Market Overview

Based on a recent historical assessment, the Japan sonar systems market was valued at approximately USD ~ billion, supported primarily by sustained naval modernization programs, submarine fleet upgrades, and continuous investments in maritime surveillance technologies. Demand is driven by the need for advanced underwater detection, anti-submarine warfare readiness, and secure maritime domain awareness. Government-funded defense procurement, long-term platform replacement cycles, and integration of sonar with combat management systems further reinforce expenditure levels across defense and dual-use maritime applications.

Japan’s dominance in the sonar systems market is concentrated around Tokyo, Yokosuka, Kobe, and Yokohama, where naval command centers, shipbuilding hubs, and defense electronics clusters are established. Japan leads due to its extensive coastline, strategic sea lanes, and advanced naval doctrine emphasizing underwater superiority. Strong domestic manufacturing capabilities, close coordination between the Ministry of Defense and local defense contractors, and long-standing technological expertise in acoustics and signal processing reinforce the country’s leadership position.

Market Segmentation

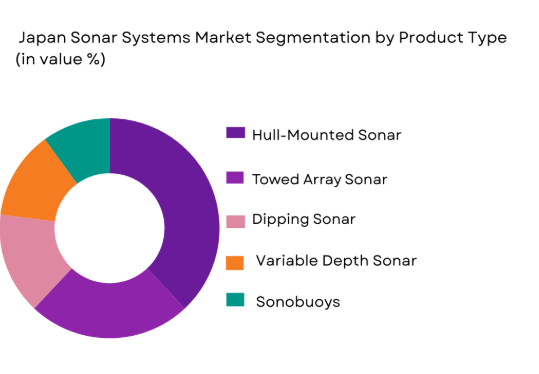

By Product Type

Japan Sonar Systems market is segmented by product type into hull-mounted sonar, towed array sonar, dipping sonar, variable depth sonar, and sonobuoys. Recently, hull-mounted sonar has a dominant market share due to factors such as consistent naval platform integration, strong domestic production capabilities, high reliability in coastal and blue-water operations, and compatibility with Japan’s destroyer and frigate fleets. Hull-mounted systems benefit from continuous upgrades rather than full replacements, ensuring steady procurement demand. Their integration with combat management systems and anti-submarine warfare doctrines supports operational effectiveness. Japan’s emphasis on indigenous shipbuilding and lifecycle support further reinforces preference for hull-mounted sonar across surface combatants and patrol vessels.

By Platform Type

Japan Sonar Systems market is segmented by platform type into surface combatants, submarines, maritime patrol aircraft, helicopters, and unmanned platforms. Recently, surface combatants had a dominant market share due to fleet modernization priorities, multi-mission destroyer deployments, and the central role of surface ships in Japan’s maritime security strategy. Surface platforms offer greater space, power availability, and upgrade flexibility for advanced sonar suites. Continuous commissioning of new destroyers and frigates sustains integration demand. Additionally, surface combatants serve as command nodes within network-centric naval operations, increasing reliance on high-performance sonar for coordinated underwater surveillance.

Competitive Landscape

The Japan sonar systems market is moderately consolidated, with a small group of domestic defense electronics firms dominating supply through long-term government contracts. Strong entry barriers exist due to security regulations, technology sensitivity, and qualification requirements. Major players benefit from deep integration with naval platforms, sustained R&D funding, and close collaboration with the defense establishment, limiting competitive pressure from foreign suppliers.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Naval Platform Integration |

| Mitsubishi Electric | 1921 | Tokyo, Japan | ~ | ~ | ~ | ~ | ~ |

| NEC Corporation | 1899 | Tokyo, Japan | ~ | ~ | ~ | ~ | ~ |

| Fujitsu | 1935 | Tokyo, Japan | ~ | ~ | ~ | ~ | ~ |

| Hitachi | 1910 | Tokyo, Japan | ~ | ~ | ~ | ~ | ~ |

| Japan Radio Co. | 1915 | Tokyo, Japan | ~ | ~ | ~ | ~ | ~ |

Japan sonar systems Market Analysis

Growth Drivers

Maritime Security Modernization Programs

Maritime Security Modernization Programs: explanation continues in the same sentence. Maritime security modernization programs are a central growth driver for the Japan sonar systems market because the nation places exceptional strategic importance on maintaining underwater awareness across surrounding seas, contested maritime zones, and vital shipping routes. Japan’s defense policy prioritizes early detection of submarines, underwater drones, and asymmetric threats, directly increasing demand for advanced sonar technologies across surface ships, submarines, and airborne platforms. Continuous fleet upgrades require integration of next-generation acoustic sensors, signal processors, and data fusion capabilities to enhance detection accuracy and response times. These programs also emphasize interoperability between platforms, driving investments in standardized sonar architecture. Domestic defense budgets allocated to naval systems support multi-year procurement stability for sonar manufacturers. Technological collaboration between the Ministry of Defense and domestic firms accelerates system upgrades. The focus on lifecycle extension of existing vessels further sustains retrofit demand. Collectively, these factors ensure consistent long-term expansion of sonar system deployments.

Technological Advancements in Underwater Acoustics

Technological Advancements in Underwater Acoustics: explanation continues in the same sentence. Technological advancements in underwater acoustics drive the Japan sonar systems market by enabling higher detection ranges, improved target classification, and reduced false alarms in complex maritime environments. Progress in digital signal processing, artificial intelligence-assisted pattern recognition, and low-frequency acoustics enhance operational effectiveness. Japanese firms invest heavily in research to adapt sonar performance to shallow coastal waters and high-traffic sea lanes. Integration of sonar with combat management and surveillance systems increases system value. These innovations support multi-mission naval platforms requiring flexible sensor suites. Continuous improvement cycles encourage replacement and upgrade programs. Export-oriented technology development also strengthens domestic capability. Overall, innovation-led differentiation sustains market growth momentum.

Market Challenges

High Development and Integration Costs

High Development and Integration Costs: explanation continues in the same sentence. High development and integration costs pose a significant challenge for the Japan sonar systems market because advanced sonar requires substantial investment in research, testing, and platform-specific customization. Acoustic systems must be tailored to vessel design, propulsion noise, and operational profiles, increasing engineering complexity. Long testing cycles in controlled and real-sea environments extend development timelines. Integration with combat management systems demands rigorous validation and cybersecurity compliance. These factors elevate unit costs and limit rapid deployment. Budget allocation constraints can delay procurement schedules. Smaller suppliers face entry barriers due to capital intensity. Consequently, cost pressures influence program pacing and supplier concentration.

Regulatory and Security Constraints

Regulatory and Security Constraints: explanation continues in the same sentence. Regulatory and security constraints challenge market growth by restricting technology transfer, foreign collaboration, and export opportunities for sonar systems. Japan’s strict defense export controls limit economies of scale for domestic manufacturers. Security clearance requirements slow supplier qualification and innovation partnerships. Compliance with naval standards increases documentation and certification costs. International collaboration is often constrained by classified technology considerations. These restrictions can reduce flexibility in sourcing components. Market access limitations affect revenue diversification. Overall, regulatory rigor shapes competitive dynamics and investment decisions.

Opportunities

Integration with Unmanned Maritime Systems

Integration with Unmanned Maritime Systems: explanation continues in the same sentence. Integration with unmanned maritime systems presents a major opportunity as Japan expands the use of unmanned surface and underwater vehicles for surveillance and my countermeasures. Sonar systems optimized for autonomous platforms enable persistent monitoring with reduced operational risk. Demand for compact, energy-efficient sonar sensors is rising. These systems complement crewed platforms in layered defense strategies. Government trials accelerate adoption pathways. Domestic firms can leverage existing acoustic expertise. Scalable solutions support future procurement. This trend opens new application-driven revenue streams.

Dual-Use Civil and Security Applications

Dual-Use Civil and Security Applications: explanation continues in the same sentence. Dual-use civil and security applications offer growth potential by extending sonar deployment beyond defense into port security, seabed mapping, and maritime infrastructure monitoring. Japan’s advanced ports and offshore installations require continuous underwater inspection. Sonar systems support disaster prevention and environmental monitoring missions. Civil adoption benefits from defense-grade reliability. Public-private partnerships encourage technological diffusion. Cost-optimized variants expand addressable markets. Export of civil sonar solutions enhances scale. These applications diversify demand for drivers.

Future Outlook

The Japan sonar systems market is expected to experience steady development over the next five years, supported by naval modernization, sensor integration initiatives, and technological innovation in underwater acoustics. Advancements in autonomous systems and digital processing will reshape deployment models. Regulatory stability and defense policy continuity will support procurement visibility. Demand will increasingly emphasize interoperability and lifecycle efficiency.

Major Players

• Mitsubishi Electric

• NEC Corporation

• Fujitsu

• Hitachi

• Japan Radio Co.

• Toshiba

• IHI Corporation

• Kawasaki Heavy Industries

• Oki Electric

• NTT Data

• Furuno Electric

• Yokogawa Electric

• Tamura Corporation

• Meisei Electric

• Sumitomo Electric

Key Target Audience

• Investments and venture capitalist firms

• Government and regulatory bodies

• Naval procurement agencies

• Defense system integrators

• Shipbuilding companies

• Maritime security agencies

• Port authorities

• Offshore infrastructure operators

Research Methodology

Step 1: Identification of Key Variables

Key demand, technology, regulatory, and procurement variables were identified through defense policy reviews and industry databases. Emphasis was placed on platform integration and sonar application scope. Data points were screened for relevance and reliability.

Step 2: Market Analysis and Construction

Market structure was constructed using platform and product segmentation aligned with procurement patterns. Industry financial and defense spending data informed market sizing logic. Cross-validation ensured internal consistency.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses were validated through expert interviews with defense analysts and maritime technology specialists. Feedback refined assumptions on adoption drivers and constraints. Conflicting inputs were reconciled through secondary verification.

Step 4: Research Synthesis and Final Output

Findings were synthesized into a coherent framework emphasizing accuracy and clarity. Data triangulation ensured robustness. Final outputs were structured to support strategic decision-making.

- Executive Summary

- Japan Sonar Systems Market Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Rising maritime security requirements and anti-submarine warfare capability enhancements

Naval modernization and fleet expansion initiatives

Technological advancements in AI-enabled acoustic processing

Expansion of unmanned underwater platforms

Government support for indigenous sonar R&D - Market Challenges

High development and integration costs

Stringent defense regulatory and certification processes

Dependence on specialized components and foreign technologies

Integration complexity across multi-platform systems

Environmental and operational constraints impacting performance - Market Opportunities

Domestic development of advanced AI and signal processing sonar solutions

Expansion of coastal and oceanographic surveillance programs

Export opportunities to allied nations undergoing naval modernization - Trends

Integration of AI and machine learning in sonar data analysis

Growth of UUV-mounted sonar deployments

multi-static and networked sonar system adoption

Focus on miniaturization and low-power acoustic sensors

Dual-use adoption across defense and commercial sectors - Government Regulations & Defense Policy

National defense procurement and sonar standards frameworks

Maritime security and ASW capability mandates

Export control and licensing regulations

SWOT Analysis

Stakeholder and Ecosystem Analysis

Porter’s Five Forces Analysis

Competition Intensity and Ecosystem Mapping

Japan Sonar Systems Market Size 2020-2025

By Market Value, 2020-2025

By Installed Units, 2020-2025

By Average System Price, 2020-2025

By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Hull-mounted sonar systems

Towed array sonar systems

Variable depth sonar systems

Sonobuoy and airborne sonar solutions

Underwater acoustic sensors and signal processing units - By Platform Type (In Value%)

Naval ships (frigates, destroyers, submarines)

Maritime patrol aircraft and helicopters

Unmanned underwater vehicles (UUVs)

Coastal surveillance installations

Commercial marine and research vessels - By Application (In Value%)

Anti-submarine warfare (ASW)

Mine detection and clearance

Underwater surveillance and monitoring

Navigation and obstacle avoidance

Scientific and research applications - By End User Segment (In Value%)

Japan Maritime Self-Defense Force (JMSDF)

Defense-related research institutions

Coast guard and maritime safety agencies

Commercial maritime operators

Underwater science and survey organizations - By Procurement Channel (In Value%)

Direct defense acquisition programs

Domestic OEM contracts and licensed production

Foreign technology integration agreements

Public-private R&D collaboration

Commercial and scientific procurement channels

- Market share snapshot of major players

- Cross Comparison Parameters (signal processing sophistication, platform adaptability, system reliability, integration capability, after-sales support, export footprint, R&D intensity, cost competitiveness, certification compliance)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Mitsubishi Heavy Industries Maritime Systems

Kawasaki Heavy Industries Maritime Systems

Furuno Electric Co., Ltd.

Japan Radio Co., Ltd.

Toshiba Corporation

NEC Corporation

Ultra Electronics Holdings

Thales Underwater Systems

Kongsberg Gruppen ASA

Lockheed Martin (Underwater Systems)

Raytheon Technologies (Sonar Division)

Saab Group (Underwater Systems)

Leonardo (Naval & Sonar Systems)

Atlas Elektronik

ECA Group

- JMSDF focus on submarine detection and blue-water readiness

- Coast guard emphasis on maritime safety and border surveillance

- Defense research institutions driving innovation adoption

- Commercial marine operators prioritizing obstacle detection

- Scientific organizations requiring high-resolution acoustic data

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Application and Platform, 2026-2035