the Japan InsurTech market: product types, technology categories, distribution channels, regulatory framework, and customer segments. Secondary sources, official regulatory publications (e.g. FSA), corporate reports are used to gather data on these variables.

Step 2: Market Analysis and Construction

Historical data points are compiled (2019‑2024) to measure past growth: revenue, number of digital policies, claim processes, technology adoption. Segment‑wise and sub‑segment‑wise performance is assessed using published reports and filings. Cross‑validation is done to ensure consistency among sources.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses (e.g. which insurance types or technologies will dominate, impact of regulation) are validated via interviews or dialogues with industry experts—senior leaders at insurers, startup founders, regulatory officials. This yields insights into projected challenges and practical constraints.

Step 4: Forecasting and Synthesis

Using quantitative forecast models (exponential smoothing, scenario analysis) together with Factor‑based drivers (e.g. regulatory changes, demographic shifts, technology adoption rates), projections for 2024‑2030 are built. Final outputs consolidate all segment forecasts, competitive benchmark data, and recommendations.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope of Japan InsurTech

- InsurTech Market Genesis and Evolution in Japan

- Key Events Timeline (Regulatory Milestones, Product Launches, Partnerships)

- InsurTech Value Chain Analysis

- Business Cycle and Product Lifecycle Mapping

- Insurance Penetration Rate, Digitalization Rate, and Smartphone Adoption

- Value Chain – From Digital Brokerages to Embedded Models

- Industry Stakeholder Mapping (FSA, JPI, Conglomerates)

- Growth Drivers

Aging Population & Rising Health Consciousness

Smartphone Penetration and App Ecosystem Growth

Regulatory Push for Digitalization (FSA Sandbox, eKYC)

Urbanization and Personal Risk Awareness

Partnerships between Traditional Insurers & Startups - Market Challenges

Stringent Compliance Norms by FSA

Limited Risk Appetite Among Japanese Consumers

Legacy IT Systems in Traditional Carriers

Talent Shortages in AI/Data Science

High Capital Entry Barriers for Startups - Opportunities

Growth in Embedded Insurance via Mobility, Retail & Health Ecosystems

Expansion in Parametric and Disaster Insurance Models - Trends

Telemedicine Integration into Health Covers

AI in Claims Automation and Personalization

Usage-Based Insurance and Telematics Adoption

Blockchain-Enabled Fraud Prevention and Smart Contracts - Regulatory Framework

Licensing under the Insurance Business Act

Digital Identity and eKYC Regulations

Data Localization and Privacy Guidelines (My Number System, APPI)

Regulatory Sandbox Outcomes (2018–Present) - SWOT Analysis

- Stakeholder Ecosystem (FSA, Startups, Incumbents, Reinsurers, Platforms, Big Tech)

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Policy Value, 2019-2024

- By Insurance Type (In Value %)

Auto Insurance

Health Insurance

Life Insurance

Property & Casualty Insurance

Specialty Insurance

Travel Insurance

Others - By Business Model (In Value %)

Digital Insurer

B2B Tech Vendor

Insurance Platform / Marketplace

Backend-as-a-Service (BaaS)

Embedded & Affinity Insurance

Insurer–Startup Partnerships - By Technology (In Value %)

AI & Machine Learning

IoT & Telematics

Blockchain

Big Data & Advanced Analytics

Cloud Computing

Robo-Advisory

Parametric Insurance Tools - By Deployment / Delivery Channel (In Value %)

Direct-to-Consumer (Digital)

Agent & Broker Network

Bancassurance

Embedded via Ecosystem Platforms

Mobile-First Insurance Platforms - By Region (In Value %)

Kanto (Tokyo, Kanagawa, Saitama)

Kansai (Osaka, Kyoto, Hyogo)

Chubu (Nagoya, Shizuoka, Aichi)

Kyushu–Okinawa

Tohoku

Hokkaido

Chugoku

Shikoku

- Market Share Analysis (By Product, By Channel, By Region)

- Cross Comparison Parameters (Product Portfolio Breadth, API Exposure, AI/ML Use Cases, Platform UX/UI Scores, Strategic Partnerships, Licensing Breadth, Claim Settlement, Efficiency, Distribution Network Scalability)

- SWOT Analysis of Major Players

- Digital Pricing, Claims TAT, and User Satisfaction Benchmarks

- Profiles of Major Players

Tokio Marine Holdings

Sompo Holdings

MS&AD Insurance Group

Nippon Life Insurance

Dai-ichi Life Insurance

Meiji Yasuda Life Insurance

JustInCase

iChain Japan

Global Mobility Service

Rakuten General Insurance

SBI Insurance

LINE Financial

Credit Engine Inc.

Green Reach

Warrantee Inc.

- Digital Journey Mapping

- Adoption by Age Groups (Millennials, Gen Z, Elderly)

- Group vs Individual Demand Analysis

- SME vs Corporate Risk Appetite

- Wellness-Linked Behavioral Insurance Preferences

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Policy Value, 2025-2030