Market Overview

The Japan Maritime Surveillance Market is valued at USD ~billion, driven by technological advancements in surveillance systems, increasing maritime security concerns, and government support in defense and infrastructure development. The market’s growth is largely fueled by Japan’s strategic position as a maritime nation, with a large proportion of its trade reliant on maritime routes. This is coupled with growing investments in surveillance systems for defense, coastal security, and environmental monitoring. The increasing need to ensure safety in the maritime space has made this market a key focus area for both government and private sector investments.

Japan remains a dominant force in the maritime surveillance market, primarily due to its advanced technological landscape and strategic importance in the Pacific region. The country’s extensive maritime boundaries and its reliance on international trade make it a key player in surveillance technology for both security and operational purposes. Other influential players include neighboring countries like South Korea and China, which have significant naval capabilities and maritime interests. These regions also invest heavily in surveillance infrastructure, enhancing the global market presence of Asia-Pacific countries in maritime security technology.

Market Segmentation

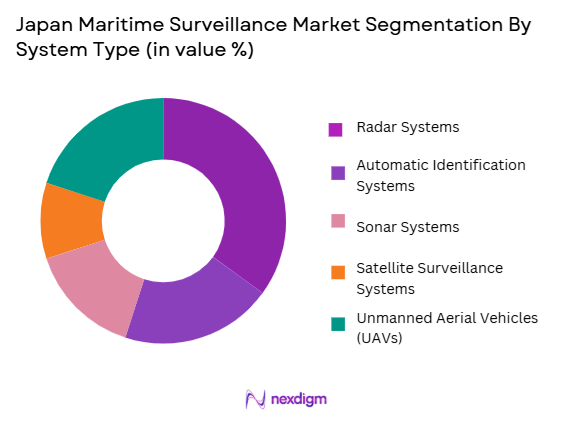

By System Type

The Japan Maritime Surveillance market is segmented by system type into radar systems, automatic identification systems (AIS), sonar systems, satellite surveillance systems, and unmanned aerial vehicles (UAVs). Among these, radar systems dominate the market share due to their critical role in long-range detection, tracking, and identification of vessels, especially in adverse weather conditions. The versatility of radar systems in providing real-time data for maritime navigation, search and rescue operations, and border control makes them integral to Japan’s maritime surveillance infrastructure.

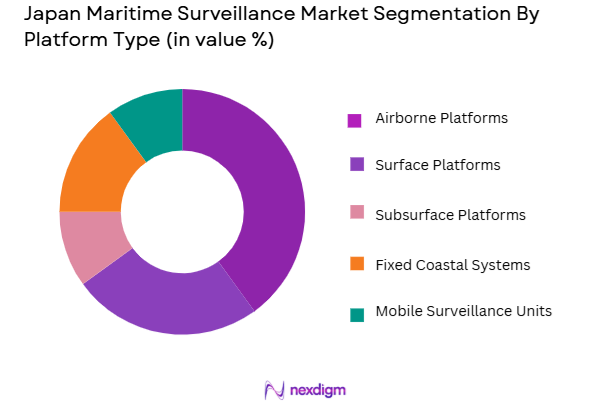

By Platform Type

The Japan Maritime Surveillance market is also segmented by platform type into airborne platforms, surface platforms, subsurface platforms, fixed coastal systems, and mobile surveillance units. Among these, airborne platforms, which include drones and manned aircraft equipped with surveillance equipment, lead the market due to their flexibility, rapid deployment capabilities, and extensive coverage area. The use of UAVs and aircraft in maritime surveillance is particularly valued for their ability to monitor vast areas without the need for constant ground or sea-based installations.

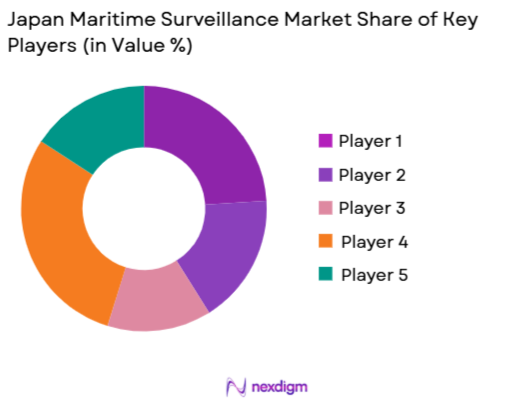

Competitive Landscape

The Japan Maritime Surveillance Market is characterized by a few major global players, including Raytheon Technologies, Thales Group, Saab Group, Lockheed Martin, and Kongsberg Gruppen. These companies maintain a strong presence in the market, owing to their technological innovations, vast product portfolios, and established relationships with government defense agencies. Their dominance is also a result of continuous advancements in radar, sonar, and satellite surveillance systems, positioning them as leaders in maritime security solutions.

| Company Name | Establishment Year | Headquarters | Product Portfolio | Technological Innovation | Market Reach | Partnerships |

| Raytheon Technologies | 1922 | Waltham, USA | ~ | ~ | ~ | ~ |

| Thales Group | 2000 | Paris, France | ~ | ~ | ~ | ~ |

| Saab Group | 1986 | Gothenburg, Sweden | ~ | ~ | ~ | ~ |

| Lockheed Martin | 1995 | Bethesda, USA | ~ | ~ | ~ | ~ |

| Kongsberg Gruppen | 1814 | Kongsberg, Norway | ~ | ~ | ~ | ~ |

Japan Maritime Surveillance Market Analysis

Growth Drivers

Urbanization

Japan’s urban population continues to grow, with ~% of the country’s population residing in urban areas in 2024, according to the United Nations. This urbanization trend is closely linked to the expansion of Japan’s maritime trade infrastructure, especially in major port cities like Tokyo, Yokohama, and Osaka. As the population in coastal cities increases, so does the need for efficient maritime surveillance systems to monitor increased maritime traffic and ensure safety. The rapid urbanization near coastlines requires robust monitoring to safeguard shipping routes, harbor security, and related activities, driving demand for advanced surveillance systems.

Industrialization

Japan’s industrial activities, particularly in the manufacturing and energy sectors, significantly contribute to the country’s maritime traffic. As of 2024, Japan’s industrial production is expected to continue expanding, with a ~% growth forecast by the Asian Development Bank (ADB). Industrial zones along Japan’s coast contribute to high volumes of shipping traffic, making maritime surveillance crucial for managing environmental safety, security, and trade. Additionally, Japan’s focus on offshore wind energy and maritime transport infrastructure development demands real-time monitoring to ensure operational safety and environmental compliance.

Restraints

High Initial Costs

One of the major restraints in the Japanese maritime surveillance market is the high initial investment required for advanced surveillance systems. In 2024, the cost of installing state-of-the-art radar and satellite monitoring systems is high, with initial setup costs for a single coastal surveillance station exceeding ¥ ~ million ($~USD). Additionally, the cost of maintaining and updating these systems frequently poses a financial burden, particularly for smaller ports and local governments. While technological advancements are helping to reduce ongoing costs, the capital required for initial infrastructure setup remains a significant barrier for widespread adoption.

Technical Challenges

Japan faces several technical challenges in its maritime surveillance efforts, primarily related to the integration of various technologies into a seamless monitoring system. As of 2024, one of the main obstacles is the difficulty in synchronizing radar, sonar, and satellite data across different maritime platforms. In regions with complex weather conditions, such as typhoons, the effectiveness of monitoring systems can be compromised, leading to inconsistent data accuracy. Moreover, the limited coverage of some sensors in the remote maritime zones surrounding Japan increases the complexity of managing and improving the reliability of the surveillance systems.

Opportunities

Technological Advancements

Technological advancements in surveillance systems, such as the integration of artificial intelligence (AI) and machine learning algorithms, present a significant growth opportunity for the maritime surveillance market in Japan. In 2024, Japan has been at the forefront of incorporating AI into maritime security, enhancing the ability to detect illegal activities such as piracy and illegal fishing in real time. The development of low-cost, high-efficiency sensors and satellites is expected to lower costs and increase the accessibility of maritime monitoring systems. These advancements create new opportunities for both government and private sector players to expand their monitoring infrastructure.

International Collaborations

Japan has increasingly turned to international collaborations to improve its maritime surveillance capabilities. In 2024, Japan partnered with the United States and Australia in a joint initiative to develop and deploy advanced maritime surveillance technologies. These collaborations are designed to address shared security concerns in the Pacific region, such as illegal fishing, smuggling, and environmental threats. By pooling resources and expertise with international partners, Japan has the opportunity to improve its surveillance network’s reach and effectiveness, contributing to both national and regional maritime security efforts.

Future Outlook

Over the next decade, the Japan Maritime Surveillance Market is expected to see significant growth, driven by technological advancements in surveillance platforms such as UAVs and satellites, coupled with increasing governmental investments in maritime safety and security. With Japan being a maritime nation, there will be a continued need to enhance maritime monitoring systems, ensuring the country’s robust maritime defense capabilities in the face of growing global maritime threats. The forecasted market growth is also supported by regional stability efforts and advancements in AI and machine learning, improving surveillance efficiency and decision-making.

Major Players

- Raytheon Technologies

- Thales Group

- Saab Group

- Lockheed Martin

- Kongsberg Gruppen

- L3 Technologies

- Northrop Grumman

- Elbit Systems

- Leonardo

- General Electric

- Furuno Electric

- Teledyne Marine

- Honeywell International

- Martek Marine

- ST Engineering

Key Target Audience

- Investments and Venture Capitalist Firms

- Japan Ministry of Defense

- Japan Coast Guard

- Japan Maritime Self-Defense Force

- Regional Maritime Security Agencies

- Government and Regulatory Bodies

- Maritime Infrastructure Companies

- Environmental Monitoring Agencies

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Japan Maritime Surveillance Market. This step utilizes secondary research to identify and define the critical variables that influence market dynamics, such as technological advancements, government defense spending, and maritime trade volumes.

Step 2: Market Analysis and Construction

This phase entails compiling and analyzing historical data relating to Japan’s maritime surveillance infrastructure. Key elements include assessing the penetration of surveillance technologies and evaluating service provider revenue generation. Data from government reports and market leaders will form the basis for the analysis.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are tested through consultations with experts from Japan’s defense and maritime sectors. Industry specialists provide valuable operational and financial insights, further validating the data and refining the market’s outlook.

Step 4: Research Synthesis and Final Output

The final phase involves gathering insights from key manufacturers and surveillance system integrators in Japan to refine the segmentation analysis. Detailed input on product offerings, pricing strategies, and consumer preferences will ensure that the market analysis is comprehensive and accurate.

- Executive Summary

- Research Methodology(Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increased maritime security concerns

Technological advancements in surveillance systems

Government investments in maritime infrastructure - Market Challenges

High system deployment and maintenance costs

Data overload and management complexities

Environmental factors affecting surveillance efficiency - Trends

Integration of AI and machine learning in surveillance systems

Adoption of hybrid surveillance platforms

Growth of real-time monitoring and decision-making technologies

- Market Opportunities

Growing demand for unmanned maritime surveillance systems

Increase in cross-border maritime trade and shipping activities

Expansion of government defense budgets for surveillance upgrades - Government regulations

Implementation of stricter maritime security regulations

Government policies on marine environmental protection

Increased focus on international maritime safety standards - SWOT analysis

Strength: Strong government support and funding

Weakness: High dependency on technological upgrades

Opportunity: Expanding international partnerships for maritime surveillance

- Porters 5 forces

Bargaining power of suppliers is high due to limited technology providers

Bargaining power of buyers is moderate due to increasing number of alternatives

Threat of new entrants is low due to high entry barriers in technology and capital requirements

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Radar Systems

Automatic Identification Systems

Sonar Systems

Satellite Surveillance Systems

Unmanned Aerial Vehicles - By Platform Type (In Value%)

Airborne Platforms

Surface Platforms

Subsurface Platforms

Fixed Coastal Systems

Mobile Surveillance Units - By Fitment Type (In Value%)

Government Fitment

Commercial Fitment

Hybrid Fitment

Military Fitment

Research & Development Fitment - By EndUser Segment (In Value%)

Coastal Security

Search and Rescue Operations

Fisheries Management

Defense and Military Applications

Environmental Monitoring - By Procurement Channel (In Value%)

Direct Procurement

Distributor Procurement

Government Tenders

Online/Third-party Platforms

Private Sector Procurement

- Market Share Analysis

- CrossComparison Parameters(Technological Innovation, Market Share, Price Competitiveness, Brand Reputation, Distribution Network)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Raytheon Technologies

Harris Corporation

Kongsberg Gruppen

L3 Technologies

Northrop Grumman

Elbit Systems

Leonardo

Thales Group

Saab Group

ST Engineering

General Electric

Martek Marine

Furuno Electric

Teledyne Marine

Honeywell International

- Growing demand for maritime security in the defense sector

- Surge in environmental monitoring requirements for marine ecosystems

- Need for enhanced fishery management tools for sustainable fishing

- Rising pressure from international organizations on maritime safety regulations

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035