Market Overview

The Japan Maritime Situational Awareness Systems market is valued at USD ~ billion in 2023, reflecting an increasing investment in maritime security, navigation, and operational efficiency across the country. The market is primarily driven by the growing need for real-time surveillance and tracking systems for both commercial and naval applications. Additionally, the rise in maritime trade, coupled with the adoption of advanced technologies like radar, sonar, and AIS systems, has fueled growth in this segment. The government’s strategic initiatives to modernize Japan’s maritime infrastructure and the increasing demand for integrated situational awareness systems are contributing to the expansion of the market.

Japan, being one of the world’s leading maritime nations, dominates the situational awareness systems market due to its vast maritime industry, including naval defense, shipping, and fishing. Tokyo and Yokohama serve as significant hubs for this market due to their proximity to Japan’s largest ports and the presence of major maritime players. Moreover, the government’s investment in naval defense technologies, along with the increasing number of maritime accidents in busy trade routes, strengthens the demand for such systems. Japan’s established maritime regulations also encourage the adoption of advanced maritime awareness solutions.

Market Segmentation

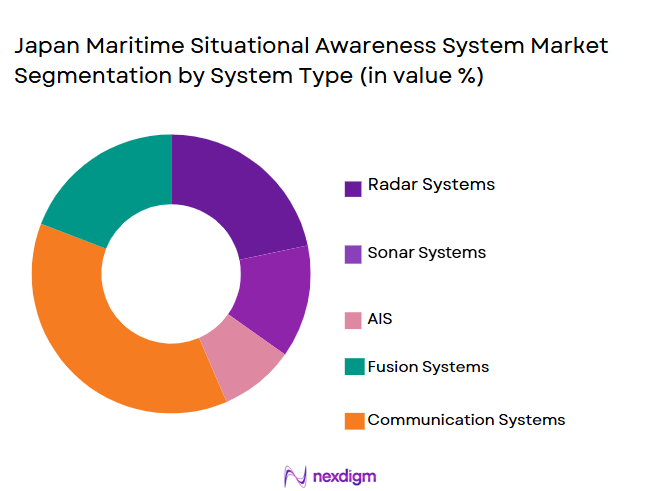

By System Type

Japan Maritime Situational Awareness Systems market is segmented by system type into radar systems, automatic identification systems (AIS), integrated bridge systems (IBS), sonar systems, and weather monitoring systems. Among these, radar systems have the largest market share due to their critical role in collision avoidance, navigation, and surveillance in both commercial and naval sectors. Radar technology continues to evolve with advanced capabilities for detecting smaller and distant objects, which is crucial in ensuring maritime safety in congested shipping lanes and during adverse weather conditions. The growing use of radar systems in integrated solutions further drives the dominance of this segment. The radar market’s widespread adoption is driven by ongoing technological advancements and cost reductions, making it accessible for various maritime applications.

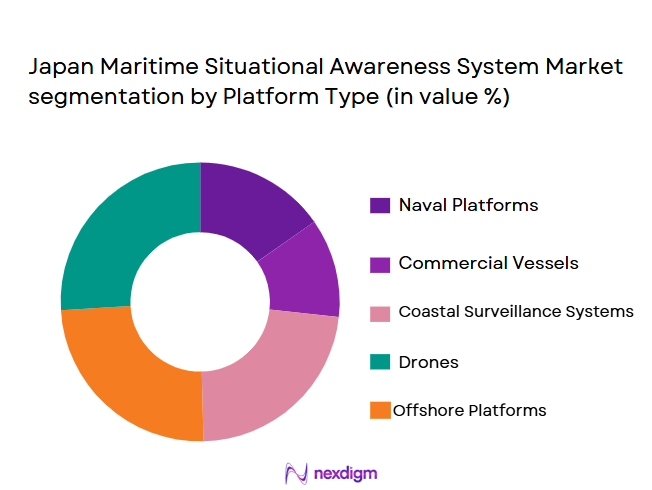

By Platform Type

The Japan Maritime Situational Awareness Systems market is also segmented by platform type into commercial vessels, naval ships, offshore platforms, cargo ships, and fishing vessels. Naval ships dominate the platform segment, driven by Japan’s strategic defense initiatives. The Japanese government’s significant investment in its defense sector, particularly in naval vessels, demands robust and advanced maritime situational awareness systems. Furthermore, Japan’s maritime security concerns, such as territorial disputes in the East China Sea, bolster the need for advanced naval systems. These systems are critical for monitoring and managing activities in the maritime domain, thus ensuring the safety of Japan’s vast maritime borders and naval assets.

Competitive Landscape

The Japan Maritime Situational Awareness Systems market is dominated by a handful of key players, including both international and local companies. These major players lead the market due to their expertise in advanced technologies and strong partnerships with government agencies. Companies such as Raytheon Technologies, Kongsberg Gruppen, and Thales Group have established a significant presence, especially in the defense and commercial shipping sectors. Their continuous innovation in radar, sonar, and AIS systems, along with their capability to offer integrated solutions, ensures their position as leaders in this market.

| Company | Establishment Year | Headquarters | Market Position | Product Portfolio | Technology Focus | Regional Presence | Government Collaborations |

| Raytheon Technologies | 1922 | Waltham, USA | ~ | ~ | ~ | ~ | ~ |

| Kongsberg Gruppen | 1814 | Kongsberg, Norway | ~ | ~ | ~ | ~ | ~ |

| Thales Group | 2000 | Paris, France | ~ | ~ | ~ | ~ | ~ |

| Saab AB | 1937 | Linköping, Sweden | ~ | ~ | ~ | ~ | ~ |

| Furuno Electric Co., Ltd. | 1938 | Nishinomiya, Japan | ~ | ~ | ~ | ~ | ~ |

Japan Maritime Situational Awareness Systems Market Dynamics

Growth Drivers

Advancements in radar and AIS technologies

Radar and AIS technologies are at the forefront of enhancing maritime situational awareness. Modern radar systems are more accurate, with better resolution, allowing for improved detection of both large and small vessels in varying weather conditions. Automatic Identification Systems (AIS) have become essential for tracking maritime traffic, ensuring safety and security. The continuous evolution of these technologies, with advanced features like long-range tracking and real-time data integration, drives the growing adoption of these systems, ensuring safer navigation and reducing maritime accidents.

Increased investments in maritime security and surveillance

The Japanese government and private sector have significantly increased investments in maritime security and surveillance. This trend is driven by the growing need to secure Japan’s vast maritime borders, protect critical infrastructure, and prevent illegal activities such as piracy and smuggling. Strategic investments in advanced situational awareness systems are essential for ensuring national security and managing the maritime domain effectively. These investments extend beyond defense and also impact the commercial shipping industry, where real-time monitoring of vessels is crucial to safeguard maritime assets and reduce operational risks.

Market Challenges

High initial cost of advanced systems

One of the primary challenges facing the Japan Maritime Situational Awareness Systems market is the high initial cost of acquiring and installing advanced systems. These systems, including radar, AIS, and integrated bridge solutions, require significant upfront investment in technology, installation, and training. While the long-term benefits, such as improved safety and operational efficiency, outweigh the costs, the high price point can be a barrier for small to mid-sized operators in the maritime sector. This challenge is particularly impactful for smaller fleets that may struggle to afford advanced monitoring solutions.

Complexity in system integration and training

The integration of complex maritime situational awareness systems requires advanced technical expertise, which can pose a significant challenge. Many of these systems involve combining multiple technologies, such as radar, sonar, and AIS, into a cohesive platform. Ensuring that all components work seamlessly together requires specialized integration skills. Additionally, ongoing training is necessary to ensure that operators can use the systems effectively. The complexity of system integration and the need for continuous staff training can lead to increased costs and time delays, making it difficult for some organizations to fully adopt these solutions.

Market Opportunities

Rising adoption of AI and machine learning in maritime systems

Artificial Intelligence (AI) and machine learning are transforming the maritime situational awareness systems market. By leveraging AI, these systems can process large volumes of data in real-time, improving decision-making capabilities. AI can help predict potential maritime risks, such as collisions or adverse weather conditions, and recommend optimal responses. Machine learning algorithms enhance system learning over time, enabling more accurate tracking and anomaly detection. The growing adoption of AI and machine learning in maritime applications offers significant opportunities for improving operational efficiency, safety, and cost-effectiveness, making it a key growth driver for the market.

Growing interest in integrated systems for enhanced situational awareness

The demand for integrated systems that combine radar, AIS, weather monitoring, and sonar technologies is increasing as maritime operators seek a more comprehensive view of their operational environment. Integrated systems provide a holistic approach to maritime awareness, enabling operators to monitor multiple factors at once, improving safety, and reducing response times to potential threats. The growing interest in these integrated systems is driven by the desire for more streamlined operations and the need to manage increasingly complex maritime environments. The demand for such systems presents a significant opportunity for market growth, particularly in both commercial and defense sectors.

Future Outlook

Over the next decade, the Japan Maritime Situational Awareness Systems market is expected to experience robust growth. The demand for advanced maritime surveillance and situational awareness technologies will continue to increase as Japan invests in modernizing its naval fleet and expanding its commercial shipping operations. Government initiatives aimed at enhancing maritime security and disaster management will further drive the adoption of these systems. Moreover, the integration of AI, IoT, and machine learning into maritime awareness systems will play a crucial role in the evolution of the market, enhancing the ability to predict and respond to maritime threats more effectively.

Major Players in the Market

- Raytheon Technologies

- Kongsberg Gruppen

- Thales Group

- Saab AB

- Furuno Electric Co., Ltd.

- Northrop Grumman Corporation

- L3 Technologies

- Elbit Systems

- Panasonic Corporation

- Mitsubishi Heavy Industries

- Navico

- Sperry Marine

- Telenor Maritime

- C-MAP

- Wärtsilä Corporation

Key Target Audience

- Defense and Armed Forces (e.g., Japan Self-Defense Forces)

- Coast Guard and Border Security Agencies (e.g., Japan Coast Guard)

- Commercial Shipping Companies

- Offshore Platform Operators

- Fishing and Aquaculture Enterprises

- Investment and Venture Capitalist Firms

- Government and Regulatory Bodies (e.g., Ministry of Land, Infrastructure, Transport and Tourism)

- System Integrators and Technology Providers

Research Methodology

Step 1: Identification of Key Variables

In this initial phase, the primary focus is to identify key variables such as technological advancements, regulatory trends, and end-user preferences that influence the Japan Maritime Situational Awareness Systems market. This will be accomplished through secondary research and leveraging industry reports, market data, and government publications.

Step 2: Market Analysis and Construction

This phase involves gathering historical data and constructing an accurate model of the Japan Maritime Situational Awareness Systems market. Key factors like market size, market penetration, and system adoption rates will be analyzed using market intelligence tools, industry databases, and proprietary research.

Step 3: Hypothesis Validation and Expert Consultation

Following the analysis of historical data, market hypotheses will be tested through interviews with industry experts, including stakeholders from maritime security, defense agencies, and system integrators. These insights will validate the initial findings and provide a more accurate market forecast.

Step 4: Research Synthesis and Final Output

In the final phase, all collected data and insights will be synthesized to produce a comprehensive market report. This will include an in-depth analysis of key market dynamics, opportunities, challenges, and the competitive landscape, providing actionable insights for stakeholders.

- Executive Summary

- Japan Maritime Situational Awareness Systems Research Methodology

(Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Advancements in radar and AIS technologies

Increased investments in maritime security and surveillance

Growing demand for automation and remote monitoring systems - Market Challenges

High initial cost of advanced systems

Complexity in system integration and training

Regulatory challenges and compliance issues - Market Opportunities

Rising adoption of AI and machine learning in maritime systems

Growing interest in integrated systems for enhanced situational awareness

Expansion of maritime surveillance in emerging markets - Trends

Integration of IoT in maritime situational awareness systems

Shift towards autonomous and unmanned maritime operations

Focus on cybersecurity for maritime systems

- Government Regulations & Defense Policy

FDI Rules

Offset Obligations

Export Licenses - SWOT Analysis (Capability Strengths, Cost Vulnerabilities, Competitive Pressures)

- Porter’s Five Forces (Procurement Power, Supplier Concentration, Substitutes, Barriers to Entry)

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Radar Systems

Automatic Identification Systems (AIS)

Integrated Bridge Systems (IBS)

Sonar Systems

Weather Monitoring Systems - By Platform Type (In Value%)

Commercial Vessels

Naval Ships

Offshore Platforms

Cargo Ships

Fishing Vessels - By Fitment Type (In Value%)

Retrofit

New Installation

OEM Integration

Modular Systems

Turnkey Solutions - By EndUser Segment (In Value%)

Naval Forces

Coast Guard & Border Protection

Commercial Shipping Companies

Offshore & Port Operators

Fishing Industry - By Procurement Channel (In Value%)

Direct Procurement

Third-Party Distributors

System Integrators

Government Procurement

Online Procurement

- Market Share Analysis

- Cross Comparison Parameters

(Product Features, Regional Reach, Technological Advancements, Pricing Strategy, Customer Base) - SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Raytheon Technologies

Kongsberg Gruppen

Thales Group

Saab AB

Northrop Grumman Corporation

L3 Technologies

Elbit Systems

Furuno Electric Co., Ltd.

Wärtsilä Corporation

Mitsubishi Heavy Industries, Ltd.

Panasonic Corporation

C-MAP

Navico

Sperry Marine

Telenor Maritime

- Government agencies adopting advanced surveillance systems

- Commercial shipping companies focusing on efficiency and safety

- Growing reliance on real-time data for decision-making

- Emerging use of maritime situational awareness in defense applications

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035