Market Overview

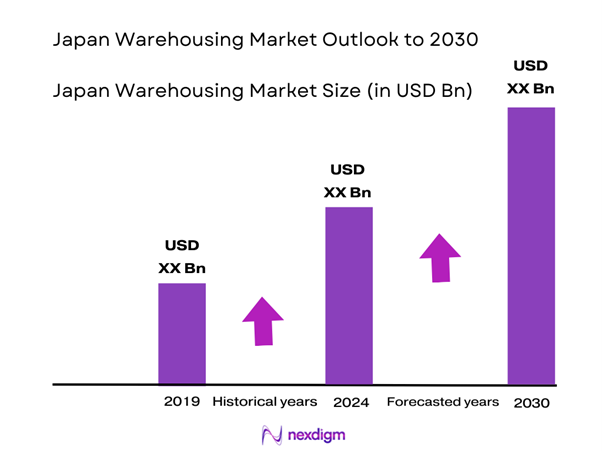

The Japan Warehousing Market is valued at approximately USD 46.4 billion in 2024 with an approximated compound annual growth rate (CAGR) of 8.5% from 2024-2030, reflecting robust growth driven by the increasing demand for logistics and storage solutions across various sectors such as e-commerce, food and beverage, electronics, and pharmaceuticals. The dynamic expansion of the e-commerce sector, accelerated by the rise of online shopping, has significantly contributed to the market’s growth.

Tokyo, Osaka, and Yokohama are the dominant cities driving the Japan Warehousing Market. These metropolitan areas serve as crucial logistics hubs due to their advanced infrastructure, strategic geographical locations, and high population density. The concentration of businesses and consumers in these areas fosters a continuous demand for warehousing services. Moreover, Tokyo, being Japan’s capital, attracts numerous multinational corporations and domestic firms, further solidifying its position as the primary hub for warehousing activities in the country.

The growth of e-commerce in Japan is a significant driver for the warehousing market. As of 2022, Japan’s e-commerce sales amounted to approximately USD 122 billion, with projections suggesting that the figure will reach USD 141 billion in 2023. This surge mandates better warehousing infrastructure to manage increased product volumes and ensure rapid distribution. The rise of platforms like Rakuten and Amazon Japan necessitates the expansion of warehousing capabilities, facilitating quicker delivery times and enhancing customer satisfaction.

Market Segmentation

By Type

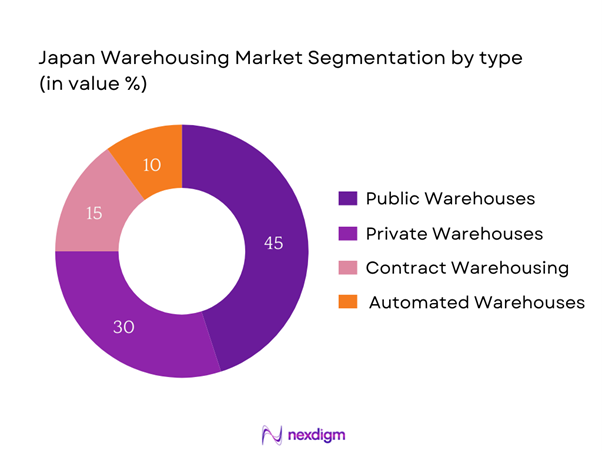

The Japan Warehousing Market is segmented by type into public warehousing, private warehousing, contract warehousing, and automated warehousing. Among these, public warehousing currently holds the dominant market share due to its flexibility and cost-effectiveness. Businesses, especially small and medium-sized enterprises (SMEs), prefer public warehousing as it allows them to utilize storage space without the commitment of long-term leases or ownership. The ability to scale operations and efficiently manage inventory without heavy capital investments has made public warehousing an attractive option.

By Industry

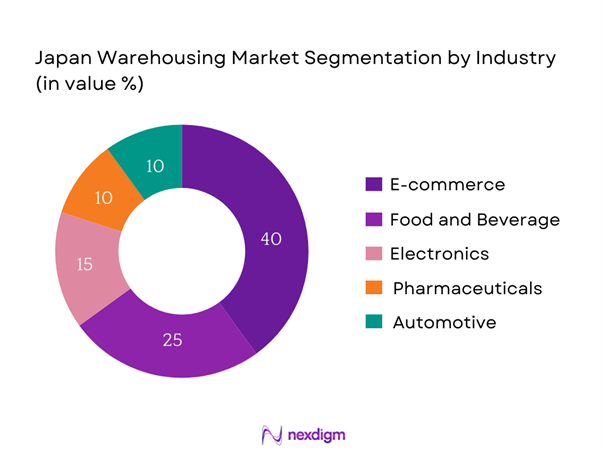

The market is also segmented by industry, encompassing e-commerce, food and beverage, electronics, pharmaceuticals, and automotive sectors. The e-commerce segment dominates the Japan Warehousing Market, primarily due to the exponential growth of online shopping platforms. The shift in consumer behavior towards purchasing goods over the Internet has necessitated the establishment of efficient warehousing solutions to facilitate prompt order fulfillment and distribution. Companies within this segment have heavily invested in logistics and supply chain enhancements to meet the rising demand.

Competitive Landscape

The Japan Warehousing Market is characterized by a competitive landscape dominated by key players such as Nippon Express, SG Holdings, and Yamato Holdings. These companies have established a significant presence in the market through their extensive networks and services. The consolidation of logistics services among major players has heightened competition, encouraging continuous innovation and improvements in operational efficiency.

| Company | Establishment Year | Headquarters | Market Share (%) | Service Type | Geographic Reach | Partnerships |

| Nippon Express | 1907 | Tokyo | – | – | – | – |

| SG Holdings | 2006 | Osaka | – | – | – | – |

| Yamato Holdings | 1919 | Tokyo | – | – | – | – |

| Kintetsu World Express | 1948 | Osaka | – | – | – | – |

| Seino Holdings | 1946 | Gifu | – | – | – | – |

Japan Warehousing Market Analysis

Growth Drivers

Technological Advancements

Technological advancements are revolutionizing the Japan Warehousing Market, particularly through the use of automation and data analytics. In 2023, the adoption of warehouse management systems (WMS) and robotics led to increased operational efficiency, reducing error rates by up to 30%. This transformation is bolstered by Japan’s significant investment in technology, with spending on industrial robots estimated to reach USD 6.5 billion by end of 2025, according to the International Federation of Robotics. Such advancements enhance inventory management, minimize labor costs, and optimize space utilization, thereby driving overall market growth.

Urbanization Trends

Japan’s urban population is projected to increase to 113 million by end of 2025, resulting in heightened demand for warehousing solutions. This trend is predominantly observed in metropolitan areas like Tokyo and Osaka, where over 80% of the country’s GDP is generated. Rapid urbanization intensifies logistic challenges, as companies seek strategic locations for warehousing to cater to dense customer bases. Urban areas experience significant supply chain complexities, making efficient warehousing essential for meeting local demand, thus propelling market expansion.

Market Challenges

Labor Shortages

Japan faces considerable labor shortages, primarily due to its aging population. By end of 2025, the working-age population is expected to decline by nearly 2 million, exacerbating the pressure on logistics companies to find sufficient labor to operate warehouses effectively. Additionally, the unemployment rate stood at just 2.6% in early 2024, indicating that the labor market is tight. This shortage compels companies to explore automation and technology solutions to maintain efficiency in warehousing operations.

Rising Real Estate Costs

Real estate costs in metropolitan regions of Japan have surged, with Tokyo’s commercial property prices seeing a 15% increase since 2022. The rising demand for warehousing space in urban areas leads to significant financial pressures on logistics companies, which must adapt to ensure sustainable operations. A report from CBRE indicates that prime logistics property rental rates in Tokyo reached approximately USD 450 per square meter in 2023. These rising costs affect profitability and operational viability within the warehousing sector.

Opportunities

Adoption of IoT Technologies

The adoption of Internet of Things (IoT) technologies within warehouses reveals significant opportunities for operational optimization and growth in the Japan Warehousing Market. As of 2023, approximately 45% of logistics companies have implemented IoT solutions to enhance inventory tracking, reduce waste, and optimize space utilization. The expected increase in IoT sensor deployment, which is projected to exceed 20 million devices by end of 2025, indicates a growing emphasis on smart warehousing solutions. This trend can enhance efficiency and responsiveness in supply chain management, providing a competitive edge.

Sustainability Initiatives

The demand for sustainability initiatives in warehousing is creating new market opportunities in Japan. Companies are increasingly focusing on reducing their carbon footprint and optimizing logistics operations. For instance, as of 2023, around 60% of major logistics firms have begun integrating green logistics practices, such as energy-efficient transportation and eco-friendly warehouse solutions. The estimated savings from adopting sustainable practices are expected to exceed USD 3 billion annually across the logistics sector, which would further drive investments in sustainable warehousing technologies and practices.

Future Outlook

Over the next five years, the Japan Warehousing Market is expected to witness significant growth fueled by the surge in e-commerce activities, advancements in warehousing technologies, and increasing demands for efficient logistics solutions. As companies continue to optimize their supply chains, investments in automation and smart warehousing will enhance productivity and effectiveness. Additionally, sustainability practices are expected to shape the future of warehousing, as businesses adopt greener solutions to meet environmental regulations.

Major Players

- Nippon Express

- SG Holdings

- Yamato Holdings

- Kintetsu World Express

- Seino Holdings

- Hitachi Transport System

- Daifuku Co.

- Sagawa Express

- Konoike Transport

- Saito Kogyo

- Asahi Logitrans

- Japan Logistics Systems

- Mitsui-Soko Holdings

- Marubeni Logistics

- Nittsu

Key Target Audience

- Logistics and supply chain management companies

- E-commerce retail platforms

- Manufacturing firms

- Distributors and wholesalers

- Investments and venture capitalist firms

- Government and regulatory bodies (Ministry of Land, Infrastructure, Transport and Tourism)

- Real estate developers and property investors

- Technology providers specializing in warehouse automation

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map covering all major stakeholders within the Japan Warehousing Market. This step relies on extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, historical data pertaining to the Japan Warehousing Market will be compiled and analyzed. This includes assessing market penetration, the ratio of marketplaces to service providers, and resulting revenue generation. Furthermore, we will evaluate service quality statistics to ensure the reliability and accuracy of revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and validated through computer-assisted telephone interviews (CATI) with industry experts representing diverse companies. These consultations will provide valuable operational and financial insights directly from industry practitioners, which are instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with major warehousing and logistics companies to acquire detailed insights into product segments, sales performance, customer preferences, and other pertinent factors. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the Japan Warehousing Market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Historical Evolution of the Market

- Major Industry Milestones and Players

- Business Cycle Analysis

- Comprehensive Supply Chain and Value Chain Analysis

- Growth Drivers

Technological Advancements

Urbanization Trends

Growth of E-commerce - Market Challenges

Labor Shortages

Rising Real Estate Costs

Regulatory Compliance - Opportunities

Adoption of IoT Technologies

Sustainability Initiatives - Trends

Automation of Warehouses

Collaborative Logistics - Government Policies and Regulations

- SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces Analysis

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Type (In Value %)

Public Warehousing

– Shared Warehousing Space

– Short-Term Rental Warehouses

– Pay-per-Use Facilities

Private Warehousing

– Company-Owned Facilities

– In-House Supply Chain Hubs

– Dedicated Storage Centers

Contract Warehousing

– Long-Term Logistics Contracts

– Third-Party Operated Facilities

– Customized Storage Solutions

Automated Warehousing

– Robotics-Based Picking Systems

– Automated Storage & Retrieval Systems (AS/RS)

– IoT-Enabled Smart Warehouses - By Industry (In Value %)

E-commerce

– Fulfillment Centers

– Last-Mile Hub Storage

– Returns Management Warehousing

Food and Beverage

– Cold Chain Storage

– Bulk Food Storage

– Beverage Inventory Warehousing

Electronics

– High-Security Warehousing

– Static-Control Storage Zones

– Assembly-Ready Inventory Centers

Pharmaceuticals

– Temperature-Controlled Storage

– Compliance-Certified Warehousing

– Sensitive Material Handling

Automotive

– OEM Parts Warehousing

– Just-in-Time Inventory Centers

– Aftermarket Parts Warehousing - By Region (In Value %)

Tokyo

Osaka

Nagoya

Yokohama

Sapporo - By Storage Type (In Value %)

Cold Storage

– Frozen Goods Storage

– Chilled Perishables Handling

– Temperature Monitoring Systems

Hazardous Material Storage

– Chemical-Grade Safety Facilities

– Fire-Resistant Zones

– Secure Ventilation Systems

General Storage

– Ambient Temperature Facilities

– Palletized Goods

– Bulk Storage Areas - By Service Type (In Value %)

Inventory Management

– Real-Time Stock Monitoring

– SKU-Level Tracking

– Demand Forecasting Integration

Packaging

– Kitting & Assembly

– Labeling and Repackaging

– Protective Packing for Fragile Items

Distribution

– Regional Dispatch Services

– Last-Mile Coordination

– Reverse Logistics Handling

- Market Share of Major Players by Value and Volume, 2024

- Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strengths, Weaknesses, Organizational Structure, Revenues, Number of Facilities, Distribution Network, Key Partnerships, Service Capabilities)

- SWOT Analysis of Major Players

- Pricing Analysis for Major Service Providers

- Detailed Profiles of Major Companies

Nippon Express

Yamato Holdings

SG Holdings

Hitachi Transport System

Kintetsu World Express

Daifuku Co.

Mitsui-Soko Holdings

Japan Logistics Systems

Seino Holdings

Marubeni

Sagawa Express

Konoike Transport

Saito Kogyo

Asahi Logitrans

SCSK Corporation

- Market Demand and Utilization Trends

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision-Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030