Market Overview

Based on a recent historical assessment, the Japan smart airport market generated approximately USD ~ billion in total spending, reflecting confirmed investments in airport digitalization, automation systems, and intelligent infrastructure upgrades across major civil aviation hubs. The market size is driven by sustained government-backed airport modernization programs, rising passenger throughput recovery, deployment of biometric passenger processing, and integration of AI-enabled operational management platforms. Additional drivers include national transport resilience initiatives, cybersecurity mandates, and large-scale terminal redevelopment projects supported by public infrastructure budgets and long-term airport authority for capital expenditure plans.

Based on a recent historical assessment, Tokyo, Osaka, and Nagoya dominate the Japan smart airport market due to their concentration of international passenger traffic, complex airport operations, and early adoption of advanced digital aviation technologies. Tokyo leads through continuous upgrades at Haneda and Narita driven by international connectivity requirements and automation needs. Osaka benefits from Kansai International Airport’s smart terminal investments and disaster-resilient infrastructure priorities. Nagoya’s dominance is supported by Chubu Contrail’s cargo-driven digital systems, strong regional manufacturing presence, and close alignment with national smart mobility and logistics policies.

Market Segmentation

By Product Type

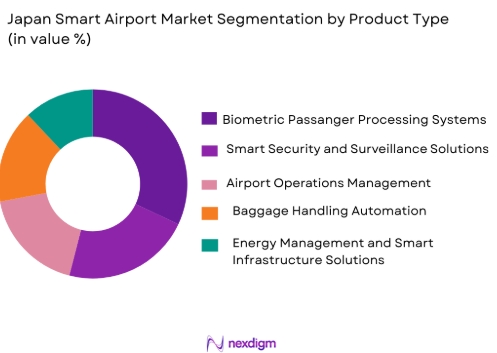

Japan smart airport market is segmented by product type into biometric passenger processing systems, smart security and surveillance solutions, airport operations management platforms, baggage handling automation systems, and energy management and smart infrastructure solutions. Recently, biometric passenger processing systems had a dominant market share due to accelerated deployment of facial recognition for check-in, security, boarding, and immigration processes across major Japanese airports. Strong government support for contactless travel, alignment with national digital identity initiatives, and proven operational efficiency gains have driven adoption. Airports prioritize biometric systems to reduce congestion, improve passenger experience, and enhance security compliance. Integration compatibility with airline platforms, scalability across terminals, and demonstrated reliability during peak travel periods further reinforce dominance. High visibility pilot programs transitioning into full-scale deployments have solidified procurement momentum, while domestic technology suppliers ensure system localization, regulatory compliance, and long-term maintenance support

By Platform Type

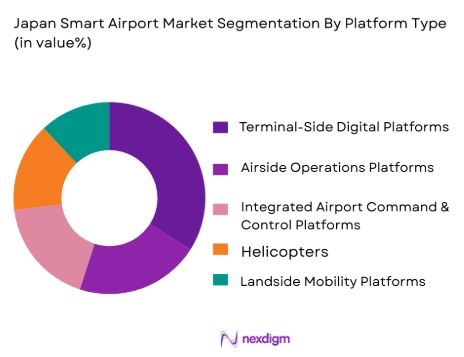

Japan smart airport market is segmented by platform type into terminal-side digital platforms, airside operations platforms, landside mobility platforms, integrated airport command and control platforms, and cloud-based airport management platforms. Recently, terminal-side digital platforms have had a dominant market share due to direct impact on passenger flow efficiency, safety compliance, and service quality. Airports prioritize terminal systems to manage high-density passenger movements, retail optimization, and real-time information dissemination. Continuous terminal expansion and refurbishment projects reinforce investment concentration in this platform category. Integration of self-service kiosks, biometric gates, digital signage, and AI-driven queue management strengthens operational value. Terminal platforms also offer faster return on investment compared to airside systems, driving procurement preference. Strong vendor ecosystems and standardized deployment frameworks further support dominance.

Competitive Landscape

The competitive landscape reflected in the table shows a highly consolidated Japan smart airport market dominated by large domestic technology conglomerates with deep expertise in critical infrastructure, automation, and digital systems. Companies such as NEC Corporation, Fujitsu Limited, and Hitachi Ltd benefit from long-standing relationships with airport authorities, strong alignment with national digital policies, and proven capabilities in large-scale system integration. High entry barriers are created by stringent regulatory requirements, cybersecurity compliance, and the need for localized technology customization. Competition is driven more by technological depth, reliability, and lifecycle support than by price, reinforcing the dominance of established players

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD) | Key Strength in Smart Airports |

| NEC Corporation | 1899 | Tokyo, Japan | ~ | ~ | ~ | ~ | ~ |

| Fujitsu Limited | 1935 | Tokyo, Japan | ~ | ~ | ~ | ~ | ~ |

| Hitachi Ltd | 1910 | Tokyo, Japan | ~ | ~ | ~ | ~ | ~ |

| Mitsubishi Electric Corporation | 1921 | Tokyo, Japan | ~ | ~ | ~ | ~ | ~ |

| Toshiba Infrastructure Systems & Solutions | 2017 | Tokyo, Japan | ~ | ~ | ~ | ~ | ~ |

Japan Smart Airport Market Analysis

Growth Drivers

Digital Transformation of Airport Operations

Digital Transformation of Airport Operations: Digital transformation of airport operations represents a critical growth driver for the Japan smart airport market due to sustained investments in automation, data-driven decision-making, and system integration across major aviation hubs. Japanese airports face increasing operational complexity arising from high passenger density, tight slot management, and stringent safety requirements, which necessitate advanced digital platforms capable of real-time monitoring and predictive analytics. Government-backed infrastructure modernization programs encourage airport authorities to replace legacy systems with integrated smart solutions to enhance resilience and efficiency. Adoption of AI-enabled operational management allows airports to optimize runway usage, gate allocation, and ground handling coordination. Cloud-based platforms enable centralized control and scalable expansion across terminals. Digital transformation also supports regulatory compliance through automated reporting and monitoring systems. Domestic technology providers offer localized solutions aligned with national standards, accelerating deployment. These factors collectively sustain long-term demand for smart airport technologies across Japan.

Contactless Passenger Experience and Automation Demand

Contactless passenger experience and automation demand is a major growth driver as airports prioritize seamless, low-touch travel journeys to improve efficiency and safety. Passenger expectations increasingly favor frictionless check-in, security, and boarding processes supported by biometric identification and self-service technologies. Japanese airports leverage automation to manage peak traffic volumes while maintaining service quality and regulatory compliance. Integration of biometric systems reduces processing times and staffing pressure. Automation also enhances security accuracy and reduces human error. Strong public acceptance of advanced technology supports rapid adoption. Airlines and airport operators jointly invest in interoperable systems to ensure end-to-end passenger journeys. This sustained emphasis on automation directly accelerates market growth.

Market Challenges

High Capital Expenditure and Integration Complexity

High capital expenditure and integration complexity pose significant challenges for the Japan smart airport market due to the cost-intensive nature of deploying advanced digital infrastructure across large, operational airports. Smart airport systems require substantial upfront investment in hardware, software, cybersecurity, and system integration services. Integration with existing legacy systems increases project complexity and extends deployment timelines. Airports must manage phased implementation without disrupting ongoing operations. Budget constraints at regional airports limit adoption speed. Procurement processes involve extensive testing and certification, adding cost and time. Long approval cycles further delay returns on investment. These factors collectively restrain rapid market expansion despite strong demand fundamentals.

Cybersecurity and Data Governance Risks

Cybersecurity and data governance risks represent a major challenge as smart airport systems increasingly rely on interconnected digital platforms and sensitive passenger data. Biometric and AI systems process large volumes of personal information, requiring strict compliance with national data protection regulations. Airports face heightened exposure to cyber threats targeting critical infrastructure. Ensuring system resilience demands continuous investment in cybersecurity frameworks and skilled personnel. Compliance requirements increase operational costs and complexity. Public trust concerns can slow deployment of biometric solutions. Managing cross-platform data interoperability further complicates governance. These risks necessitate cautious implementation strategies, slowing overall market momentum.

Opportunities

Expansion of Smart Solutions in Regional Airports

Expansion of smart solutions in regional airports presents a significant opportunity as national policies promote balanced regional development and transport connectivity. Many secondary airports are undergoing modernization to support tourism and logistics growth. Scalable smart airport platforms offer cost-efficient deployment options tailored to smaller facilities. Digital systems improve operational efficiency without extensive physical expansion. Government funding programs support regional infrastructure upgrades. Standardized solutions reduce integration complexity. Technology providers can leverage modular offerings to penetrate untapped markets. This creates substantial long-term growth potential beyond major hubs.

AI-Driven Predictive Analytics and Maintenance Platforms

AI-driven predictive analytics and maintenance platforms offer strong growth opportunities by enabling airports to shift from reactive to proactive asset management. Predictive systems optimize maintenance schedules for runways, terminals, and equipment. Reduced downtime improves operational reliability and cost efficiency. Data-driven insights support capacity planning and energy optimization. Japanese airports value precision and reliability, aligning with AI adoption. Integration with existing digital platforms enhances value proposition. Vendors offering advanced analytics gain competitive advantage. This opportunity supports sustained innovation-led market expansion.

Future Outlook

The Japan smart airport market is expected to maintain steady growth over the next five years driven by continued airport modernization, expansion of biometric and AI-enabled systems, and strong regulatory support for digital infrastructure. Technological advancements will focus on deeper system integration, cybersecurity enhancement, and data-driven operational optimization. Government investment programs and resilience planning will reinforce adoption across both major and regional airports. Demand-side factors such as passenger experience improvement and operational efficiency will remain central to future market development.

Major Players

- NEC Corporation

- Fujitsu Limited

- Hitachi Ltd

- Mitsubishi Electric Corporation

- Toshiba Infrastructure Systems & Solutions

- NTT Data Corporation

- Panasonic Connect

- SITA

- Thales Group

- Amadeus IT Group

- Honeywell Aerospace

- Siemens Smart Infrastructure

- Indra Sistemas

- IBM Japan

- Accenture Japan

Key Target Audience

- Airport authorities and operators

- Government and regulatory bodies

- Investments and venture capitalist firms

- Airlines and aviation service providers

- Infrastructure development agencies

- Smart city solution providers

- Airport system integrators

- Technology OEMs

Research Methodology

Step 1: Identification of Key Variables

Market variables including technology adoption, infrastructure spending, regulatory frameworks, and operational requirements were identified. Primary focus was placed on smart systems, automation levels, and airport modernization initiatives. Relevant demand and supply-side indicators were mapped to define market boundaries.

Step 2: Market Analysis and Construction

Data from government aviation bodies, airport authorities, and industry publications were analyzed. Market structure was constructed by segmenting technologies, platforms, and end users. Cross-validation ensured consistency across multiple data sources.

Step 3: Hypothesis Validation and Expert Consultation

Preliminary findings were validated through expert interviews with aviation technology providers and infrastructure specialists. Assumptions were refined based on operational insights and regulatory considerations to improve accuracy.

Step 4: Research Synthesis and Final Output

Validated data and insights were synthesized into structured market narratives. Quantitative and qualitative findings were aligned to ensure coherence. Final outputs were reviewed for consistency, relevance, and clarity.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Rising passenger traffic concentration at major international hubs

Government-backed airport digitization and resilience programs

Demand for contactless and automated passenger services

Operational efficiency requirements under capacity constraints

Integration of sustainability and energy optimization technologies - Market Challenges

High upfront capital expenditure for integrated smart systems

Complex integration with legacy airport infrastructure

Cybersecurity and data privacy compliance requirements

Skilled workforce shortages for advanced digital operations

Lengthy procurement and regulatory approval cycles - Market Opportunities

Expansion of smart solutions across regional and secondary airports

Deployment of AI-driven predictive maintenance and analytics

Integration of multimodal transport and smart mobility platforms - Trends

Widespread adoption of biometric based passenger journeys

Growth of centralized airport operations control centers

Increased use of cloud-native airport management systems

Integration of renewable energy and smart grid solutions

Rising collaboration between airports and technology startups - Government Regulations & Defense Policy

Civil aviation digital infrastructure standardization initiatives

National cybersecurity compliance frameworks for airports

Smart infrastructure funding under transport modernization programs - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Passenger processing and biometric identification systems

Airport operations management and analytics platforms

Smart security screening and surveillance systems

Baggage handling and tracking automation systems

Energy management and smart infrastructure systems - By Platform Type (In Value%)

Terminal-side digital platforms

Airside operations platforms

Landside access and mobility platforms

Integrated airport command and control platforms

Cloud-based airport management platforms - By Fitment Type (In Value%)

New greenfield airport projects

Brownfield airport modernization projects

Terminal expansion fitments

Runway and airside system retrofits

Standalone digital system upgrades - By EndUser Segment (In Value%)

International commercial airports

Domestic regional airports

Airport authorities and operators

Government-owned airport infrastructure agencies

Private airport management concessionaires - By Procurement Channel (In Value%)

Direct government procurement

Public private partnership contracts

System integrator led procurement

OEM direct sales agreements

Technology licensing and service contracts - By Material / Technology (in Value %)

Artificial intelligence and machine learning platforms

Internet of Things enabled sensor networks

Biometric and facial recognition technologies

Cloud computing and data analytics technologies

Advanced communication and cybersecurity technologies

- Cross Comparison Parameters (system integration capability, digital maturity, airport project experience, cybersecurity compliance, lifecycle support strength, scalability, pricing competitiveness, local partnership presence)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

NEC Corporation

Fujitsu Limited

Hitachi Ltd

Mitsubishi Electric Corporation

Toshiba Infrastructure Systems & Solutions

NTT Data Corporation

Panasonic Connect

SITA

Thales Group

Amadeus IT Group

Honeywell Aerospace

Siemens Smart Infrastructure

Indra Sistemas

IBM Japan

Accenture Japan

- International hub airports prioritizing end-to-end passenger automation

- Regional airports focusing on cost-efficient digital upgrades

- Airport authorities emphasizing resilience and disaster preparedness

- Operators leveraging analytics for capacity and revenue optimization

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035