Market Overview

The KSA AI Algorithms in Healthcare market was valued at USD ~ million based on a recent historical assessment, driven by accelerated digital health adoption, large-scale hospital modernization programs, and rising integration of artificial intelligence into diagnostics, clinical decision support, and administrative workflows. Strong government funding under national health transformation initiatives, combined with growing private sector investment, has supported rapid deployment of machine learning, computer vision, and natural language processing solutions across hospitals, diagnostic centers, and payer systems, reinforcing sustained demand for advanced healthcare algorithms.

Riyadh and Jeddah dominate the KSA AI Algorithms in Healthcare market due to their concentration of tertiary care hospitals, national research institutions, and centralized healthcare administration bodies. These cities host major public healthcare clusters and private hospital networks that act as early adopters of AI-driven diagnostics and analytics. The Kingdom overall leads regional adoption due to strong regulatory backing, centralized health data programs, and national-scale digital infrastructure, enabling faster validation and deployment of clinical AI algorithms compared to neighboring markets.

Market Segmentation

By Product Type

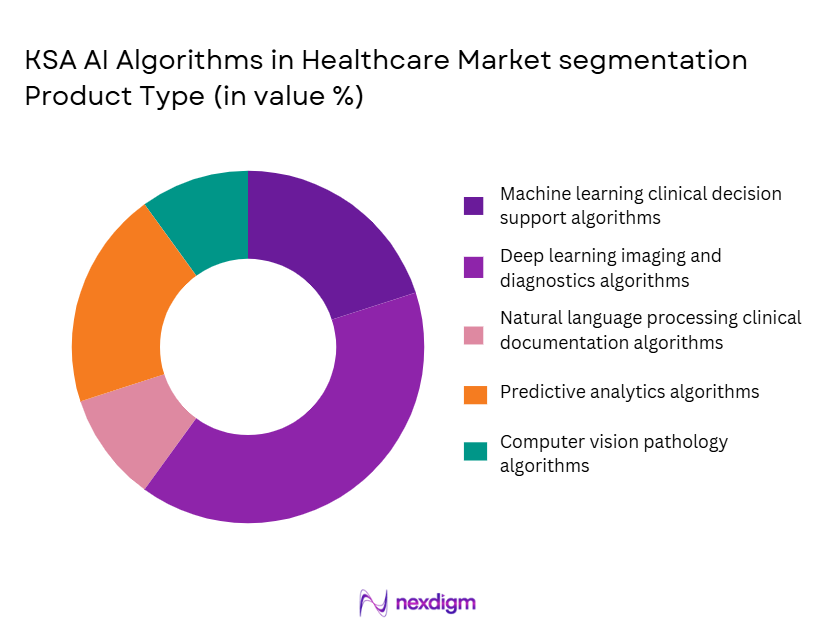

The KSA AI Algorithms in Healthcare market is segmented by product type into machine learning clinical decision support algorithms, deep learning imaging algorithms, natural language processing clinical documentation algorithms, predictive analytics algorithms, and computer vision pathology algorithms. Recently, deep learning imaging and diagnostics algorithms have held a dominant market share due to high demand for radiology and pathology automation, strong clinical validation, and immediate impact on diagnostic accuracy and workflow efficiency. Public and private hospitals prioritize imaging AI because radiology departments face high patient volumes and specialist shortages. The availability of large annotated imaging datasets and regulatory clarity for imaging software further supports adoption. Additionally, integration with existing PACS systems has reduced deployment complexity, reinforcing sustained dominance across major healthcare facilities.

By End User

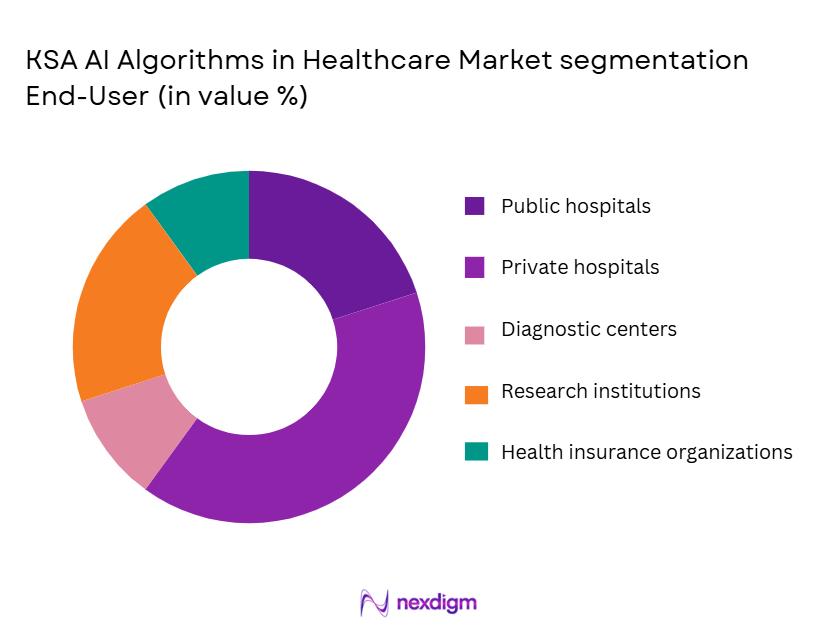

The KSA AI Algorithms in Healthcare market is segmented by end user into public hospitals, private hospitals, diagnostic centers, research institutions, and health insurance organizations. Recently, public hospitals have maintained a dominant market share due to centralized procurement, large patient volumes, and direct alignment with national digital health initiatives. Government hospitals are primary beneficiaries of state-funded AI programs aimed at improving care quality and operational efficiency. Their scale enables faster algorithm training and validation using diverse patient data. Additionally, public hospitals often serve as pilot sites for national AI deployments, accelerating adoption compared to smaller private providers and reinforcing their leadership position.

Competitive Landscape

The KSA AI Algorithms in Healthcare market is moderately consolidated, with global technology providers and specialized healthcare AI firms exerting strong influence through advanced algorithms, regulatory readiness, and integration capabilities. Large multinational companies dominate core hospital deployments, while niche AI vendors focus on imaging, analytics, and clinical workflow optimization, creating a competitive environment shaped by partnerships, localization strategies, and long-term government contracts.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Regional Integration Capability |

| IBM Watson Health | 2015 | United States | ~

|

~

|

~

|

~

|

~

|

| Philips Healthcare | 1891 | Netherlands | ~

|

~

|

~

|

~

|

~

|

| GE HealthCare | 1994 | United States | ~

|

~

|

~

|

~

|

~

|

| Siemens Healthineers | 1847 | Germany | ~

|

~

|

~

|

~

|

~

|

| Oracle Health | 1977 | United States | ~

|

~

|

~

|

~

|

~

|

KSA AI Algorithms in Healthcare Market Analysis

Growth Drivers

National Digital Health Transformation Programs

National digital health transformation programs continue to drive expansion of the KSA AI Algorithms in Healthcare market by embedding artificial intelligence into core healthcare infrastructure and service delivery models across the Kingdom. These programs prioritize interoperable data platforms, centralized health records, and AI-enabled analytics to improve clinical outcomes and system efficiency. Large-scale government funding ensures sustained demand for advanced algorithms across public hospitals and national health systems. Integration mandates encourage providers to adopt AI for diagnostics, triage, and resource optimization. Regulatory support accelerates approvals and reduces deployment risks for vendors. Public sector leadership also stimulates private sector participation. Long-term strategic planning aligns AI adoption with population health objectives. This coordinated ecosystem approach reinforces stable growth conditions for healthcare AI algorithms nationwide.

Rising Demand for Diagnostic Accuracy and Efficiency

Rising demand for diagnostic accuracy and operational efficiency is a major driver shaping adoption of AI algorithms across Saudi healthcare facilities. Growing patient volumes and chronic disease prevalence place pressure on clinicians to deliver faster and more precise diagnoses. AI-driven imaging and predictive analytics help reduce diagnostic errors and turnaround times. Hospitals increasingly rely on algorithms to support clinical decision-making and workflow automation. Specialist shortages further intensify reliance on intelligent diagnostic tools. Improved accuracy strengthens clinician trust in AI systems. Demonstrated efficiency gains support broader institutional adoption. This demand-side pressure ensures continued investment in advanced healthcare algorithms.

Market Challenges

Healthcare Data Privacy and Governance Constraints

Healthcare data privacy and governance constraints present a significant challenge for the KSA AI Algorithms in Healthcare market by limiting data accessibility and algorithm training. Strict national regulations govern patient data usage, storage, and cross-border transfer. Compliance requirements increase implementation complexity for AI vendors. Hospitals often face internal approval delays for data sharing initiatives. Limited access to large, diverse datasets can reduce algorithm performance. Governance frameworks require continuous monitoring and audits. Smaller providers struggle to meet compliance costs. These factors collectively slow deployment timelines and increase operational risk.

Integration Complexity with Legacy Healthcare Systems

Integration complexity with legacy healthcare systems restricts seamless deployment of AI algorithms across existing hospital infrastructure. Many facilities operate heterogeneous IT environments with outdated systems. Compatibility issues increase customization requirements. Integration projects often demand significant time and technical resources. Disruptions to clinical workflows raise adoption resistance among staff. Data standardization challenges limit real-time analytics. Vendor coordination becomes more complex in multi-system environments. These barriers constrain scalability of AI solutions across the healthcare network.

Opportunities

Expansion of AI-Driven Preventive and Population Health Solutions

Expansion of AI-driven preventive and population health solutions offers significant opportunity for the KSA AI Algorithms in Healthcare market by shifting focus from reactive to proactive care. National health strategies emphasize early detection and chronic disease management. AI analytics can identify population-level risk patterns. Preventive insights reduce long-term treatment costs. Integration with national health records enhances predictive accuracy. Government backing supports large-scale deployment. Providers benefit from improved care planning. This creates new revenue streams for AI vendors.

Localization of AI Algorithms for Regional Clinical Needs

Localization of AI algorithms for regional clinical needs represents a major opportunity to enhance adoption and effectiveness across Saudi healthcare systems. Disease prevalence patterns differ from global averages. Arabic language processing improves clinical documentation accuracy. Cultural and demographic tailoring increases clinician acceptance. Local validation strengthens regulatory compliance. Partnerships with regional hospitals improve dataset relevance. Customized solutions outperform generic models. This differentiation supports competitive advantage for localized AI providers.

Future Outlook

The KSA AI Algorithms in Healthcare market is expected to experience sustained expansion over the next five years, supported by continued government investment, regulatory clarity, and growing clinical reliance on data-driven decision-making. Advancements in imaging AI, predictive analytics, and interoperable health platforms will drive deeper integration across care pathways. Regulatory support for digital health innovation and rising demand for efficiency and accuracy are expected to reinforce long-term growth momentum.

Major Players

- IBM Watson Health

- Philips Healthcare

- GE HealthCare

- Siemens Healthineers

- Oracle Health

- Microsoft Healthcare AI

- Google Health

- NVIDIA Healthcare AI

- Tempus

- Aidoc

- Arterys

- Paige AI

- Zebra Medical Vision

- Corti

- Qure.ai

Key Target Audience

- Hospitals and healthcare providers

- Diagnostic and imaging centers

- Health insurance companies

- Medical device manufacturers

- Digital health startups

- Pharmaceutical companies

- Investments and venture capitalist firms

- Government and regulatory bodies

Research Methodology

Step 1: Identification of Key Variables

Key market variables including technology adoption, regulatory frameworks, healthcare spending, and provider demand were identified to establish the analytical foundation.

Step 2: Market Analysis and Construction

Data from government sources, healthcare institutions, and industry publications were analyzed to construct market structure and segmentation.

Step 3: Hypothesis Validation and Expert Consultation

Findings were validated through expert interviews with healthcare IT professionals and clinical AI specialists operating in the region.

Step 4: Research Synthesis and Final Output

Validated insights were synthesized into a structured report ensuring consistency, accuracy, and relevance for strategic decision-making.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Rising adoption of digital health and hospital automation initiatives

Government backed investments in health AI and data infrastructure

Increasing clinical workload and demand for decision support automation - Market Challenges

Data privacy compliance and patient data security constraints

Limited availability of high quality localized healthcare datasets

Integration complexity with legacy hospital IT systems - Market Opportunities

Expansion of AI driven diagnostics in secondary and tertiary care

Localization of algorithms for Arabic language and regional disease profiles

Public private collaborations for national AI healthcare platforms - Trends

Shift toward explainable and transparent AI algorithms

Growing use of AI in population health and preventive care

Increased cloud deployment of clinical AI solutions - Government Regulations

Saudi Health Information Exchange compliance requirements

Medical device software and AI algorithm regulatory approvals

National data residency and cybersecurity regulations

- By Market Value 2019-2025

- By Installed Units 2019-2025

- By Average System Price 2019-2025

- By System Complexity Tier 2019-2025

- By System Type (In Value%)

Machine learning based clinical decision support algorithms

Deep learning imaging and diagnostics algorithms

Natural language processing for clinical documentation

Predictive analytics and risk stratification algorithms

Computer vision algorithms for pathology and radiology - By Platform Type (In Value%)

Hospital information system integrated AI platforms

Cloud based AI healthcare analytics platforms

Standalone diagnostic AI software platforms

AI enabled telehealth and remote monitoring platforms

Embedded AI platforms for medical devices - By Fitment Type (In Value%)

New deployment in greenfield healthcare facilities

Retrofit integration with existing IT infrastructure

API based integration with legacy hospital systems

On device embedded AI algorithm fitment

Hybrid on premise and cloud AI fitment - By EndUser Segment (In Value%)

Public hospitals and government healthcare facilities

Private multispecialty hospitals

Diagnostic imaging and pathology centers

Research institutes and academic medical centers

Health insurance and payer organizations - By Procurement Channel (In Value%)

Direct procurement from AI solution providers

Government tenders and national digital health programs

System integrator and IT service provider contracts

Strategic partnerships with healthcare OEMs

Subscription based cloud marketplace procurement

- Market Share Analysis

- CrossComparison Parameters (Algorithm accuracy and validation level, Integration compatibility, Regulatory readiness, Data security architecture, Scalability and deployment flexibility)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Key Players

IBM Watson Health

Philips Healthcare Informatics

GE HealthCare AI Solutions

Siemens Healthineers Digital Health

Oracle Health

Microsoft Healthcare AI

Google Health

NVIDIA Healthcare AI

Tempus

Aidoc

Arterys

Paige AI

Zebra Medical Vision

Corti

Qure.ai

- Hospitals prioritize AI for workflow efficiency and diagnostic accuracy

- Diagnostics centers focus on imaging and pathology automation

- Payers use AI for fraud detection and utilization management

- Research institutions adopt AI for clinical trials and genomics analysis

- Forecast Market Value 2026-2030

- Forecast Installed Units 2026-2030

- Price Forecast by System Tier 2026-2030

- Future Demand by Platform 2026-2030