Market Overview

The Japan sonobuoy market current size stands at around USD ~ million and reflects stable procurement momentum driven by maritime surveillance priorities. Deployment volumes during 2024 and 2025 remained consistent, supported by recurring defense allocations and fleet modernization programs. Demand was concentrated in anti-submarine warfare and coastal monitoring roles, with recurring procurement cycles ensuring steady operational replacement needs. Technology refresh programs supported consistent acquisition levels across multiple naval platforms. Operational requirements emphasized interoperability, signal reliability, and environmental endurance across mission profiles.

The market is primarily concentrated around major naval and aerospace hubs including Kanagawa, Aichi, and Kyushu regions. These areas benefit from established defense infrastructure, testing facilities, and naval command centers. Strong integration between domestic manufacturers and defense agencies supports steady demand. Regional concentration is further reinforced by proximity to maritime patrol squadrons and logistics bases. Policy emphasis on maritime domain awareness continues to shape procurement priorities.

Market Segmentation

By Application

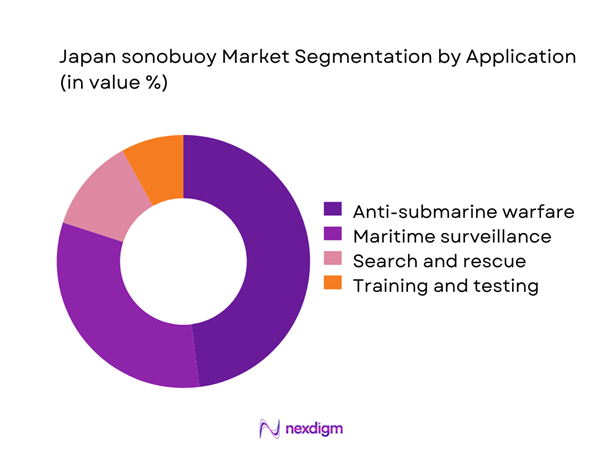

Anti-submarine warfare represents the dominant application segment, driven by sustained maritime security priorities and increasing underwater threat monitoring requirements. Continuous patrol operations and regular fleet exercises sustain recurring sonobuoy usage. Surveillance applications follow closely, benefiting from integration with maritime patrol aircraft and helicopter platforms. Search and rescue usage remains limited but essential, especially in high-traffic sea lanes. Training and testing applications contribute steady baseline demand due to regular crew certification cycles and operational readiness drills.

By Technology Architecture

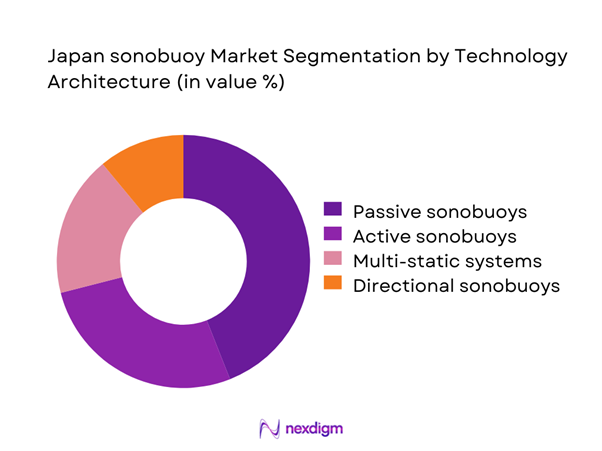

Passive sonobuoys dominate deployment due to lower operational complexity and wide-area detection capabilities. Active sonobuoys are increasingly deployed for high-precision tracking during tactical missions. Multi-static sonobuoys are gaining traction as naval doctrines shift toward networked sensing. Directional and DIFAR-based systems maintain relevance for specialized operations. Technological adoption is driven by interoperability, signal clarity, and data processing efficiency across platforms.

Competitive Landscape

The competitive environment is moderately consolidated, with a mix of international defense suppliers and domestic manufacturers supporting Japan’s naval requirements. Long-term supply contracts and qualification standards create high entry barriers. Competitive differentiation is primarily driven by acoustic performance, system reliability, and integration compatibility. Established players maintain advantage through long-standing defense relationships and platform certifications.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Company A | 1947 | Japan | ~ | ~ | ~ | ~ | ~ | ~ |

| Company B | 1952 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Company C | 1960 | France | ~ | ~ | ~ | ~ | ~ | ~ |

| Company D | 1940 | Sweden | ~ | ~ | ~ | ~ | ~ | ~ |

| Company E | 1958 | Japan | ~ | ~ | ~ | ~ | ~ | ~ |

Japan sonobuoy Market Analysis

Growth Drivers

Rising undersea threat perception in the Indo-Pacific

Rising undersea threat perception in the Indo-Pacific is reshaping maritime defense priorities across regional naval forces. Increased submarine patrol frequency has driven higher sonobuoy deployment rates during routine surveillance missions. Strategic chokepoints require persistent acoustic monitoring to deter covert underwater movements effectively. Advanced adversary capabilities encourage continuous sensor refresh cycles and technology upgrades. Maritime security doctrines increasingly emphasize early detection through distributed sensing networks. Sonobuoys remain central to layered undersea awareness strategies. Regional naval exercises reinforce operational familiarity and consumption intensity. Threat-driven planning sustains consistent procurement authorizations. Operational commanders prioritize acoustic coverage density over platform expansion. This driver structurally anchors demand irrespective of short-term geopolitical fluctuations.

Expansion of Japan Maritime Self-Defense Force ASW capabilities

Expansion of Japan Maritime Self-Defense Force ASW capabilities directly accelerates sonobuoy integration across air and naval platforms. New patrol aircraft deployments require compatible and higher-performance acoustic payloads. Helicopter-based ASW missions increasingly rely on rapid deployment sonobuoy patterns. Training hours increased significantly, driving replenishment demand for expendable systems. Fleet modernization programs emphasize sensor-network interoperability. ASW doctrine evolution supports multi-static deployment concepts. Operational readiness benchmarks mandate higher inventory availability. Integration testing expands usage during qualification cycles. Capability expansion aligns with alliance interoperability objectives. This driver reinforces structurally sustained procurement momentum.

Challenges

High cost of advanced sonobuoy systems

High cost of advanced sonobuoy systems constrains procurement flexibility within fixed defense budgeting frameworks. Sophisticated signal processing components elevate unit-level expenditure significantly. Expendable nature amplifies cumulative financial pressure during intensive training cycles. Cost sensitivity influences cautious adoption of next-generation architectures. Budget planners balance capability upgrades against quantity requirements. High specification systems face longer approval timelines. Domestic cost optimization options remain limited. Lifecycle cost visibility remains constrained due to classified performance parameters. Cost pressure encourages selective rather than broad deployment strategies. This challenge moderates adoption velocity despite operational advantages.

Dependence on foreign suppliers

Dependence on foreign suppliers exposes procurement programs to geopolitical and supply chain risks. Import reliance complicates long-term sustainment planning for critical acoustic components. Technology transfer restrictions limit domestic production scalability. Lead times extend due to export control compliance processes. Strategic autonomy objectives face structural constraints from reliance patterns. Supplier concentration elevates bargaining power imbalances. Customization flexibility remains limited under foreign intellectual property regimes. Maintenance and upgrade cycles depend on external approvals. Policy scrutiny increases around defense import exposure. This challenge motivates gradual localization efforts without immediate resolution.

Opportunities

Development of indigenous sonobuoy programs

Development of indigenous sonobuoy programs presents a strategic opportunity to enhance technological sovereignty. Domestic R&D initiatives can tailor systems to local acoustic environments. Indigenous programs reduce long-term dependence on imported components. Collaboration with national research agencies accelerates capability maturation. Local manufacturing improves supply chain resilience. Program visibility strengthens budget justification processes. Export potential emerges through allied defense cooperation frameworks. Customization enables faster iteration cycles. Workforce skill development supports adjacent defense technologies. This opportunity aligns industrial policy with operational requirements.

Integration with unmanned and autonomous platforms

Integration with unmanned and autonomous platforms expands sonobuoy deployment concepts beyond traditional crewed assets. Unmanned aerial systems enable wider-area acoustic coverage with reduced operational risk. Autonomous surface vessels support persistent sensor deployment patterns. Integration enhances endurance and mission flexibility. Data fusion from autonomous nodes improves detection accuracy. Platform diversification reduces reliance on limited airframe availability. Experimental deployments demonstrate operational feasibility. Autonomy-driven concepts attract innovation funding attention. Software-defined interfaces ease integration complexity. This opportunity reshapes future ASW operational architectures.

Future Outlook

The Japan sonobuoy market is expected to maintain steady growth through 2035 driven by evolving maritime security needs. Continued modernization of naval assets and increased emphasis on undersea surveillance will sustain demand. Advancements in digital processing and networked warfare capabilities will further enhance system relevance. Domestic development initiatives are likely to strengthen supply resilience. Strategic alignment with regional security objectives will remain a key growth driver.

Major Players

- Ultra Maritime

- Sparton

- L3Harris Technologies

- Thales Group

- Raytheon Technologies

- General Dynamics Mission Systems

- Saab AB

- Leonardo S.p.A.

- Elbit Systems

- Mitsubishi Electric

- NEC Corporation

- Safran Group

- Teledyne Technologies

- Kongsberg Defence

- Boeing Defense

Key Target Audience

- Japan Maritime Self-Defense Force

- Ministry of Defense Japan

- Acquisition, Technology and Logistics Agency

- Naval aviation command units

- Defense procurement authorities

- Maritime surveillance program offices

- Defense system integrators

- Investments and venture capital firms

Research Methodology

Step 1: Identification of Key Variables

Core variables including application scope, deployment platforms, and technology types were identified. Emphasis was placed on operational relevance and procurement alignment. Data points were filtered for consistency and defense relevance.

Step 2: Market Analysis and Construction

Market structure was developed through segmentation mapping and demand trend evaluation. Operational usage patterns were analyzed across multiple mission profiles. Supply-side dynamics were examined through production and integration pathways.

Step 3: Hypothesis Validation and Expert Consultation

Findings were validated through domain expert consultations and defense sector insights. Assumptions were tested against operational deployment trends. Iterative validation ensured logical consistency.

Step 4: Research Synthesis and Final Output

All data streams were consolidated into a structured analytical framework. Qualitative and quantitative insights were harmonized. Final outputs were refined for accuracy and clarity.

- Executive Summary

- Research Methodology (Market Definitions and scope alignment for sonobuoy systems in Japan, Platform and mission-based segmentation framework, Bottom-up and top-down market sizing using procurement and deployment data, Revenue attribution by program lifecycle and contract value analysis, Primary validation through defense procurement experts and naval program stakeholders, Data triangulation using defense budgets)

- Definition and scope

- Market evolution

- Operational role in maritime surveillance and ASW missions

- Ecosystem structure across OEMs, integrators, and defense agencies

- Supply chain and procurement structure

- Regulatory and defense acquisition environment

- Growth Drivers

Rising undersea threat perception in the Indo-Pacific

Expansion of Japan Maritime Self-Defense Force ASW capabilities

Modernization of maritime patrol aircraft fleets

Increased defense spending and surveillance investments

Growing focus on maritime domain awareness

Technological upgrades in acoustic sensing - Challenges

High cost of advanced sonobuoy systems

Dependence on foreign suppliers

Restricted technology transfer regulations

Limited domestic manufacturing base

Short operational lifecycle of expendable systems

Procurement delays due to regulatory scrutiny - Opportunities

Development of indigenous sonobuoy programs

Integration with unmanned and autonomous platforms

Adoption of multi-static sonar networks

Export collaboration with allied nations

Digital signal processing advancements

AI-enabled acoustic analysis - Trends

Shift toward networked and software-defined sonobuoys

Increasing demand for low-frequency active systems

Integration with P-1 and next-generation patrol aircraft

Focus on interoperability with allied naval forces

Rising use of expendable and lightweight designs

Emphasis on real-time data transmission - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Volume, 2020–2025

- By Installed Base, 2020–2025

- By Average Selling Price, 2020–2025

- By Fleet Type (in Value %)

Maritime patrol aircraft

Naval helicopters

Unmanned aerial systems

Surface vessels - By Application (in Value %)

Anti-submarine warfare

Maritime surveillance

Search and rescue

Training and testing - By Technology Architecture (in Value %)

Active sonobuoys

Passive sonobuoys

Directional frequency analysis and recording sonobuoys

Multi-static and networked sonobuoys - By End-Use Industry (in Value %)

Defense and naval forces

Homeland security and coast guard

Defense research organizations - By Connectivity Type (in Value %)

Analog sonobuoys

Digital sonobuoys

RF-linked sonobuoys

Satellite-enabled sonobuoys - By Region (in Value %)

Kanto region

Kansai region

Chubu region

Kyushu and Okinawa

Other maritime zones

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (Product portfolio depth, Technology maturity, Regional presence, Defense contract wins, R&D intensity, Pricing strategy, Platform compatibility, Aftermarket support)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

Ultra Maritime

Sparton (Elbit Systems of America)

L3Harris Technologies

Thales Group

Raytheon Technologies

General Dynamics Mission Systems

Saab AB

Leonardo S.p.A.

Elbit Systems Ltd.

Mitsubishi Electric Corporation

NEC Corporation

Safran Group

Teledyne Technologies

Kongsberg Defence & Aerospace

Boeing Defense, Space & Security

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2026–2035

- By Volume, 2026–2035

- By Installed Base, 2026–2035

- By Average Selling Price, 2026–2035