Market Overview

As of 2024, the Japan ultrasound machines market is valued at USD 479.4 million, with a growing CAGR of 5.5% from 2024 to 2030, driven by technological advancements in imaging modalities and the rising prevalence of chronic diseases that necessitate diagnostic imaging. The market experiences robust demand from healthcare providers looking for efficient, non-invasive diagnostic tools. Factors like an aging population and increased healthcare spending are fueling market expansion, positioning ultrasound machines as essential in medical diagnostics according to industry reports and forecasts.

The dominant regions within the Japan ultrasound machines market include Tokyo, Osaka, and Yokohama. These cities host significant healthcare infrastructure, including leading hospitals and research institutes, which contribute to technological innovations and patient care advancements. Additionally, these urban centres are characterized by high population density, resulting in greater demand for diagnostic services. Their strategic emphasis on healthcare technology development further strengthens Japan’s leadership in the ultrasound machines market, underpinned by robust R&D initiatives.

Market Segmentation

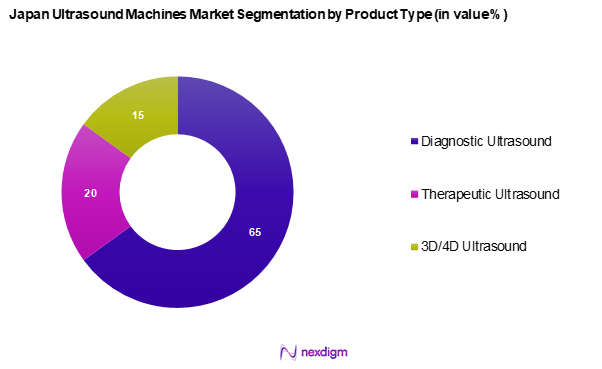

By Product Type:

The Japan ultrasound machines market is segmented into diagnostic ultrasound, therapeutic ultrasound, and 3D/4D ultrasound. Currently, diagnostic ultrasound holds a substantial market share owing to its widespread application in various medical fields, including obstetrics, gynecology and cardiology. The demand for diagnostic ultrasound is driven by its ability to provide real-time imaging, facilitating accurate diagnoses and monitoring of patients. Brands like Philips and GE have established a stronghold in this segment by continuously innovating and improving imaging technologies, making diagnostic ultrasound an integral part of modern medical practice.

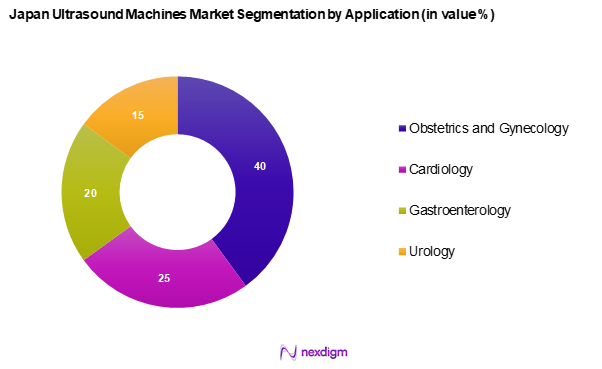

By Application

The Japan ultrasound machines market segmented into obstetrics and gynecology, cardiology, gastroenterology, and urology. The obstetrics and gynecology segment dominates the market due to the increasing birth rates and heightened focus on prenatal care. The use of ultrasound machines in detecting fetal anomalies and monitoring pregnancy has boosted its demand significantly. The preference for non-invasive imaging techniques in this field makes it a vital component of regular healthcare protocols, establishing obstetrics and gynecology as a critical application area for ultrasound technology.

Competitive Landscape

The Japan ultrasound machines market is characterized by the presence of several key players, including global giants like Philips Healthcare, GE Healthcare, and Siemens Healthineers. This consolidation emphasizes the significant influence of these companies, as they continuously innovate and expand their product offerings to meet the dynamic needs of healthcare providers.

| Company | Establishment Year | Headquarters | Market Position | Revenue

(USD Mn) |

Market

Share |

Weaknesses |

| Koninklijke Philips N.V. | 1891 | Amsterdam, Netherlands | – | – | – | – |

| GE HealthCare | 1892 | Chicago, USA | – | – | – | – |

| Siemens Healthineers AG | 1847 | Erlangen, Germany | – | – | – | – |

| CANON MEDICAL SYSTEMS CORPORATION | 1933 | Tokyo, Japan | – | – | – | – |

| Hitachi High-Tech Corporation | 1949 | Tokyo, Japan | – | – | – | – |

Japan Ultrasound Machines Market Analysis

Growth Drivers

Rise in Chronic Diseases

The increase in cases of chronic diseases significantly drives the Japan ultrasound machines market. According to the World Health Organization, Non-Communicable Diseases (NCDs) such as cardiovascular diseases and diabetes accounted for 80% of all deaths in Japan in 2022. Furthermore, the prevalence of diabetes among adults aged 20 years and older reached 11 million, reflecting a substantial healthcare challenge. As a result, healthcare providers are turning to advanced diagnostic tools like ultrasound machines, which are cost-effective and provide real-time imaging necessary for monitoring chronic conditions. This trend is set to continue as Japan’s investment in healthcare seeks to address the growing burden of NCDs.

Increasing Geriatric Population

With the proportion of older adults expected to rise sharply, Japan’s geriatric population is projected to reach 35% of the total population by 2025, as per the Ministry of Health, Labour and Welfare. The rise in this demographic correlates with higher incidences of age-related diseases, driving demand for diagnostic imaging services, particularly ultrasound machines. In 2022, approximately 24% of Japan’s population was over 65 years old, necessitating accessible healthcare solutions. This demographic shift emphasizes the crucial role of ultrasound technology in early diagnosis and ongoing management of health conditions prevalent among seniors.

Market Challenges

High Equipment Costs

The increasing costs of ultrasound equipment pose a significant challenge to market growth. In 2023, the average price of high-end ultrasound machines was reported at approximately USD 70,000 per unit, creating budget constraints for smaller healthcare facilities. Furthermore, rising raw material costs, driven by supply chain disruptions due to the COVID-19 pandemic, impact the pricing of ultrasound devices. These factors result in a slower adoption rate among healthcare providers, particularly in rural areas where budget limitations are more pronounced. Efforts are being made to offer leasing options, but the upfront investment remains a hurdle for many.

Technical Complexity

The technical complexity associated with operating advanced ultrasound machines can restrict their adoption in certain healthcare settings. Training required for medical personnel to efficiently use sophisticated imaging technologies often involves substantial time and financial investment. According to the Japan Society of Ultrasonics in Medicine, approximately 40% of medical professionals felt inadequately trained to operate high-tech ultrasound equipment effectively in 2022. This skill gap can lead to underutilization of the devices and may deter hospitals from investing in new technology, even as demand for imaging services continues to rise.

Opportunities

Advancement in Imaging Technology

Current advancements in imaging technology present significant growth opportunities for the ultrasound machines market in Japan. The shift towards portable and point-of-care ultrasound systems has made diagnostic imaging more accessible to a diverse range of healthcare settings. In 2022, approximately 30% of ultrasound devices sold were handheld or portable units, driven by their convenience and decreasing cost of technology. Innovations such as 3D and 4D imaging have also enhanced diagnostic capabilities, facilitating earlier detection of medical conditions. As hospitals continue to embrace these new technologies, they will likely witness improvements in patient outcomes and operational efficiencies.

Expansion of Healthcare Infrastructure

Japan’s ongoing investment in healthcare infrastructure provides a robust opportunity for ultrasound market growth. The government allocated around USD 30 billion for healthcare improvements in its 2023 budget, focusing on enhancing diagnostic imaging and medical equipment access across the country. This funding aims to modernize rural healthcare facilities that have historically lagged in technology adoption. The expansion projects are expected to increase the demand for ultrasound machines, as equipped facilities can provide better diagnostic services to their local populations. This infrastructure support aligns with Japan’s commitment to improving healthcare services for its citizens.

Future Outlook

Over the next five years, the Japan ultrasound machines market is expected to witness significant growth driven by continuous advancements in ultrasound technology, increasing government healthcare funding, and a growing aging population that demands more healthcare services. With the increasing adoption of portable and point-of-care ultrasound applications, the market is well-positioned for innovation and expansion. The integration of artificial intelligence and machine learning capabilities in ultrasound devices is anticipated to further propel market growth, enhancing diagnostic accuracy and efficiency.

Major Players

- Koninklijke Philips N.V.

- GE HealthCare

- Siemens Healthineers AG

- CANON MEDICAL SYSTEMS CORPORATION

- FUJIFILM Corporation

- Hitachi High-Tech Corporation

- Samsung Medison Co., Ltd.

- Mindray Medical India Pvt. Ltd.

- Agfa-Gevaert Group.

- Alpinion Medical Systems

- Esaote SPA

- CHISON Medical Technologies Co., Ltd.

- SonoScape Medical Corp.

- Delphinus Medical Technologies, Inc.

Key Target Audience

- Healthcare Providers

- Hospitals and Diagnostic Centres

- Medical

- Imaging Equipment Distributors

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (e.g., Ministry of Health, Labour and Welfare)

- Medical Device Manufacturers

- Research and Development Institutions

- Healthcare Technology Innovators

Research Methodology

Step 1: Identification of Key Variables

In the initial phase, a comprehensive ecosystem map is constructed encompassing all major stakeholders within the Japan ultrasound machines market. This involves extensive desk research, utilizing secondary sources, proprietary databases, and industry reports to gather comprehensive information. The objective is to identify and define critical variables that drive market dynamics, technical advancements, and consumer behaviour.

Step 2: Market Analysis and Construction

This phase compiles and analyses historical data relevant to the market. It includes assessing regional market penetration, the ratio of ultrasound units to healthcare providers, and resultant revenue generation. Additionally, an analysis of service quality metrics will be conducted to ensure the accuracy of the revenue estimates as well as the reliability of findings.

Step 3: Hypothesis Validation and Expert Consultation

Developed market hypotheses are validated through structured consultations with industry experts, including professionals from health organizations, manufacturers, and technology providers. These consultations provide valuable insights from operational and financial perspectives, which are crucial for refining and corroborating market data.

Step 4: Research Synthesis and Final Output

In the final phase, engaged discussions with ultrasound machine manufacturers yield detailed insights regarding product portfolios, sales performance across various applications, and consumer preferences. This interaction serves to verify and complement statistics derived from the bottom-up approach, ensuring a comprehensive, accurate, and validated analysis of the Japan Ultrasound Machines market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Overview Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain & Value Chain Analysis

- Growth Drivers

Rise in Chronic Diseases

Increasing Geriatric Population - Market Challenges

High Equipment Costs

Technical Complexity - Opportunities

Advancement in Imaging Technology

Expansion of Healthcare Infrastructure - Trends

Move Towards Point of Care Testing

Integration of AI in Ultrasound Machines - Government Regulation

Medical Device Regulations

Reimbursement Policies - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces Analysis

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Type of Ultrasound Machine (In Value %)

Diagnostic Ultrasound

Therapeutic Ultrasound

– High-intensity Focused Ultrasound

– Extracorporeal Shockwave Lithotripsy

3D/4D Ultrasound - By Application (In Value %)

Obstetrics and Gynecology

Cardiology

Gastroenterology

Urology - By End-User (In Value %)

Hospitals

Clinics

Diagnostic Imaging Centers - By Region (In Value %)

Kanto

Kansai

Chubu

Kyushu - By Technology (In Value %)

Portable Ultrasound

Trolley-Based Ultrasound

- Market Share of Major Players by Value/Volume, 2024

Market Share of Major Players by Type of Ultrasound Machine Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strengths, Weaknesses, Organizational Structure, Revenue Breakdown, Market Presence)

- SWOT Analysis of Major Players

- Pricing Analysis Based on SKUs for Major Players

- Detailed Profiles of Major Companies

Koninklijke Philips N.V.

GE HealthCare

Siemens Healthineers AG

CANON MEDICAL SYSTEMS CORPORATION

FUJIFILM Corporation

Hitachi High-Tech Corporation

Samsung Medison Co., Ltd.

Mindray Medical India Pvt. Ltd.

Agfa-Gevaert Group.

Alpinion Medical Systems

Esaote SPA

CHISON Medical Technologies Co., Ltd.

SonoScape Medical Corp.

Delphinus Medical Technologies, Inc.

- Market Demand and Utilization Patterns

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision-Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030