Market Overview

The KSA aerial smart weapons market is valued at approximately USD ~ billion. This growth is driven by the increasing demand for advanced aerial systems, particularly Unmanned Aerial Vehicles (UAVs), Unmanned Combat Aerial Vehicles (UCAVs), and loitering munitions. The country’s modernization efforts and Vision 2030 initiative, which prioritizes the development of indigenous defense capabilities, have significantly contributed to this market’s expansion. Additionally, Saudi Arabia’s strategic partnerships with global defense manufacturers and its substantial defense budget, which reached over USD 61 billion, have further accelerated the growth of this sector. The rising security concerns in the region and the adoption of precision warfare technologies also continue to boost the market’s demand.

Saudi Arabia’s dominance in the aerial smart weapons market is primarily driven by its significant defense expenditure and strategic geopolitical position in the Middle East. Major cities such as Riyadh, Jeddah, and Dhahran serve as key hubs for defense activities, housing several defense contractors, government agencies, and military bases. The country is investing heavily in the development and procurement of advanced aerial systems, focusing on both defense and domestic security. Furthermore, the establishment of the Saudi Arabian Military Industries (SAMI) is a pivotal step in reducing dependency on foreign technology and advancing the nation’s aerial capabilities. Saudi Arabia’s defense collaboration with international players, like the United States, Russia, and France, also reinforces its market dominance in the region.

Market Segmentation

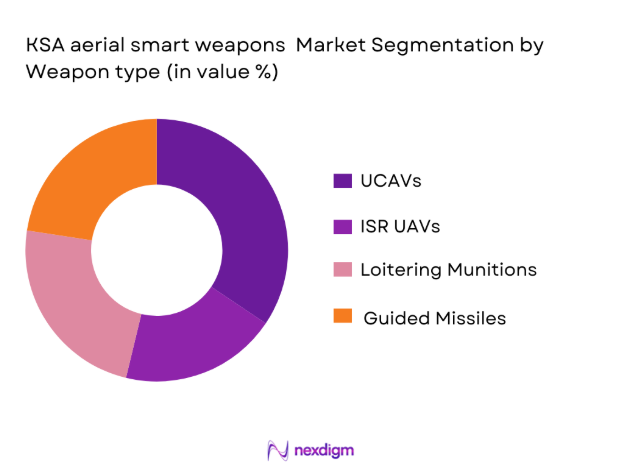

By Weapon Type

The KSA aerial smart weapons market is segmented by weapon type into UCAVs, ISR UAVs, loitering munitions, and guided missiles. Among these, UCAVs (Unmanned Combat Aerial Vehicles) dominate the market share due to their versatility, long endurance, and cost-effectiveness in military operations. UCAVs are increasingly deployed for precision strikes, surveillance, and tactical operations, which are critical for Saudi Arabia’s defense strategy. The RSAF (Royal Saudi Air Force) is actively enhancing its fleet of UCAVs, including foreign systems like the MQ-9 Reaper, and developing indigenous platforms, increasing the adoption of these systems.

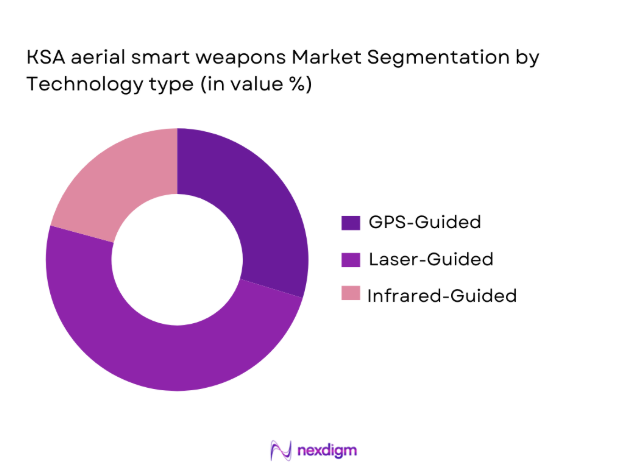

By Technology Type

The market is also segmented by technology type into GPS-guided, laser-guided, and infrared-guided systems. Among these, GPS-guided systems are the most dominant due to their wide applicability, cost-effectiveness, and ease of integration with various aerial platforms. GPS-guided systems are especially favored for long-range, precision targeting, making them ideal for both strike and surveillance missions. This technology’s growth is bolstered by advancements in satellite navigation and GPS accuracy, providing a reliable and efficient solution for smart weaponry.

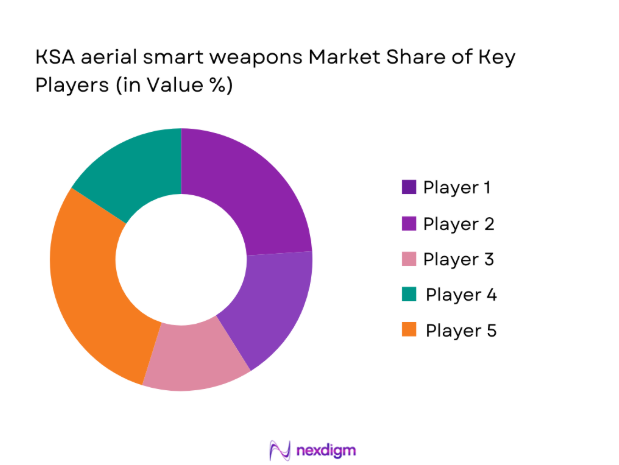

Competitive Landscape

The KSA aerial smart weapons market is dominated by a few major players that have established a significant presence due to their technological expertise, product offerings, and defense collaborations. Companies like Boeing, Lockheed Martin, and Raytheon are major players in the UCAV and missile systems segments. The consolidation of international manufacturers alongside local companies such as Saudi Arabian Military Industries (SAMI) and Advanced Electronics Company (AEC) highlights the competitive landscape of the market. These companies are leading the market by investing in R&D, forming strategic partnerships with the government, and offering systems that meet the region’s specific security needs.

| Company | Establishment Year | Headquarters | Product Portfolio | Market Segment | Technology | Strategic Alliances | R&D Investment |

| Boeing | 1916 | Chicago, USA | ~ | ~ | ~ | ~ | ~ |

| Lockheed Martin | 1912 | Bethesda, USA | ~ | ~ | ~ | ~ | ~ |

| Raytheon | 1922 | Waltham, USA | ~ | ~ | ~ | ~ | ~ |

| SAMI | 2017 | Riyadh, Saudi Arabia | ~ | ~ | ~ | ~ | ~ |

| AEC | 1988 | Riyadh, Saudi Arabia | ~ | ~ | ~ | ~ | ~ |

KSA aerial smart weapons Market Analysis

Growth Drivers

Defense Modernization Spending

Governments around the world are prioritizing the modernization of their military capabilities to address evolving threats and maintain strategic advantages. In regions like the Middle East, defense modernization programs include upgrading air forces with advanced fighter jets, drones, and aerial smart weapons, as well as integrating cutting-edge command, control, communications, computers, intelligence, surveillance, and reconnaissance (C4ISR) systems. This large-scale investment is driven by the need to replace aging platforms, enhance operational readiness, and achieve technological parity with potential adversaries. Aerial smart weapons, which offer precision targeting, network connectivity, and advanced guidance systems, are a key component of these modernization initiatives. Consequently, increasing defense budgets and procurement programs directly drive the demand for next-generation aerial munitions, making defense modernization a critical growth driver for the aerial smart weapons market.

Precision Warfare Demand

Modern military operations increasingly emphasize precision, efficiency, and reduced collateral damage. Precision-guided aerial weapons allow armed forces to strike high-value or time-sensitive targets accurately while minimizing unintended damage to civilian infrastructure and personnel. The growing complexity of warfare, including urban operations and counterterrorism missions, has heightened the need for such precision capabilities. Additionally, advancements in targeting sensors, GPS-guided systems, and artificial intelligence-driven weapon guidance have expanded the effectiveness and appeal of smart aerial munitions. Nations seeking to maintain operational superiority, deter threats, and achieve strategic objectives with minimal resource wastage are driving robust demand for precision warfare technologies. This trend positions precision-guided aerial weapons as essential tools for modern military strategy, making precision warfare demand a significant market growth driver for the aerial smart weapons sector.

Market Challenges

High Development Costs

The KSA aerial smart weapons market faces substantial development costs due to the advanced nature of technologies involved. Developing Unmanned Combat Aerial Vehicles (UCAVs), loitering munitions, and guided missile systems requires significant capital investment in R&D, manufacturing facilities, and specialized components. For instance, a UCAV can cost tens of millions of dollars, with a significant portion of these costs directed towards materials like carbon composites, radar technology, and autonomy systems. The Kingdom of Saudi Arabia has dedicated substantial defense spending, with the defense budget set at approximately USD 61 billion in 2024 (World Bank). These high costs are offset through government funding, partnerships with international defense companies, and offset agreements. However, these financial barriers still affect the adoption and expansion of new technologies in the local defense ecosystem.

Regulatory Airspace Constraints

Saudi Arabia has set stringent regulations for the deployment of aerial smart weapons, especially UAVs, within its airspace. The Saudi General Authority of Civil Aviation (GACA) is responsible for enforcing strict airspace management rules to ensure the safe operation of drones and UAVs. As the technology for aerial smart weapons grows more advanced, these airspace constraints are becoming more pronounced. The government has been working to balance the benefits of unmanned aerial systems (UAS) for military operations with safety and security concerns in civilian airspace. In 2024, the GACA is tightening regulations on UAV operations, limiting the scope for operations near populated areas, which can hinder the rapid adoption of aerial weapons systems for security and defense.

Market Opportunities

AI Capabilities

The integration of Artificial Intelligence (AI) into aerial smart weapons is transforming the market. AI capabilities allow for real-time decision-making, autonomous targeting, and enhanced operational efficiency, which is increasingly becoming a necessity for military operations. Saudi Arabia, which is investing heavily in AI technologies, has already initiated defense projects aimed at integrating AI into unmanned systems. According to the World Economic Forum, the AI market in the Middle East, including defense applications, is expected to grow significantly by 2025, with governments accelerating their AI integration in military systems. Saudi Arabia’s Vision 2030 emphasizes enhancing AI to achieve operational autonomy in defense systems, and this is set to drive the demand for more advanced aerial smart weapons. As a result, AI-driven unmanned aerial vehicles (UAVs) are becoming central to KSA’s defense modernization.

Localization & Export Potential

Saudi Arabia’s Vision 2035 encourages the localization of defense manufacturing, with the goal of producing a significant portion of the nation’s military requirements domestically. This has paved the way for local defense contractors to enhance their capabilities in producing aerial smart weapons. The Saudi Arabian Military Industries (SAMI), in collaboration with international defense companies, is actively engaged in producing indigenous UAVs, loitering munitions, and guided missiles. This not only strengthens the local supply chain but also offers export opportunities, as KSA seeks to become a regional exporter of defense systems. In 2024, the Saudi defense industry is focused on advancing its export infrastructure, which will help open markets in other parts of the Middle East and Africa, where demand for such technologies is increasing due to geopolitical instability.

Future Outlook

Over the next few years, the KSA aerial smart weapons market is expected to experience significant growth. This growth will be driven by continuous government support, the evolution of aerial warfare tactics, and increased demand for precise and cost-effective weaponry. Furthermore, the advancement of autonomous systems and the integration of AI-driven technologies are expected to revolutionize the sector, providing Saudi Arabia with cutting-edge defense capabilities. The kingdom’s defense collaborations with international players and its growing defense infrastructure will continue to play a vital role in the market’s expansion. Increased investments in indigenous military technology are likely to enhance the market potential as well.

KSA Aerial Smart Weapons Market Analysis

15 Major Players

- Boeing Defense, Space & Security

- Lockheed Martin Corporation

- Raytheon Technologies

- Northrop Grumman

- General Atomics Aeronautical Systems

- Airbus Defence & Space

- Thales Group

- Israel Aerospace Industries

- Baykar

- Turkish Aerospace Industries

- SAMI

- Advanced Electronics Company

- Leonardo S.p.A.

- MBDA

- Elbit Systems

Key Target Audience

- Ministry of Defense

- Royal Saudi Air Force

- Saudi Arabian Military Industries

- Advanced Electronics Company

- Defense Contractors and System Integrators

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies

- Aerospace and Defense Manufacturing Companies

Research Methodology

Step 1: Identification of Key Variables

The first phase of research focuses on identifying the critical variables that influence the KSA aerial smart weapons market. This includes analyzing the market dynamics, government regulations, and defense budget allocations. This phase involves extensive desk research through secondary data sources, including defense publications, market reports, and government documentation, alongside expert interviews.

Step 2: Market Analysis and Construction

In this phase, historical data from secondary sources is compiled to construct an accurate market model. Key aspects, such as defense spending, procurement cycles, and product adoption rates, are analyzed to understand the market’s structure. Detailed assessments of market penetration and the competitive landscape help refine the understanding of future trends and growth potential.

Step 3: Hypothesis Validation and Expert Consultation

In this stage, hypotheses related to market size, growth drivers, and key challenges are validated through consultations with industry experts, including senior officials from defense organizations, manufacturers, and technology developers. These insights provide an operational and financial perspective that strengthens the overall analysis.

Step 4: Research Synthesis and Final Output

The final research phase synthesizes all findings and insights derived from expert consultations and data analysis. This stage involves verifying the data through additional interviews with key stakeholders, ensuring the accuracy and completeness of the market report. Final outputs include a comprehensive analysis with actionable insights for stakeholders in the KSA aerial smart weapons market.

- Executive Summary

- Research Methodology (Market Definitions & Assumptions, Defense‑Sector Sizing Approach, Primary vs Secondary Data Sources, Bottom‑Up & Top‑Down Triangulation, Intelligence Interviews with Defense Stakeholders, Data Validation Protocols, Limitations & Confidence Intervals)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Defense Modernization Spending

Precision Warfare Demand

UAV ISR Priority

Local Content Mandates - Market Constraints

Regulatory Airspace Restrictions

High Capital Outlays

Cybersecurity Concerns - Market Challenges

High Development Costs

Regulatory Airspace Constraints - Market Opportunities

AI Capabilities

Localization & Export Potential - Market Technology Trends

AI Targeting

Swarming UAVs

Sensor Fusion

- By Market Value, 2020-2025

- By Installed Units, 2020-2025,

- By average System, 2020-2025

- By system Complexity tier 2020-2025

- By system Complexity Tier, 2020-2025

- By Weapon Platform (In Value %)

Unmanned Combat Aerial Vehicles (UCAVs)

Intelligence, Surveillance & Reconnaissance (ISR) UAVs

Loitering Munitions Systems

Guided Missile Systems - By Guidance Technology (In Value %)

GPS/GNSS Guided

Laser‑Guided

Inertial Navigation Systems (INS)

Imaging Infrared (IIR)

Active/Passive Radar Homing - By Functional Segment (In Value %)

Surveillance & Reconnaissance

Strike & Precision Engagement

Electronic Warfare & Jamming

Target Training & Simulation

Logistics & Resupply UAVs - By End‑User (In Value %)

Royal Saudi Air Force (RSAF)

Ministry of Defence Platforms

National Guard & Border Guard

Internal Security Agencies

Defense Contractors & Integrators - By Procurement Channel (In Value %) Direct Government Acquisition

Strategic Partnerships / Joint Ventures

Technology Transfer / Co‑Production

Foreign Military Sales (FMS)

Private Defence Supply Contract

- Market Share Analysis of Major Players

- Cross Comparison Parameters (Company Overview, Business Strategy, Product Roadmap, R&D Spend % of Revenue, Local Footprint (%), Number of Defense Contracts Awarded, Integration Capabilities, After‑Sales Support Ecosystem)

- Detailed Company Profiles

Boeing Defense, Space & Security

Lockheed Martin Corporation

Raytheon Technologies

Northrop Grumman Corporation

General Atomics Aeronautical Systems

Airbus Defence & Space

Leonardo S.p.A.

Thales Group

MBDA

Israel Aerospace Industries (IAI)

Baykar (Turkey)

Turkish Aerospace Industries (TAI)

Advanced Electronics Company (AEC) KSA

Saudi Arabian Military Industries (SAMI)

Intra Defense Technologies KSA

- Royal Saudi Air Force

- Ministry of Defense Units

- Border Security Command

- Kingdom Special Forces

- National Guard Aviation

- Global Smart Weapons Growth, 2026-2035

- Saudi Defense Budget, 2026-2035

- Military Modernization, 2026-2035

- Growing Procurement Demand, 2026-2035

- Global Supplier Influence, 2026-2035