Market Overview

The Japan Marine Simulators Market is valued at approximately USD ~billion, driven by the increasing demand for simulation-based training solutions in the maritime sector. Technological advancements in marine simulator systems and growing emphasis on safety and operational efficiency have bolstered market growth. Additionally, government regulations surrounding maritime safety and training have fostered the adoption of simulators, further driving market expansion. The rise of automation and the digital transformation in maritime operations are further expected to accelerate market adoption.

Japan dominates the marine simulators market due to its advanced maritime industry and well-established infrastructure. Major shipping companies, ports, and training institutes in the country have invested heavily in simulation technology to enhance operational efficiency and safety. Tokyo and Yokohama are key cities, housing the largest marine training centers and technological hubs. Furthermore, Japan’s global leadership in shipbuilding and maritime technology has reinforced its position as a market leader for marine simulators.

Market Segmentation

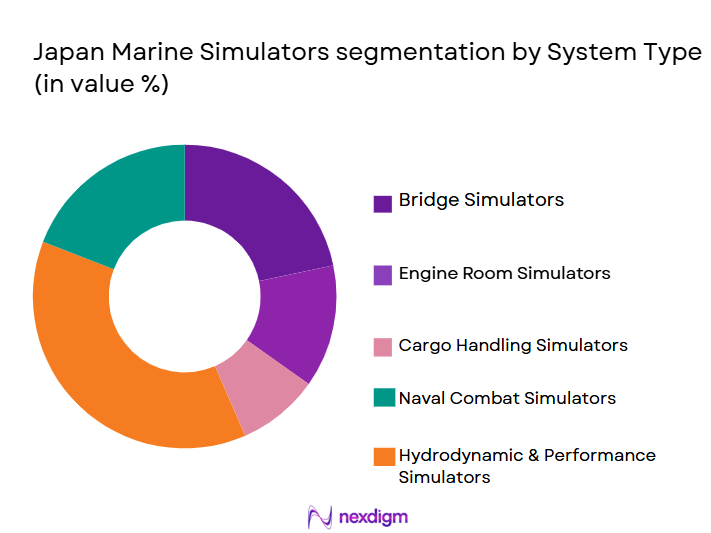

By System Type

Japan Marine Simulators Market is segmented by system type into full mission simulators, desktop simulators, ship handling simulators, bridge team simulators, and part-task simulators. Full mission simulators dominate the market due to their ability to replicate complex real-world maritime scenarios. These systems are essential for large-scale training programs in naval forces and commercial shipping companies, offering high fidelity simulations for navigation, emergency response, and team coordination. Their comprehensive nature and high demand from training institutions and maritime agencies make them the dominant segment in Japan.

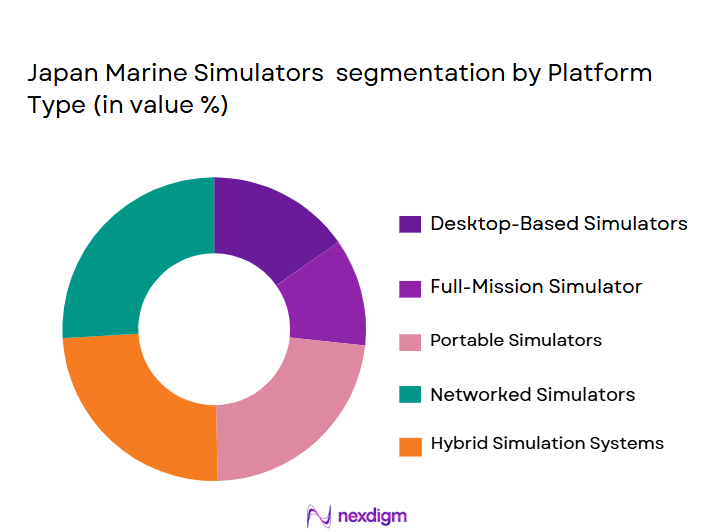

By Platform Type

The Japan Marine Simulators Market is further segmented by platform type into onshore systems, offshore systems, land-based platforms, training vessels, and hybrid systems. Onshore systems lead the market due to their flexibility, scalability, and cost-effectiveness. These platforms can be easily deployed in training centers and used to simulate a variety of maritime operations. Furthermore, the ability to update and modify scenarios to reflect the latest maritime conditions ensures their continued dominance. The availability of onshore systems across numerous training institutes in Japan contributes to their significant share.

Competitive Landscape

The Japan Marine Simulators Market is highly competitive, with a few key players driving the industry forward. The market is dominated by global and regional companies that offer diverse simulator solutions, ranging from full mission to part-task systems. Major players in Japan’s marine simulators market include companies like Furuno Electric Co., Ltd., Mitsubishi Heavy Industries, and Kongsberg Gruppen. These players dominate through their technological advancements, extensive service offerings, and partnerships with naval and commercial maritime organizations. As the market is highly regulated and dependent on technological advancements, these major players hold a significant share, constantly innovating to meet the needs of the maritime industry.

| Company | Establishment Year | Headquarters | Product Range | Market Focus | Revenue Growth Rate | Customer Base | Technological Capability |

| Furuno Electric Co., Ltd. | 1948 | Japan | ~ | ~ | ~ | ~ | ~ |

| Mitsubishi Heavy Industries | 1884 | Japan | ~ | ~ | ~ | ~ | ~ |

| Kongsberg Gruppen | 1814 | Norway | ~ | ~ | ~ | ~ | ~ |

| Transas | 1990 | Russia | ~ | ~ | ~ | ~ | ~ |

| VSTEP | 2004 | Netherlands | ~ | ~ | ~ | ~ | ~ |

Japan marine simulators Market Dynamics

Growth Drivers

Rising demand for advanced training solutions in maritime industries

The growing need for highly skilled personnel in the maritime industry has led to increased demand for advanced training solutions. Marine simulators provide a cost-effective and efficient way to train personnel in handling complex maritime operations, navigation, and safety protocols, ultimately boosting demand for these systems.

Growing adoption of simulation-based training for safety and cost-efficiency

Simulation-based training is widely adopted due to its ability to replicate real-world scenarios while significantly reducing training costs. It allows maritime professionals to practice emergency responses, navigation techniques, and operational procedures safely, improving efficiency and minimizing the risk of costly mistakes during actual operations.

Market Challenges

High initial investment for advanced simulation systems

One of the key challenges faced by the marine simulators market is the high initial investment required to purchase and install advanced systems. These simulators, especially full mission simulators, require significant capital, making them a barrier for smaller maritime training centers and commercial shipping companies to adopt the technology.

Regulatory and certification compliance requirements

Marine simulators must adhere to stringent industry regulations and certification standards, including those set by international maritime organizations. This complexity adds another layer of cost and complexity for manufacturers and users, requiring additional time and resources for compliance and maintenance.

Market Opportunities

Expansion of simulators for emerging market training centers

As the maritime industry grows in emerging markets, there is a significant opportunity to expand marine simulators to new training centers. These regions are increasingly adopting modern training technologies to build a skilled workforce for their expanding maritime sectors, offering a new avenue for growth in the market.

Development of AI-driven and virtual reality-based training solutions

The development of AI-driven and virtual reality-based training solutions presents a major opportunity for the marine simulators market. These technologies enable more dynamic and realistic training scenarios, enhancing the overall learning experience and improving training outcomes, which is likely to drive increased adoption in the coming years.

Future Outlook

Over the next 5-10 years, the Japan Marine Simulators Market is expected to experience significant growth driven by continuous advancements in technology, including the integration of artificial intelligence and virtual reality into marine training. The growing focus on safety, environmental concerns, and operational efficiency in maritime operations will propel the demand for simulation systems. Moreover, the increasing complexity of maritime operations and the rising need for skilled personnel in the maritime industry are expected to fuel further adoption of advanced simulators in both military and commercial sectors. The expansion of hybrid and remote training solutions will also contribute to the market’s positive outlook.

Major Players in the Japan Marine Simulators Market

- Furuno Electric Co., Ltd.

- Mitsubishi Heavy Industries

- Kongsberg Gruppen

- Transas

- VSTEP

- Wärtsilä

- L3 Technologies

- AVEVA Group

- KVH Industries

- BMT Group

- Nobeltec

- L-3 Communications

- Ashore Marine Systems

- Rixensart Technologies

- MPC Computer Software

Key Target Audience

- Maritime Operators and Fleet Owners

- Naval Forces (e.g., Japan Maritime Self-Defense Force)

- Shipping Companies

- Maritime Training Institutes

- Shipbuilders and Shipyards

- Government and Regulatory Bodies (e.g., Japan Coast Guard)

- Investments and Venture Capitalist Firms

- International Maritime Organizations

Research Methodology

Step 1: Identification of Key Variables

The first step in the research methodology involves constructing an ecosystem map that includes all major stakeholders in the Japan Marine Simulators Market. This step is supported by comprehensive secondary research and the analysis of proprietary databases, identifying key variables that influence market growth.

Step 2: Market Analysis and Construction

In this phase, historical data from the Japan Marine Simulators Market is gathered and analyzed. This includes examining market penetration, the ratio of simulators to service providers, and evaluating the sales performance of key players. This analysis helps in constructing a detailed market picture.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and validated through expert consultations. These consultations are conducted with industry leaders via computer-assisted telephone interviews (CATI), gathering valuable insights that inform and refine market data.

Step 4: Research Synthesis and Final Output

The final stage includes engaging with simulator manufacturers and training institutes to acquire specific insights into product segments, sales performance, and user preferences. This process serves to verify and complement the data gathered through prior steps, ensuring a reliable and comprehensive market analysis.

- Executive Summary

- Japan Marine Simulators Market Research Methodology

(Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Rising demand for advanced training solutions in maritime industries

Growing adoption of simulation-based training for safety and cost-efficiency

Technological advancements in simulation hardware and software - Market Challenges

High initial investment for advanced simulation systems

Regulatory and certification compliance requirements

Complex integration with existing maritime training infrastructures - Market Opportunities

Expansion of simulators for emerging market training centers

Development of AI-driven and virtual reality-based training solutions

Increasing demand for hybrid and remote training platforms - Trends

Integration of artificial intelligence in marine simulation

Shift towards cloud-based training platforms

Growing focus on environmental sustainability in maritime training

- Government Regulations & Defense Policy

FDI Rules

Offset Obligations

Export Licenses - SWOT Analysis (Capability Strengths, Cost Vulnerabilities, Competitive Pressures)

- Porter’s Five Forces (Procurement Power, Supplier Concentration, Substitutes, Barriers to Entry)

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Full Mission Simulators

Desktop Simulators

Ship Handling Simulators

Bridge Team Simulators

Part Task Simulators - By Platform Type (In Value%)

Onshore Systems

Offshore Systems

Land-based Platforms

Training Vessels

Hybrid Systems - By Fitment Type (In Value%)

New Installations

Upgrades

Retrofits

Modular Fitments

Custom Fitments - By EndUser Segment (In Value%)

Naval Forces

Commercial Shipping Companies

Training Institutes

Port Operators

Government & Defense - By Procurement Channel (In Value%)

Direct Sales

Distributors & Resellers

Online Sales

Government Contracts

End-User Corporate Procurement

- Market Share Analysis

- Cross Comparison Parameters

(Market Share, System Complexity, Fitment Type, End-User Segmentation, Platform Type) - SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Furuno Electric Co., Ltd.

Kongsberg Gruppen

Mitsubishi Heavy Industries

Transas

VSTEP

Wartsila

CAE Inc.

AVEVA Group

KVH Industries

MPC Computer Software

Nobeltec

L3 Technologies

Ashore Marine Systems

BMT Group

Rixensart Technologies

- Increasing adoption of simulators in maritime safety training

- Rising focus on compliance with international maritime regulations

- Shift in commercial shipping towards advanced navigation and automation training

- Expanding demand for specialized training in high-risk maritime environments

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035