Market Overview

The Japan Mergers and Acquisitions in Aerospace and Defense market is valued at approximately USD ~billion in 2023. This market is driven by the increasing need for technological advancements, strategic defense expansions, and a growing focus on global defense collaborations. Aerospace and defense companies in Japan are undergoing several mergers and acquisitions to improve production capabilities, streamline supply chains, and align with defense modernization strategies. Government policies and defense budgets have supported this growth, especially in the context of international collaborations and military technology advancements.

The dominant countries in this market include Japan, the United States, and European nations, with Japan leading in the Asia-Pacific region. Japan’s dominance in the aerospace and defense mergers and acquisitions market is primarily due to its strong technological base, government backing, and strategic defense policies. Japan’s position as a key player in aerospace technology and its proactive approach to defense collaborations with international defense contractors have fueled its leadership in the market. Japan has continued to drive mergers and acquisitions to improve its defense and aerospace manufacturing capacity, often targeting global partnerships.

Market Segmentation

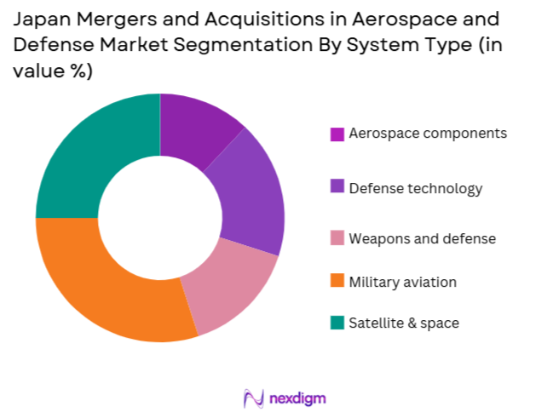

By System Type

Japan’s Aerospace and Defense Mergers and Acquisitions market is segmented by system type into aerospace components, defense technology solutions, weapons and defense systems, military aviation, and satellite and space systems. The dominant system type in this segment is military aviation, which accounts for a substantial market share. The increasing demand for advanced fighter jets, helicopters, and unmanned aerial systems has contributed to the rise in mergers and acquisitions. Companies are focused on acquiring cutting-edge aviation technologies and defense systems to strengthen national security. Japan’s strong aviation infrastructure and government-supported defense modernization initiatives continue to drive the dominance of military aviation in this market.

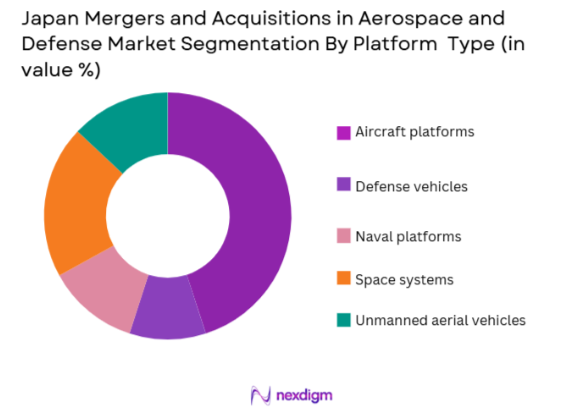

By Platform Type

The market is also segmented by platform type, which includes aircraft platforms, defense vehicles, naval platforms, space systems, and unmanned aerial vehicles (UAVs). Aircraft platforms dominate the market, driven by ongoing technological upgrades and increasing demand for advanced jet fighters, surveillance aircraft, and air mobility solutions. Mergers and acquisitions within this segment are mainly focused on acquiring advanced technologies in avionics, propulsion systems, and unmanned aircraft systems to enhance performance. Japan’s aircraft manufacturing capabilities and collaboration with international partners have bolstered its position in the global aircraft platforms market.

Competitive Landscape

The Japan Mergers and Acquisitions in Aerospace and Defense market is dominated by a few key players, including Mitsubishi Heavy Industries, Kawasaki Heavy Industries, and Japan Aerospace Exploration Agency (JAXA). These companies hold significant market share and lead the market due to their established presence in aerospace technologies and defense systems. The consolidation of these companies, along with the growing trend of strategic acquisitions, highlights the concentration of the market around a few powerful players. Collaborations with global defense contractors and governments are further strengthening their market dominance.

| Company | Establishment Year | Headquarters | Product Types | Key Competitors | Market Focus | Research and Development Budget |

| Mitsubishi Heavy Industries | 1884 | Tokyo, Japan | ~ | ~ | ~ | ~ |

| Kawasaki Heavy Industries | 1896 | Kobe, Japan | ~ | ~ | ~ | ~ |

| JAXA | 2003 | Tokyo, Japan | ~ | ~ | ~ | ~ |

| IHI Corporation | 1853 | Tokyo, Japan | ~ | ~ | ~ | ~ |

| Nippon Steel Corporation | 1950 | Tokyo, Japan | ~ | ~ | ~ | ~ |

Japan Mergers and Acquisitions in Aerospace and Defense Market Analysis

Growth Drivers

Urbanization

Urbanization is a key growth driver for many markets, especially in developing regions. The rapid expansion of cities in countries like Japan, China, and India is contributing to increased infrastructure development, higher consumption of goods and services, and enhanced demand for technology-driven solutions. In Japan, urban areas such as Tokyo, Yokohama, and Osaka are seeing significant growth in their populations and infrastructure projects. Japan’s urban population reached ~% in 2024, up from ~% in 2020, reflecting the shift towards urban-centric living and economic activity (World Bank). As more people migrate to urban areas, demand for advanced aerospace and defense systems, smart technologies, and infrastructure innovations rises.

Industrialization

The ongoing industrialization, particularly in Japan and other industrial hubs in Asia, is a major factor driving the aerospace and defense sectors. Japan’s industrial output remains one of the highest in the world, with manufacturing contributing to over ~% of the country’s GDP in 2024. This high level of industrial activity fuels the demand for aerospace products, military defense systems, and space technologies. As industries grow, so does the need for more advanced, reliable defense systems and aerospace components to secure economic infrastructure. With Japan’s manufacturing sector projected to grow steadily, driven by the push for automation and precision manufacturing, the aerospace and defense market is expected to see sustained demand.

Restraints

High Initial Costs

One of the significant restraints on the aerospace and defense market is the high initial costs associated with advanced systems. The development, testing, and deployment of aerospace systems and military defense technologies require substantial capital investment. In Japan, the cost of building and maintaining cutting-edge aerospace and defense infrastructure can reach billions of dollars. For example, Japan’s development of the next-generation fighter jet, the F-X program, is projected to cost approximately USD ~billion by 2026. These high costs restrict smaller players from entering the market and create a barrier to entry for many potential investors.

Technical Challenges

The aerospace and defense sectors face several technical challenges, especially in the context of emerging technologies like AI and autonomous systems. Japan’s defense contractors are grappling with complex integration issues as new systems are being developed. The technical challenge of seamlessly integrating new aerospace systems with existing military infrastructure continues to impede market progress. For instance, integrating advanced radar systems into Japan’s defense fleet has encountered delays due to compatibility issues with older systems. The rapid pace of technological innovation also leads to constant updates and upgrades, increasing the technical demands on both manufacturers and the government.

Opportunities

Technological Advancements

Technological advancements present substantial opportunities for growth in the aerospace and defense market. The development of cutting-edge technologies such as autonomous drones, AI-driven systems, and hypersonic vehicles is creating new opportunities for market expansion. Japan is investing heavily in these advanced technologies, particularly in the unmanned aerial vehicle (UAV) sector. In 2024, Japan’s government allocated USD ~billion to support the development of autonomous defense systems and UAVs. These advancements are expected to significantly enhance Japan’s defense capabilities while creating opportunities for companies to expand their product portfolios and increase market share.

International Collaborations

International collaborations, particularly in the aerospace and defense sectors, offer substantial opportunities for market growth. Japan has actively pursued partnerships with major global defense players such as the United States, the United Kingdom, and Australia. These collaborations foster technology exchange, joint ventures, and enhanced defense capabilities. In 2024, Japan’s participation in the trilateral security dialogue with the United States and Australia is expected to result in increased defense spending and collaboration on advanced military technologies. These collaborations will not only drive innovation but also open up new avenues for growth and expansion in the aerospace and defense market.

Future Outlook

Over the next decade, the Japan Mergers and Acquisitions in Aerospace and Defense market is expected to see robust growth, propelled by the increasing emphasis on defense modernization, the rise of strategic alliances, and significant investments in aerospace technologies. Japan’s defense spending and technological upgrades will continue to fuel mergers and acquisitions, particularly in the domains of military aviation and space technologies. Additionally, rising international collaborations and the expansion of Japan’s aerospace and defense capabilities in the global market will drive further growth, enhancing the industry’s technological edge and positioning.

Major Players

- Mitsubishi Heavy Industries

- Kawasaki Heavy Industries

- Japan Aerospace Exploration Agency

- IHI Corporation

- Nippon Steel Corporation

- Subaru Corporation

- Japan Steel Works

- Ricoh Japan

- Fuji Heavy Industries

- Hitachi High-Technologies

- Mitsubishi Electric

- Sumitomo Precision Products

- Hitachi

- National Aerospace Laboratory of Japan

- Japan Aircraft Industries

Key Target Audience

- Aerospace Manufacturers

- Defense Contractors

- Aerospace and Defense Investment Firms

- Aerospace and Defense Equipment Suppliers

- Government Agencies

- Regulatory Bodies

- International Aerospace and Defense Collaborators

- Investment and Venture Capitalist Firms

Research Methodology

Step 1: Identification of Key Variables

The research begins by identifying key variables that influence mergers and acquisitions in the Japanese aerospace and defense market. These include defense budgets, technological advancements, policy shifts, and the role of international collaborations. Extensive desk research and secondary data sources help in constructing the foundational variables.

Step 2: Market Analysis and Construction

In this phase, historical data on the aerospace and defense market in Japan is collected and analyzed. Data sources include trade publications, financial reports, government publications, and industry surveys. This analysis helps to map trends and market dynamics, assessing growth patterns in mergers and acquisitions.

Step 3: Hypothesis Validation and Expert Consultation

The formulated hypotheses are validated through consultations with experts in the aerospace and defense sectors. Interviews and surveys with industry leaders, including representatives from major corporations and government agencies, help refine the insights and validate the market trends.

Step 4: Research Synthesis and Final Output

The final phase integrates all findings into a comprehensive report. This involves synthesizing the data from both primary and secondary sources, analyzing market conditions, and providing insights on the future outlook of the aerospace and defense mergers and acquisitions market in Japan.

- Executive Summary

- Research Methodology(Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing defense budgets

Technological advancements in aerospace

Growing international defense collaborations - Market Challenges

Regulatory complexities in international mergers

High capital requirements for acquisitions

Limited market access for new players

- Trends

Integration of AI and automation in defense systems

Increasing focus on cybersecurity in aerospace

Rising importance of unmanned systems and drones

- Market Opportunities

Expanding space exploration investments

Demand for modernized defense systems

Mergers to improve supply chain efficiency

- Government regulations

Japan’s defense export control policies

Aerospace safety certification standards

Regulations regarding UAVs and drones - SWOT analysis

Opportunities in defense innovation and technology

Challenges in regulatory compliance

Strategic advantage through international partnerships - Porters 5 forces

High supplier power due to specialized components

Moderate threat of new entrants in defense

Strong bargaining power of government contracts

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Aerospace components

Defense technology solutions

Weapons and defense systems

Military aviation

Satellite and space systems - By Platform Type (In Value%)

Aircraft platforms

Defense vehicles

Naval platforms

Space systems

Unmanned aerial vehicles (UAVs) - By Fitment Type (In Value%)

Onboard systems

Integrated defense solutions

Standalone components

Advanced avionics

Weaponry and missile systems - By EndUser Segment (In Value%)

Government & Military

Aerospace manufacturers

Defense contractors

Private defense firms

Space agencies - By Procurement Channel (In Value%)

Direct government contracts

B2B aerospace sales

Defense procurement through tenders

Private sector defense acquisitions

International collaborations

- Market Share Analysis

- CrossComparison Parameters(Regulatory landscape, technological innovation, supply chain efficiency, international partnerships, capital investment)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Mitsubishi Heavy Industries

Kawasaki Heavy Industries

IHI Corporation

Sumitomo Precision Products

Japan Steel Works

Mitsubishi Electric

Hitachi High-Technologies

Nippon Steel Corporation

Ricoh Japan

Japan Aerospace Exploration Agency

Subaru Corporation

Fuji Heavy Industries

Advanced Aircraft Company

Nihon Aerospace Technologies

Japan Aircraft Industries

- Government agencies driving defense tech investments

- Aerospace manufacturers adopting new technologies

- Private defense contractors entering strategic acquisitions

- Space agencies focusing on satellite and UAV technologies

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035