Market Overview

The Japan naval vessels market has been witnessing continuous growth, driven by the nation’s focus on enhancing its maritime defense capabilities. The market size was valued at USD ~ billion in 2023, supported by Japan’s long-standing commitment to maintaining a robust naval fleet. Investments are largely directed toward modernizing existing vessels and incorporating advanced technologies like AI, autonomous systems, and enhanced propulsion. With a strategic interest in maintaining security within the Indo-Pacific region, Japan has been expanding its defense budgets, further fueling the demand for naval vessels and their maintenance.

Japan dominates the naval vessels market due to its geopolitical importance in the Indo-Pacific region. Cities such as Tokyo, Yokohama, and Kure are at the center of the naval industry, where key naval shipyards and defense contractors are located. These cities play a critical role in shipbuilding, maintenance, and technological innovation. Japan’s strong maritime defense posture, coupled with ongoing collaborations with international partners like the U.S., ensures its leadership in naval technology and fleet modernization efforts.

Market Segmentation

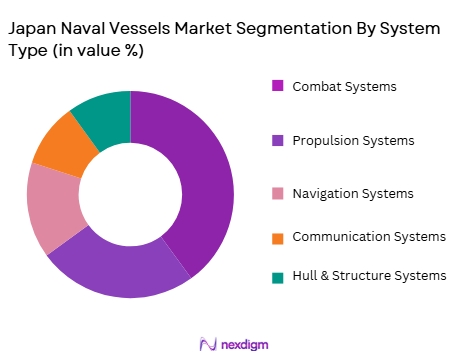

By System Type

The Japan naval vessels market is segmented by system type into combat systems, propulsion systems, navigation systems, communication systems, and hull & structure systems. Among these, combat systems are the dominant segment, driven by the increasing demand for advanced weaponry and defense technologies. Japan’s naval fleet modernization efforts heavily focus on strengthening its combat capabilities, as geopolitical tensions in the region continue to rise. Advanced radar systems, missile defense, and integrated weapon platforms are integral to Japan’s naval defense strategy, contributing to the strong presence of this sub-segment in the market.

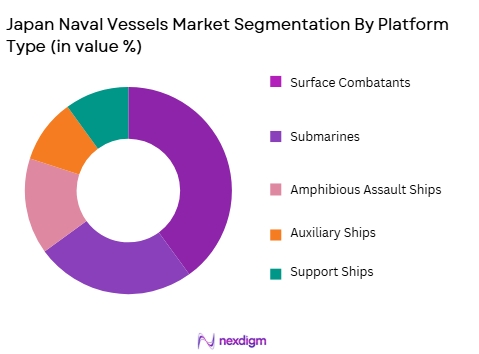

By Platform Type

The market is also segmented by platform type, which includes surface combatants, submarines, amphibious assault ships, auxiliary ships, and support ships. Surface combatants lead the segment, due to their critical role in Japan’s defense strategy. These vessels, which include destroyers and frigates, are equipped with cutting-edge combat systems and are essential for ensuring maritime security. Japan has heavily invested in surface combatants in response to rising threats in the Indo-Pacific, making this sub-segment the largest in the naval vessels market.

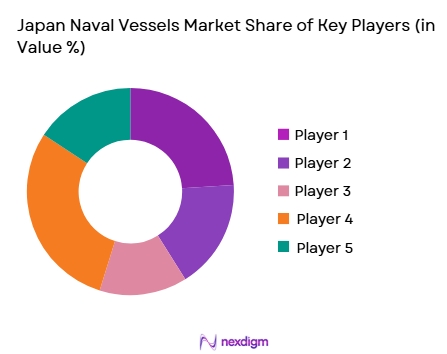

Competitive Landscape

The Japan naval vessels market is highly competitive, dominated by both local and international players. The consolidation of defense manufacturers and the country’s partnerships with global defense firms have shaped the competitive landscape. Companies like Mitsubishi Heavy Industries, Kawasaki Heavy Industries, and Japan Marine United are central to the market, supported by their advanced capabilities in shipbuilding, maintenance, and technology integration. Additionally, international players like Lockheed Martin and BAE Systems play an important role in providing specialized systems for Japan’s naval vessels.

| Company Name | Establishment Year | Headquarters | Annual Revenue (USD) | Key Product/Service | Fleet Size | Defense Contracts |

| Mitsubishi Heavy Industries | 1884 | Tokyo | ~ | ~ | ~ | ~ |

| Kawasaki Heavy Industries | 1896 | Kobe | ~ | ~ | ~ | ~ |

| Japan Marine United | 2000 | Yokohama | ~ | ~ | ~ | ~ |

| Lockheed Martin | 1912 | Bethesda, USA | ~ | ~ | ~ | ~ |

| BAE Systems | 1958 | London, UK | ~ | ~ | ~ | ~ |

Japan Naval Vessels Market Analysis

Growth Drivers

Increasing Defense Budget and Fleet Modernization

Japan’s government has made significant investments in strengthening its defense capabilities, particularly its naval fleet. The country’s defense budget has seen consistent increases, primarily focused on modernizing aging naval vessels and enhancing the technological capabilities of its fleet. These investments are aimed at maintaining Japan’s maritime security amid growing regional tensions in the Indo-Pacific. The modernization efforts include upgrading combat systems, propulsion systems, and advanced defense technologies. As Japan continues to strengthen its naval defense to ensure its territorial integrity, demand for advanced naval vessels and their maintenance is expected to drive market growth in the coming years. This focus on fleet modernization and the need for enhanced operational readiness are key drivers of the Japan naval vessels market.

Geopolitical Tensions in the Indo-Pacific Region

Rising geopolitical tensions in the Indo-Pacific region, particularly with China’s growing maritime assertiveness, have significantly influenced Japan’s naval defense strategy. The increase in territorial disputes and maritime security concerns has prompted Japan to enhance its naval presence and capabilities. This is driving demand for new naval vessels, including surface combatants, submarines, and support ships, as well as their maintenance and repair services. In response to these security threats, Japan is also prioritizing the development of advanced naval systems, including integrated combat and surveillance systems. This increased focus on regional security and the need for a robust naval defense force are powerful growth drivers for the market.

Market Challenges

Skilled Labor Shortages

The Japan naval vessels market faces a significant challenge due to a shortage of skilled labor, particularly in the areas of shipbuilding, maintenance, and advanced naval system integration. As Japan’s naval vessels become increasingly sophisticated, the demand for specialized technical expertise to maintain, repair, and upgrade these vessels has grown. However, the country’s aging population and a lack of younger professionals entering the industry are exacerbating this labor shortage. Without a sufficient influx of skilled workers, the country may face delays in the production and maintenance of its naval fleet, ultimately impacting the overall efficiency of the sector. Addressing this workforce gap through enhanced training and recruitment efforts is crucial for sustaining market growth.

High Maintenance and Upgrading Costs

The cost of maintaining and upgrading naval vessels is another challenge facing the Japanese market. As Japan focuses on enhancing the technological capabilities of its naval fleet, the associated costs for upgrading systems, repairing critical parts, and ensuring the overall operational readiness of the fleet have risen significantly. Additionally, while Japan’s defense budget has increased, there are still limitations on how much the government can allocate to the naval sector each year. High maintenance costs can lead to delays in scheduled repairs and updates, which could result in the fleet being less operationally effective or efficient. Managing these costs while maintaining a strong and modern fleet is a significant hurdle for Japan’s naval vessels market.

Opportunities

Technological Advancements in Naval Systems

The rapid advancements in naval technologies, including artificial intelligence (AI), robotics, autonomous systems, and predictive maintenance, offer significant opportunities for the Japan naval vessels market. As Japan modernizes its fleet, there is a growing demand for the integration of cutting-edge technologies that enhance vessel performance, safety, and efficiency. For example, AI-based systems for predictive maintenance can reduce downtime and extend the life of naval vessels by detecting potential issues before they become critical. Moreover, autonomous naval vessels and drones can increase operational effectiveness while reducing human resource requirements. These technological advancements present opportunities for market players to offer innovative products and services, further driving growth in the naval vessels sector.

Expansion of Strategic Defense Partnerships

Japan has increasingly engaged in strategic defense collaborations with international partners, such as the United States, Australia, and other Indo-Pacific countries. These partnerships not only enhance Japan’s naval capabilities but also create long-term opportunities for the country’s naval vessels market. Through joint naval exercises, technology sharing, and defense contracts, Japan can access new markets and secure ongoing maintenance and upgrade contracts. These collaborations can foster the exchange of knowledge and best practices, contributing to the advancement of Japan’s naval technologies. Additionally, such strategic alliances can lead to more lucrative defense contracts, driving the market growth by expanding Japan’s naval defense presence and capabilities regionally and globally.

Future Outlook

Over the next decade, the Japan naval vessels market is expected to continue growing steadily, driven by increasing defense budgets, regional security concerns, and technological advancements. As Japan seeks to modernize its fleet and enhance its strategic defense capabilities, demand for advanced naval vessels, including combat systems and submarines, is expected to rise. Investments in AI-driven systems, automation, and cybersecurity technologies will further shape the future of the naval defense sector, enabling Japan to maintain a competitive edge in the global defense market.

Major Players

- Mitsubishi Heavy Industries

- Kawasaki Heavy Industries

- Japan Marine United

- Lockheed Martin

- BAE Systems

- Navantia

- Thales Japan

- Raytheon Technologies

- Saab Japan

- Fincantieri Japan

- Naval Group Japan

- Austal Japan

- L3 Technologies

- Huntington Ingalls Industries

- Huntington Ingalls Industries Japan

Key Target Audience

- Government Agencies

- Naval Contractors

- Shipbuilders

- Research Institutions

- Security Agencies

- Investments and Venture Capitalist Firms

- Regulatory Bodies

- Commercial and Private Sector Operators

Research Methodology

Step 1: Identification of Key Variables

The first step involves identifying the critical variables impacting the Japan naval vessels market. These include trends in defense spending, fleet modernization programs, and advancements in naval technology. Secondary research, along with expert consultations, will be used to collect insights into these variables, ensuring a comprehensive understanding of market dynamics.

Step 2: Market Analysis and Construction

In this phase, historical data from shipbuilding records, defense procurement trends, and market penetration rates will be analyzed. A bottom-up approach will be employed to build a reliable market model that reflects the market’s current size and growth trajectory.

Step 3: Hypothesis Validation and Expert Consultation

Expert consultations and interviews with key players in the naval defense sector will help validate the hypotheses regarding market trends, challenges, and growth drivers. These interviews will provide in-depth insights into the operational aspects of naval vessel production and MRO services.

Step 4: Research Synthesis and Final Output

The final phase involves synthesizing the insights from the collected data and expert consultations to prepare a comprehensive report. The research findings will be cross-referenced with market trends and future projections to provide a robust market outlook.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Rising defense budgets and modernization of naval fleet

Increasing geopolitical tensions in the Indo-Pacific region

Adoption of advanced technologies and digital systems - Market Challenges

High maintenance costs and budget constraints

Skilled labor shortage and technical expertise gap

Intense competition from regional and global defense players - Market Opportunities

Expansion of strategic partnerships with private sector

Growth in predictive and condition-based maintenance services

Increasing demand for sustainable naval systems and green technologies - Trends

Integration of AI and automation in naval maintenance

Shift towards modular and flexible maintenance systems

Growing emphasis on cybersecurity in naval vessels - Government regulations

Defense Procurement Act (Japan)

Naval Vessel Sustainability Regulations

Maritime Safety and Pollution Prevention Standards - SWOT analysis

- Porters 5 forces

- By Market Value,2020-2025

- By Installed Units,2020-2025

- By Average System Price,2020-2025

- By System Complexity Tier,2020-2025

- By System Type (In Value%)

Combat Systems

Propulsion Systems

Navigation Systems

Communication Systems

Hull & Structure Systems - By Platform Type (In Value%)

Surface Combatants

Submarines

Amphibious Assault Ships

Auxiliary Ships

Support Ships - By Fitment Type (In Value%)

Newbuild

Retrofit

Upgrade

Refurbishment

Overhaul - By EndUser Segment (In Value%)

Government & Defense

Naval Contractors

Shipbuilders

Research Institutions

Security Agencies - By Procurement Channel (In Value%)

Direct Procurement

Tendering & Bidding

Private Contracts

Government Funding

International Collaboration

- Cross Comparison Parameters (System complexity, Procurement channels, Regional influence, Technological innovation, Contract length)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

ASC Pty Ltd

BAE Systems Australia

Navantia Australia

Thales Australia

Rheinmetall Defence Australia

Raytheon Australia

Huntington Ingalls Industries

Lockheed Martin Australia

Naval Group Australia

Downer EDI

Australian Submarine Corporation

L3 Technologies Australia

Austal Limited

Hewlett Packard Enterprise

General Dynamics Bath Iron Works

- Government & defense agencies focusing on naval fleet readiness

- Naval contractors looking for specialized MRO services

- Shipbuilders investing in long-term vessel life-cycle support

- Research institutions leveraging naval vessels for technological development

- Forecast Market Value,2026-2035

- Forecast Installed Units,2026-2035

- Price Forecast by System Tier,2026-2035

- Future Demand by Platform,2026-2035