Market Overview

The Japan Naval Actuators and Valves market is poised for steady growth driven by increasing demand in the naval defense sector. In 2023, the market was valued at USD ~ billion, and it is projected to reach USD ~billion by 2024. This growth is primarily driven by the modernization of Japan’s naval fleet and technological advancements in actuator systems, which have enhanced operational efficiency and reliability. The market’s growth is also supported by Japan’s strategic defense initiatives and rising investments in cutting-edge naval technologies, particularly in automation and energy efficiency.Japan stands as the dominant force in the naval actuators and valves market due to its robust defense sector and technological leadership in maritime systems. Major cities like Tokyo, Yokohama, and Kobe are central to the production and development of naval technologies, housing key manufacturers and defense contractors. Japan’s strategic location in the Asia-Pacific region further enhances its importance in regional naval dynamics, making it a hub for naval innovations, especially with its focus on expanding its fleet and enhancing its defense capabilities against geopolitical tensions in the region.

Market Segmentation

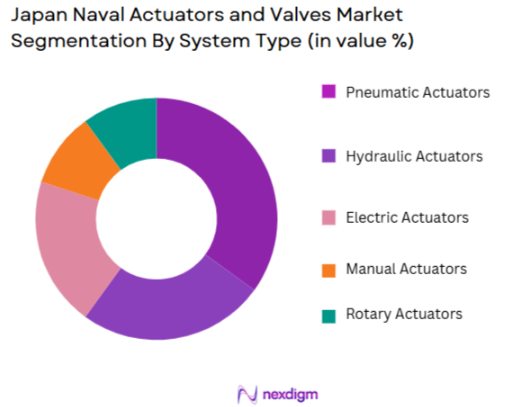

By System Type

The Japan Naval Actuators and Valves market is segmented by system type into pneumatic actuators, hydraulic actuators, electric actuators, manual actuators, and rotary actuators. Among these, pneumatic actuators dominate the market in 2024 due to their widespread use in various naval applications, offering a balance of reliability, power, and compactness. The high demand for pneumatic actuators is driven by their robustness in extreme maritime conditions and their application in various naval systems, such as propulsion, steering, and fire control systems. Pneumatic actuators are preferred for their efficient performance and ease of maintenance, particularly in military vessels and submarines.

By Platform Type

The market is also segmented by platform type, including surface ships, submarines, naval aircraft, amphibious vessels, and naval drones. Surface ships dominate the segment in 2024, largely due to the high number of operational surface fleets in Japan. These ships, which include destroyers, frigates, and aircraft carriers, require advanced actuator and valve systems for various applications, including propulsion, control systems, and weaponry. The emphasis on upgrading and modernizing existing surface fleets contributes significantly to the dominance of this segment.

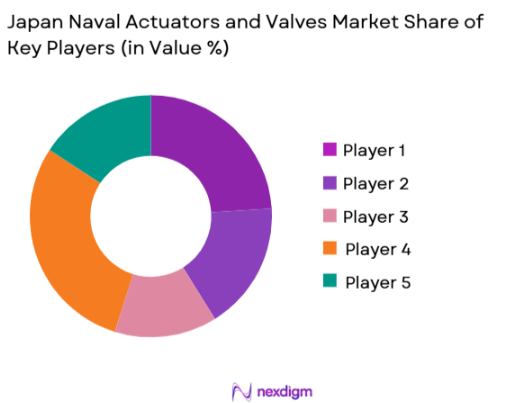

Competitive Landscape

The Japan Naval Actuators and Valves market is dominated by several key players, including both global and local companies. These players include manufacturers like Mitsubishi Heavy Industries, Kawasaki Heavy Industries, and local suppliers such as Japan Actuator Corporation. The competitive landscape is characterized by strong technological innovation, particularly in the areas of actuator efficiency and reliability in harsh marine environments. Furthermore, government defense contracts and increasing collaboration between private companies and naval contractors are further fueling competition.

| Company | Establishment Year | Headquarters | Product Range | Innovation Focus | Market Positioning | Regional Presence |

| Mitsubishi Heavy Industries | 1884 | Tokyo, Japan | ~ | ~ | ~ | ~ |

| Kawasaki Heavy Industries | 1878 | Kobe, Japan | ~ | ~ | ~ | ~ |

| Japan Actuator Corporation | 1950 | Yokohama, Japan | ~ | ~ | ~ | ~ |

| Moog Inc. | 1951 | East Aurora, USA | ~ | ~ | ~ | ~ |

| Parker Hannifin | 1917 | Cleveland, USA | ~ | ~ | ~ | ~ |

Japan Naval Actuators and Valves Market Analysis

Growth Drivers

Urbanization

Urbanization plays a significant role in the growth of the Japan Naval Actuators and Valves market as it contributes to the country’s increasing demand for advanced infrastructure, including naval defense systems. With more urbanized areas along the coastline, there is a heightened need for robust naval defense systems to secure trade routes, coastlines, and ensure national security. This rising urbanization, particularly in coastal cities like Tokyo, Yokohama, and Osaka, leads to the increased development of maritime defense strategies, consequently boosting demand for naval vessels and the advanced actuator systems used in them. Urbanization supports infrastructure growth and increases defense spending to ensure preparedness, further propelling the market for naval actuators and valves. As Japan’s cities continue to expand, urbanization will likely drive demand for new technologies, including high-efficiency actuators in naval defense systems.

Industrialization

Industrialization in Japan has contributed significantly to the growth of the naval actuators and valves market by fostering the development of advanced industrial machinery and systems used in the defense sector. Japan’s robust manufacturing sector, including industries such as shipbuilding, automotive, and precision machinery, requires high-performance actuators and valves for the efficient operation of military vessels. The nation’s industrial growth has also encouraged technological advancements in actuator systems, supporting the integration of more sophisticated features in naval vessels. Industrialization enables the production of high-quality actuators and valves and provides the infrastructure necessary for innovation and mass production, further promoting the expansion of the naval defense sector.

Restraints

High Initial Costs

The high initial costs of naval actuators and valves represent a key restraint in the Japanese market. The advanced materials, precision engineering, and cutting-edge technology required to manufacture these systems result in significant upfront costs for both manufacturers and defense contractors. These expenses can be a barrier, especially for smaller shipbuilders or organizations with limited budgets. Furthermore, the long lifespan and high maintenance costs of these systems require continued investment over time, which can deter potential buyers from making new purchases or upgrading their current systems. While high initial costs might be offset by the long-term benefits of enhanced system reliability, they still pose a challenge to market penetration and growth, particularly among smaller operators and shipyards.

Technical Challenges

Technical challenges related to the integration and maintenance of naval actuators and valves are another significant restraint. As naval systems become more complex and technologically advanced, the requirement for precise and reliable actuator systems increases. However, the integration of these components into existing naval platforms can be complicated, especially for older vessels. Additionally, actuator systems must withstand extreme maritime conditions, such as saltwater corrosion, pressure, and temperature fluctuations. These challenges can increase the technical complexity of design, installation, and ongoing maintenance. Moreover, skilled labor is required to ensure the proper functioning and repair of these advanced systems, which can lead to higher costs and resource limitations.

Opportunities

Technological Advancements

Technological advancements in the actuator and valve systems offer significant opportunities for the Japan naval market. Innovations such as the development of energy-efficient actuators, smart valves with automation capabilities, and systems that reduce environmental impacts are becoming increasingly critical to modern naval operations. These advancements help to reduce operational costs, improve performance, and ensure greater operational reliability. With the ongoing push for automation in naval fleets, particularly in unmanned naval vehicles and robotic systems, the demand for cutting-edge actuator technologies will continue to rise. As Japan focuses on enhancing its naval defense capabilities, technological innovation provides opportunities for companies to develop next-generation actuator systems that align with the evolving needs of defense contractors and military agencies.

International Collaborations

International collaborations present significant growth opportunities for the Japan Naval Actuators and Valves market. Japan’s global partnerships with other advanced nations in defense and technology can foster the exchange of knowledge, materials, and innovations. Collaborative projects can lead to joint ventures between Japanese companies and international defense contractors, expanding access to new markets and technologies. These collaborations are beneficial in developing and deploying advanced actuator and valve systems for naval platforms that meet the global defense industry’s stringent standards. Additionally, through international collaborations, Japan can leverage the strengths of foreign expertise in actuator technologies, enhancing the performance and capabilities of its own naval defense systems. This approach not only drives innovation but also enables Japan to maintain its competitive edge in the global naval defense market.

Future Outlook

Over the next decade, the Japan Naval Actuators and Valves market is expected to show significant growth, driven by continued investments in naval defense technologies, the modernization of Japan’s maritime fleet, and increasing demand for automation and energy-efficient systems. The country’s defense strategies, focused on enhancing military capabilities amidst rising regional tensions, will play a key role in the market’s expansion. Additionally, technological advancements in actuator systems, such as improved energy efficiency and reduced environmental impact, will further boost the demand for advanced actuator and valve systems.

Major Players

- Mitsubishi Heavy Industries

- Kawasaki Heavy Industries

- Japan Actuator Corporation

- Moog Inc.

- Parker Hannifin

- Yokogawa Electric Corporation

- Sumitomo Heavy Industries

- Festo AG & Co. KG

- IMI Precision Engineering

- Rotork PLC

- Ebara Corporation

- Honeywell International

- Brodie International

- Schlumberger Limited

- Emerson Electric Co.

Key Target Audience

- Defense Contractors

- Naval Fleet Operators

- Government and Regulatory Bodies

- Military Shipbuilders

- Investment and Venture Capitalist Firms

- Naval Research Institutes

- Shipyard and Maintenance Services

- Public and Private Naval Agencies

Research Methodology

Step 1: Identification of Key Variables

This initial phase involves mapping the ecosystem of stakeholders within the Japan Naval Actuators and Valves market. Extensive desk research using secondary databases helps identify key players and their influence on the market, setting the foundation for further analysis.

Step 2: Market Analysis and Construction

In this phase, historical data on the naval defense sector, particularly the demand for actuators and valves, is gathered. The analysis includes the assessment of naval procurement patterns, technology adoption rates, and key market drivers, ensuring an accurate understanding of market trends.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are validated through consultations with industry experts, including naval engineers, defense analysts, and manufacturers. These expert insights help refine market assumptions and ensure that the projections are aligned with industry practices and technological advancements.

Step 4: Research Synthesis and Final Output

The final phase involves synthesizing all collected data, refining market projections, and consolidating findings into actionable insights. This phase includes direct feedback from key industry players, ensuring that the market analysis reflects the latest developments and trends in naval defense technology.

- Executive Summary

- Research Methodology(Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Growing naval defense budgets in Japan

Technological advancements in actuator systems

Increasing demand for energy-efficient naval systems - Market Challenges

High initial costs of naval actuator systems

Complexity of integration with existing naval platforms

Regulatory hurdles in naval defense procurements - Trends

Development of autonomous naval systems

Rise in environmental regulations for naval operations

Adoption of additive manufacturing for actuator components

- Market Opportunities

Expansion of naval fleets in Asia-Pacific

Advancements in smart actuator technologies

Increasing focus on naval vessel upgrades - Government regulations

New emissions standards for naval vessels

Defense procurement policies for actuator systems

Regulations on the use of autonomous naval vehicles - SWOT analysis

Strengths: Advanced technology in actuators and valves

Weaknesses: High maintenance cost of actuator systems

Opportunities: Expanding defense contracts in Asia

- Porters 5 forces

Bargaining power of suppliers: Moderate

Threat of new entrants: Low

Competitive rivalry: High

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Pneumatic Actuators

Hydraulic Actuators

Electric Actuators

Manual Actuators

Rotary Actuators - By Platform Type (In Value%)

Surface Ships

Submarines

Naval Aircraft

Amphibious Vessels

Naval Drones - By Fitment Type (In Value%)

Retrofit Systems

New Build Systems

Integrated Systems

Modular Systems

Custom Fit Systems - By EndUser Segment (In Value%)

Naval Defense Contractors

Government Naval Agencies

Private Shipbuilders

Naval Research & Development Institutes

Naval Operations & Maintenance Units - By Procurement Channel (In Value%)

Direct Sales

Distribution Networks

Online Marketplaces

Government Bidding

Partnerships & Alliances

- Market Share Analysis

- CrossComparison Parameters(Market share, technological innovation, supply chain efficiency, pricing strategy, customer satisfaction)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Mitsubishi Heavy Industries

Yokogawa Electric Corporation

Hitachi Zosen Corporation

Kawasaki Heavy Industries

Sumitomo Heavy Industries

Ebara Corporation

IMI Precision Engineering

Parker Hannifin

Moog Inc.

Festo AG & Co. KG

Rotork PLC

Auma Actuators

Honeywell International

Brodie International

Schlumberger Limited

Emerson Electric Co.

- Naval defense contractors’ increasing focus on system reliability

- Government agencies prioritizing energy-efficient solutions

- Private shipbuilders embracing customized actuator solutions

- Naval R&D institutes experimenting with new technologies

Forecast Market Value, 2026-2035

Forecast Installed Units, 2026-2035

Price Forecast by System Tier, 2026-2035

Future Demand by Platform, 2026-2035