Market Overview

The Kenya Africa Aircraft Seating market is valued at USD ~million in 2024. This growth is largely driven by the increasing demand for air travel in Africa, especially in Kenya, which is considered a regional aviation hub. As of 2024, Kenya’s aviation sector has seen consistent growth with the expansion of both domestic and international flight routes, supported by government initiatives to modernize infrastructure. With Kenya’s growing tourism industry and its role as a key player in Africa’s aviation network, demand for advanced aircraft seating solutions is expected to continue increasing.

Kenya is the dominant market for aircraft seating in East Africa due to its strategic position as a regional transport and tourism hub. Nairobi, with its major international airport, Jomo Kenyatta International Airport, serves as a critical gateway to both East Africa and the global market. The country’s aviation sector benefits from strong governmental support for infrastructure development, including modernizing airports and expanding regional connectivity. Additionally, Kenya’s growing economy and increasing middle class are contributing to a steady rise in air travel, further driving the demand for aircraft seating solutions.

Market Segmentation

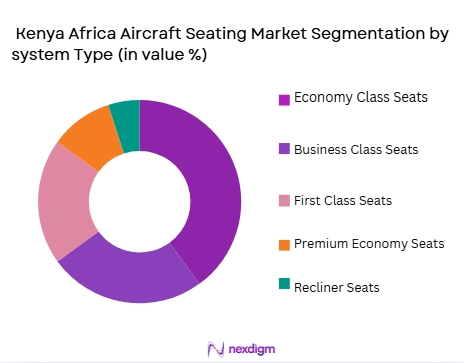

By System Type

The Kenya Aircraft Seating market is segmented by system type into economy class seats, business class seats, first class seats, premium economy seats, and recliner seats. Economy class seats dominate the market due to the widespread use of commercial airlines for both domestic and international flights. The economy class seat segment benefits from the high volume of budget travelers and the large number of low-cost carriers operating in Kenya and the broader African region. As a result, airlines focus on offering cost-effective seating solutions that maximize capacity and ensure comfort.

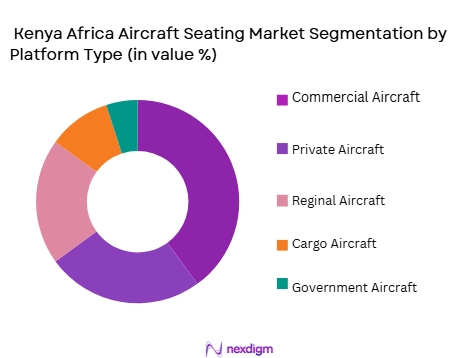

By Platform Type

The market is also segmented by platform type into commercial aircraft, private aircraft, regional aircraft, cargo aircraft, and government aircraft. Commercial aircraft seats have the largest market share due to the high demand for seats in both regional and international flights. Kenya’s role as a transport hub for East Africa contributes to a significant number of commercial flights arriving and departing, requiring a large volume of seating solutions. The increasing growth in international routes, particularly to Europe and the Middle East, further supports the dominance of this segment.

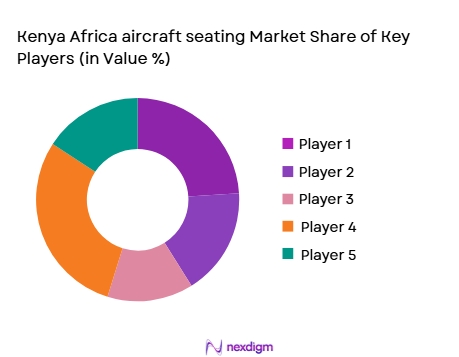

Competitive Landscape

The Kenya Africa Aircraft Seating market is driven by both global and regional players. Major global players like Recaro Aircraft Seating and B/E Aerospace, along with local manufacturers, are vying for a share of the growing market. These key players provide a wide range of seating solutions that are increasingly being adopted by both domestic and international airlines flying into Kenya. The market is characterized by innovation in lightweight and ergonomic designs, with a growing emphasis on eco-friendly materials and cost-efficiency.

Competitive Landscape Table

| Company Name | Establishment Year | Headquarters | Focus Area | Market Segment | Product Innovation | Strategic Initiatives |

| Recaro Aircraft Seating | 1906 | Germany | ~ | ~ | ~ | ~ |

| B/E Aerospace | 1954 | USA | ~ | ~ | ~ | ~ |

| Zodiac Aerospace | 1896 | France | ~ | ~ | ~ | ~ |

| Geven | 1952 | Italy | ~ | ~ | ~ | ~ |

| Aciturri Aeronáutica | 1993 | Spain | ~ | ~ | ~ | ~ |

Kenya Africa Aircraft seating Market Analysis

Growth Drivers

Urbanization

Urbanization is a significant growth driver for the air quality monitoring system market in Indonesia, where urban populations have increased substantially. In 2024, Indonesia’s urban population is projected to reach ~ of its total population, with cities like Jakarta, Surabaya, and Bandung seeing rapid population growth. This leads to higher pollution levels due to increased vehicular emissions, construction, and industrial activities. Consequently, air quality monitoring systems are in greater demand to track and mitigate the environmental impact in urban areas.

Industrialization

Indonesia’s industrial sector contributes nearly ~ to its GDP, with significant growth in manufacturing, mining, and energy production. As industrial activity intensifies, particularly in areas like East Java, emissions from factories and power plants rise, further deteriorating air quality. In 2024, Indonesia’s industrial output is expected to increase, driving further demand for air quality monitoring systems to comply with environmental regulations and ensure sustainability. This increased industrialization in key regions necessitates robust air quality management solutions.

Restraints

High Initial Costs

The high initial cost of installing air quality monitoring systems remains a significant barrier in Indonesia. While technological advancements have reduced some costs, high-quality sensors and advanced data collection systems are still expensive to deploy, particularly in large urban areas or industrial zones. The cost of implementation, including the need for specialized infrastructure, remains a restraint for many industries and government bodies. Despite the long-term benefits, these high initial expenses hinder the rapid expansion of monitoring systems across Indonesia.

Technical Challenges

Indonesia faces technical challenges in the deployment and maintenance of air quality monitoring systems. The country’s diverse climate and geography, including tropical weather and dense urbanization, complicate the implementation of consistent and accurate air quality monitoring networks. Furthermore, inadequate infrastructure in remote areas makes it challenging to deploy systems effectively. These technical limitations affect the reliability and effectiveness of air quality data, which in turn impacts the widespread adoption of air quality monitoring systems in the country.

Opportunities

Technological Advancements

Technological advancements in air quality monitoring systems present a major opportunity for the market in Indonesia. The introduction of IoT-enabled sensors and cloud-based data analytics is making air quality monitoring more affordable, accurate, and scalable. In 2024, Indonesia is seeing a shift toward low-cost, high-efficiency monitoring systems that can be deployed quickly in both urban and rural areas. These advancements open the door to wider adoption of monitoring solutions across different sectors, from government agencies to industrial operations.

International Collaborations

Indonesia has been involved in several international collaborations to improve air quality monitoring. The country’s participation in the United Nations Environment Programme (UNEP) and other global initiatives is expected to boost the adoption of advanced air monitoring technologies. These collaborations bring access to funding, expertise, and advanced systems that can help Indonesia enhance its air quality monitoring infrastructure. In 2024, Indonesia is benefiting from international partnerships, which will continue to expand the market for air quality monitoring systems.

Future Outlook

Over the next decade, the Kenya Aircraft Seating market is expected to grow steadily due to increasing demand for both regional and international air travel. Government investments in infrastructure, particularly the expansion of Jomo Kenyatta International Airport and other regional airports, will further bolster the demand for aircraft seating solutions. Additionally, Kenya’s growing tourism industry and the rising middle class will continue to support the increase in airline capacity and seating upgrades. With the advent of technological advancements in seating comfort and efficiency, Kenya is poised to become a leading market for innovative aircraft seating solutions.

Major Players

- Recaro Aircraft Seating

- B/E Aerospace

- Zodiac Aerospace

- Geven

- Aciturri Aeronáutica

- Thales Group

- Safran

- Panasonic Avionics

- Collins Aerospace

- JAMCO Corporation

- Stelia Aerospace

- HAECO

- Aviointeriors

- Rockwell Collins

- Armstrong Aerospace

Key Target Audience

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies

- Commercial Airlines

- Private Aviation Operators

- Aircraft Seat Manufacturers

- Aviation Infrastructure Development Agencies

- Airlines and Aircraft Operators

- Regional Aviation Associations

Research Methodology

Step 1: Identification of Key Variables

This phase involves constructing an ecosystem map encompassing all relevant stakeholders within the Kenya Africa Aircraft Seating market. Desk research and proprietary databases are utilized to gather comprehensive industry-level information. The key objective is to define the critical variables that impact market dynamics, such as consumer demand for different seat types and airline growth rates.

Step 2: Market Analysis and Construction

The market analysis phase focuses on compiling and analyzing historical data related to the aircraft seating market in Kenya. This involves assessing the ratio of seat types used across different airline segments and evaluating revenue generation from various seating solutions. Historical growth trends in Kenya’s aviation sector are incorporated into this analysis.

Step 3: Hypothesis Validation and Expert Consultation

In this phase, market hypotheses are validated through expert consultations with representatives from airlines, seating manufacturers, and aviation regulatory bodies. These consultations help refine the market data and validate assumptions regarding seat preferences, material innovations, and growth rates.

Step 4: Research Synthesis and Final Output

The final phase involves synthesizing data gathered from primary and secondary research sources. This step includes direct engagement with key manufacturers and airlines to acquire detailed insights into their seating preferences and the performance of different seat types. The data is then analyzed and presented to provide a comprehensive, accurate market report.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing demand for air travel in Africa

Growth in regional and international airline fleets

Advancements in seating comfort and customization options - Market Challenges

High cost of premium seating materials

Limited local manufacturing capabilities

Stringent safety and certification regulations - Market Opportunities

Rising focus on eco-friendly and lightweight materials

Growing low-cost carrier market in Africa

Expansion of regional air connectivity - Trends

Shift towards more ergonomic seating designs

Integration of in-flight entertainment systems with seating

Adoption of lighter, sustainable materials for seat manufacturing

- Government Regulation & Policy Impact

- SWOT Analysis

- Porter’s Five Forces

- By Market Value 2020-2025

- By Installed Units 2020-2025

- By Average System Price 2020-2025

- By System Complexity Tier 2020-2025

- By System Type (In Value%)

Economy Class Seats

Business Class Seats

First Class Seats

Premium Economy Seats

Recliner Seats - By Platform Type (In Value%)

Commercial Aircraft

Private Aircraft

Regional Aircraft

Cargo Aircraft

Government Aircraft - By Fitment Type (In Value%)

Retrofit Seats

Linefit Seats

Modular Seats

Customizable Seats

Standard Seats - By EndUser Segment (In Value%)

Commercial Airlines

Private Operators

Government Agencies

Cargo Airlines

Charter Services - By Procurement Channel (In Value%)

Direct Purchase from Manufacturers

OEMs

Distributors and Resellers

Online Platforms

Second-hand Procurement

- Cross Comparison Parameters (System Type, Platform Type, Procurement Channel, Pricing Strategy, Global Reach, Seat Pitch, Seat Width, Recline & Seat Type, Aircraft type & Layout, Installed Base by Aircraft Type, Seat Configuration Flexibility, Customer Segment Penetration, Average Seat Weight Efficiency

Compliance with Regional Safety Standards)

- SWOT Analysis of Key Competitors

- Key Players

Zodiac Aerospace

Recaro Aircraft Seating

B/E Aerospace

SABIC

Aciturri Aeronáutica

HAECO

Thompson Aero Seating

Geven

Aviointeriors

Panasonic Avionics

Collins Aerospace

Sichuan Haite High-Tech

Faurecia

JAMCO Corporation

Stelia Aerospace

- Expansion of low-cost carriers in the region

- Increased air travel demand due to economic growth

- Rising adoption of business and first-class seating

- Government investments in regional aviation infrastructure

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier ,2026-2035

- Future Demand by Platform ,2026-2035