Market Overview

The Japan Maritime Security market has demonstrated significant growth, driven by increasing maritime traffic, rising security concerns, and substantial government investments in advanced technologies. In 2023, the market size was valued at approximately USD ~ billion, with continuous growth attributed to strategic measures to secure Japan’s maritime borders and critical ports. Japan’s focus on enhancing its maritime infrastructure and investing in state-of-the-art surveillance systems is expected to fuel the demand for security solutions in the coming years.

Japan, being an island nation with a significant maritime trade route, holds a dominant position in the maritime security landscape. Key cities such as Tokyo, Yokohama, and Osaka are at the heart of Japan’s maritime operations, benefiting from strong port infrastructure and strategic positioning. The country’s geographical location near vital shipping lanes amplifies the demand for enhanced security solutions. Japan’s robust navy and port authorities continually invest in cutting-edge surveillance systems and monitoring technologies, reinforcing its market dominance.

Market Segmentation

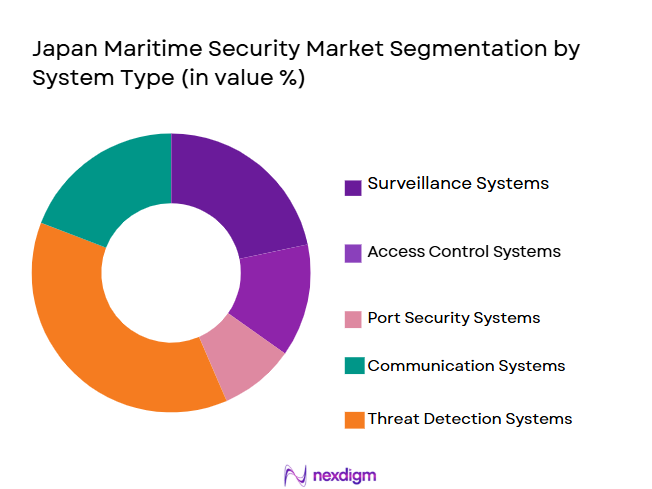

By System Type

Japan Maritime Security market is segmented by system type into surveillance systems, communication systems, vessel tracking systems, navigation safety systems, and intruder detection systems. Surveillance systems hold the largest share in the market due to their extensive use in port security, vessel monitoring, and real-time threat detection. With the increasing need for comprehensive maritime security solutions, surveillance systems such as radar, sonar, and satellite monitoring are integral to safeguarding the nation’s coastline and waterways. Leading maritime players like Japan Radio Co. and Furuno Electric Co. have heavily invested in surveillance technologies, making them a dominant force in this segment.

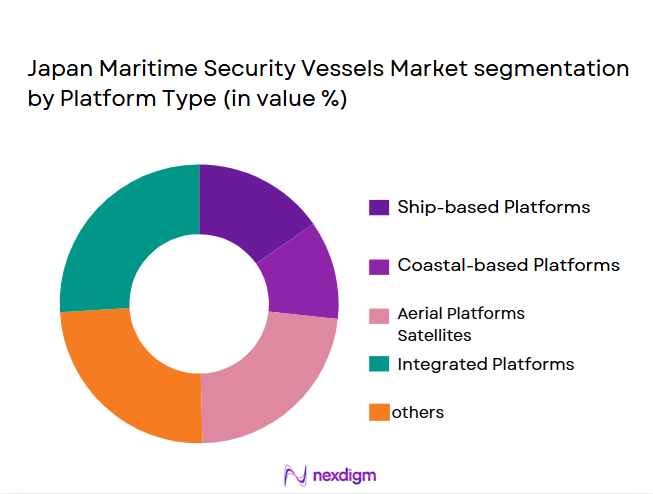

By Platform Type

The Japan Maritime Security market is also segmented by platform type, including ships, marine drones, coastal infrastructure, floating platforms, and ports and terminals. Ports and terminals dominate this segment, accounting for the highest market share. With Japan’s extensive port network handling international shipping traffic, the need for robust security in these areas is paramount. Investments in security infrastructure at key ports such as Tokyo, Yokohama, and Kobe have led to the adoption of advanced monitoring and access control systems. These platforms are critical for detecting unauthorized access and ensuring the safety of both cargo and passengers.

Competitive Landscape

The Japan Maritime Security market is highly competitive, with a few key players dominating the landscape. Local companies such as Mitsubishi Heavy Industries and Kawasaki Heavy Industries lead in technology and infrastructure solutions. They are supported by global companies like Lockheed Martin and Raytheon, who provide advanced surveillance and security systems to the market. The consolidation of these major players underscores their significant influence in shaping market trends, driving innovation, and ensuring maritime security in Japan’s critical regions.

| Company Name | Establishment Year | Headquarters | Surveillance Systems | Market Reach | Technological Innovation | Government Partnerships | Revenue (USD) | Product Portfolio | R&D Investment |

| Mitsubishi Heavy Industries | 1884 | Tokyo, Japan | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| Kawasaki Heavy Industries | 1896 | Tokyo, Japan | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| Raytheon | 1922 | Waltham, USA | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| Lockheed Martin | 1912 | Bethesda, USA | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| Furuno Electric Co. | 1938 | Nishinoseki, Japan | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

Japan maritime security Market Dynamics

Growth Drivers

Increasing maritime trade and traffic in Japan

Japan is one of the world’s largest maritime nations, with significant international trade flowing through its ports. The growth in global trade and shipping activities has led to a higher volume of vessels navigating Japanese waters, driving the demand for enhanced maritime security. The increasing flow of goods, including key commodities like automobiles and electronics, creates a need for advanced monitoring systems to ensure safety and prevent unauthorized access or attacks. The high volume of trade and the strategic location of Japan in the Pacific Ocean further boost the need for robust maritime security solutions.

Government initiatives for enhanced maritime security

The Japanese government has placed a strong emphasis on securing its maritime borders and critical infrastructure. Policies aimed at improving national security, alongside significant investments in maritime surveillance and defense, have been a key driver for the market. Initiatives such as increased funding for the Japan Coast Guard, upgrades to security at major ports like Tokyo and Yokohama, and the implementation of advanced monitoring systems reflect Japan’s commitment to improving its maritime security posture. These government efforts ensure a safe and secure environment for maritime trade, thereby propelling market growth.

Market Challenges

High capital investment for advanced systems

One of the main challenges in the Japan Maritime Security market is the substantial capital investment required to implement state-of-the-art security systems. Advanced surveillance technologies such as radar systems, drones, and satellite monitoring equipment are costly, and upgrading existing infrastructure can involve considerable financial outlays. For smaller port operators or maritime service providers, these high costs may create barriers to adopting these advanced solutions. As a result, the high capital expenditure required for such security measures can limit the market’s growth potential, especially in regions with smaller budgets or less developed security infrastructures.

Integration complexities with existing infrastructure

Integrating new maritime security systems with existing infrastructure is another significant challenge in Japan. Many of the country’s ports and maritime assets have older systems that were not designed to work with the latest technologies. The complexity of upgrading legacy systems and ensuring seamless interoperability between new and old technologies can be a time-consuming and costly process. Moreover, systems from different vendors may not always integrate smoothly, which could lead to inefficiencies in monitoring, response times, and overall security effectiveness. This challenge poses a risk for the swift and cost-effective implementation of advanced maritime security systems across the country.

Market Opportunities

Growing demand for smart ports and automated surveillance

The rise in digital transformation and the increasing adoption of automation in port operations create substantial opportunities for the Japan Maritime Security market. Smart ports, which utilize technologies like IoT, AI, and big data analytics, are becoming more common in Japan, providing a seamless and automated way to monitor and secure port activities. These ports can use automated surveillance systems to track vessel movements, detect potential threats, and reduce the need for manual oversight. The growing trend of smart port development opens new avenues for maritime security companies to offer integrated solutions that enhance both operational efficiency and safety.

Public-private partnerships in port security enhancements

Public-private partnerships (PPPs) are emerging as a key opportunity for enhancing maritime security in Japan. Collaboration between the government and private companies can lead to more efficient deployment of advanced security technologies and resources. PPPs allow for the pooling of public and private sector expertise, financial resources, and innovative solutions. This collaboration enables the development of more advanced and cost-effective maritime security systems, which can be deployed across various ports and maritime facilities. As Japan continues to modernize its infrastructure and enhance its security posture, PPPs will play an important role in shaping the future of the market.

Future Outlook

Over the next decade, the Japan Maritime Security market is poised to experience significant growth, driven by continued technological advancements in surveillance, cybersecurity, and maritime navigation systems. The market is set to expand as Japan increases its investments in both defense and commercial sectors to address growing maritime security concerns. The government’s focus on securing vital shipping lanes and ports, coupled with the rise in international maritime trade, will drive demand for sophisticated security solutions.

Major Players

- Mitsubishi Heavy Industries

- Kawasaki Heavy Industries

- Raytheon

- Lockheed Martin

- Furuno Electric Co.

- Japan Radio Co.

- Hitachi Ltd.

- NEC Corporation

- Panasonic Corporation

- Toshiba Corporation

- Marubeni Corporation

- Yokogawa Electric Corporation

- IHI Corporation

- STX Marine Solutions

- Tokyo Keiki Inc.

Key Target Audience

- Port Authorities (e.g., Japan Port Authority)

- Maritime Defense Agencies (e.g., Japan Maritime Self-Defense Force)

- Commercial Shipping Companies

- Vessel Operators

- Marine Infrastructure Developers

- Government and Regulatory Bodies (e.g., Japan Coast Guard)

- Investments and Venture Capitalist Firms

- Defense Contractors

Research Methodology

Step 1: Identification of Key Variables

The first phase involves the identification and mapping of all key stakeholders in the Japan Maritime Security market, including government agencies, security technology providers, and infrastructure developers. Desk research will utilize secondary databases and industry reports to define the critical variables shaping market dynamics.

Step 2: Market Analysis and Construction

This phase focuses on compiling and analyzing historical market data for Japan’s maritime security sector. It includes evaluating market penetration, technological advancements, and regional security initiatives, in addition to gathering insights into stakeholder roles and financial performance.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be refined through expert consultations. These consultations, conducted via interviews with industry leaders and practitioners, will help validate initial hypotheses and ensure the accuracy of the market’s current and future projections.

Step 4: Research Synthesis and Final Output

The final phase entails direct engagement with key maritime security stakeholders to collect detailed insights into current market conditions. Insights from these engagements will be synthesized with primary and secondary data to ensure a comprehensive, reliable, and validated market analysis.

- Executive Summary

- Japan Maritime Security Market Research Methodology

(Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing maritime trade and traffic in Japan

Government initiatives for enhanced maritime security

Technological advancements in surveillance and tracking systems - Market Challenges

High capital investment for advanced systems

Integration complexities with existing infrastructure

Cybersecurity risks in maritime security systems - Market Opportunities

Growing demand for smart ports and automated surveillance

Public-private partnerships in port security enhancements

Technological advancements in AI and IoT for maritime security - Trends

Shift towards integrated maritime security systems

Increased use of drones and autonomous systems for surveillance

Focus on reducing environmental impact in maritime security

- Government Regulations & Defense Policy

FDI Rules

Offset Obligations

Export Licenses - SWOT Analysis (Capability Strengths, Cost Vulnerabilities, Competitive Pressures)

- Porter’s Five Forces (Procurement Power, Supplier Concentration, Substitutes, Barriers to Entry)

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Surveillance Systems

Intruder Detection Systems

Communication Systems

Navigation Safety Systems

Vessel Tracking Systems - By Platform Type (In Value%)

Ships

Marine Drones

Coastal Infrastructure

Ports and Terminals

Floating Platforms - By Fitment Type (In Value%)

Retrofit

New Installation

Upgrades

Integrated Systems

Modular Systems - By EndUser Segment (In Value%)

Commercial Shipping Companies

Naval Forces

Port Authorities

Coastal Surveillance Agencies

Private Security Firms - By Procurement Channel (In Value%)

Direct Sales

Distributors

Online Retailers

Government Contracts

OEMs

- Market Share Analysis

- Cross Comparison Parameters

(Market share, Product quality, Technology adoption, Geographic reach, Regulatory compliance) - SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Mitsubishi Heavy Industries

Kawasaki Heavy Industries

Japan Radio Co.

Hitachi Ltd.

Furuno Electric Co.

NEC Corporation

Toshiba Corporation

STX Marine Solutions

Marubeni Corporation

Yokogawa Electric Corporation

Mitsui Engineering & Shipbuilding

IHI Corporation

Panasonic Corporation

Tokyo Keiki Inc.

Subaru Corporation

- Increased focus on security for commercial shipping and trade routes

- Naval forces upgrading systems for enhanced coastal defense

- Ports investing in smart security infrastructure

- Private security firms expanding maritime service offerings

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035