Market Overview

The KSA aerospace and defense biometrics market is expected to experience substantial growth, with the market size for 2024 valued at USD ~billion. This growth is driven by increasing security concerns within the aerospace and defense sectors, government initiatives for enhanced border control, and the rising adoption of biometrics for military, law enforcement, and access control purposes. The demand for reliable identity verification technologies in these sectors has made biometrics a critical tool in ensuring national security. Additionally, KSA’s investments in defense infrastructure and modernization of security systems further catalyze the biometrics market’s expansion.

Saudi Arabia remains the dominant player in the KSA aerospace and defense biometrics market due to its substantial investments in defense modernization, increasing need for border security, and the role of biometrics in military operations. Riyadh, being the political and economic hub, alongside Jeddah and Dammam, plays a crucial role in spearheading the adoption of advanced biometric technologies across defense and aerospace sectors. The country’s strategic focus on improving internal security and its central position in the Middle East make it a key driver for this market.

Market Segmentation

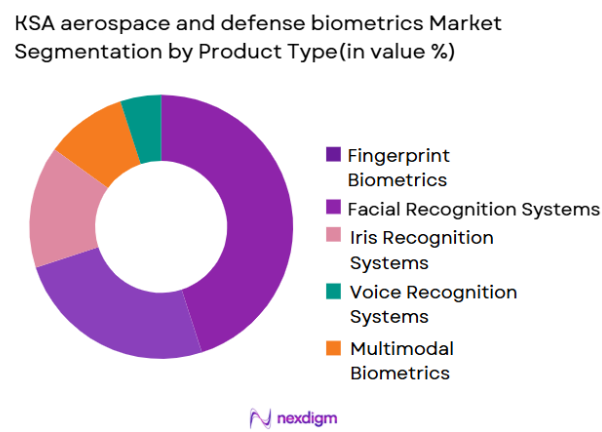

By Product Type

The KSA aerospace and defense biometrics market is segmented by product type, including fingerprint biometrics, facial recognition, iris scanning, voice recognition, and multimodal biometric systems. Among these, fingerprint biometrics dominate the market due to their established reliability, cost-effectiveness, and wide application in military and law enforcement sectors. Fingerprint systems are widely used for access control and personnel identification, backed by high accuracy and ease of integration into existing security infrastructure. Furthermore, fingerprint-based biometric solutions are considered a staple for securing critical infrastructure in defense settings, further boosting their dominance in the market.

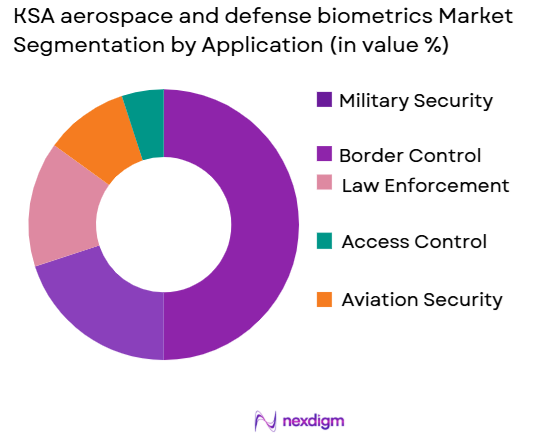

By Application

The KSA aerospace and defense biometrics market is also segmented by application into military security, border control, law enforcement, access control, and aviation security. Military security is the leading segment, driven by the growing use of biometrics for securing military bases, identifying personnel, and controlling access to sensitive areas. The demand for biometric systems in military applications is fueled by the need to enhance operational efficiency, ensure safe identification of personnel, and streamline security protocols. This has led to a robust adoption of biometrics by defense contractors and governmental agencies, making it the dominant application in the market.

Competitive Landscape

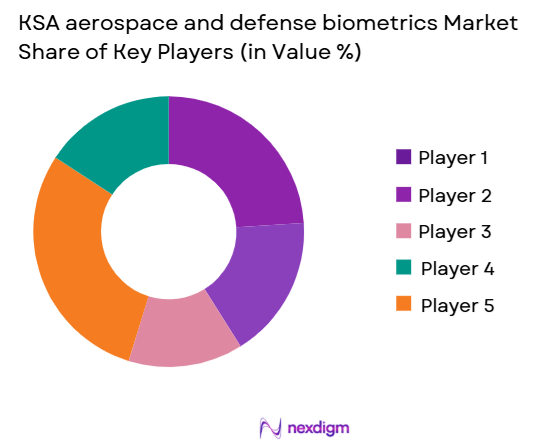

The KSA aerospace and defense biometrics market is highly competitive, with several prominent players leading the sector. Global companies such as IDEMIA, Thales Group, NEC Corporation, and Safran Group have established strong market positions in KSA due to their technological expertise and longstanding relationships with government and defense agencies. These players provide a wide range of biometric solutions tailored for security-critical applications in aerospace and defense sectors. Local players also contribute to the market’s growth by offering region-specific solutions and customization services for the unique needs of KSA’s defense infrastructure.

| Company | Year Established | Headquarters | Market Focus | Technological Advancements | Revenue | Strategic Partnerships |

| IDEMIA | 1980 | France | ~ | ~ | ~ | ~ |

| Thales Group | 2000 | France | ~ | ~ | ~ | ~ |

| NEC Corporation | 1899 | Japan | ~ | ~ | ~ | ~ |

| Safran Group | 2005 | France | ~ | ~ | ~ | ~ |

| Suprema Inc. | 2000 | South Korea | ~ | ~ | ~ | ~ |

KSA aerospace and defense biometrics Market Analysis

Growth Drivers

Urbanization

The rapid urbanization of KSA has significantly increased the demand for advanced security solutions, including biometrics for aerospace and defense applications. As urban populations grow, security concerns regarding infrastructure, military facilities, airports, and transportation hubs are becoming more critical. Saudi Arabia’s urban population is estimated to reach ~million by 2025, up from ~million in 2024. This surge in urbanization directly correlates with an increase in the adoption of biometrics, which are integral to national security and the protection of critical infrastructure. Urbanization in KSA is expected to propel the demand for biometrics technologies across government and defense sectors.

Industrialization

KSA’s industrialization efforts, especially in the defense and aerospace sectors, have driven the need for robust security solutions, including biometric systems. With large-scale defense projects, such as those outlined in Saudi Vision 2030, the demand for secure access and identification systems is expected to rise. In 2024, KSA’s industrial output increased by ~%, fueled by growth in non-oil sectors, including defense and aerospace. This growing industrial base requires advanced biometric solutions for workforce and asset management, ensuring operational security and integrity. The industrialization efforts, combined with defense sector growth, will continue to drive biometric technology adoption.

Restraints

High Initial Costs

The high upfront costs associated with implementing biometric systems remain a key restraint in the KSA aerospace and defense biometrics market. Biometric technologies, such as facial recognition and iris scanning systems, often require significant investment in hardware, software, and integration. This is particularly challenging in the defense sector, where budgets are typically allocated for other high-priority projects. The high capital expenditure can deter smaller defense contractors and military entities from adopting biometric solutions. In 2025, KSA’s defense budget was approximately USD ~billion, but the allocation for cybersecurity and biometrics was just a small portion of it, illustrating the fiscal constraints faced by the sector.

Technical Challenges

Technical challenges, including system integration issues and interoperability concerns, act as significant barriers to the adoption of biometric solutions in KSA’s aerospace and defense sectors. Many biometric systems require integration with existing security infrastructure, which can be complex and time-consuming. Moreover, the scalability of these systems can be an issue as the volume of data processed increases in large military and defense installations. These technical challenges are exacerbated by a shortage of local expertise in deploying and maintaining advanced biometric technologies. As of 2024, KSA faced a shortfall of over ~skilled cybersecurity professionals, which poses a challenge for the adoption of sophisticated biometric systems in defense applications.

Opportunities

Technological Advancements

Technological advancements in biometrics, particularly artificial intelligence (AI) and machine learning, present significant opportunities for the KSA aerospace and defense biometrics market. AI-driven biometrics can improve the speed and accuracy of identification systems, providing enhanced security features in both military and commercial aerospace applications. In 2025, KSA invested heavily in AI research, with the AI research and development sector growing by ~%. This growth is expected to benefit biometric technologies, especially in areas like facial recognition, which can now be enhanced with AI for greater precision. As the adoption of AI-based biometric solutions becomes more prevalent, the opportunities for their application in KSA’s aerospace and defense sectors are expanding rapidly.

International Collaborations

International collaborations between KSA and leading global biometric technology providers represent a key opportunity for growth in the aerospace and defense sectors. KSA’s efforts to modernize its defense infrastructure under Vision 2030 are creating opportunities for foreign partnerships in the biometrics market. In 2024, KSA signed a strategic defense agreement with the US worth USD ~billion to enhance cybersecurity measures, including biometric systems for military applications. These collaborations provide KSA with access to cutting-edge technologies and expertise, accelerating the integration of advanced biometric systems into its defense operations. As KSA continues to prioritize defense modernization, partnerships with global biometrics leaders will further drive the market’s growth.

Future Outlook

Over the next six years, the KSA aerospace and defense biometrics market is expected to witness significant growth, primarily driven by increasing security concerns and the growing demand for secure, real-time identity verification solutions. As KSA continues to invest in defense and national security infrastructure, the role of biometrics will become more integral in ensuring the safety of military personnel, borders, and critical infrastructure. Additionally, advancements in biometrics technologies, such as AI-driven facial recognition and multimodal biometric systems, are set to provide more efficient and secure solutions for the KSA defense sector. The expansion of KSA’s defense collaborations and modernization projects will further fuel the demand for biometrics across various military and aerospace applications.

Major Players in the Market

- IDEMIA

- Thales Group

- NEC Corporation

- Safran Group

- Suprema Inc.

- HID Global

- Crossmatch

- ZKAccess

- Aware Inc.

- Panasonic Corporation

- Fujitsu Limited

- L3 Technologies

- Morpho

- Cognitec Systems

- Gemalto (now part of Thales)

Key Target Audience

- Government and Regulatory Bodies

- Investments and Venture Capitalist Firms

- Defense Contractors

- Military OEMs

- Law Enforcement Agencies

- Aerospace Companies

- Airport Authorities

Research Methodology

Step 1: Identification of Key Variables

In this initial phase, we identify and define the primary variables that influence the aerospace and defense biometrics market in KSA. We analyze the key stakeholders, including government agencies, defense contractors, OEMs, and cybersecurity providers. Desk research is employed to gather relevant data on market dynamics, adoption rates, and technological trends.

Step 2: Market Analysis and Construction

Here, we evaluate historical market trends and data, including penetration rates of biometric solutions in defense and aerospace sectors. We also analyze data related to government initiatives and security needs, integrating secondary data sources to provide a comprehensive view of the market’s growth trajectory.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and validated through expert consultations. We engage with defense experts, security agencies, and OEMs in KSA to understand practical insights on biometric system adoption and the challenges faced during implementation. These consultations help refine the market data and assumptions.

Step 4: Research Synthesis and Final Output

In this phase, we consolidate findings from various research methodologies, including expert consultations, secondary research, and interviews with key stakeholders in the KSA aerospace and defense sector. The final report is synthesized and validated with the help of industry experts to ensure accuracy and comprehensiveness.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, KSA-Specific Terminologies, Abbreviations, Market Sizing Logic, Bottom-Up & Top-Down Validation, Triangulation Framework, Primary Interviews Across Aerospace and Defense Biometrics Providers, Government Agencies, OEMs, and Industry Experts, Demand-Side & Supply-Side Weightage, Data Reliability Index, Limitations & Forward-Looking Assumptions)

- Definition and Scope of Aerospace and Defense Biometrics

- Market Genesis and Evolution Pathway

- KSA Aerospace and Defense Biometrics Industry Timeline

- Aerospace and Defense Biometrics Business Cycle

- Aerospace and Defense Biometrics Supply Chain & Value Chain Analysis

- Key Growth Drivers

Increasing National Security Threats and Biometric Adoption

Growing Demand for Secure Identification Systems

Strategic Government Investments in Defense Infrastructure

Technological Advancements in Biometric Solutions

- Market Challenges

Privacy Concerns and Ethical Implications

Integration Issues with Existing Systems

High Implementation and Maintenance Costs - Market Opportunities

Increasing Demand for Biometrics in Aviation Security

Integration of Biometrics for Autonomous Military Systems

Strategic Partnerships for Advanced Biometric Solutions - Key Trends

Biometric Integration in Military and Defense Applications

Adoption of AI and Machine Learning in Biometric Security

Rising Demand for Secure and Efficient Identity Management Systems - Governement Regulations

KSA National Security Regulations and Standards

Privacy and Data Protection Laws Impacting Biometric Systems

International Biometric Standards and Compliance (ISO, NIST) - SWOT Analysis

Strengths

Weaknesses

Opportunities

Threats - Porter’s Five Forces

- By Value, 2020-2025

- By Volume, 2020-2025

- By Average Price, 2020-2025

- By Product Type Adoption, 2020-2025

- By Product Type (In Value %)

Biometric Systems

Fingerprint Biometrics

Facial Recognition Systems

Iris Recognition Systems

Voice Recognition Systems

Multimodal Biometric Solutions - By Application (In Value %)

Military Security Applications

Border Control and Immigration

Aviation and Airport Security

Law Enforcement & Intelligence

Access Control for Facilities and Vehicles - By Technology Type (In Value %)

Fingerprint Recognition

Facial Recognition

Iris Scanning

Voice Biometrics

Behavioral Biometrics - By Deployment Type (In Value %)

On-Premise Solutions

Cloud-Based Solutions

Hybrid Solutions - By Region (In Value %)

Central Region

Eastern Region

Western Region

Southern Region

- Market Share Analysis

- Cross Comparison Parameters(Product Portfolio Breadth, Biometric System Efficiency and Security Features, Regulatory Approvals and Certifications, Distribution Footprint and Global Reach, Manufacturing & Localization Capabilities, R&D Investment and Technological Advancements, Strategic Partnerships and Collaborations)

- SWOT Analysis of Key Players

- Pricing Analysis

Pricing Trends for Different Biometric Technologies

Comparison of Prices Across Leading Biometrics Providers - Detailed Company Profiles

Thales Gr

IDEMIA

NEC Corporation

HID Global

Safran Group

Morpho

Suprema Inc.

Crossmatch

ZKAccess

Gemalto (now part of Thales)

Aware Inc.

Panasonic Corporation

L3 Technologies

Fujitsu Limited

Cognitec Systems

- Demand Pattern & Utilization Metrics

- Procurement Models & Purchasing Cycles for Biometrics Solutions

- Compliance & Certification Expectations

- Consumer Needs, Desires & Pain-Point Mapping

- Decision-Making Framework for Aerospace and Defense Buyers

- Cost vs. Security Prioritization

- By Value, 2026-2035

- By Volume, 2026-2035

- By Average Selling Price, 2026-2035

- By Technology and Deployment Type, 2026-2035