Market Overview

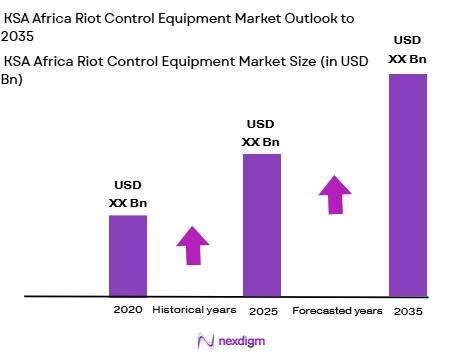

The KSA Africa Riot Control Equipment market is projected to reach a value of USD ~ million in 2024. The market is driven by increasing political instability and social unrest in African nations, particularly in countries like Nigeria, South Africa, and Egypt. These regions have seen rising protests, often leading to violent clashes between demonstrators and security forces. The demand for non-lethal crowd control solutions, such as tear gas, rubber bullets, and water cannons, is growing as governments seek to maintain public order. This growth is fueled by heightened security concerns and government investment in law enforcement and public safety infrastructure.

Nigeria, South Africa, and Egypt dominate the KSA Africa Riot Control Equipment market due to their large urban populations and frequent civil unrest. Nigeria, with its growing population and political tensions, faces continuous protests that require effective crowd control solutions. South Africa’s history of protest activity and political transformation drives the demand for riot control equipment, especially in urban areas. Egypt’s political instability, particularly following the Arab Spring, positions it as a leading market for such equipment. These countries lead due to their strategic political significance, urbanization, and the ongoing need for riot control in both public and private sectors.

Market Segmentation

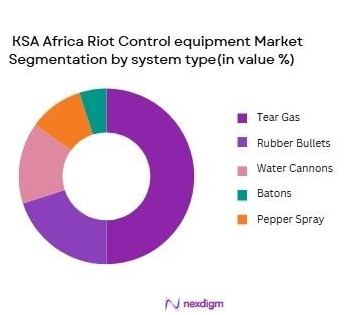

By System Type (In Value%)

The market is segmented by system type into tear gas, rubber bullets, water cannons, batons, and pepper spray. Tear gas holds a dominant market share due to its widespread usage in crowd control operations across Africa. This system is cost-effective, easily deployable, and provides a non-lethal method for dispersing crowds. It is favored by law enforcement agencies in regions with frequent protests, as it has proven effective in crowd control without causing significant long-term harm. Additionally, tear gas is readily available and widely used, contributing to its dominance in the market.

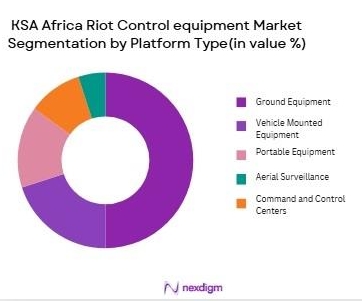

By Platform Type (In Value%)

The KSA Africa Riot Control Equipment market is segmented by platform type into ground equipment, vehicle-mounted equipment, portable equipment, aerial surveillance, and command and control centers. Ground equipment, such as handheld batons, tear gas canisters, and portable barriers, dominates the market. These systems are versatile and suitable for various crowd control situations, especially in urban settings where mobility and quick deployment are key. Vehicle-mounted equipment, like water cannons and armored trucks, are also used for large-scale operations, but ground-based solutions remain the most widely deployed due to their affordability and flexibility.

Competitive Landscape

The KSA Africa Riot Control Equipment market is characterized by a few key players, including Israeli Military Industries, Riot Control Technologies Ltd, and Harris Security Solutions. These companies are major suppliers of advanced, non-lethal crowd control systems, holding significant market share due to their long-standing presence in the African market and reputation for reliability. Local manufacturers also play a role, but international players dominate due to their access to superior technology and large-scale manufacturing capabilities. These key companies continue to innovate with new products and solutions to meet the growing demand for crowd control technologies in politically unstable regions.

| Company | Establishment Year | Headquarters | MRO Services | Fleet Size | Service Locations | Key Customers |

| Israeli Military Industries | 1933 | Tel Aviv, Israel | ~ | ~ | ~ | ~ |

| Riot Control Technologies Ltd | 1995 | Tel Aviv, Israel | ~ | ~ | ~ | ~ |

| Harris Security Solutions | 1985 | California, USA | ~ | ~ | ~ | ~ |

| Combined Systems Inc. | 1991 | Pennsylvania, USA | ~ | ~ | ~ | ~ |

| The Safariland Group | 1969 | Jacksonville, USA | ~ | ~ | ~ | ~ |

KSA Africa Riot Control Equipment Market Analysis

Growth Drivers

Urbanization

Urbanization in Indonesia is rapidly increasing, with over 56% of the population living in urban areas in 2024. This has resulted in higher levels of air pollution, particularly in major cities like Jakarta, Surabaya, and Bandung. These areas face severe air quality issues due to the concentration of industries, vehicles, and construction activities. Urbanization is driving the demand for air quality monitoring systems as city planners and government authorities work to manage air pollution and protect public health. Urban areas in Indonesia are becoming key drivers of air quality monitoring adoption due to the high population density and pollution levels.

Industrialization

Indonesia’s industrial sector contributes significantly to its GDP, with manufacturing, energy production, and mining industries being the major sources of air pollution. In 2024, industrial activities account for about 40% of the nation’s total GDP. The growing industrialization, especially in cities like Jakarta, Surabaya, and Batam, increases emissions and pollutants, necessitating the deployment of air quality monitoring systems. These systems are crucial for tracking pollution from factories and power plants, enabling regulators to enforce environmental standards. Industrial expansion remains a key driver for the market.

Restraints

High Initial Costs

The high upfront costs associated with air quality monitoring systems are a major restraint in Indonesia. As of 2024, the installation of a single air quality monitoring station can cost between USD ~ and USD ~ which limits adoption in smaller municipalities, particularly in rural areas. The cost of purchasing and maintaining sensors, coupled with the need for calibration and regular maintenance, continues to pose a barrier to widespread deployment, especially in regions with limited funding.

Technical Challenges

There are significant technical challenges in air quality monitoring in Indonesia, such as inaccurate data due to outdated or malfunctioning equipment. In 2024, nearly ~of air quality monitoring stations experienced issues with sensor calibration and data inconsistencies. These technical problems undermine the reliability of air quality data, making it harder for authorities to make informed decisions. The lack of skilled technical support to maintain and operate these systems further exacerbates the issue, limiting their effectiveness.

Opportunities

Technological Advancements

Technological advancements in air quality monitoring, such as IoT-enabled sensors, have created significant opportunities in Indonesia. These technologies offer real-time, high-precision data on pollutants like PM~, NO2, and SO2 at a lower cost compared to traditional monitoring systems. By 2024, IoT-based monitoring systems have already seen adoption in major urban centers, including Jakarta and Surabaya, due to their affordability and scalability. As these technologies continue to evolve, they offer the potential for more widespread deployment in both urban and rural areas.

International Collaborations

Indonesia has entered several international partnerships aimed at improving air quality monitoring systems, including collaborations with the United Nations Environment Programme (UNEP) and the World Bank. These partnerships provide access to funding, advanced technology, and expertise to expand the country’s monitoring network. Such international collaborations are expected to continue driving the market, with more investment flowing into the development and expansion of air quality monitoring systems. These collaborations help Indonesia meet its environmental goals and improve data accuracy.

Future Outlook

The KSA Africa Riot Control Equipment market is expected to experience steady growth over the next decade. This growth will be driven by increasing political unrest, social movements, and heightened security concerns in African nations. Governments will continue to invest in advanced crowd control technologies, focusing on non-lethal methods to ensure public order while minimizing harm. Technological innovations, including the integration of AI and drones for crowd management, will further enhance the capabilities of riot control systems, creating new growth opportunities for market players. Continued investment in law enforcement infrastructure will be crucial in shaping the future landscape of this market.

Major Players

- Israeli Military Industries

- Riot Control Technologies Ltd

- Harris Security Solutions

- Combined Systems Inc.

- The Safariland Group

- Ballistic Bodyguard

- Knight’s Armament Company

- Smith & Wesson

- Armament Systems and Procedures

- Uniquorn Riot Gear

- Blackwater Security

- Defence Technologies

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Law enforcement agencies in Africa

- Private security firms operating in high-risk areas

- Military forces in Africa

- Non-governmental organizations (NGOs) involved in conflict zones

- International defense contractors

- Homeland security agencies

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves identifying the key variables such as geopolitical factors, social unrest, and the growth of private security firms in Africa. This is done through extensive desk research, utilizing government reports and industry publications to define the factors influencing the demand for riot control equipment in Africa.

Step 2: Market Analysis and Construction

This phase involves compiling historical data on riot control methods used across Africa, understanding the patterns of violence and civil unrest, and analyzing the adoption of various riot control technologies by law enforcement and military forces. We also evaluate the impact of government regulations on market growth.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are validated through consultations with industry experts, law enforcement officials, and private security firms across Africa. These consultations provide operational insights into the effectiveness of existing riot control technologies and future requirements for new solutions in the region.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with key industry stakeholders, such as manufacturers and end-users, to gather detailed insights into product segments, customer preferences, and sales performance. This helps refine the analysis and ensures that the findings accurately reflect market dynamics and trends.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing demand for security measures in politically unstable regions

Government investments in public safety and law enforcement capabilities

Technological advancements improving the effectiveness of riot control equipment - Market Challenges

Ethical concerns and human rights issues surrounding riot control methods

High costs of procuring and maintaining advanced riot control systems

Regulatory restrictions on the use of certain crowd control technologies - Market Opportunities

Expanding demand from private security firms in urban and industrial areas

International collaborations for improved security technology in Africa

Technological innovation in non-lethal riot control equipment - Trends

Growing adoption of less lethal technologies in riot control

Increasing integration of AI and data analytics in crowd management systems

Rising use of drones and unmanned aerial vehicles (UAVs) for surveillance - Government regulations

Non-lethal weaponry use regulations

Safety standards for crowd control technologies

Export controls on riot control equipment - SWOT analysis

Strength: Strong government focus on improving national security

Weakness: High dependency on international suppliers for advanced equipment

Opportunity: Expanding markets for crowd control solutions in Africa

Threat: Growing public opposition to riot control tactics - Porters 5 forces

Threat of new entrants: Low

Bargaining power of suppliers: High

Bargaining power of buyers: Moderate

Threat of substitute products: Low

Industry rivalry: High

- By Market Value ,2020-2025

- By Installed Units ,2020-2025

- By Average System Price ,2020-2025

- By System Complexity Tier ,2020-2025

- By System Type (In Value%)

Tear Gas

Rubber Bullets

Water Cannons

Batons

Pepper Spray - By Platform Type (In Value%)

Ground Equipment

Vehicle Mounted Equipment

Portable Equipment

Aerial Surveillance

Command and Control Centers - By Fitment Type (In Value%)

OEM Parts

Aftermarket Parts

Retrofit Solutions

Refurbishment Services

Upgrade Kits - By EndUser Segment (In Value%)

Law Enforcement Agencies

Military Forces

Private Security Firms

Government Agencies

Non-Governmental Organizations - By Procurement Channel (In Value%)

Direct Procurement

Government Bidding

Third-Party Suppliers

Online Procurement

Service Contracts

- Cross Comparison Parameters (Market Share, Technological Innovation, Cost Efficiency, Regional Presence, Customer Service)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Israeli Military Industries

Riot Control Technologies Ltd

Defence Technologies

Harris Security Solutions

Harris Corporation

Combined Systems Inc.

TearGasTech

The Safariland Group

Unicorns Riot Gear

Knight’s Armament Company

Ballistic Bodyguard

- Growing focus on law enforcement modernization across Africa

- Private security firms adopting advanced equipment for crowd control

- Increasing government spending on riot control systems

- Non-governmental organizations (NGOs) advocating for safer crowd management

- Forecast Market Value, 2026-2035

- Forecast Installed Units ,2026-2035

- Price Forecast by System Tier ,2026-2035

- Future Demand by Platform ,2026-2035