Market Overview

Based on a recent historical assessment, the Japan ship leasing market was valued at approximately USD ~ billion, supported by data from the Japanese Ministry of Land, Infrastructure, Transport and Tourism and disclosures from major domestic leasing houses. The market is driven by Japan’s role as a global maritime financing hub, long-standing relationships with international shipowners, and the preference for operating leases that reduce balance sheet exposure. Stable banking support, competitive yen-denominated financing structures, and strong demand for bulk carriers, LNG carriers, and container vessels continue to sustain leasing activity.

Tokyo and Osaka emerge as dominant centers within the Japan ship leasing market due to their concentration of financial institutions, trading companies, and maritime service providers. Tokyo hosts the headquarters of leading ship leasing firms and major banks, enabling efficient capital deployment and deal structuring. Osaka benefits from its historical shipbuilding and trading ecosystem, supporting close coordination with domestic yards and equipment suppliers. Internationally, strong leasing linkages with shipowners in Greece, Singapore, and Hong Kong reinforce Japan’s influence through cross-border transactions and long-term charter-backed lease arrangements.

Market Segmentation

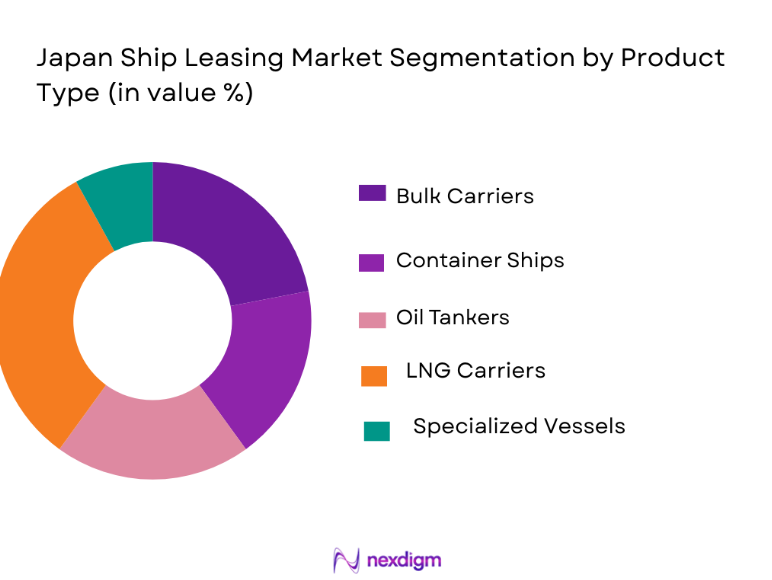

By Product Type

Japan Ship Leasing market is segmented by product type into bulk carriers, container ships, oil tankers, LNG carriers, and specialized vessels. Recently, LNG carriers had a dominant market share due to long-term charter contracts with Japanese utilities, stable cash flow profiles, and strong alignment with national energy security priorities. Japanese lessors prefer LNG assets because they are backed by creditworthy charterers and supported by government-linked financing programs. The complexity and high capital value of LNG carriers favor experienced leasing houses, reinforcing concentration in this sub-segment. Additionally, global LNG trade expansion and Japan’s reliance on imported natural gas sustain consistent demand for leased LNG tonnage.

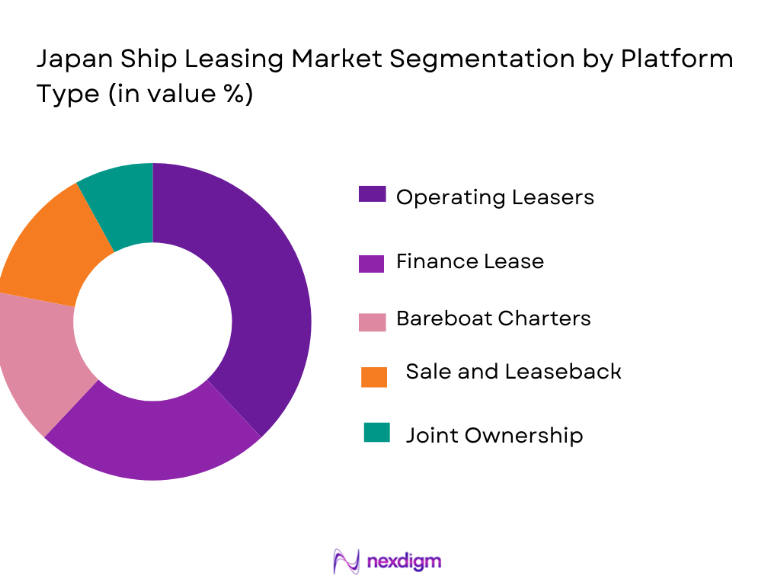

By Platform Type

Japan Ship Leasing market is segmented by lease structure into operating leases, finance leases, bareboat charters, sale and leaseback arrangements, and joint ownership structures. Recently, operating leases had a dominant market share due to their flexibility, off-balance-sheet treatment for shipowners, and alignment with Japanese lessors’ risk management practices. Operating leases allow Japanese firms to retain asset ownership while securing long-term charter income, which is attractive under conservative financial strategies. The structure also enables easier redeployment of vessels across global routes, supporting portfolio resilience amid fluctuating freight markets.

Competitive Landscape

The Japan ship leasing market is moderately consolidated, with a small number of large financial groups and trading houses exerting significant influence over global leasing activity. Major players benefit from strong balance sheets, access to low-cost capital, and deep relationships with shipbuilders and charterers. Competitive intensity is shaped by long-term contracts rather than spot exposure, leading to stable revenue visibility and high barriers to entry for new participants.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Charter Contract Tenure |

| Mitsui OSK Lines Leasing | 1964 | Tokyo, Japan | ~ | ~ | ~ | ~ | ~ |

| NYK Line Leasing | 1885 | Tokyo, Japan | ~ | ~ | ~ | ~ | ~ |

| K Line Leasing | 1919 | Tokyo, Japan | ~ | ~ | ~ | ~ | ~ |

| SMBC Leasing | 1963 | Tokyo, Japan | ~ | ~ | ~ | ~ | ~ |

| Orix Shipping | 1964 | Tokyo, Japan | ~ | ~ | ~ | ~ | ~ |

Japan Ship Leasing Market Analysis

Growth Drivers

Energy Security Driven LNG Fleet Expansion

Energy security considerations play a central role in driving Japan ship leasing market growth, as Japan remains one of the world’s largest importers of liquefied natural gas and relies heavily on maritime transport to secure stable energy supplies. Japanese leasing companies actively finance LNG carriers under long-term charter agreements with domestic utilities and global energy firms, ensuring predictable cash flows and lower credit risk. This structure aligns well with Japan’s conservative financial culture and long investment horizons. Government-backed export credit agencies and policy banks further support LNG vessel financing, reducing capital costs for lessors. The expansion of LNG import terminals and long-term procurement contracts sustains demand for additional vessels. Technological advancements in LNG carrier design, including improved fuel efficiency and boil-off management, increase asset attractiveness. Leasing firms benefit from residual value stability due to limited global supply of advanced LNG carriers. Strong charter coverage insulates lessors from freight market volatility. This driver continues to reinforce Japan’s leadership in high-value ship leasing segments.

Strong Domestic Financial Institutions and Trading

The presence of large, well-capitalized banks and diversified trading houses underpins sustained growth in the Japan ship leasing market by providing reliable access to low-cost funding and integrated maritime services. Japanese megabanks and leasing subsidiaries offer structured finance solutions that combine vessel ownership, insurance, and long-term charter placement. Trading houses leverage global networks to source charters and manage operational risks, enhancing asset utilization. This ecosystem reduces counterparty risk and supports large-scale fleet investments. Conservative credit assessment practices ensure portfolio stability across economic cycles. Long-standing relationships with shipbuilder’s secure favorable construction terms and delivery schedules. The integration of financial, operational, and commercial capabilities creates competitive advantages for Japanese lessors. This institutional strength enables consistent market participation even during global downturns.

Market Challenges

Exposure to Global Shipping Cyclicality and Asset Value Risk

Despite stable charter structures, the Japan ship leasing market faces challenges from global shipping cyclicality that can affect vessel values and redeployment opportunities. Fluctuations in freight demand influence secondary market prices, impacting balance sheets of asset-owning lessors. While long-term contracts mitigate short-term risk, off-hire periods or early charter terminations can expose firms to unfavorable market conditions. Regulatory changes affecting fuel standards may accelerate asset obsolescence. Currency fluctuations between yen-denominated financing and dollar-based charter income add complexity to risk management. Portfolio concentration in specific vessel types can amplify exposure during sector downturns. Conservative accounting practices may require impairment recognition during market stress. These factors necessitate robust risk assessment frameworks. Managing cyclicality remains a persistent operational challenge.

Increasing Regulatory and Environmental Compliance Costs

Environmental regulations impose rising compliance costs on leased fleets, challenging profitability in the Japan ship leasing market. International emissions standards require investments in cleaner propulsion systems and retrofits, increasing capital expenditure. Leasing companies must balance compliance investments with chartered willingness to pay higher lease rates. Uncertainty around future regulatory pathways complicates asset valuation and long-term planning. Older vessels face accelerated depreciation as compliance costs rise. Coordination with charterers on cost-sharing arrangements can be complex. Compliance monitoring increases operational overhead. These pressures affect return expectations across leasing portfolios. Regulatory uncertainty remains a significant constraint.

Opportunities

Green Ship Leasing and Sustainable Finance Structures

The transition toward environmentally sustainable shipping presents a significant opportunity for the Japan ship leasing market through the development of green leasing models and sustainable finance instruments. Japanese lessors can leverage access to green bonds and sustainability-linked loans to finance low-emission vessels. Collaboration with shipyards on next-generation propulsion technologies enhances asset competitiveness. Long-term charters with environmentally conscious charters provide stable returns. Government incentives for decarbonization reduce financing costs. Transparent emissions reporting strengthens investor confidence. Green assets are likely to retain higher residual values. This opportunity aligns with Japan’s broader environmental policy goals. Sustainable leasing can differentiate market leaders.

Expansion of Cross-Border Leasing with Emerging Asian Shipowners

Growing demand from emerging Asian shipowners offers new growth avenues for the Japan ship leasing market. Japanese lessors can deploy capital to fast-growing trade regions while maintaining ownership control. Strong structuring capabilities mitigate credit risk in developing markets. Partnerships with regional operators expand market reach. Diversification across geographies reduces concentration risk. Long-term demand growth in Asia supports fleet utilization. Knowledge transfer enhances operational efficiency. This opportunity supports portfolio expansion beyond traditional markets.

Future Outlook

Over the next five years, the Japan ship leasing market is expected to maintain steady expansion supported by LNG trade growth, sustainable finance adoption, and strong institutional backing. Technological innovation in vessel efficiency and emissions management will shape new leasing structures. Regulatory alignment with global decarbonization goals is likely to encourage green asset deployment. Demand-side stability from long-term charters will continue to underpin predictable revenue streams.

Major Players

- Mitsui OSK Lines Leasing

- NYK Line Leasing

- K Line Leasing

- SMBC Leasing

- Orix Shipping

- Marubeni Leasing

- Sumitomo Mitsui Trust Leasing

- Mitsubishi HC Capital

- Itochu Shipping

- Sojitz Shipping

- Nissho Iwai Leasing

- Shinsei Bank Shipping

- Tokyo Century

- JA Mitsui Leasing

- Resona Leasing

Key Target Audience

- Shipowners

- Shipping operators

- Energy companies

- Port authorities

- Investments and venture capitalist firms

- Government and regulatory bodies

- Maritime insurers

- Shipbuilding companies

Research Methodology

Step 1: Identification of Key Variables

Key variables including vessel types, lease structures, charter tenures, and financing sources were identified through industry reports and regulatory publications to define the analytical scope.

Step 2: Market Analysis and Construction

Quantitative and qualitative data were analyzed to construct market segmentation and competitive positioning, ensuring consistency with verified financial disclosures.

Step 3: Hypothesis Validation and Expert Consultation

Preliminary findings were validated through expert consultation with maritime finance professionals and cross-checked against authoritative industry databases.

Step 4: Research Synthesis and Final Output

Validated insights were synthesized into a structured market outlook ensuring methodological transparency and internal consistency.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Expansion of LNG import requirements supporting long-term carrier leases

Strong balance sheets of Japanese trading houses enabling asset-heavy leasing

Replacement demand for aging bulk and tanker fleets

Growth in Asia-Pacific trade volumes requiring chartered capacity

Stable access to low-cost capital from domestic financial institutions - Market Challenges

High exposure to global freight rate volatility impacting lease returns

Regulatory pressure on vessel emissions increasing compliance costs

Currency fluctuation risks between yen financing and USD leases

Long asset lifecycles limiting portfolio flexibility

Rising competition from alternative maritime finance hubs - Market Opportunities

Leasing of next-generation low-emission vessels for global operators

Expansion of Japanese leasing participation in offshore wind support fleets

Structured leasing solutions for emerging Asian shipping companies - Trends

Shift toward dual-fuel and LNG-powered vessel lease contracts

Increased use of digital asset monitoring in lease management

Growth of consortium-based leasing to distribute risk

Longer lease tenures for specialized vessels

Closer collaboration between shipyards and lessors - Government Regulations & Defense Policy

Alignment with international maritime emission regulations

Supportive financial regulations for maritime asset financing

Maritime security policies influencing fleet modernization - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Operating lease agreements

Finance lease agreements

Bareboat charter structures

Time charter lease structures

Hybrid leasing models - By Platform Type (In Value%)

Bulk carrier leasing

Tanker vessel leasing

Container ship leasing

LNG and LPG carrier leasing

Offshore support vessel leasing - By Fitment Type (In Value%)

Newbuild vessel leasing

Mid-life vessel leasing

Second-hand vessel leasing

Fleet renewal replacement leasing

Charter conversion leasing - By EndUser Segment (In Value%)

Domestic shipping companies

International shipping operators

Energy and commodity traders

Offshore and marine service providers

Logistics and integrated transport firms - By Procurement Channel (In Value%)

Direct leasing from financial institutions

Leasing via trading houses

Shipyard-linked leasing arrangements

Consortium-based leasing structures

Cross-border leasing partnerships - By Material / Technology (in Value %)

Conventional fuel vessel leasing

Dual-fuel vessel leasing

LNG-powered vessel leasing

Energy-efficient eco-ship leasing

Digitally monitored smart vessel leasing

- Market structure and competitive positioning

- Market share snapshot of major players

- Cross Comparison Parameters (Lease tenor, Vessel type coverage, Financing structure, Geographic charter reach, Fuel technology support, Risk sharing mechanisms, Regulatory compliance capability, Asset management services)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Mitsui O.S.K. Lines Finance

NYK Group Leasing

Kawasaki Kisen Kaisha Leasing

Mitsubishi HC Capital Marine

Sumitomo Mitsui Finance and Leasing Marine

Mizuho Leasing Marine

Tokio Marine Asset Management Shipping

Orix Maritime Leasing

Itochu Shipping Finance

Marubeni Ship Leasing

Sojitz Marine Leasing

Mitsubishi Corporation Ship Finance

Sumitomo Corporation Marine Assets

Japan Bank for International Cooperation Maritime

Development Bank of Japan Ship Finance

- Shipping companies prioritize predictable charter costs and fleet flexibility

- Energy traders favor long-term LNG carrier leases for supply security

- Logistics firms use leasing to scale capacity without capital strain

- Offshore operators demand specialized vessels under tailored lease terms

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035