Market Overview

The Japan naval combat systems market is valued at approximately USD~ billion, driven by a combination of technological advancements and rising defense expenditure. The demand for modernized naval combat systems is further supported by Japan’s strategic maritime position and national security imperatives. With a focus on enhancing the operational capabilities of the nation’s naval forces, there is a steady shift towards advanced radar, sonar, and combat management systems. In 2025, the market is anticipated to continue to grow, underpinned by government initiatives to modernize Japan’s naval fleet and bolster its defense posture.

Japan is dominated by a few key players, with Tokyo, Yokohama, and Nagoya emerging as central hubs in the naval combat systems landscape. These cities benefit from Japan’s rich history in naval technology and defense manufacturing. Yokosuka, a major naval base near Tokyo, is also a crucial strategic location for naval operations, driving significant investment in combat systems development and integration. The country’s commitment to upgrading its maritime defense capabilities, in response to regional geopolitical tensions, places Japan at the forefront of the global naval combat systems market.

Market Segmentation

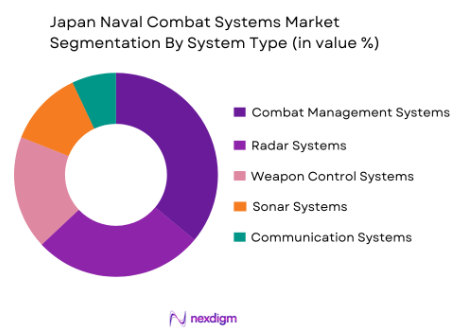

By System Type

The Japan naval combat systems market is segmented by system type into combat management systems, radar systems, weapon control systems, sonar systems, and communication systems. Among these, combat management systems have the largest market share. This dominance is largely attributed to Japan’s growing need for advanced situational awareness and real-time data fusion in its defense strategy. Combat management systems allow seamless integration of various weaponry, sensors, and communications platforms, making them critical for modern naval operations. Their role in enhancing command and control capabilities has driven substantial demand within the market.

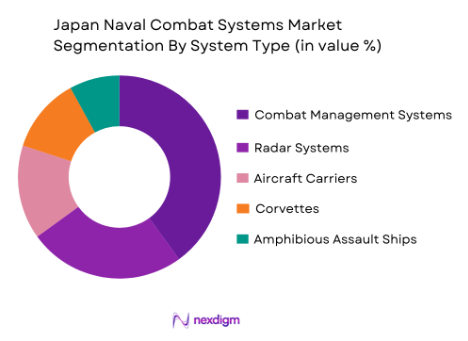

By Platform Type

The market is also segmented by platform type, which includes destroyers, submarines, aircraft carriers, corvettes, and amphibious assault ships. Destroyers hold the dominant market share in Japan, driven by the country’s focus on strengthening its surface combatant capabilities. Destroyers are equipped with a broad array of combat systems to counter maritime threats and are central to Japan’s maritime defense strategy. Their multi-role capabilities, which include air defense, anti-submarine warfare, and missile defense, make them essential assets for the Japanese Navy, leading to their significant market share.

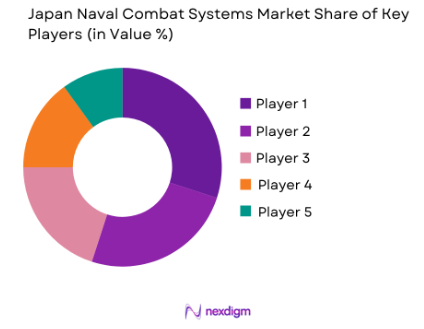

Competitive Landscape

The Japan naval combat systems market is characterized by the dominance of both local and international companies. Key players such as Mitsubishi Heavy Industries, Kawasaki Heavy Industries, and IHI Corporation, alongside global giants like Lockheed Martin and Raytheon Technologies, shape the competitive dynamics of the industry. These companies leverage advanced technological expertise, strong defense sector relationships, and strategic collaborations with the Japanese government to maintain a leading position.

| Company | Establishment Year | Headquarters | Defense Sector Experience | Product Portfolio | R&D Investment | Government Partnerships | Global Presence |

| Mitsubishi Heavy Industries | 1884 | Tokyo, Japan | 100+ years | ~ | ~ | ~ | ~ |

| Kawasaki Heavy Industries | 1878 | Kobe, Japan | 90+ years | ~ | ~ | ~ | ~ |

| IHI Corporation | 1853 | Tokyo, Japan | 150+ years | ~ | ~ | ~ | ~ |

| Lockheed Martin | 1912 | Bethesda, USA | 100+ years | ~ | ~ | ~ | ~ |

| Raytheon Technologies | 1922 | Waltham, USA | 100+ years | ~ | ~ | ~ | ~ |

Japan Naval Combat Systems Market Analysis

Growth Drivers

Rising Defense Budgets and National Security Concerns

Japan’s commitment to enhancing its defense capabilities is a significant driver for the naval combat systems market. With increasing regional security threats, particularly from neighboring nations like North Korea and China, Japan has been steadily raising its defense budget. The Japanese government has been focusing on modernizing its naval fleet, which includes upgrading and integrating advanced combat management systems, radar, sonar, and weapon control technologies. This growing defense expenditure is crucial to maintaining Japan’s position as a maritime power and safeguarding its economic interests, especially in the East China Sea and the broader Pacific region. These budgetary allocations ensure that naval combat systems remain at the forefront of Japan’s defense priorities, stimulating steady demand for advanced naval technologies and systems.

Technological Advancements in Naval Warfare Systems

Continuous innovations in naval combat systems technology are contributing significantly to market growth. Japan is investing heavily in research and development (R&D) to integrate cutting-edge technologies such as artificial intelligence (AI), autonomous operations, and advanced cybersecurity into naval systems. These innovations enhance operational efficiency, improve decision-making, and offer better protection against emerging threats like cyber-attacks. Additionally, developments in multi-domain operations, where naval forces collaborate seamlessly with air and land units, are increasing the sophistication of Japan’s combat systems. The increasing focus on next-generation radar, sonar systems, and automated weapon control platforms is transforming the Japanese Navy into a more agile and resilient force. These technological advancements not only improve operational capabilities but also create significant demand for advanced naval combat systems, contributing to the market’s robust growth.

Market Challenges

High Cost of Advanced Naval Combat Systems

The procurement and integration of advanced naval combat systems are capital-intensive processes, representing a key challenge in Japan’s defense market. As the complexity of systems increases, so does their cost. The integration of sophisticated technologies like AI, multi-layered cybersecurity, and highly advanced radar and sonar systems requires significant financial investments. This poses a challenge not only to the Japanese government but also to local manufacturers, who must balance innovation with cost-efficiency. High development and maintenance costs may limit the speed at which new systems can be deployed, delaying the full realization of advanced capabilities within Japan’s naval fleet. Furthermore, these costs can also lead to budgetary constraints, particularly as Japan faces competing demands in other sectors such as healthcare and infrastructure.

Integration and Compatibility Challenges

One of the primary challenges in the Japan naval combat systems market is the integration and compatibility of new technologies with existing naval platforms. Many of Japan’s naval vessels are older and may require significant retrofitting to accommodate advanced systems. This integration process can be time-consuming and costly, often requiring customized solutions to ensure that different combat systems work cohesively across various platforms. Additionally, the diversity of platforms in Japan’s fleet, such as destroyers, submarines, and aircraft carriers, makes it difficult to develop one-size-fits-all solutions. Furthermore, as Japan seeks to adopt state-of-the-art systems, ensuring that new technologies are compatible with legacy systems without compromising operational efficiency remains a persistent challenge. These integration complexities can delay upgrades and introduce technical difficulties that affect the overall effectiveness of Japan’s naval forces.

Opportunities

Growing Demand for Autonomous and Unmanned Naval Systems

The increasing interest in unmanned systems presents a significant opportunity for the Japan naval combat systems market. Autonomous surface vessels, submarines, and aerial drones are poised to play a larger role in naval operations, reducing the risk to human life and providing enhanced surveillance and reconnaissance capabilities. Japan is actively pursuing the development of autonomous technologies, aiming to integrate these systems into its naval forces. The incorporation of unmanned systems can also lower operational costs and increase the fleet’s efficiency, as these platforms can operate for extended periods with minimal human intervention. As international defense trends move toward unmanned systems, Japan’s growing investment in these technologies presents a substantial growth opportunity for companies offering advanced unmanned and autonomous naval combat systems.

Strategic International Collaborations and Defense Partnerships

Japan’s naval combat systems market has significant potential for growth through strategic international collaborations and defense partnerships. Japan’s defense relationships with global powers such as the United States, Australia, and NATO countries offer opportunities for joint development and technology-sharing agreements. These collaborations allow Japan to access the latest advancements in naval combat technologies, including radar, communication systems, and weapons management. Moreover, joint defense initiatives and participation in multinational maritime security operations increase demand for interoperable systems, offering new avenues for the Japanese defense sector. Additionally, as Japan strengthens its defense alliances in the face of rising regional threats, these partnerships provide both economic and technological opportunities, enabling Japan to maintain and enhance its naval defense capabilities.

Future Outlook

Over the next decade, the Japan naval combat systems market is poised for steady growth, driven by a combination of technological innovations and defense budget increases. The Japanese government’s ongoing efforts to enhance maritime defense capabilities in the face of regional security challenges, particularly related to North Korea and China, will contribute to this growth. Furthermore, increasing integration of artificial intelligence, automation, and cybersecurity solutions in naval systems will play a significant role in transforming the market landscape. The market will also benefit from stronger international collaborations, particularly in joint defense initiatives with allied nations.

Major Players

- Mitsubishi Heavy Industries

- Kawasaki Heavy Industries

- IHI Corporation

- Lockheed Martin

- Raytheon Technologies

- BAE Systems

- Thales Group

- Saab AB

- Leonardo S.p.A.

- General Dynamics

- Northrop Grumman

- Naval Group

- L3 Technologies

- Rheinmetall

- Honeywell International

Key Target Audience

- Government agencies

- Defense contractors

- Military procurement departments

- Investments and venture capitalist firms

- Naval research institutions

- Aerospace and defense technology companies

- Military equipment manufacturers

- Regulatory bodies

Research Methodology

Step 1: Identification of Key Variables

The research begins by identifying key variables that shape the market dynamics, including technological advancements, defense expenditure, and geopolitical factors. Secondary data from industry reports, market studies, and government publications are utilized to outline the essential drivers and challenges influencing the market.

Step 2: Market Analysis and Construction

Data is collected from historical reports to construct a baseline analysis of market size, growth patterns, and major developments in naval combat systems. This step includes assessing system installations, platform types, and technological innovations to understand market behavior.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses, including the impact of government policies and technological shifts, are validated through interviews with industry experts. The insights gathered help refine the market model and provide qualitative validation to the quantitative data.

Step 4: Research Synthesis and Final Output

Finally, the collected data is synthesized and validated through consultations with key players

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing defense budgets in Japan

Rising demand for advanced naval warfare systems

Technological advancements in radar and sonar systems - Market Challenges

High cost of advanced naval combat systems

Technological complexity and integration challenges

Geopolitical tensions affecting market stability - Market Opportunities

Growing modernization programs for naval fleets

Collaborations and partnerships for technology exchange

Rising demand for autonomous naval combat systems - Trends

Shift towards network-centric warfare in naval systems

Growing importance of cybersecurity in combat systems

Rise in multi-domain operations in naval defense

- By Market Value 2020-2025

- By Installed Units 2020-2025

- By Average System Price 2020-2025

- By System Complexity Tier 2020-2025

- By System Type (In Value%)

Combat Management Systems

Radar Systems

Weapon Control Systems

Sonar Systems

Communication Systems - By Platform Type (In Value%)

Destroyers

Submarines

Aircraft Carriers

Corvettes

Amphibious Assault Ships - By Fitment Type (In Value%)

New Installations

Retrofit/Upgrades

Replacement Systems

Integration with Existing Systems

System Enhancements - By End User Segment (In Value%)

Government Defense Ministries

Naval Forces

Military Contractors

Private Defense Contractors

Research and Development Institutions - By Procurement Channel (In Value%)

Direct Government Procurement

Defense Contractors

Military Auctions

International Partnerships

Private Sector Procurement

- Market Share Analysis

- Cross Comparison Parameters (Market Penetration, Product Innovation, Technological Advancements, Customer Reach, Price Competitiveness)

SWOT Analysis of Key Competitors

Pricing & Procurement Analysis

Porter’s Five Forces

Key Players

Mitsubishi Heavy Industries

Hitachi

Kawasaki Heavy Industries

IHI Corporation

Naval Group

Lockheed Martin

BAE Systems

Northrop Grumman

Thales Group

Saab AB

Raytheon Technologies

Leonardo S.p.A.

General Dynamics

Rheinmetall

L3 Technologies

- Increased focus on indigenous defense manufacturing

- Growing participation of private defense firms in government projects

- Shift from traditional combat systems to hybrid systems

- Enhanced collaboration between Japan and global naval powers

- Forecast Market Value 2026-2035

- Forecast Installed Units 2026-2035

- Price Forecast by System Tier 2026-2035

- Future Demand by Platform 2026-2035