Market Overview

The Japan Submarine Market market current size stands at around USD ~ million, supported by active fleet modernization programs and sustained naval investment levels. The market reflects consistent procurement activity, mid-life upgrades, and integration of advanced propulsion technologies. Demand remains stable due to strategic maritime requirements, evolving threat perceptions, and fleet replacement cycles. Industrial participation remains concentrated, with domestic shipbuilders executing long-term defense contracts. Technology intensity continues increasing, especially in propulsion, stealth, and combat system integration. Procurement cycles remain lengthy but predictable, supporting long-term planning stability.

The market is primarily concentrated around major naval infrastructure zones with established shipbuilding and defense manufacturing ecosystems. Coastal industrial clusters dominate due to proximity to naval bases, testing facilities, and logistics infrastructure. Strong policy backing supports indigenous production and technology sovereignty. High technical entry barriers reinforce supplier consolidation. Demand is driven by maritime security priorities, regional deterrence needs, and interoperability requirements. Long-term defense planning ensures continuity of submarine development and sustainment activities.

Market Segmentation

By Fleet Type

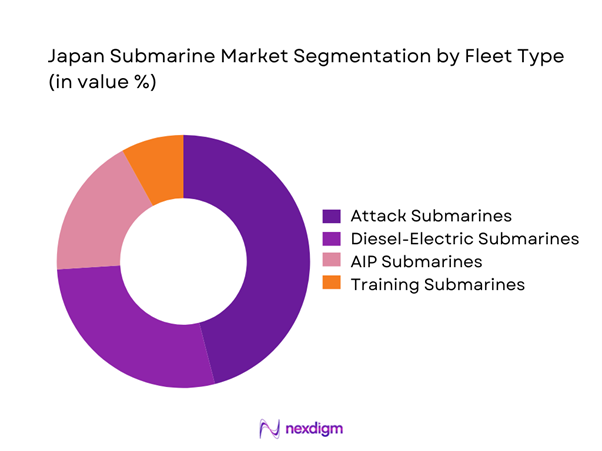

The fleet type segmentation is dominated by conventional and advanced diesel-electric submarines optimized for coastal defense and extended patrol operations. Modernization programs emphasize quiet operation, endurance, and sensor integration, strengthening the dominance of attack-class submarines. Air-independent propulsion platforms are increasingly prioritized due to endurance benefits. Training and experimental platforms maintain smaller shares but support operational readiness. Fleet composition reflects a balance between deterrence, surveillance, and defensive posturing. Procurement decisions emphasize lifecycle reliability and technological maturity.

By Technology Architecture

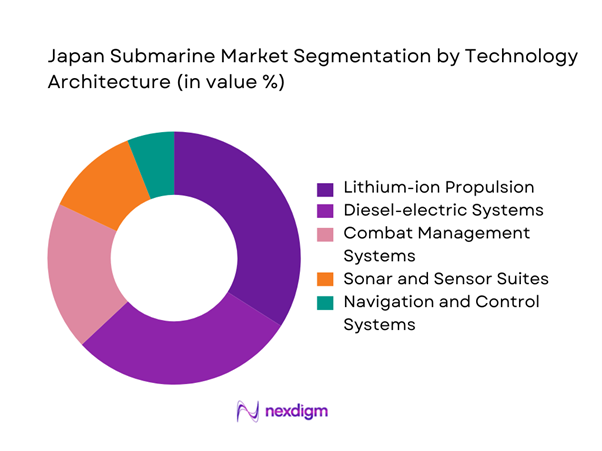

Technology architecture segmentation is led by lithium-ion and advanced battery systems, reflecting a shift toward higher endurance and reduced acoustic signatures. Conventional diesel systems remain relevant due to proven reliability. Combat management systems and integrated sonar architectures account for significant value share due to upgrade cycles. Automation and digital navigation technologies continue gaining importance. Platform integration complexity increases technological differentiation. Architecture selection is strongly influenced by mission requirements and interoperability standards.

Competitive Landscape

The competitive landscape is moderately consolidated, with domestic shipbuilders holding dominant positions supported by long-term defense relationships. Competition is primarily technology-driven, focusing on propulsion efficiency, stealth capabilities, and lifecycle support. Foreign suppliers participate mainly through subsystem collaboration rather than platform manufacturing. Strategic partnerships and government-backed programs shape competitive positioning. Entry barriers remain high due to regulatory oversight and capital intensity.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Mitsubishi Heavy Industries | 1884 | Japan | ~ | ~ | ~ | ~ | ~ | ~ |

| Kawasaki Heavy Industries | 1896 | Japan | ~ | ~ | ~ | ~ | ~ | ~ |

| Japan Marine United | 2013 | Japan | ~ | ~ | ~ | ~ | ~ | ~ |

| ThyssenKrupp Marine Systems | 1999 | Germany | ~ | ~ | ~ | ~ | ~ | ~ |

| Naval Group | 1626 | France | ~ | ~ | ~ | ~ | ~ | ~ |

Japan Submarine Market Analysis

Growth Drivers

Rising maritime security threats in the Indo-Pacific

Regional security tensions continue increasing demand for advanced underwater deterrence and maritime domain awareness capabilities. Submarine deployments are expanding due to strategic chokepoint monitoring and extended patrol requirements. Increased naval exercises reinforce the need for technologically superior platforms. Governments prioritize underwater superiority for defensive resilience. Investment allocation reflects heightened focus on undersea warfare readiness. Strategic doctrines emphasize submarine fleet strength as a core naval asset. Continuous fleet modernization supports sustained procurement activity. Indigenous manufacturing ensures supply security and technological sovereignty. Operational reliability remains a top acquisition priority. Long-term defense planning sustains market stability.

Modernization of Japan Maritime Self-Defense Force fleet

Fleet renewal programs are accelerating replacement of aging submarines with advanced platforms. Modern vessels emphasize enhanced endurance, stealth, and sensor fusion capabilities. Procurement cycles align with long-term naval modernization roadmaps. Integration of digital systems improves mission effectiveness and survivability. Upgrades address evolving underwater warfare threats and operational doctrines. Government commitment ensures continuity of funding pipelines. Domestic shipyards benefit from consistent order visibility. Technology transfer programs enhance indigenous design capabilities. Platform standardization improves maintenance efficiency. Modernization remains a primary driver of market expansion.

Challenges

High capital and lifecycle costs

Submarine development involves extensive capital commitment across design, testing, and deployment phases. Lifecycle costs remain significant due to maintenance and upgrade requirements. Budget constraints limit procurement flexibility despite strategic necessity. Cost overruns pose challenges during advanced technology integration. Long development timelines increase financial exposure. Limited economies of scale affect cost efficiency. Specialized materials and components raise procurement complexity. Skilled labor shortages further elevate operational expenses. Sustaining readiness requires continuous investment. Financial planning remains a persistent challenge for stakeholders.

Lengthy development and procurement cycles

Submarine programs involve multi-year design and validation phases. Regulatory approvals extend timelines significantly. Testing requirements delay operational deployment. Technological complexity increases integration risks. Delayed procurement impacts fleet availability planning. Contractual rigidity limits rapid adaptation. Supply chain dependencies create scheduling vulnerabilities. Program adjustments often require extended review processes. Innovation adoption remains slower compared to surface platforms. Extended cycles reduce responsiveness to emerging threats.

Opportunities

Next-generation submarine development programs

Advanced submarine programs offer opportunities for technological leadership and capability enhancement. Emphasis on stealth and endurance creates demand for innovation. Digitalization enables smarter platform management systems. Indigenous design initiatives strengthen domestic industrial bases. Export collaboration potential increases through co-development programs. Advanced materials improve performance and lifecycle efficiency. Modular architectures enable flexible upgrades. Research investments support next-generation propulsion solutions. Long-term programs ensure sustained industrial activity. Strategic alignment enhances international cooperation opportunities.

Advanced sonar and combat system upgrades

Modern sonar technologies improve detection and situational awareness capabilities. Combat system upgrades enhance real-time decision support. Integration of artificial intelligence optimizes threat identification. Upgraded systems extend platform operational relevance. Retrofit opportunities generate sustained revenue streams. Digital architectures improve interoperability across naval assets. Sensor fusion increases mission success rates. Continuous upgrades reduce obsolescence risks. Technology refresh cycles stimulate supplier engagement. Innovation adoption strengthens operational superiority.

Future Outlook

The Japan Submarine Market is expected to maintain stable growth supported by long-term naval modernization strategies. Continued focus on technological self-reliance will shape procurement priorities. Integration of advanced propulsion and combat systems will dominate development programs. Regional security dynamics will sustain demand. Policy continuity ensures predictable investment patterns through the forecast period.

Major Players

- Mitsubishi Heavy Industries

- Kawasaki Heavy Industries

- Japan Marine United

- ThyssenKrupp Marine Systems

- Naval Group

- Saab Kockums

- BAE Systems

- General Dynamics Electric Boat

- Huntington Ingalls Industries

- Fincantieri

- Navantia

- Hanwha Ocean

- Hyundai Heavy Industries

- Rubin Design Bureau

- Damen Shipyards

Key Target Audience

- Japan Maritime Self-Defense Force

- Ministry of Defense Japan

- Acquisition, Technology and Logistics Agency

- Naval shipbuilding companies

- Defense electronics manufacturers

- Maritime security agencies

- Investments and venture capital firms

- Government and regulatory bodies including MOD Japan

Research Methodology

Step 1: Identification of Key Variables

Market scope, platform classifications, technology adoption levels, and procurement structures were identified. Key operational and industrial parameters were defined. Demand and supply interactions were mapped. Policy and regulatory influences were assessed.

Step 2: Market Analysis and Construction

Historical procurement trends and platform deployments were evaluated. Segmentation logic was applied based on fleet composition and technology architecture. Qualitative and quantitative indicators were aligned. Market structure was constructed using defense planning data.

Step 3: Hypothesis Validation and Expert Consultation

Assumptions were validated through expert discussions and industry consultations. Technical feasibility and procurement feasibility were assessed. Market behavior assumptions were tested. Risk factors were refined through expert input.

Step 4: Research Synthesis and Final Output

All findings were consolidated into structured insights. Cross-validation ensured consistency across sections. Strategic interpretations were aligned with defense planning trends. Final outputs were reviewed for analytical coherence.

- Executive Summary

- Research Methodology (Market Definitions and scope alignment for Japan’s submarine domain, Platform and fleet segmentation framework specific to naval assets, Bottom-up market sizing using shipyard output and defense budgets, Revenue attribution by program lifecycle and contract value, Primary interviews with naval procurement officials and shipbuilders, Triangulation using defense spending data and fleet deployment records, Assumptions based on classified program disclosures and delivery timelines)

- Definition and scope

- Market evolution and modernization cycles

- Operational role in maritime defense strategy

- Ecosystem structure and key stakeholders

- Supply chain and industrial base structure

- Regulatory and defense procurement environment

- Growth Drivers

Rising maritime security threats in the Indo-Pacific

Modernization of Japan Maritime Self-Defense Force fleet

Shift toward lithium-ion propulsion systems

Increased defense budget allocation

Emphasis on stealth and endurance capabilities - Challenges

High capital and lifecycle costs

Lengthy development and procurement cycles

Technological complexity and integration risks

Export restrictions and regulatory limitations

Skilled workforce constraints - Opportunities

Next-generation submarine development programs

Indigenous component manufacturing expansion

Advanced sonar and combat system upgrades

International defense collaboration opportunities

Lifecycle maintenance and retrofit services - Trends

Adoption of lithium-ion battery propulsion

Digitalization of combat management systems

Enhanced stealth and acoustic reduction designs

Automation and reduced crew size concepts

Increased focus on undersea domain awareness - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Volume, 2020–2025

- By Installed Base, 2020–2025

- By Average Selling Price, 2020–2025

- By Fleet Type (in Value %)

Attack submarines

Conventional diesel-electric submarines

Air-independent propulsion submarines

Training and experimental submarines - By Application (in Value %)

Maritime defense and deterrence

Intelligence, surveillance, and reconnaissance

Anti-submarine warfare

Sea lane protection

Training and evaluation - By Technology Architecture (in Value %)

Diesel-electric propulsion

AIP systems

Lithium-ion battery-based propulsion

Combat management systems

Sonar and sensor integration - By End-Use Industry (in Value %)

Naval defense forces

Defense research and testing agencies

Maritime security agencies - By Connectivity Type (in Value %)

Satellite communication systems

Underwater acoustic communication

Line-of-sight and periscope-based communication

Integrated combat network systems - By Region (in Value %)

Kanto region

Kansai region

Chugoku region

Kyushu region

Other naval bases

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (Fleet size, Technology capability, Contract value, Domestic manufacturing share, R&D intensity, Delivery timelines, Lifecycle support capability, Export involvement)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

Mitsubishi Heavy Industries

Kawasaki Heavy Industries

Japan Marine United

Sumitomo Heavy Industries

ThyssenKrupp Marine Systems

Naval Group

Saab Kockums

BAE Systems

General Dynamics Electric Boat

Huntington Ingalls Industries

Fincantieri

Navantia

Hanwha Ocean

Hyundai Heavy Industries

Rubin Design Bureau

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2026–2035

- By Volume, 2026–2035

- By Installed Base, 2026–2035

- By Average Selling Price, 2026–2035