Market Overview

The KSA Adaptive Headlights Market is valued at USD ~. The adaptive headlight opportunity in the Kingdom is fundamentally driven by the size and renewal of the on-road vehicle base and the premium/ADAS feature mix on new registrations. Saudi Arabia’s registered and roadworthy vehicles reached ~ in 2024 versus ~ in the prior year, expanding the installed base that ultimately feeds both OE fitments and collision/age-related replacements. At the same time, passenger-car sales rose to ~ units in 2024 from ~ units in the prior year, increasing the addressable pool for trims that bundle adaptive lighting with ADAS and premium packages.

Demand is most concentrated in Riyadh, Jeddah (Makkah Region), and the Eastern Province (Dammam/Khobar/Jubail) because these hubs combine higher new-vehicle turnover, denser dealer/service networks, and heavier night-time expressway usage that makes glare-free high beam and bending light more valued. Riyadh typically anchors premium showrooming and corporate fleet procurement; Jeddah concentrates high-utilization urban driving and insurance-backed collision repair volume; the Eastern Province combines logistics/industrial traffic with long corridor driving, supporting higher wear-and-tear replacement cycles and professional workshop calibration demand.

Market Segmentation

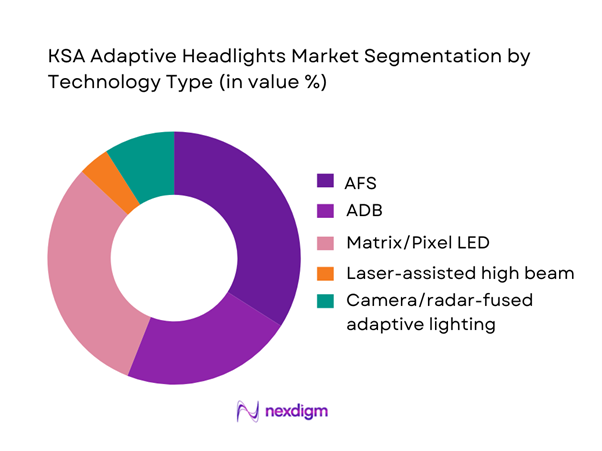

By Technology Type

AFS and Matrix/Pixel LED together lead because they sit at the intersection of “perceived premium” and practical KSA operating needs: curve illumination for high-speed ramps, auto-leveling under load, and higher lumen output with better cutoff control for highways. Their dominance is reinforced by the Kingdom’s rising passenger-car sales base (~ units 2024) and the expansion of the registered vehicle fleet (~ 2024), which increases both OE fitment opportunities and the replacement pipeline for adaptive-capable headlamp assemblies. ADB penetration is accelerating but remains more constrained by model availability, software/homologation readiness, and calibration ecosystem depth across independent workshops.

By Sales Channel

OEM/dealer-led sales dominate because adaptive headlamps are highly platform-specific modules (lamp + ECU logic + sensor integration) and are commonly packaged into trim levels and ADAS bundles at the point of sale. As the passenger-car market expanded from ~ units (prior year) to ~ units (2024), the incremental sales disproportionately favored factory-fit feature ladders where dealers control warranty, diagnostics, and aiming/calibration workflows. IAM demand is meaningful but is pulled mainly by collision replacement and premium upgrades; it is also limited by counterfeit risk and the need for correct coding/aiming to avoid glare and inspection issues.

Competitive Landscape

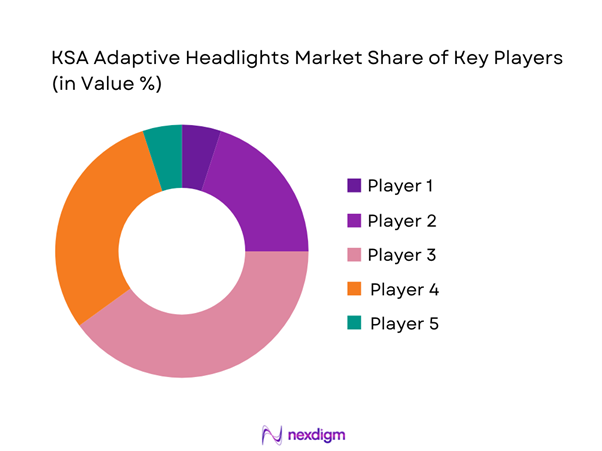

The KSA adaptive headlights market is supplied through a mix of global Tier-1 lighting system leaders and component specialists whose products reach the Kingdom via OEM programs, distributor agreements, and dealer service channels. Competitive advantage is typically decided by platform coverage (Toyota/Hyundai/Kia/Nissan-heavy parc fitments), ADB/matrix readiness, heat/dust reliability engineering, and the ability to support calibration and warranty handling locally.

| Company | Est. Year | HQ | Core Adaptive Tech | KSA Route-to-Market Strength | Platform Coverage Depth | Local Support Enablement | Differentiation |

| Koito Manufacturing | 1915 | Japan | ~ | ~ | ~ | ~ | ~ |

| Valeo | 1923 | France | ~ | ~ | ~ | ~ | ~ |

| FORVIA HELLA | 1899 | Germany | ~ | ~ | ~ | ~ | ~ |

| Marelli | 2019 | Japan/Italy | ~ | ~ | ~ | ~ | ~ |

| ZKW Group | 1938 | Austria | ~ | ~ | ~ | ~ | ~ |

KSA Adaptive Headlights Market Analysis

Growth Drivers

New-vehicle sales uplift

Saudi Arabia’s adaptive-headlight install base expands first with the absolute flow of new vehicles entering the parc. Road Transport Statistics show vehicles registered as a new issue reached ~ and registered & roadworthy vehicles reached ~ (up from ~), which mechanically lifts the number of OEM headlamp modules (including AFS/ADB-ready variants) that will later cycle into replacement and refurbishment demand. As a macro “ability-to-pay” anchor, GDP (current US$) at ~ and GDP per capita (current US$) at ~ support continued new-vehicle purchase capacity for feature-rich trims where adaptive lighting is most commonly packaged. Demand concentration also rises with licensing throughput: first-time driving licenses exceeded ~, which correlates with incremental household vehicle additions and usage intensity that increases wear exposure (lamp lens pitting, DRL driver stress, actuator duty cycles). For adaptive systems specifically, higher annual inflow of vehicles tightens the linkage between dealership-spec headlamp availability (OEM part pipelines) and workshop capability (aiming + calibration), creating a reinforcing adoption loop: more new vehicles → more factory-fitted advanced lamps → more service events that “normalize” adaptive lighting in repair standards and resale inspections, raising buyer willingness to pay for lighting packages in the next purchase cycle.

Premium trim mix expansion

Adaptive headlamps in KSA are disproportionately pulled by premium trims (LED matrix, cornering AFS, glare-free ADB) because consumers associate lighting performance with visibility on long intercity corridors and high-speed ring roads, and OEMs bundle the feature into upper variants alongside larger wheels, panoramic cameras, and advanced interiors. This “trim-mix effect” strengthens when household purchasing power and financing capacity remain supportive, reinforcing the addressable base for higher-spec vehicles that typically carry adaptive lamps as standard or as part of safety packs. The parc is also expanding in a way that increases the number of upgrade-oriented buyers: ~ registered & roadworthy vehicles mean more trade-ins and replacement cycles where used-car shoppers increasingly filter for “LED / adaptive headlights” as a feature proxy. On the demand side, Saudi Arabia’s population of ~ supports sustained urban and peri-urban expansion across Riyadh, Makkah region and the Eastern Province, where premium dealerships and certified body shops are densest—reducing perceived risk of owning complex lighting modules because service access is easier. Premium-mix expansion also links to compliance and resale inspections: higher-end imports and GCC-spec vehicles are more likely to require documented conformity and correct beam pattern/leveling performance, which encourages buyers to stay within authorized channels rather than grey imports—again increasing the penetration of OEM adaptive systems rather than downgraded reflector conversions.

Challenges

Homologation and compliance interpretation

For adaptive headlamps, KSA compliance is not only about photometrics; it extends to labeling, conformity documentation, and (in some cases) how regulators interpret equivalence across GCC/UNECE-aligned requirements—creating friction for importers, aftermarket distributors, and even fleets that source parts internationally. Enforcement evidence appears in formal customs committee decisions that list cases involving compliance checks, rules and labeling convictions, and non-compliance with specifications or incorrect certificates of conformity. That matters for adaptive headlights because AFS/ADB assemblies include control units and specific approval markings; any mismatch between documentation and the physical assembly can block clearance or trigger penalties, increasing lead times for legitimate supply. Macro conditions amplify the operational impact because scale is large: ~ registered & roadworthy vehicles means a high volume of repair parts flows through the system, and interpretation inconsistencies can create widespread supply interruptions for popular models. From a macro anchor, GDP at ~ supports high vehicle and parts throughput, but also raises the expectation that compliance frameworks are enforced consistently as the market modernizes. The market consequence is that distributors and service networks must invest in compliance teams, certificate validation workflows, and traceability—especially for advanced lighting where “looks similar” is not technically equivalent (beam pattern, leveling logic, CAN coding).

Calibration capability gaps

Adaptive headlights require correct commissioning and, after front-end repairs, re-calibration (headlamp aim, leveling sensors, sometimes camera alignment). In KSA, capability gaps show up as uneven workshop readiness outside top-tier dealer networks—especially as the parc expands quickly. The service base has been formalizing, but the numbers still imply an “underserved calibration density” challenge: approved vehicle maintenance and repair centers number ~ (after ~ approvals in the first half of the year), which is meaningful growth but must be read against a parc of ~ roadworthy vehicles—a scale where not every city and corridor will have the tools and training for AFS/ADB calibration. Calibration gaps matter more as new-vehicle inflow rises: ~ new vehicle registrations increase the number of vehicles entering circulation with advanced lamps and sensor fusion front ends, which increases the probability of post-incident recalibration requirements. Macro indicators reinforce that this is not a “demand shortage” problem but a capability build-out issue, supporting a market where consumers can purchase advanced trims, but where technician upskilling and equipment diffusion can lag the technology curve. The business consequence is higher comeback rates and customer dissatisfaction when repairs are done without correct aiming—especially on highways where glare and insufficient throw become obvious.

Opportunities

ADB adoption expansion

The opportunity for Adaptive Driving Beam (ADB) in Saudi Arabia is best understood as “share shift within advanced lighting,” supported by current market signals: a fast-expanding new-vehicle pipeline (~ new registrations) continuously refreshes the fleet with camera/radar architectures that can technically support glare-free high-beam functions when regulations and OEM configurations allow. The safety context creates a strong justification layer for ADB features that reduce night-driving risk, keeping visibility and driver-assistance features in the spotlight for fleets, insurers, and premium consumers. Macro capacity supports continued technology adoption cycles, enabling premium-feature diffusion from luxury segments into broader upper-mid segments over time as used vehicles circulate. Additionally, the operating environment (dust + extreme heat) makes the value proposition of “smart beam control” more tangible: during dust episodes where visibility drops, drivers respond strongly to lighting performance, and OEMs can position ADB as a functional safety enhancement rather than a luxury add-on. The near-term business opportunity is therefore ecosystem-building using current indicators: expanding certified calibration capability beyond the existing approved-repair-center footprint, strengthening compliant parts availability to avoid delays seen in enforcement actions related to bulbs and parts, and insurer-aligned repair protocols that require documented beam verification after collision repair.

Pixel LED localization and assembly

Localization for pixel LED and advanced headlamp assemblies is an “industrial opportunity” supported by current scale and enforcement realities rather than by forward projections. Saudi Arabia’s fleet scale (~ roadworthy vehicles) and annual intake (~ new registrations) create a large recurring demand base for OE lamps, service replacements, brackets, harnesses, and associated electronics—conditions that can justify regional assembly, kitting, and eventually localized sub-component production (heat sinks, lens modules, driver boards) when supply-chain economics align. Compliance pressure supports localization because it reduces border friction: customs decisions show convictions related to bulbs and car spare parts for non-compliance or incorrect conformity certificates; local assembly under controlled conformity processes can reduce documentation mismatch risk and improve traceability. Counterfeit pressure is another structural reason localization can win: IP enforcement reporting references ~ counterfeit products in customs-linked activity, and documented enforcement cooperation includes more than ~ counterfeit products seized or destroyed—signals that authenticated local supply can differentiate against grey-market lighting. Macro capacity and industrial readiness are underpinned by GDP at ~ and a large population base (~), enabling both consumption scale and workforce development for electronics assembly and automotive service ecosystems. For pixel LED specifically, KSA’s environment strengthens the case for local validation: extreme heat and frequent dust events necessitate region-tuned durability testing and sealing quality. Localization enables faster feedback loops from local failure modes into design or supplier selection—reducing repeat repairs and raising customer satisfaction.

Future Outlook

Over the next five years, the KSA adaptive headlights market is expected to advance on three tracks: continued growth in the national vehicle base and annual new-vehicle inflow, higher penetration of ADAS bundles that “pull through” adaptive lighting, and stronger local service capability for calibration, coding, and warranty handling—critical for ADB and pixel LED systems. The Kingdom’s expanding vehicle parc (~ 2024) and rising passenger-car sales (~ 2024) support a larger installed base for both OE and replacement demand, while premiumization and EV showrooming amplify the value of intelligent front lighting.

Major Players

- Koito Manufacturing

- Valeo

- FORVIA HELLA

- Marelli

- Stanley Electric

- ZKW Group

- Varroc Engineering

- ams OSRAM

- Lumileds

- Nichia

- Hyundai MOBIS

- SL Corporation

- TYC

- DEPO

Key Target Audience

- Passenger vehicle OEMs & national sales companies

- Authorized dealer groups & service networks

- Tier-1 and Tier-2 automotive lighting suppliers targeting KSA programs

- Insurance companies & motor claims administrators

- Collision repair networks & bodyshop chains

- Fleet operators

- Investments and venture capitalist firms

- Government and regulatory bodies

Research Methodology

Step 1: Identification of Key Variables

We build an ecosystem map covering OEMs, Tier-1 lighting suppliers, distributors, calibration workshops, insurers, and fleet buyers. Desk research is combined with proprietary databases to define variables such as platform fitment rates, channel markups, and replacement triggers.

Step 2: Market Analysis and Construction

We compile historical vehicle parc and new-vehicle sales flows, then map adaptive-headlamp take-rates by trim ladders and model mix. This is blended with pricing waterfalls (module + ECU + calibration) to construct value and volume.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses are validated via CATIs with dealer service heads, collision repair managers, distributor category owners, and fleet maintenance leaders—focused on real-world failure modes, lead times, and warranty patterns.

Step 4: Research Synthesis and Final Output

We reconcile top-down benchmarks with bottom-up SKU/fitment builds and channel interviews. The final model is stress-tested for platform coverage, ASP dispersion, and channel split sensitivity before publication.

- Executive Summary

- Research Methodology (Market Definitions & Scope Boundary for “Adaptive Headlights”, Assumptions & Data Normalization, Abbreviations, Dual-Track Market Sizing Approach, Primary Research Framework, Demand-Side Validation, Pricing & ASP Build-Up, Trade/HS-Code Triangulation for Lighting Assemblies, Competitive Intelligence Method, Limitations & Sensitivity Checks)

- Definition and Scope

- Market Genesis and Evolution

- Technology Timeline

- Business Cycle and Replacement Cycle Mapping

- Ecosystem Map and Stakeholder Roles

- Growth Drivers

New-vehicle sales uplift

Premium trim mix expansion

ADAS and safety feature bundling

Insurer-led repair standards

EV and luxury showrooming impact - Challenges

Homologation and compliance interpretation

Calibration capability gaps

Counterfeit and grey-market penetration

Heat and dust reliability constraints

High replacement and repair cost - Opportunities

ADB adoption expansion

Pixel LED localization and assembly

Fleet safety lighting packages

Certified retrofit programs

Dealer service revenue attachment - Trends

Increasing pixel density and beam control

Software-defined lighting logic

Micro-LED pilot integration

OTA-enabled lighting updates

V2X signaling concepts - Regulatory & Policy Landscape

- SWOT Analysis

- Stakeholder & Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competitive Intensity & Ecosystem Mapping

- By Value, 2019–2024

- By Volume, 2019–2024

- By Average Selling Price, 2019–2024

- Installed Base & Fitment Penetration, 2019–2024

- By Technology Architecture (in Value %)

Adaptive Front-lighting System (AFS: bending/leveling)

Adaptive Driving Beam (ADB: glare-free high beam)

Matrix/Pixel LED

Laser-assisted High Beam

Camera/Radar-fused Adaptive Lighting - By Connectivity Type (in Value %)

Camera-based systems

Radar-assisted systems

Camera and radar fusion systems

ECU-driven standalone systems - By Application (in Value %)

Passenger vehicles

Commercial vehicles

Fleet vehicles

Government and utility vehicles - By End-Use Industry (in Value %)

OEM factory fitment

Authorized dealership upgrades

Independent aftermarket replacements

Fleet and government procurement - By Region (in Value %)

Riyadh

Makkah Region

Eastern Province

Northern and logistics corridors

Southern Region

- Market share framework by value and volume

- Cross Comparison Parameters (KSA homologation readiness, pixel and dimming zone depth, sensor and ECU integration capability, thermal and dust-proofing performance, platform coverage depth, local availability and lead time, calibration ecosystem support, warranty and claims handling capability)

- Competitive positioning matrix

- SWOT Analysis of Key Players

- Strategic moves and recent developments

- Pricing benchmarking

- Detailed Profiles of Major Companies

Koito Manufacturing

Valeo

FORVIA HELLA

Marelli

Stanley Electric

ZKW Group

Varroc Engineering

ams OSRAM

Lumileds

Nichia

Hyundai MOBIS

SL Corporation

TYC Brother Industrial

DEPO Maxzone

Bosch

- OE fitment decision logic

- Aftermarket purchase triggers

- Fleet procurement criteria

- Workshop and calibration capability mapping

- Insurer influence on parts selection

- By Value, 2025–2030

- By Volume, 2025–2030

- By Average Selling Price, 2025–2030

- Installed Base & Penetration Outlook, 2025–2030