Market Overview

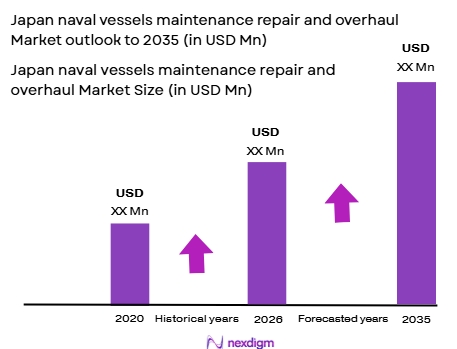

The Japan naval vessels maintenance, repair, and overhaul (MRO) market is valued at approximately USD ~billion, driven by the increasing need for regular maintenance, upgrades, and repairs for the country’s aging naval fleet. Japan’s strong naval defense infrastructure and maritime security concerns, coupled with a commitment to modernization and defense capabilities, are key factors propelling this market. Additionally, Japan’s efforts to enhance naval operations and maintain operational readiness drive substantial investments in the MRO sector, ensuring the fleet’s continued strength.

The market is dominated by cities like Yokohama, Kawasaki, and Kure, which are home to major naval shipyards and manufacturing hubs. Yokohama’s significance is primarily driven by its proximity to naval bases and defense contractors, while Kawasaki has a strong naval manufacturing presence. Kure, known for its historical shipbuilding and MRO facilities, remains a strategic location for Japan’s defense and naval sector. These cities continue to foster growth in the MRO market by maintaining strong infrastructure and capabilities for naval vessel repairs and upgrades.

Market Segmentation

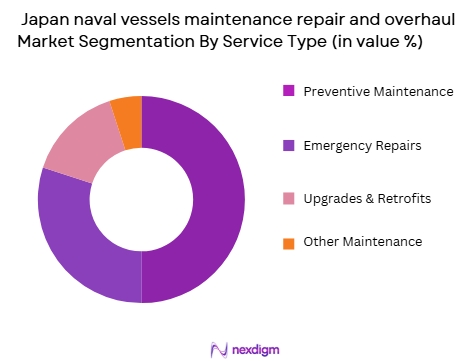

By Service Type

The Japan naval vessels MRO market is segmented into preventive maintenance, emergency repairs, upgrades & retrofits, and other maintenance services. Preventive maintenance holds a dominant share in the market. This is because preventive maintenance is essential for ensuring the long-term operational readiness of naval vessels, particularly in an environment where defense capabilities are a high priority. Scheduled checks and maintenance routines for critical systems, such as propulsion and navigation, help prevent costly breakdowns, ensuring the efficiency and operational life of vessels in Japan’s naval fleet. Furthermore, the need to maintain modern warfare systems increases the reliance on preventive services.

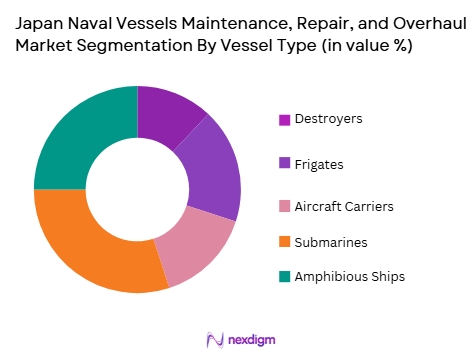

By Vessel Type

The market is also segmented by vessel type, including destroyers, frigates, aircraft carriers, submarines, and amphibious ships. Destroyers dominate the market share in Japan. These ships form a core part of Japan’s defense strategy due to their versatility and role in anti-air, anti-submarine, and anti-surface warfare. Japan’s maritime security focus requires a robust fleet of destroyers, which necessitates continuous MRO services to keep them operational and mission-ready. The need for advanced technological upgrades, such as improved radar and weapon systems, further drives the demand for MRO services for destroyers in the Japanese naval fleet.

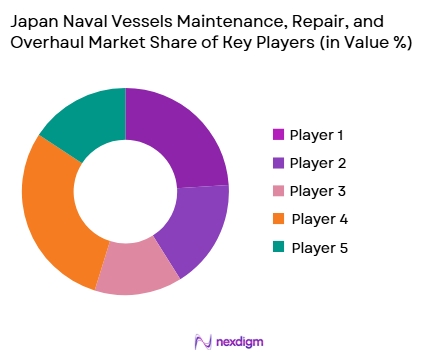

Competitive Landscape

The Japan naval vessels MRO market is highly competitive, with several domestic and international players vying for market share. Japan’s well-established naval defense industry is supported by key players, including Mitsubishi Heavy Industries, Kawasaki Heavy Industries, and Japan Marine United. These companies offer comprehensive MRO services and have long-standing relationships with Japan’s Ministry of Defense, ensuring a steady stream of contracts. The market also sees participation from foreign firms that provide specialized MRO technologies, particularly in the fields of advanced radar systems and propulsion technologies.

Competitive Landscape Table

| Company Name | Establishment Year | Headquarters | Product & Service Focus | Key Clients | Government Partnerships | Research & Development Focus |

| Mitsubishi Heavy Industries | 1884 | Tokyo, Japan | ~ | ~ | ~ | ~ |

| Kawasaki Heavy Industries | 1896 | Kobe, Japan | ~ | ~ | ~ | ~ |

| Japan Marine United | 2003 | Tokyo, Japan | ~ | ~ | ~ | ~ |

| Hitachi Zosen Corporation | 1881 | Osaka, Japan | ~ | ~ | ~ | ~ |

| IHI Corporation | 1853 | Tokyo, Japan | ~ | ~ | ~ | ~ |

Japan Naval Vessels Maintenance, Repair, and Overhaul Market Analysis ️

Growth Drivers

Strengthening Japan’s Naval Modernization and Fleet Sustainment Needs

Japan’s Maritime Self-Defense Force is focused on enhancing fleet readiness amid escalating regional maritime security challenges. Continuous investments in maintenance, repairs, and mid‑life overhauls are critical to keeping existing destroyers, submarines, and patrol vessels operational and capable. Regular MRO work ensures fleet longevity, safety, and performance — especially as more advanced systems and modular upgrades become part of naval procurement plans. As defense budgets grow, this drives demand for specialized MRO services through 2035.

Adoption of Advanced Technologies (AI, Predictive Maintenance)

The integration of digital technologies — such as AI‑based diagnostics, autonomous inspection platforms, and predictive maintenance — is transforming naval MRO efficiency. These technologies help reduce downtime, optimize maintenance scheduling, and improve safety outcomes. Japan’s tech‑savvy industrial ecosystem positions it well to adopt such innovations, boosting market growth as digital solutions become standard practice in naval maintenance and overhaul workflows.

Market Challenges

Competitive Pressures from Regional Shipbuilding Powers

Japan’s broader shipbuilding and maritime support industry faces intense competition from China and South Korea, which dominate global ship orders and maintenance infrastructure. This competitive dynamic places pressure on domestic yards and MRO service providers to innovate while managing costs, potentially slowing expansion or scaling of naval‑specific maintenance services if not matched by strategic investment.

Skilled Labor Shortages and Aging Workforce

Like many advanced economies, Japan confronts demographic headwinds, including an aging workforce and limited inflow of young technical talent. For the naval MRO market — which increasingly requires high‑skill engineering, digital fluency, and systems integration — a constrained talent pool can challenge delivery timelines, raise costs, and slow adoption of cutting‑edge maintenance practices unless targeted workforce development programs are implemented.

Opportunities

Strategic Export and Collaboration Gains from Defense Partnerships

Recent defense export deals — such as major warship contracts with partners like Australia — not only expand Japan’s geopolitical footprint but also create long‑term MRO commitments tied to those vessels. Such international cooperation can translate into sustained service contracts and technology exchange, bolstering the domestic naval MRO industry well into the 2030s.

Expansion into Predictive and Condition‑Based Maintenance Services

With global naval forces emphasizing lifecycle cost reduction and fleet availability, there is a growing opportunity for Japanese MRO providers to lead in condition‑based and predictive maintenance services. By offering advanced analytics, digital twin models, and remote monitoring solutions — especially tailored for complex naval systems — Japanese firms can differentiate themselves domestically and internationally, capturing more sophisticated service segments in the broader Asia‑Pacific MRO market.

Future Outlook

Over the next decade, the Japan naval vessels MRO market is expected to witness steady growth driven by the continued modernization and expansion of Japan’s naval fleet. With increasing geopolitical tensions in the Asia-Pacific region and Japan’s strategic defense priorities, the need for operational naval vessels will remain a key focus. Consequently, investments in MRO activities, including vessel upgrades, advanced propulsion systems, and the integration of new technologies, will continue to drive the market. Moreover, Japan’s plans to strengthen its maritime defense capabilities through international collaborations will further contribute to market expansion.

Major Players

- Mitsubishi Heavy Industries

- Kawasaki Heavy Industries

- Japan Marine United

- Hitachi Zosen Corporation

- IHI Corporation

- Sumitomo Heavy Industries

- STX Offshore & Shipbuilding

- Daewoo Shipbuilding & Marine Engineering

- Hyundai Heavy Industries

- Saab AB

- Lockheed Martin

- Babcock International Group

- General Electric

- Rolls-Royce Holdings

- Northrop Grumman

Key Target Audience

- Japan Ministry of Defense

- Japan Maritime Self-Defense Force

- Naval Defense Contractors

- Shipbuilding Companies

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies

- Military Equipment Manufacturers

- Naval Training and Maintenance Institutions

Research Methodology

Step 1: Identification of Key Variables

The first phase of the research involves identifying all key factors influencing the Japan naval vessels MRO market, including technological advancements, defense expenditure, and government priorities. A combination of secondary and proprietary data sources is used to analyze these variables.

Step 2: Market Analysis and Construction

In this phase, we analyze historical data related to Japan’s naval fleet, focusing on MRO expenditure, vessel type-specific requirements, and major defense initiatives. This data will provide a comprehensive market overview and help estimate future trends and demands.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are tested by conducting interviews with industry experts, naval officers, and MRO service providers. These consultations validate the trends and insights derived from secondary data sources, ensuring the reliability of the analysis.

Step 4: Research Synthesis and Final Output

The final stage involves consolidating data gathered from manufacturers, defense authorities, and market research reports. This step ensures the comprehensive nature of the final output, which offers an accurate and validated understanding of the Japan naval vessels MRO market.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Expansion of Japan’s naval defense capabilities

Technological advancements in maintenance techniques

Increasing defense spending in Japan - Market Challenges

High cost of MRO services

Integration of new systems with legacy platforms

Dependency on foreign suppliers for advanced parts - Market Opportunities

Growing demand for autonomous and AI-driven maintenance systems

Opportunities for domestic MRO capabilities expansion

Collaboration with international partners for MRO services - Trends

Shift towards predictive maintenance and automation

Increasing focus on eco-friendly and sustainable MRO solutions

Advancement in digital twin technology for naval vessel management - Government regulations

Japanese defense procurement regulations

Environmental regulations for naval vessels

Naval defense system certification standards - SWOT analysis

- Porters 5 forces

- By Market Value,2020-2025

- By Installed Units,2020-2025

- By Average System Price,2020-2025

- By System Complexity Tier,2020-2025

- By System Type (In Value%)

Hull Maintenance Systems

Engine Maintenance Systems

Combat Systems Maintenance

Communication Systems Maintenance

Other Specialized Systems - By Platform Type (In Value%)

Corvettes

Frigates

Destroyers

Submarines

Amphibious Warfare Vessels - By Fitment Type (In Value%)

OEM Systems

Upgraded Systems

Integrated Systems

Retrofit Systems

Hybrid Systems - By EndUser Segment (In Value%)

Japan Maritime Self-Defense Force (JMSDF)

Other Japanese Defense Agencies

International Defense Agencies

Commercial Vessels

Private Defense Contractors - By Procurement Channel (In Value%)

Direct Procurement

Government Contracts

OEM Partnerships

Defense Distributors

Third-Party Suppliers

- Cross Comparison Parameters (Service Reliability, Turnaround Time, Maintenance Cost, Technological Expertise, Cost of Spare Parts)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Mitsubishi Heavy Industries

Navantia Japan

Kawasaki Heavy Industries

Lockheed Martin Japan

Raytheon Japan

Japan Marine United

Saab Japan

Northrop Grumman Japan

BAE Systems Japan

General Dynamics

L3 Technologies

Leonardo Japan

Saab Group

Thales Japan

Kongsberg Gruppen

- JMSDF’s continuous shipbuilding and fleet modernization programs

- Increased private contractor involvement in MRO services

- Collaboration with international defense contractors

- Demand for MRO services in commercial and non-defense sectors

- Forecast Market Value,2026-2035

- Forecast Installed Units,2026-2035

- Price Forecast by System Tier,2026-2035

- Future Demand by Platform,2026-2035