Market Overview

The Kenya Africa Aviation MRO market is valued at USD ~million in 2023 and continues to expand due to the increasing demand for aviation services across Africa. The growth is primarily driven by the region’s expanding air traffic, with Kenya being a pivotal hub for East African aviation. Additionally, the rising number of aircraft operations and fleet expansion by both commercial airlines and private operators are contributing to the market’s steady growth. The government’s infrastructure initiatives, such as upgrades to Nairobi’s Jomo Kenyatta International Airport, further support market expansion by attracting international airlines to set up base operations in Kenya.

Kenya, particularly Nairobi and Mombasa, dominates the Africa Aviation MRO market. Nairobi, with its strategic location, serves as a gateway to East Africa, positioning it as a regional hub for aviation maintenance, repair, and overhaul services. Mombasa, being a major coastal city, also plays a significant role in servicing both international and domestic fleets. The dominance of Kenya in the market is largely due to the presence of a strong aviation ecosystem, supported by well-established players like Kenya Airways, and substantial government investment aimed at improving aviation infrastructure and local MRO facilities.

Market Segmentation

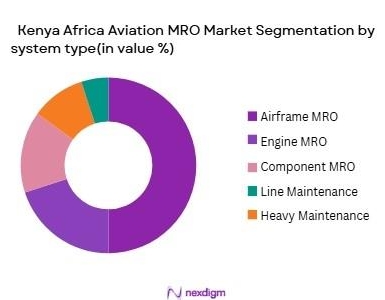

By System Type

The Kenya Africa Aviation MRO market is segmented by system type into airframe MRO, engine MRO, component MRO, line maintenance, and heavy maintenance. Among these, airframe MRO holds the dominant market share, accounting for approximately ~ of the market in 2024. The strong position of this segment can be attributed to the growing fleet of commercial aircraft in Africa and the need for frequent airframe inspections, repairs, and overhauls to ensure safety standards. Airframe MRO services are essential for maintaining aircraft integrity, which makes this segment critical in the region.

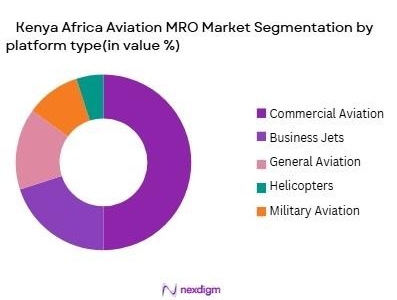

By Platform Type

The market is also segmented by platform type into commercial aviation, business jets, general aviation, helicopters, and military aviation. Commercial aviation holds the largest share of the market, estimated at ~ in 2024. This dominance is due to the growth of major regional airlines operating in East Africa, including Kenya Airways, which requires extensive MRO services. As the demand for air travel continues to rise across the continent, commercial aircraft operators represent the most significant customer base for MRO services in the region.

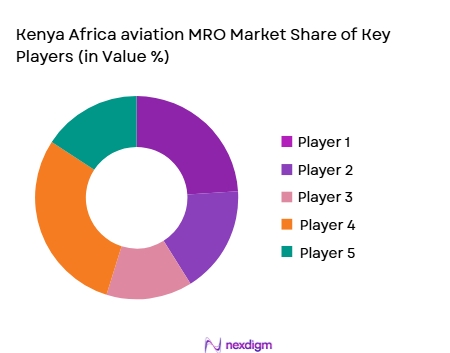

Competitive Landscape

The Kenya Africa Aviation MRO market is dominated by a few major players that include both local and international companies. Key players such as Kenya Airways, Lufthansa Technik, and Ethiopian Airlines provide robust MRO services to both domestic and international carriers. This consolidation of major players highlights the importance of having access to specialized facilities and skilled labor. Kenya Airways, with its long-standing presence in the region, plays a critical role in shaping the competitive dynamics of the MRO market in Kenya.

| Company | Establishment Year | Headquarters | MRO Services | Fleet Size | Service Locations | Key Customers |

| Kenya Airways | 1944 | Nairobi, Kenya | ~ | ~ | ~ | ~ |

| Lufthansa Technik | 1995 | Frankfurt, Germany | ~ | ~ | ~ | ~ |

| Ethiopian Airlines | 1945 | Addis Ababa, Ethiopia | ~ | ~ | ~ | ~ |

| Safran Aircraft Engines | 2005 | Paris, France | ~ | ~ | ~ | ~ |

| Aerotech Aviation | 2000 | Nairobi, Kenya | ~ | ~ | ~ | ~ |

Kenya Africa Aviation MRO Market Analysis

Growth Drivers

Urbanization

Kenya’s urban population is steadily growing, with projections indicating that over ~of the population will be living in urban areas by 2025. This rapid urbanization is leading to an increase in air traffic, both domestically and internationally, thus driving demand for aviation maintenance, repair, and overhaul (MRO) services. Nairobi, Kenya’s capital, serves as the key regional aviation hub, and urban centers are seeing increased air traffic, which in turn fuels the demand for aircraft maintenance. The rise in air travel increases the need for efficient and timely MRO services across the country.

Industrialization

Kenya’s industrial sector contributes significantly to the country’s GDP, with key sectors including manufacturing, construction, and transportation. As of 2024, industrialization in Kenya continues to grow, and the expansion of commercial flights and cargo transport has made it essential to maintain a well-functioning aviation fleet. The growth of industries like logistics and freight forwarding, which depend on air transport, directly contributes to the increasing demand for MRO services. Increased industrial activity results in higher air traffic, further supporting the aviation sector’s need for maintenance and repair services.

Restraints

High Initial Costs

The cost of setting up an air quality monitoring system in Indonesia can be a significant barrier to adoption. Installing a comprehensive air quality monitoring network requires substantial investment in equipment and infrastructure, with an average cost of USD ~to USD ~ per monitoring station. In 2024, many cities in Indonesia still struggle to deploy these systems due to the high upfront costs associated with acquiring and maintaining air quality sensors and data collection technologies. This financial challenge limits the ability of local governments and businesses to implement robust monitoring systems

Technical Challenges

Indonesia faces a number of technical challenges in the implementation and maintenance of air quality monitoring systems. In 2024, a significant portion of the air quality stations, particularly in rural regions, face issues such as inaccurate calibration, data integration, and system reliability. The lack of standardized procedures for data collection, coupled with the lack of a unified system for data analysis, contributes to inefficiencies in air quality monitoring. These technical challenges make it difficult for local authorities to ensure accurate and reliable air quality data across the country.

Lack of Skilled Workforce

Indonesia’s air quality monitoring system faces significant human resource challenges, particularly in terms of a shortage of trained personnel who can operate and maintain the monitoring equipment. In 2024, only about 15% of Indonesia’s air quality monitoring stations are staffed by personnel with specialized skills in environmental data analysis. This lack of skilled labor affects the effectiveness of air quality monitoring programs, as systems may not be fully utilized or maintained properly, leading to data inaccuracies. This shortage of skilled workers remains one of the primary barriers to the effective implementation of air quality management systems.

Opportunities

Technological Advancements

Technological advancements, particularly in sensor technology and the Internet of Things (IoT), are creating significant opportunities for the air quality monitoring system market in Indonesia. As of 2024, IoT devices are increasingly being integrated into air quality sensors to provide real-time monitoring, data analytics, and remote access to air quality data. This shift toward more affordable and scalable technologies is expected to drive the growth of air quality monitoring systems in Indonesia, especially in areas with limited infrastructure. These technologies are enhancing the capacity to monitor air quality effectively at a lower cost.

International Collaborations

Indonesia has increasingly partnered with international organizations to improve its air quality monitoring capabilities. In 2024, the Indonesian government collaborated with the United Nations Environment Programme (UNEP) to enhance the monitoring network and improve data accuracy. These partnerships allow the country to access advanced monitoring technologies and technical expertise, supporting the broader adoption of air quality monitoring systems. These international collaborations are expected to continue as the Indonesian government seeks global support to meet air quality standards and enhance environmental protection efforts.

Future Outlook

Over the next ~ years, the Kenya Africa Aviation MRO market is expected to show significant growth. This growth will be propelled by the increasing fleet of both commercial and private aircraft in the region, coupled with substantial government and private sector investments in aviation infrastructure. As East Africa continues to strengthen its position as a major aviation hub, the demand for advanced MRO services will continue to rise. Additionally, international partnerships and technological advancements in MRO techniques, including predictive maintenance and digitalization, will contribute to the region’s growth.

Major Players

- Kenya Airways

- Lufthansa Technik

- Ethiopian Airlines

- Safran Aircraft Engines

- Aerotech Aviation

- Joramco

- Air Seychelles

- Air Mauritius

- Precision Air

- Air Tanzania

- FastJet

- RwandAir

- Fly540

- Astral Aviation

- Aviation Solutions Africa

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Airlines operating in East Africa

- Aircraft manufacturers

- Aircraft leasing companies

- MRO service providers

- Regional airports and infrastructure developers

- International aviation associations

Research Methodology

Step 1: Identification of Key Variables

The initial phase of the research focuses on defining key market variables, including the types of MRO services required, the demand for different platform types, and the regulatory landscape. A combination of secondary research and expert consultations helps gather detailed industry-level data for analysis.

Step 2: Market Analysis and Construction

This step involves analyzing historical data related to the Kenya Africa Aviation MRO market, including the growth of airlines, fleet expansion, and technological developments in MRO services. The analysis also examines the distribution of MRO services across different platforms and regions.

Step 3: Hypothesis Validation and Expert Consultation

The hypotheses regarding market growth and trends are validated through interviews with industry experts. These consultations offer valuable insights into market trends, technological shifts, and business challenges that impact MRO service providers in Kenya and the broader African region.

Step 4: Research Synthesis and Final Output

In the final stage, the research team synthesizes findings from the analysis and expert consultations to provide a comprehensive outlook for the Kenya Africa Aviation MRO market. This process ensures the report delivers actionable insights, verified data, and reliable forecasts.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing air traffic and aircraft fleet expansion in Africa

Growing demand for cost-efficient and reliable MRO services

Government initiatives and infrastructure investment in Kenya - Market Challenges

Limited availability of skilled workforce and technical expertise

High operational and maintenance costs

Regulatory and certification challenges in the region - Market Opportunities

Investment in local MRO facilities and capabilities

Expanding MRO services to regional aircraft

Collaborations with international MRO providers - Trends

Digital transformation in MRO operations

Sustainability and eco-friendly MRO practices

Rise of predictive maintenance technologies

- Government regulations

Aviation safety and maintenance standards compliance

Environmental regulations impacting MRO processes

Government incentives for the aviation sector - SWOT analysis

- Porters 5 forces

- By Market Value ,2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Airframe MRO

Engine MRO

Component MRO

Line Maintenance

Heavy Maintenance - By Platform Type (In Value%)

Commercial Aviation

Business Jets

General Aviation

Helicopters

Military Aviation - By Fitment Type (In Value%)

OEM Parts

Aftermarket Parts

Retrofit Solutions

Refurbishment Services

Modification Services - By End User Segment (In Value%)

Commercial Airlines

Government & Defense Agencies

Business & Private Operators

MRO Service Providers

Aircraft Leasing Companies - By Procurement Channel (In Value%)

Direct Procurement

Third-Party Suppliers

OEM Channels

Online Marketplaces

Service Contracts

- Cross Comparison Parameters (Market Share, Technological Innovation, Cost Efficiency, Regional Presence, Customer Service, Market Presence, Capacity & Infrastructure)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Kenya Airways

Safi Airways

FastJet

Air Kenya Express

Ethiopian Airlines

South African Airways

RwandAir

Air Tanzania

Fly540

Precision Air

EgyptAir

Jet Aviation

Aerotech Aviation

Aviation Solutions Africa

Zawadi Aviation

- Increasing reliance of airlines on third-party MRO providers

- Government’s focus on enhancing defense aviation capabilities

- Private operators seeking more cost-effective maintenance solutions

- Aircraft leasing companies driving demand for fleet maintenance

- Forecast Market Value, 2026-2035

- Forecast Installed Units ,2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform ,2026-2035