Market Overview

The Japan Naval Navigation and Communication Systems market is valued at approximately USD ~billion in 2024. This market is primarily driven by Japan’s ongoing efforts to modernize its naval forces and enhance maritime security. The Japanese government continues to prioritize defense infrastructure, specifically naval capabilities, to safeguard its maritime borders and maintain its influence in the Indo-Pacific region. The modernization of Japan’s fleet with state-of-the-art communication systems, satellite links, radar systems, and advanced navigation technologies is a key factor in the market’s expansion. Additionally, Japan’s increasing defense budget supports technological advancements and procurement of cutting-edge naval systems. The growing maritime threats, regional instability, and Japan’s alliances with global powers, especially the United States, drive the continuous investment in modern naval communication and navigation technologies.

Japan plays a dominant role in the naval navigation and communication systems market due to its strategic geographical location in the Indo-Pacific region and its strong naval presence. The cities of Tokyo, Yokosuka, and Kure are pivotal in the development and deployment of naval systems, with major defense contractors and the Japan Maritime Self-Defense Force (JMSDF) headquartered in these areas. Japan’s advanced technological expertise, along with its collaborations with global defense partners, such as the United States and NATO, further strengthens its leadership in the global market. The country’s strong commitment to securing maritime trade routes and enhancing national defense capabilities ensures the sustained demand for state-of-the-art naval communication and navigation systems.

Market Segmentation

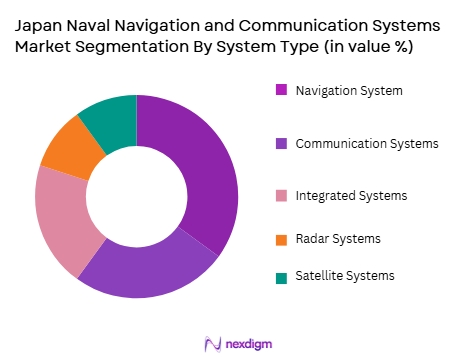

By System Type

The Japan Naval Navigation and Communication Systems market is segmented by system type into navigation systems, communication systems, integrated systems, radar systems, and satellite systems. Among these, navigation systems dominate the market share. The need for precise navigation, especially in the face of increasing regional threats, drives the demand for advanced navigation systems in Japan’s naval vessels. Navigation systems are essential for ensuring the safe and accurate movement of vessels, particularly in hostile or unfamiliar environments. The adoption of highly accurate GPS, inertial navigation, and sonar technologies is increasing, as they are crucial for Japan’s naval operations. Additionally, the integration of navigation systems with communication and radar technologies enhances operational efficiency, making these systems integral to modern naval defense strategies. As Japan continues to invest in the modernization of its naval fleet, navigation systems will remain a critical component of these efforts, securing their dominant position in the market.

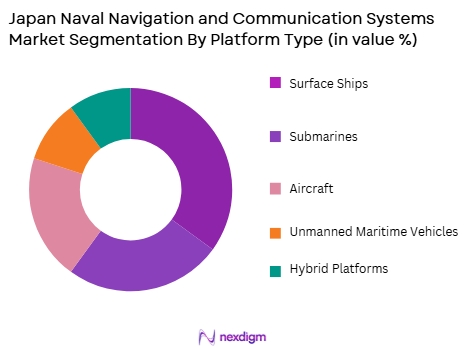

By Platform Type

The market is also segmented by platform type, including surface ships, submarines, aircraft, unmanned maritime vehicles (UMVs), and hybrid platforms. Surface ships hold the dominant market share in this segment, owing to Japan’s extensive fleet of advanced naval vessels. The Japan Maritime Self-Defense Force (JMSDF) operates numerous surface ships, including destroyers and frigates, which require sophisticated navigation and communication systems for operational effectiveness. These vessels are equipped with cutting-edge radar, satellite communication systems, and real-time data transmission capabilities, ensuring seamless operation in joint and individual missions. As Japan continues to prioritize the modernization of its naval fleet, the demand for these systems in surface ships remains high, driving the segment’s dominance. Furthermore, Japan’s role in international maritime security and defense collaborations enhances the market demand for advanced systems on surface ships.

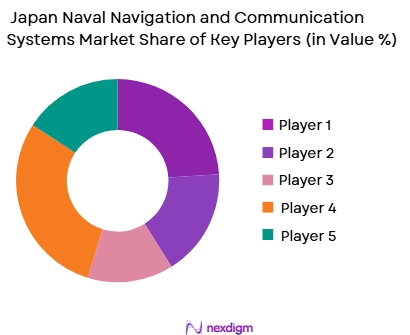

Competitive Landscape

The Japan Naval Navigation and Communication Systems market is dominated by several key players, including global defense contractors and regional technology providers. Companies such as Lockheed Martin, Thales Group, BAE Systems, and Saab Japan are integral to the development and supply of advanced naval systems. These companies have established strong positions through their technological innovations and long-standing relationships with the Japanese government and the JMSDF. Japan’s own defense contractors, like Japan Aerospace Exploration Agency (JAXA) and Mitsubishi Heavy Industries, also contribute significantly to the market by providing specialized systems tailored to the country’s defense needs. The market’s competitive nature is driven by the need for high-performance, secure, and integrated systems that can support Japan’s naval operations in both national defense and international security collaborations.

Competitive Landscape Table

| Company | Establishment Year | Headquarters | Product Portfolio | R&D Investment | Government Collaborations | Defense Contracts |

| Lockheed Martin | 1912 | Bethesda, USA | ~ | ~ | ~ | ~ |

| Thales Group | 2000 | Paris, France | ~ | ~ | ~ | ~ |

| BAE Systems | 1999 | London, UK | ~ | ~ | ~ | ~ |

| Saab Japan | 1989 | Tokyo, Japan | ~ | ~ | ~ | ~ |

| Raytheon Technologies | 1922 | Waltham, USA | ~ | ~ | ~ | ~ |

Japan Naval Navigation and Communication Systems Market Analysis

Growth Drivers

Advancements in Technology and System Integration

The rapid advancements in navigation and communication technologies are a significant driver of the Japan Naval Navigation and Communication Systems market. With growing demands for secure, efficient, and reliable communication networks, Japan is investing in next-generation systems, such as high-frequency communication technologies, integrated satellite systems, and advanced radar systems. These systems enable real-time communication between naval vessels, aircraft, and command centers, improving operational coordination and mission success. Furthermore, the increasing use of AI and machine learning in communication systems allows for better decision-making, faster data processing, and more accurate situational awareness in the high-stakes maritime environment. System integration, which combines navigation, communication, and radar functionalities into a unified platform, is becoming crucial for enhancing the operational efficiency of naval platforms. Japan’s investment in cutting-edge technologies to ensure its naval forces remain at the forefront of modern warfare is propelling growth in this sector. These technological developments also support Japan’s strategic objectives of maintaining control over vital shipping lanes and increasing security in the Indo-Pacific region, driving demand for advanced naval navigation and communication systems.

Increased Defense Budget and Naval Modernization

The growing defense budget in Japan and the continuous modernization of its naval fleet are major factors driving the demand for advanced navigation and communication systems. The Japanese government has significantly increased its defense expenditure over the past few years, recognizing the importance of naval power in maintaining regional stability and securing maritime interests. This budget expansion is directed toward procuring new naval vessels, upgrading existing platforms, and integrating advanced communication, radar, and navigation systems into Japan’s maritime defense strategy. As Japan enhances its fleet, there is a continued push to incorporate state-of-the-art technologies such as real-time satellite communication, integrated navigation systems, and highly accurate radar solutions. The modernization efforts also involve replacing aging equipment with more efficient and secure systems that align with Japan’s increasing focus on maritime security in the Indo-Pacific. Furthermore, Japan’s alliances with key defense partners, including the United States, have led to collaborative defense programs, further accelerating the growth of advanced naval technologies. The modernization of the Japan Maritime Self-Defense Force (JMSDF) is critical to ensuring Japan remains an influential naval power, contributing to the robust demand for advanced naval navigation and communication systems.

Market Challenges

High Costs and Budget Constraints

A significant challenge facing the Japan Naval Navigation and Communication Systems market is the high cost of developing, procuring, and maintaining advanced systems. The integration of cutting-edge technologies, including satellite communication, high-performance radar, and secure real-time data transmission, comes with significant financial investments. These advanced systems require not only substantial initial capital expenditure but also ongoing costs for maintenance, upgrades, and system integration. While Japan’s defense budget has increased, the costs associated with acquiring and maintaining modernized naval systems continue to place financial pressure on the government. Moreover, the need to balance defense spending with other public priorities, such as social welfare and infrastructure development, means that funding for these systems must be carefully managed. As Japan’s naval fleet grows and diversifies, the cost of equipping all new and existing vessels with the latest technologies, while ensuring compatibility with legacy systems, remains a critical challenge. These high costs can also limit the participation of smaller nations or defense contractors seeking to offer similar solutions, narrowing the pool of potential buyers and slowing the market’s growth.

Integration with Legacy Systems and Interoperability Issues

The integration of modern navigation and communication systems with Japan’s existing naval platforms presents another significant challenge. Japan’s naval fleet includes a mix of new and older vessels, each requiring different technological solutions. While new vessels are being equipped with state-of-the-art systems, older ships and submarines may require costly retrofitting or face compatibility issues with newer technologies. Ensuring seamless integration between new and legacy systems while maintaining operational effectiveness can be time-consuming and resource-intensive. Furthermore, Japan’s commitment to interoperability with allied naval forces, particularly the United States, necessitates that communication and navigation systems be compatible with international defense platforms. This requirement adds another layer of complexity to system integration and complicates procurement decisions. The technical difficulties associated with upgrading and ensuring the interoperability of these systems, along with the high costs, present challenges for Japan’s defense contractors and policymakers. Despite these hurdles, Japan remains committed to maintaining the efficiency and modernization of its naval capabilities, which continues to drive demand for advanced solutions.

Opportunities

Expansion of Autonomous Naval Systems

One of the most promising opportunities in the Japan Naval Navigation and Communication Systems market is the growing focus on autonomous naval platforms. Japan is investing heavily in unmanned maritime vehicles (UMVs) and autonomous surface ships, which require advanced navigation, communication, and control systems. These autonomous systems can perform various critical functions, such as surveillance, reconnaissance, and mine detection, without risking human lives. The integration of autonomous systems into Japan’s naval strategy is seen as a way to increase operational efficiency, reduce costs, and extend the operational range of naval forces. Autonomous systems are also expected to play a significant role in securing Japan’s maritime borders and conducting routine patrols in contested waters. As Japan develops its capabilities in unmanned systems, the need for advanced communication networks that enable real-time data transfer and control of these autonomous platforms will drive demand for more sophisticated navigation and communication technologies. This transition toward unmanned and autonomous naval platforms presents a substantial growth opportunity for defense contractors specializing in these areas.

Growth in Regional Defense Collaborations and Exports

Japan’s increasing role in regional security and its expanding defense collaborations with global allies offer significant export opportunities for its naval communication and navigation systems. As tensions rise in the Indo-Pacific region, particularly in the South China Sea, many countries are seeking advanced technologies to strengthen their naval defense capabilities. Japan’s reputation for high-quality, reliable defense systems positions it well to meet the growing demand for these solutions. By expanding defense partnerships with countries like India, Australia, and Southeast Asian nations, Japan can further integrate its advanced communication and navigation systems into the naval fleets of these countries. Additionally, Japan’s collaboration with the United States and other NATO allies allows it to share cutting-edge technologies and engage in joint defense projects. As these nations modernize their fleets and increase investments in naval defense, Japan’s defense contractors have a significant opportunity to export advanced navigation and communication systems to new markets. The increased focus on regional security also supports the long-term growth of the Japan Naval Navigation and Communication Systems market, as these technologies become crucial for global defense cooperation.

Future Outlook

The Japan Naval Navigation and Communication Systems market is expected to see steady growth over the next decade. This growth will be driven by continuous investment in Japan’s defense capabilities, the modernization of the Japan Maritime Self-Defense Force (JMSDF), and increasing regional security concerns in the Indo-Pacific. As Japan continues to focus on strengthening its maritime defense, advancements in communication, navigation, and satellite technologies will play a pivotal role in ensuring the operational effectiveness of Japan’s naval fleet. The increasing need for secure, resilient, and real-time communication networks in modern naval operations presents a substantial market opportunity for both domestic and international defense contractors. Furthermore, Japan’s ongoing participation in international defense collaborations and joint maritime operations will further drive the demand for advanced naval communication and navigation systems.

Major Players

- Lockheed Martin

- Thales Group

- BAE Systems

- Saab Japan

- Raytheon Technologies

- Japan Aerospace Exploration Agency (JAXA)

- Mitsubishi Heavy Industries

- Elbit Systems

- Northrop Grumman

- L3 Technologies

- Leonardo

- Israel Aerospace Industries

- General Dynamics Mission Systems

- Saab AB

- Naval Group

Key Target Audience

- Japan Ministry of Defense

- Japan Maritime Self-Defense Force

- International Naval Forces

- Defense Contractors

- Investments and Venture Capitalist Firms

- Government Agencies

- Military Technology Providers

- System Integrators for Naval Platforms

Research Methodology

Step 1: Identification of Key Variables

The first phase involves identifying key market drivers and stakeholders within the Japan Naval Navigation and Communication Systems market. This research will utilize secondary data sources and proprietary databases to map out critical variables influencing market dynamics.

Step 2: Market Analysis and Construction

This phase involves analyzing historical market data, technological advancements, and procurement trends. It will provide insights into market segmentation and revenue generation based on system types, platforms, and end users.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be validated through consultations with industry experts and government officials. These interviews will provide operational and financial insights that help refine market trends and projections.

Step 4: Research Synthesis and Final Output

In the final phase, the gathered data will be synthesized to produce a comprehensive report that includes detailed market forecasts, trends, and strategic recommendations for market stakeholders.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Advancements in naval communication and radar technologies

Japan’s defense modernization and increasing naval capabilities

Growing security concerns in the Indo-Pacific region - Market Challenges

High cost of advanced navigation and communication systems

Integration issues with legacy naval platforms

Cybersecurity threats and vulnerabilities in communication networks - Market Opportunities

Development of autonomous navigation systems for naval platforms

Increasing demand for secure satellite communication systems

Expansion of Japan’s defense exports in the Indo-Pacific region - Trends

Integration of AI and machine learning in naval communication systems

Shift toward hybrid naval platforms with advanced communication systems

Focus on resilient and secure maritime communication networks - Government regulations

Regulations for the integration of new communication systems in military vessels

Japan’s defense export control laws and regulations

Maritime security and communication protocols for international cooperation - SWOT analysis

- Porters 5 forces

- By Market Value,2020-2025

- By Installed Units,2020-2025

- By Average System Price,2020-2025

- By System Complexity Tier,2020-2025

- By System Type (In Value%)

Navigation Systems

Communication Systems

Integrated Systems

Radar Systems

Satellite Systems - By Platform Type (In Value%)

Surface Ships

Submarines

Aircraft

Unmanned Maritime Vehicles

Hybrid Platforms - By Fitment Type (In Value%)

OEM Fitment

Aftermarket Fitment

Modular Fitment

Custom Fitment

Upgrade Fitment - By EndUser Segment (In Value%)

Japan Maritime Self-Defense Force

International Naval Forces

Private Contractors

Defense Research Institutions

Government Defense Agencies - By Procurement Channel (In Value%)

Direct Procurement

Indirect Procurement

Government Contracts

Private Sector Contracts

Online Platforms

- Cross Comparison Parameters (Technology Adoption, System Integration, After-sales Service, Regulatory Compliance, Cost Efficiency,Technology Integration, Cost Efficiency, System Reliability, Maintenance Support, Regulatory Compliance)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Japan Aerospace Exploration Agency

Thales Group

Lockheed Martin

Boeing Defense, Space & Security

BAE Systems

Navantia

Northrop Grumman

Raytheon Technologies

L3 Technologies

Leonardo

General Dynamics Mission Systems

Saab AB

Israel Aerospace Industries

Huntington Ingalls Industries

Saab Japan

- Japan’s strategic military alliances influencing demand

- Need for advanced navigation systems in regional naval forces

- Private sector participation in providing advanced systems

- Collaboration with international defense agencies for technology transfer

- Forecast Market Value,2026-2035

- Forecast Installed Units,2026-2035

- Price Forecast by System Tier,2026-2035

- Future Demand by Platform,2026-2035