Market Overview

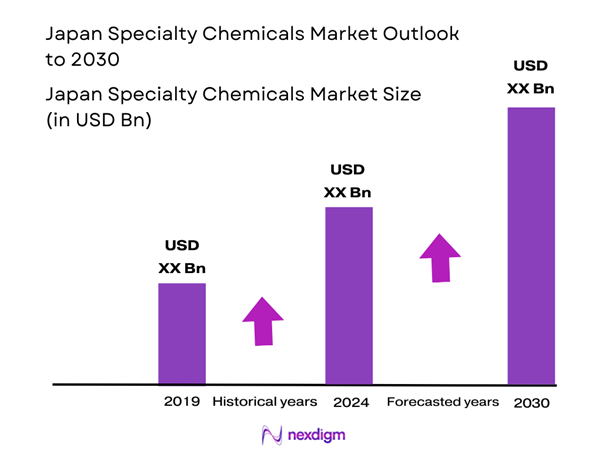

The Japan Specialty Chemicals market is valued at USD 38 billion in 2024 with an approximated compound annual growth rate (CAGR) of 6% from 2024-2030, based on a robust historical analysis of industry growth and dynamics. Driving factors include the increasing demand for advanced materials and eco-friendly solutions across various sectors, particularly automotive, electronics, and construction. These sectors are fueled by technological advancements, regulatory support for sustainable practices, and a growing emphasis on high-performance products that cater to specific consumer needs.

The market is significantly influenced by major urban centers such as Tokyo, Yokohama, and Osaka. These cities are economic powerhouses with extensive industrial capabilities, facilitating innovation in specialty chemicals. Their strategic locations, combined with strong R&D infrastructures, contribute to Japan’s dominance in the global specialty chemicals market, making it a hub for both manufacturing and technological development.

The rising demand for eco-friendly products reflects a broader shift in consumer preferences towards sustainability. The Japanese government has targeted reducing greenhouse gas emissions by 46% by 2030. This goal emphasizes the need for eco-efficient specialty chemicals in sectors such as construction, packaging, and automotive. Biodegradable materials, green solvents, and low-VOC (volatile organic compounds) products are increasingly being adopted by manufacturers to align with regulatory requirements and consumer expectations.

Market Segmentation

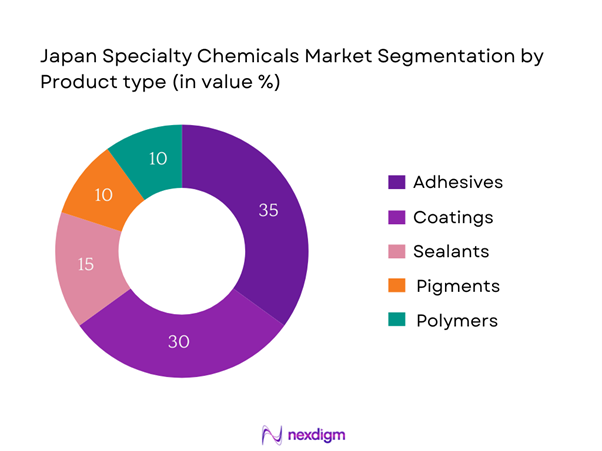

By Product Type

The Japan Specialty Chemicals market is segmented by product type into adhesives, coatings, sealants, pigments, and polymers. Recently, the adhesives segment has been dominating market share, driven by the increasing applications across various industries such as automotive and construction. This segment is particularly influenced by the rising demand for environmentally friendly adhesives that offer superior bonding capabilities. The growth in construction projects, coupled with advancements in adhesive technology that enhance performance while minimizing environmental impact, underscores the market’s shift towards sustainable solutions.

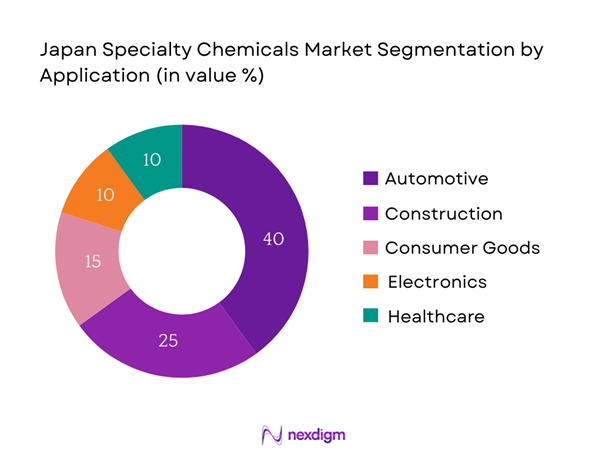

By Application

The Japan Specialty Chemicals market is further segmented by application into automotive, construction, consumer goods, electronics, and healthcare. The automotive sector leads this market segmentation, owing to the accelerating demand for innovative and lightweight materials that enhance vehicle performance and efficiency. With the push towards electric and autonomous vehicles, specialized chemicals for better insulation, durability, and safety features are in high demand. This trend is bolstered by stringent environmental regulations and consumer expectations for cleaner technology in the automotive sector.

Competitive Landscape

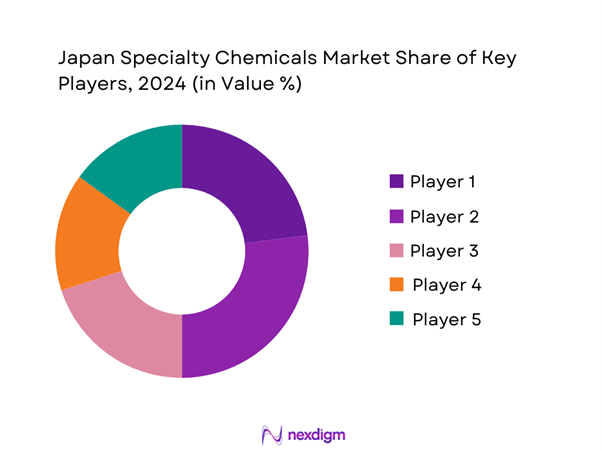

The Japan Specialty Chemicals market is dominated by several key players, including both local and international firms that leverage advanced technology and innovation. The major companies, such as Mitsui Chemicals, Asahi Kasei, and Toray Industries, maintain significant market shares due to their strong R&D capabilities and comprehensive product offerings. This consolidation highlights the competitive landscape defined by substantial investments in innovation and customer-centric approaches.

| Company | Establishment Year | Headquarters | Number of Employees | Revenue (USD Billions) | Market Focus | Key Innovations |

| Mitsui Chemicals | 1912 | Tokyo, Japan | – | – | – | – |

| Asahi Kasei | 1931 | Tokyo, Japan | – | – | – | – |

| Toray Industries | 1926 | Tokyo, Japan | – | – | – | – |

| DIC Corporation | 1908 | Tokyo, Japan | – | – | – | – |

| Shin-Etsu Chemical | 1926 | Tokyo, Japan | – | – | – | – |

Japan Specialty Chemicals Market Analysis

Growth Drivers

Technological Advancements

Technological advancements play a pivotal role in driving the growth of the Japan Specialty Chemicals market. Investment in research and development is projected to reach approximately USD 1.2 trillion by end of 2025, fostering innovation in chemical processing and material science. Enhanced technologies such as artificial intelligence (AI) and the Internet of Things (IoT) are being integrated into manufacturing processes, improving efficiency, safety, and product quality. These technologies enable real-time monitoring and predictive maintenance, thereby reducing downtime and operational costs. Consequently, the enhancements provided through technological innovation significantly bolster the market’s growth potential.

Increasing Urbanization

Japan’s urbanization rate is above 91%, leading to an increased demand for specialty chemicals across diverse sectors, including construction, automotive, and consumer goods. With over 37 million residents, Tokyo remains the most populous metropolitan area globally, necessitating advanced materials for housing and infrastructure developments. This urban growth fuels the need for high-performance products such as adhesives and coatings that meet safety and environmental standards. Furthermore, urbanization drives investments in smart cities and renewable energy, both of which rely heavily on specialty chemicals for sustainable development.

Market Challenges

Regulatory Hurdles

Regulatory hurdles continue to pose significant challenges for the specialty chemicals market in Japan. Compliance with stringent safety and environmental regulations often requires extensive testing and certifications, which can delay product launches. The Chemical Substance Control Law mandates strict assessments of new chemical substances, with over 20,000 substances already registered. Moreover, compliance costs can be upwards of 15% of the total production costs, affecting profitability for manufacturers. Consequently, navigating through these regulations necessitates time and financial investments, creating barriers for innovation and market entry.

Raw Material Price Volatility

Raw material price volatility remains a significant obstacle for the specialty chemicals industry, influenced by global supply chain disruptions and geopolitical tensions. For instance, the price of crude oil, a critical input for many specialty chemicals, fluctuated between USD 70 to USD 130 per barrel from 2022 to 2023, severely impacting manufacturing costs. The rising prices of commodities hampers long-term planning and profitability, as manufacturers struggle with inconsistent pricing models in their production processes. Such volatility can lead to increased operational costs that are ultimately passed down to consumers, impacting market stability.

Market Opportunities

Expanding E-commerce Platforms

E-commerce platforms are rapidly expanding and becoming critical to the distribution of specialty chemicals in Japan, reflecting a shift in buying behavior. E-commerce sales in the B2B sector are projected to reach approximately USD 1 trillion by end of 2025, facilitated by improvements in logistics and digital payment systems. Businesses are increasingly relying on online platforms for procurement, allowing for quicker access to product information and enhanced flexibility in supply chains. This shift towards e-commerce opens new avenues for specialty chemical manufacturers to reach customers directly, expand their market presence, and drive sales growth.

Increasing Focus on R&D

The increasing focus on R&D within the specialty chemicals sector indicates a significant opportunity for growth. Companies are investing heavily in developing innovative products tailored to meet changing consumer preferences and regulatory compliance. Japan’s average R&D spending across industries reached approximately USD 19.2 billion in 2023. Notably, sectors such as pharmaceuticals and biotechnology are driving much of this investment, which aims to develop sustainable and high-performance specialty chemicals. This landscape provides an opportunity for collaborations and partnerships, further enhancing product development and market penetration strategies.

Future Outlook

Over the next five years, the Japan Specialty Chemicals market is expected to experience substantial growth driven by a combination of government support for sustainable practices, increasing investments in R&D, and rising consumer demand for specialty products. The shift towards renewable energy solutions and advanced materials will further enhance growth prospects as industries adapt to new environmental standards and technology advancements. This evolving landscape is likely to foster innovation and strengthen the market’s competitive edge.

Major Players

- Mitsui Chemicals

- Asahi Kasei

- Toray Industries

- DIC Corporation

- Shin-Etsu Chemical

- Sumitomo Chemical

- JSR Corporation

- Showa Denko K.K.

- Santen Pharmaceutical

- Dainippon Ink and Chemicals

- Kuraray Co., Ltd.

- Chugai Pharmaceutical

- Daicel Corporation

- Kinki Chemical

- Ube Industries

Key Target Audience

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (Ministry of Economy, Trade and Industry)

- Automotive Manufacturers

- Construction Companies

- Electronics Manufacturers

- Pharmaceutical Corporations

- Distributors and Retailers of Chemical Products

- Industry Associations and Trade Organizations

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Japan Specialty Chemicals market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the Japan Specialty Chemicals market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations provide valuable operational and financial insights directly from industry practitioners, which are instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple specialty chemical manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction serves to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the Japan Specialty Chemicals market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Market Genesis and Evolution

- Timeline of Major Players

- Business Cycle Dynamics

- Supply Chain Analysis

- Value Chain Analysis

- Growth Drivers

Technological Advancements

Increasing Urbanization

Demand for Eco-Friendly Products - Market Challenges

Regulatory Hurdles

Raw Material Price Volatility - Market Opportunities

Expanding E-commerce Platforms

Increasing Focus on R&D - Market Trends

Shift to Biobased Chemicals

Automation in Manufacturing - Government Regulations

Compliance Standards

Environmental Policies - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces Analysis

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Product Type (In Value %)

Adhesives

– Sensitive Adhesives

– Hot-Melt Adhesives

– Reactive Adhesives

– Solvent-Based Adhesives

– Water-Based Adhesives

Coatings

– Protective Coatings

– Industrial Coatings

– Architectural Coatings

– Automotive Coatings

– Powder Coatings

Sealants

– Silicone Sealants

– Polyurethane Sealants

– Acrylic Sealants

– Butyl Sealants

Pigments

– Organic Pigments

– Inorganic Pigments

– Metallic Pigments

– Special Effect Pigments

Polymers

– Engineering Plastics

– Thermosetting Polymers

– Elastomers

– Functional Polymers - By Application (In Value %)

Automotive

– Coatings & Paints

– Adhesives & Sealants

– Plastic Compounds

– Heat-Resistant Chemicals

Construction

– Waterproofing Agents

– Concrete Additives

– Insulation Chemicals

– Structural Coatings

Consumer Goods

– Personal Care Ingredients

– Home Care Chemicals

– Fragrances and Flavors

Electronics

– Conductive Polymers

– Encapsulation Materials

– PCB Coatings

– Solder Resist Inks

Healthcare

– Pharmaceutical Intermediates

– Biocompatible Polymers

– Diagnostic Reagents

– Antimicrobial Coatings - By Distribution Channel (In Value %)

Direct Sales

– Strategic B2B Agreements

– In-house Manufacturer Sales Teams

Distributors

– Domestic Chemical Distributors

– Global Distribution Partners

Online Sales

– E-commerce Portals (B2B)

– Manufacturer-Run Marketplaces

– Industrial Chemical E-tailers - By Region (In Value %)

Kanto Region

Kansai Region

Chubu Region

Hokkaido Region - By End-User Industry (In Value %)

Industrial Sector

Packaging Industry

Agricultural Sector

– Crop Protection Chemicals

– Soil Enhancers

– Agrochemical Distributors

Pharmaceutical Sector

– Drug Manufacturing Firms

– Research & Development Labs

– Medical Device Coating Suppliers

- Market Share of Major Players (By Value/Volume), 2024

- Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strengths and Weaknesses, Organizational Structure, Revenues, Revenues by Product Type, Number of Touchpoints, Distribution Channels, R&D Investments, Production Capacity, Unique Value Propositions)

- SWOT Analysis of Key Players

- Pricing Analysis for Major Players

- Detailed Profiles of Major Companies

Mitsui Chemicals, Inc.

Asahi Kasei Corporation

Toray Industries, Inc.

DIC Corporation

Shin-Etsu Chemical Co., Ltd.

Sumitomo Chemical Co., Ltd.

Mitsubishi Chemical Corporation

JSR Corporation

Showa Denko K.K.

Santen Pharmaceutical Co., Ltd.

Dainippon Ink and Chemicals, Inc.

Kuraray Co., Ltd.

Chugai Pharmaceutical Co., Ltd.

Daicel Corporation

Kinki Chemical Co., Ltd.

- Demand and Utilization Patterns

- Purchasing Power Dynamics

- Regulatory and Compliance Requirements

- Customer Needs Analysis

- Decision-Making Process Insights

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030