Market Overview

The Japan Naval Ship Propeller Market is valued at USD ~ in 2025, based on a five-year historical analysis. The market is driven by increasing investments in naval defense, modernization of fleets, and demand for energy-efficient propulsion technologies. The growth is supported by Japan’s maritime industry, with significant government spending on naval defense and modernization, enhancing the demand for advanced propulsion systems.

Japan, being a maritime powerhouse with a well-established naval defense sector, leads the market. Key cities like Tokyo, Yokohama, and Kobe play a crucial role in manufacturing and shipbuilding. The dominance of Japan in the market is due to its strong maritime defense presence, technological advancements in ship propulsion systems, and a growing demand for eco-friendly naval solutions, driven by both domestic and international military collaborations.

Market Segmentation

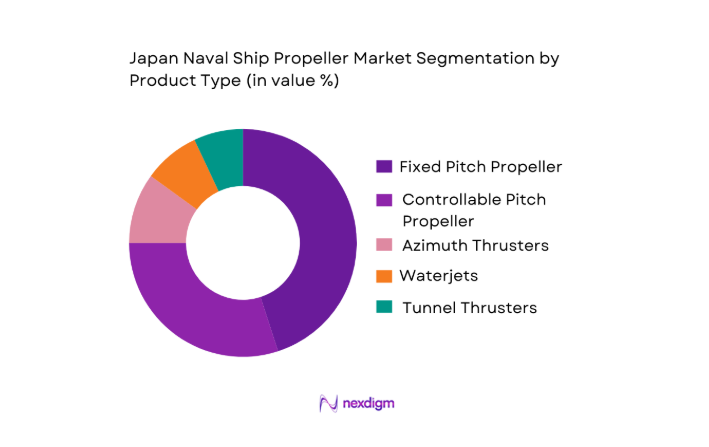

By Product Type

The Japan Naval Ship Propeller Market is segmented into fixed pitch propellers, controllable pitch propellers, azimuth thrusters, waterjets, and tunnel thrusters. Fixed pitch propellers dominate the market, accounting for a significant share in 2024. This is primarily due to their simplicity, cost-effectiveness, and reliability in both military and commercial naval applications. Their lower maintenance requirements and robust performance in various operating conditions make them the preferred choice for a wide range of naval vessels.

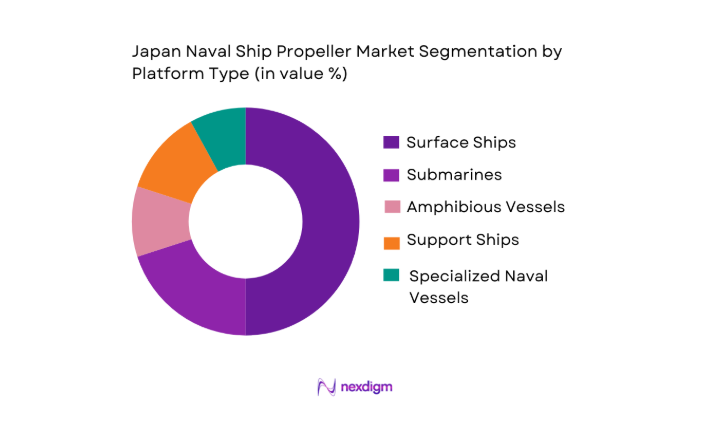

By Platform Type

The platform type segmentation includes surface ships, submarines, amphibious vessels, support ships, and specialized naval vessels. Surface ships are the dominant platform in the Japanese naval ship propeller market, making up the largest portion of the market in 2024. This is due to Japan’s strong naval presence with an extensive fleet of surface combatants, such as destroyers and frigates, which require high-performance propulsion systems for defense and strategic operations.

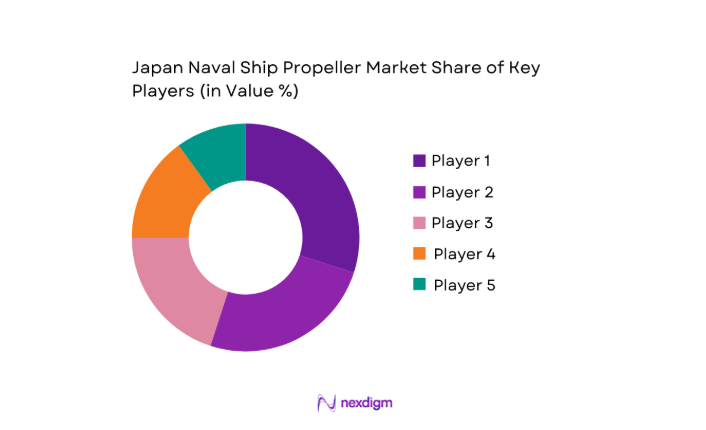

Competitive Landscape

The Japanese naval ship propeller market is consolidated, with several key players holding significant market shares. Companies such as Mitsubishi Heavy Industries and Japan Marine United dominate the market due to their strong R&D capabilities and long-standing relationships with Japan’s defense and maritime sectors. These companies lead the market by offering advanced, energy-efficient, and eco-friendly propulsion systems for both military and commercial applications.

| Company Name | Establishment Year | Headquarters | Product Focus | Technology Capability | Market Focus | R&D Investment | Environmental Impact |

| Mitsubishi Heavy Industries | 1884 | Tokyo, Japan | ~ | ~ | ~ | ~ | ~ |

| Japan Marine United | 2000 | Tokyo, Japan | ~ | ~ | ~ | ~ | ~ |

| Kawasaki Heavy Industries | 1896 | Kobe, Japan | ~ | ~ | ~ | ~ | ~ |

| Wärtsilä Corporation | 1834 | Helsinki, Finland | ~ | ~ | ~ | ~ | ~ |

| Rolls-Royce | 1904 | London, UK | ~ | ~ | ~ | ~ | ~ |

Japan naval ship propeller Market Analysis

Growth Drivers

Increasing naval defense budgets across Asia‑Pacific

Asia‑Pacific defense expenditure has risen sharply in recent years, with the total region’s military budgets contributing significantly to global spending of USD ~ in 2024, the highest on record according to SIPRI data. Japan alone increased its military expenditure to approximately USD ~, a ~ percent rise from USD 48.2 billion in 2023, reflecting sustained investment in maritime defense capabilities including surface combatants and support vessels that use advanced ship propulsion components. Countries like South Korea and Australia allocated USD 43.9 billion and USD 36.7 billion respectively to defense in 2024, reinforcing the emphasis on fleet modernization and associated propulsion systems in the region. These strong defense budgets underpin demand for naval ship propellers as part of broader naval asset enhancements.

Rising demand for fuel‑efficient propulsion systems

International maritime regulatory frameworks, particularly from the International Maritime Organization (IMO), mandate reductions in greenhouse gas emissions and carbon intensity for ships, prompting focus on fuel‑efficient propulsion technologies. Under the IMO’s 2023 GHG Strategy, targets are set to significantly reduce the carbon intensity of international shipping’s fuel use compared with 2008 levels, accelerating the adoption of energy‑efficient systems that lower fuel consumption on naval platforms. These mandates drive naval propeller providers to innovate designs that improve the energy efficiency of vessels to meet regulatory expectations, supported by operational measures such as the Ship Energy Efficiency Management Plan (SEEMP) which requires fuel oil consumption data collection and optimization practices for ships globally.

Market Challenges

High costs associated with advanced propulsion systems

Developing and deploying state‑of‑the‑art propulsion technologies involves substantial cost pressures due to advanced material requirements, precision manufacturing, and compliance with stringent technical standards. Naval propulsion systems often integrate high‑performance composites and alloys to withstand extreme operational conditions, and the procurement budgets for such systems absorb a significant portion of defense capital expenditures, as part of Japan’s USD 55.3 billion defense budget in 2024. These expenses are compounded by the need for cutting‑edge testing and certification processes, making the upfront cost of procuring advanced propellers considerably high relative to traditional marine components. Furthermore, fluctuations in raw material prices and exchange rates can affect manufacturing costs for international suppliers.

Stringent government regulations and compliance standards

Naval propulsion systems must comply with both defense procurement regulations and international maritime safety and environmental standards. Regulatory bodies such as IMO continually update energy efficiency and emissions requirements that affect how propulsion systems are designed and operated. The IMO’s strategy on GHG emissions reduction includes carbon intensity improvement checkpoints and other fuel‑efficiency mandates affecting international and naval vessels alike. This regulatory complexity requires manufacturers to invest in compliance testing, certification protocols, and design modifications to meet evolving standards, increasing development time and cost.

Opportunities

Expansion of naval fleets in the Indo‑Pacific region

The Indo‑Pacific region’s strategic significance has led countries like Japan, South Korea, and Australia to expand and modernize their naval fleets, driving demand for advanced propulsion systems and related components. Japan’s active fleet includes over 150 vessels across destroyers, frigates, and submarines, reflecting ongoing procurement and upgrades that integrate more efficient propulsion technologies. As geopolitical dynamics prompt investment in maritime capabilities, shipbuilders and propulsion system suppliers have opportunities to secure long‑term contracts for next‑generation vessels. The region’s naval expansion underscores the need for robust propulsion solutions that can support diverse missions ranging from defense deterrence to humanitarian assistance.

Growing demand for hybrid propulsion systems

Regulatory impetus and operational efficiency goals have increased interest in hybrid propulsion solutions that combine traditional engines with electric or alternative power sources. Although comprehensive 2025 adoption data is limited, trends in marine propulsion systems show shifting focus toward technologies that reduce fuel consumption and emissions, in alignment with IMO’s net zero targets. Hybrid systems offer advantages in operational flexibility and reduced environmental impact, creating opportunities for manufacturers to innovate and supply components that meet these dual objectives. Japan’s maritime sector, with its advanced shipbuilding infrastructure, is well positioned to integrate hybrid propulsion into new vessel classes.

Future Outlook

Over the next 5 years, the Japan Naval Ship Propeller Market is expected to show steady growth, driven by technological advancements in propulsion systems and the increasing demand for energy-efficient, eco-friendly solutions. The shift towards hybrid and electric propulsion in naval vessels, alongside government initiatives to reduce carbon emissions, will significantly impact the market’s trajectory. Continued investment in defense modernization and naval fleet expansion, particularly in the Asia-Pacific region, will fuel the demand for advanced propeller systems.

Major Players

- Mitsubishi Heavy Industries

- Japan Marine United

- Kawasaki Heavy Industries

- Wärtsilä Corporation

- Rolls-Royce

- General Electric

- MAN Energy Solutions

- Schottel GmbH

- Caterpillar Marine

- ZF Friedrichshafen

- Naval Group

- Saab AB

- Bendixking

- Kongsberg Gruppen

- Bramble Energy

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Naval fleet operators

- Shipbuilding companies

- Defense contractors

- Offshore platform operators

- Commercial shipping companies

- Technology developers in marine propulsion systems

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map of all major stakeholders within the Japan Naval Ship Propeller Market. This step is grounded in desk research using secondary and proprietary databases to gather industry-level information. The main goal is to identify the key drivers, challenges, and variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we will compile and analyze historical data specific to the Japan Naval Ship Propeller Market. This includes assessing market penetration, product segmentation, and historical revenue generation. The goal is to build a clear understanding of the market’s structure, growth, and competitive landscape.

Step 3: Hypothesis Validation and Expert Consultation

We will formulate hypotheses and validate them through computer-assisted telephone interviews (CATIs) with industry experts representing a range of companies. These consultations will provide operational and financial insights, which will help refine and verify the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with major ship propeller manufacturers and suppliers to obtain insights on product segments, sales performance, and future trends. This engagement helps validate data and ensure accuracy in the overall market analysis.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Definition and Scope

- Market dynamics

- Historical overview

- Timeline

- Growth Drivers

Increasing naval defense budgets across Asia-Pacific

Rising demand for fuel-efficient propulsion systems

Technological advancements in materials for naval propulsion - Market Challenges

High costs associated with advanced propulsion systems

Stringent government regulations and compliance standards

Maintenance challenges in extreme maritime environments - Opportunities

Expansion of naval fleets in the Indo-Pacific region

Growing demand for hybrid propulsion systems

Investment in autonomous naval ships - Trends

Increasing adoption of energy-efficient propeller systems

Development of environmentally-friendly propulsion technologies - Government Regulations

- SWOT Analysis

- Porters 5 forces

- By Market Value, 2020-2025

- By Volume, 2020-2025

- By Average Price, 2020-2025

- By System Type (In Value%)

Fixed Pitch Propeller

Controllable Pitch Propeller

Azimuth Thrusters

Waterjets

Tunnel Thrusters - By Platform Type (In Value%)

Surface Ships

Submarines

Amphibious Vessels

Support Ships

Specialized Naval Vessels - By Fitment Type (In Value%)

New Installation

Replacement

Retrofit

Maintenance

Upgrades - By EndUser Segment (In Value%)

Naval Defense Forces

Commercial Shipping Companies

Offshore Platforms

Private Operators

Shipyards - By Procurement Channel (In Value%)

Direct Purchase

Online Platforms

Distributors

- Market Share Analysis

- Cross Comparison Parameters (Technology adoption, manufacturing cost, market penetration, service life, environmental impact)

- SWOT Analysis of Key Players

- Pricing Analysis of Major Players

- Key Players

Mitsubishi Heavy Industries

Japan Marine United Corporation

Kawasaki Heavy Industries

MAN Energy Solutions

Wärtsilä Corporation

Rolls-Royce

Caterpillar Inc.

Schottel GmbH

ABB Ltd

Bramble Energy

Bendixking

Kongsberg Gruppen

GE Aviation

Naval Group

Saab AB

- Demand from military and defense sectors driving growth

- Increasing focus on sustainability in naval shipping

- Growing need for modernization of naval fleets

- Emergence of small and medium-sized shipbuilders

- By Market Value, 2026-2035

- By Volume, 2026-2035

- By Average Price, 2026-2035