Market Overview

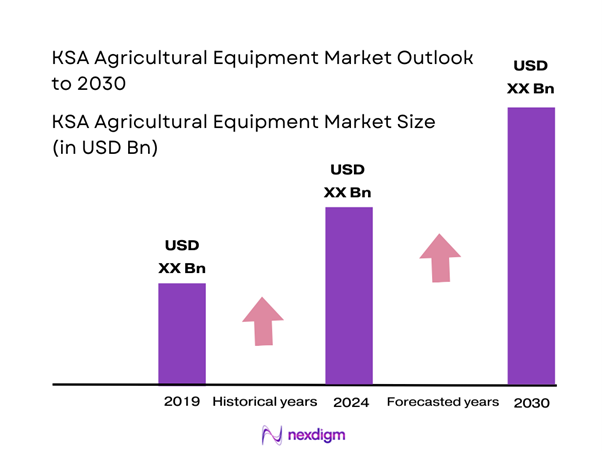

The KSA Agricultural Equipment Market is valued at USD 1.68 billion in 2024 with an approximated compound annual growth rate (CAGR) of 3% from 2024-2030, based on a five-year historical analysis. This significant market size is primarily driven by increased agricultural productivity demands due to the growing population and governmental efforts to achieve food security. The Kingdom’s Vision 2030 initiative promotes innovation and investment in sustainable agriculture, thus enhancing the market’s appeal and growth potential as it focuses on reducing dependence on food imports.

Saudi Arabia’s agricultural equipment market is dominated by central and eastern regions, primarily around cities like Riyadh, Jeddah, and Dammam. These areas exhibit a strong agricultural base due to favorable government policies and infrastructure development. Additionally, the eastern region’s proximity to major ports facilitates the import of advanced agricultural technologies, contributing to its dominance in the market.

Technological advancements are reshaping the agricultural landscape in Saudi Arabia, driving increased adoption of modern equipment. The penetration of smart technologies in agriculture, such as IoT and machine learning, is enhancing productivity. As reported by the Arab Authority for Agricultural Investment and Development, investments in agricultural technology are expected to exceed SAR 6 billion (approximately USD 1.6 billion) in the current period.

Market Segmentation

By Equipment Type

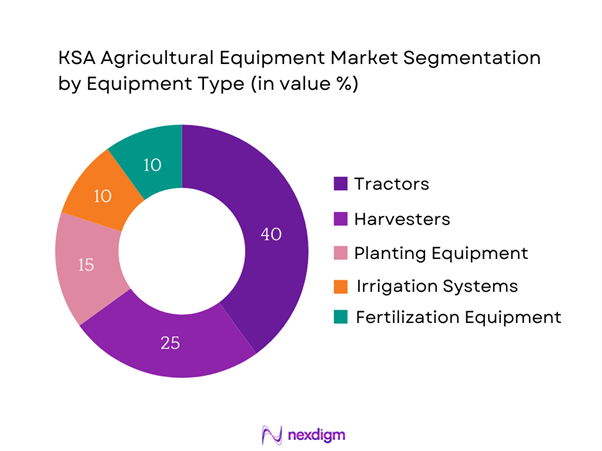

The KSA Agricultural Equipment Market is segmented by equipment type into tractors, harvesters, planting equipment, irrigation systems, and fertilization equipment. Among these, tractors hold a dominant market share due to their versatility and essential role in modern farming practices. Their ability to perform various tasks from tilling to planting makes them indispensable for improving agricultural efficiency. Furthermore, the increasing adoption of advanced features in tractors, such as GPS technology and automation, enhances productivity and attracts farmers looking for efficiency. As a result, tractors continue to lead the market segment significantly.

By Application

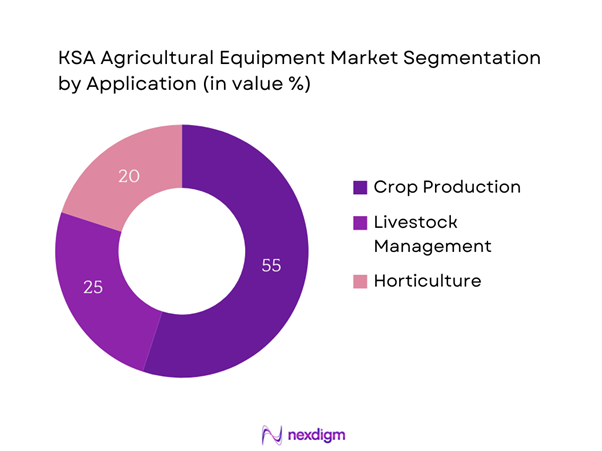

The market is also segmented by application into crop production, livestock management, and horticulture. The crop production segment dominates the market share due to the strong emphasis on increasing cereal production and improving yield efficiency. This is driven by the growing demand for food amidst population growth and the need for self-sufficiency in food production. Additionally, the application of modern farming techniques and the rise of large-scale agribusiness contribute to the growth of crop production, solidifying its position as the leading application segment in KSA’s agricultural equipment market.

Competitive Landscape

The KSA Agricultural Equipment Market is characterized by the presence of several key players, including multinational corporations and local manufacturers. Major brands like John Deere, AGCO Corporation, and Kubota dominate the industry landscape, leveraging their extensive distribution networks and strong brand equity. The competitive environment is shaped by continuous innovation, product differentiation, and strategic partnerships, highlighting the players’ significant influence in shaping trends and market dynamics.

| Company Name | Establishment Year | Headquarters | Product Portfolio | Market Position | R&D Investments | Distribution Channels | Customer Base |

| John Deere | 1837 | Moline, Illinois, USA | – | – | – | – | – |

| AGCO Corporation | 1990 | Duluth, Georgia, USA | – | – | – | – | – |

| Kubota Corporation | 1890 | Osaka, Japan | – | – | – | – | – |

| CLAAS KGaA mbH | 1913 | Harsewinkel, Germany | – | – | – | – | – |

| Mahindra & Mahindra | 1945 | Mumbai, India | – | – | – | – | – |

KSA Agricultural Equipment Market Analysis

Growth Drivers

Agricultural Policy Reforms

Saudi Arabia is experiencing a significant shift in agricultural policy aimed at enhancing food security and agricultural development. The government has allocated SAR 50 billion (approximately USD 13.3 billion) specifically for agricultural projects under its Vision 2030 initiative. According to the Ministry of Environment, Water, and Agriculture, these reforms include developing sustainable farming practices and improving land and water use efficiency, thereby promoting access to modern agricultural equipment.

Rising Food Demand

The increasing population in Saudi Arabia, projected to reach around 38 million by end of 2025, fuels robust demand for food products. In line with World Bank statistics, food consumption in Saudi Arabia is expected to grow from 2.5 million metric tons in 2022 to 3.1 million metric tons by end of 2025. The rapid urbanization in cities like Riyadh and Jeddah, accompanied by changing dietary preferences towards higher-quality and diverse food products, puts additional pressure on the agricultural sector to meet this rising demand. Hence, farmers are more inclined to invest in modern agricultural equipment to enhance yield and quality.

Market Challenges

High Cost of Equipment

The agricultural sector in Saudi Arabia faces a significant challenge due to the high cost of modern agricultural equipment, which can be a barrier for farmers, particularly smallholders. For instance, the average cost of a new tractor ranges from SAR 150,000 to SAR 500,000 (approximately USD 40,000 to USD 133,000), which is often prohibitive for many local farmers. This high initial investment not only limits the purchase of necessary equipment but also hinders advancements in agricultural practices, as many farmers resort to outdated equipment. Consequently, this issue must be addressed to enable widespread enhancement in agricultural productivity.

Limited Access to Financing

Access to financing remains one of the primary challenges in the KSA Agricultural Equipment Market. According to a report by the International Monetary Fund, around 30% of Saudi farmers report difficulty in obtaining financing due to stringent lending requirements and the perceived risks in the agricultural sector. This limited access hampers farmers’ ability to invest in modern agricultural machinery, impacting productivity and operational efficiency. Innovative financing solutions and government support initiatives will be crucial in overcoming this challenge and empowering farmers to upgrade their equipment.

Opportunities

Growth in Precision Farming

The demand for precision farming in Saudi Arabia is gaining traction, offering significant growth opportunities for the agricultural equipment market. The adoption of precision agriculture techniques enables farmers to optimize input usage, thus improving crop yields while minimizing costs. Current studies indicate that precision farming technologies, including soil moisture sensors, GPS-guided equipment, and data analytics platforms, can lead to yield increases of up to 20%, according to the Food and Agriculture Organization (FAO). As farmers increasingly recognize the benefits of these innovative solutions, investment in precision farming equipment is likely to surge, making it a pivotal area for future growth in the sector.

Adoption of Smart Farming Technologies

Smart farming technologies, such as IoT devices and drone applications, present considerable opportunities for enhancing agricultural productivity in Saudi Arabia. By integrating these technologies into farm operations, farmers can gather critical data on crop health, soil conditions, and resource usage. The Saudi Arabian government is actively supporting the development of smart farming initiatives, with funding exceeding SAR 3 billion (approximately USD 800 million) allocated for technological innovations in agriculture. This dynamic environment encourages investment in smart farming equipment, allowing for improved resource management and increased operational efficiency to meet the growing food demand.

Future Outlook

Over the next five years, the KSA Agricultural Equipment Market is expected to witness substantial growth driven by continuous government support for agricultural initiatives, advancements in farming technologies, and the increasing emphasis on food security. The integration of smart farming solutions and sustainable practices will further enhance productivity, allowing farmers to meet rising food demands efficiently. It is anticipated that innovations in mechanization and precision farming will transform the agricultural landscape in Saudi Arabia, leading to improved outcomes and profitability for both small and large-scale operations.

Major Players

- John Deere

- AGCO Corporation

- Kubota Corporation

- CLAAS

- Mahindra & Mahindra

- CNH Industrial

- Same Deutz-Fahr

- Trelleborg Wheel Systems

- Yanmar Co., Ltd.

- Trimble Inc.

- JCB

- Berthold Technologies

- Doosan Infracore

- Valtra

- Sampo Rosenlew

Key Target Audience

- Government and Regulatory Bodies (Ministry of Environment, Water, and Agriculture)

- Investors and Venture Capitalist Firms

- Agricultural Cooperatives

- Large-scale Farm Owners

- Agricultural Machinery Distributors

- Agribusiness Companies

- Farming Equipment Procurement Managers

- Agricultural Technology Startups

Research Methodology

Step 1: Identification of Key Variables

This initial phase entails developing a comprehensive ecosystem map that features all significant stakeholders in the KSA Agricultural Equipment Market. This step relies heavily on extensive desk research, making use of secondary data and proprietary databases to gather detailed industry-level information. The primary goal here is to identify and define crucial variables that can significantly influence market trends and dynamics.

Step 2: Market Analysis and Construction

During this phase, we gather and analyze historical data related to the KSA Agricultural Equipment Market. This analysis covers market penetration rates, the ratio of suppliers to service providers, and subsequent revenue generation. Additionally, quality metrics and other service-related statistics will be scrutinized to ensure the validity and reliability of our revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

The development of market hypotheses will occur alongside thorough validation through structured expert consultations, including computer-assisted telephone interviews (CATIs) with industry practitioners. By engaging individuals from various sectors within the market, we observe a wide range of insights that help refine and substantiate our market data and conclusions.

Step 4: Research Synthesis and Final Output

In this final stage, direct dialogues with several major agricultural equipment manufacturers allow us to procure invaluable insights concerning product segments, sales performance, consumer trends, and other relevant dimensions. These interactions will serve a dual purpose: confirming statistics derived from our previous analyses and enhancing the overall validity and comprehensiveness of our insights into the KSA Agricultural Equipment Market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Market Genesis and Dynamics

- Market Trends and Evolution

- Supply Chain and Value Chain Analysis

- Growth Drivers

Increasing Agricultural Productivity

Government Initiatives and Subsidies

Technological Advancements - Market Challenges

High Initial Investment Costs

Regulatory Compliance Challenges - Opportunities

Adoption of Sustainable Practices

Growing Interest in Smart Farming Solutions - Trends

Shift Towards Mechanization

Innovations in Equipment Design - Government Regulation

Import Tariffs and Duties

Safety Standards Guidelines - SWOT Analysis

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Equipment Type (In Value %)

Tractors

– Below 40 HP

– 40–100 HP

– Above 100 HP

Harvesters

– Combine Harvesters

– Forage Harvesters

– Sugarcane and Date Harvesters

– Self-propelled vs. Tractor-mounted Harvesters

Planting Equipment

– Seed Drills

– Planters

– Transplanters

– Pneumatic Planters

Irrigation Systems

– Drip Irrigation Systems

– Sprinkler Irrigation Systems

– Center Pivot Irrigation Systems

– Smart Irrigation Controllers

Fertilization Equipment

– Fertilizer Spreaders (broadcast, drop)

– Liquid Fertilizer Applicators

– Precision Nutrient Applicators

– Tractor-Mounted vs. Self-Propelled Units - By Application (In Value %)

Crop Production

– Cereal Grains

– Vegetables

– Fruits

– Fodder Crops

Livestock Management

– Milking Systems

– Feed Mixing and Distribution Equipment

– Manure Handling Equipment

– Barn and Stable Cleaning Machinery

Horticulture

– Equipment for greenhouse operations (tillers, sprayers)

– Pruning and Cutting Tools

– Irrigation and Misting Systems

– Transplanters and nursery management tools - By Technology (In Value %)

Traditional Farming Equipment

– Basic tractors and mechanical tools

– Manual seeders and tillers

– Gravity-based irrigation systems

Precision Agriculture

– GPS-guided tractors and harvesters

– Variable Rate Technology (VRT) in fertilization

– Soil and moisture sensors

– Drones for crop spraying and aerial analysis

Autonomous Equipment

– Self-driving tractors

– Robotic harvesters

– AI-powered irrigation and nutrient delivery systems

– Unmanned Aerial Vehicles (UAVs) for data collection - By Region (In Value %)

Central Region

Eastern Region

Western Region

Southern Region - By End-User (In Value %)

Commercial Farmers

Subsistence Farmers

Agricultural Cooperatives

- Market Share of Major Players on the Basis of Value/Volume, 2024

Market Share of Major Players by Type of Agricultural Equipment Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strengths and Weaknesses, Revenues, Financial KPIs, Distribution Network, Product Range, Customer Feedback / Satisfaction Index, Innovation Capability, Segment Margins, Production Plant & Capacity, Unique Value offering, Others)

- SWOT Analysis of Major Players

- Detailed Profiles of Major Companies

Al-Jazeera Agricultural Equipment Company

Al-Babtain Group

Al-Fahad Trading & Contracting

Al-Soor Agro

ALOHA Agricultural Solutions

Gulf Agricultural Company

Harsco Infrastructure

Al-Hamrani Company

Westcoast Agriculture

KSA Machinery Co.

NorthStar Agricultural Technologies

Wadi Agricultural Solutions

Greenfield Agriculture

Omni Agriculture

Saudi Agricultural Equipment Co.

- Market Demand and Utilization Patterns

- Purchasing Trends and Budget Allocations

- Regulatory Compliance Needs

- Decision-Making Process in Equipment Purchasing

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030