Market Overview

KSA AI in Clinical Decision Support Market is valued at USD ~ million. The market has moved beyond experimental deployments into a structurally embedded layer of clinical operations across hospitals and advanced care settings. Demand is driven by the need to improve diagnostic accuracy, reduce clinical variability, and support evidence-based decision-making in an increasingly complex disease environment. AI-driven decision support is being integrated into radiology, pathology, emergency care, and chronic disease management workflows where data volume and decision criticality are high. Structural demand is reinforced by national healthcare digitalization programs, rising patient loads in tertiary facilities, and the requirement to standardize care quality across public and private providers. As healthcare delivery in the country becomes more data-intensive, AI systems are increasingly viewed as core clinical infrastructure rather than optional productivity tools.

Adoption is concentrated in the Central and Western regions of the country, led by Riyadh, Jeddah, and Makkah, due to the presence of large tertiary hospitals, academic medical centers, and nationally funded reference institutions. These regions dominate because they handle the most complex cases, attract specialist talent, and receive priority funding for advanced digital health programs. Major global vendors exert strong influence through mature AI platforms, validated clinical algorithms, and deep EMR integration capabilities, while domestic and regional technology firms play a growing role in system integration, localization, and Arabic-language clinical workflows. This combination creates a hybrid ecosystem where global technology leadership is adapted to local clinical and regulatory requirements.

Market Segmentation

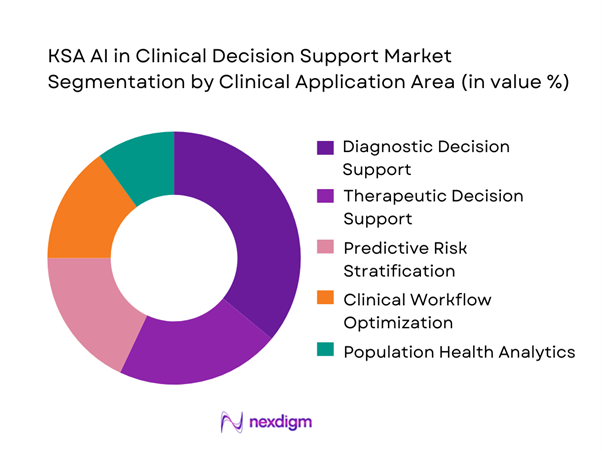

By Clinical Application Area

Clinical decision support adoption in KSA is dominated by diagnosis support solutions, as healthcare providers prioritize accuracy, early detection, and reduction of diagnostic variability across high-burden disease categories. Diagnostic AI tools are widely implemented in radiology, pathology, and cardiology, where data density and standardized imaging or test inputs enable reliable algorithmic interpretation. These systems support clinicians by flagging abnormalities, prioritizing cases, and providing differential diagnosis suggestions, thereby improving turnaround times and clinical confidence. Public hospitals and tertiary care centers drive dominance due to high imaging volumes and national initiatives to standardize diagnostic quality across regions. Diagnosis-focused AI also benefits from clearer clinical validation pathways compared to therapeutic recommendations, accelerating trust and institutional adoption.

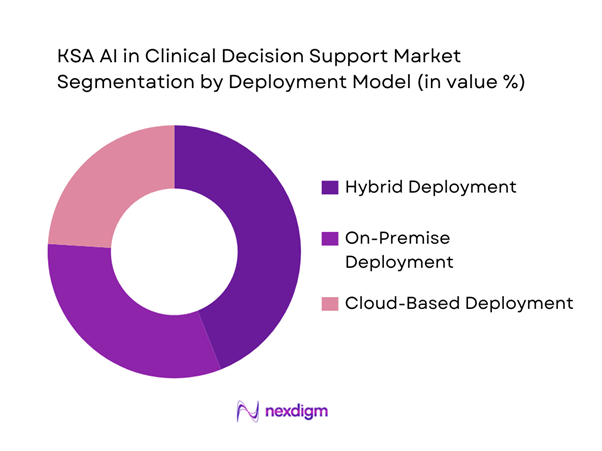

By Deployment Model

The market is segmented into on-premise, cloud-based, and hybrid solutions. Hybrid deployment models dominate the market as healthcare providers balance data localization requirements with scalability needs. Hospitals increasingly prefer hybrid architectures that retain sensitive patient data on-premise while leveraging cloud-based AI engines for model training, analytics processing, and performance updates. This structure supports compliance with national data governance policies while enabling faster AI iteration cycles and lower infrastructure costs compared to fully on-premise systems.

Competitive Landscape

The KSA AI in Clinical Decision Support market is dominated by a few major players, including IBM and global or regional brands like Oracle Health, Siemens Healthineers, and GE Healthcare. This consolidation highlights the significant influence of these key companies.

| Company | Establishment Year | Headquarters | Core AI Focus | Deployment Model | Integration Capability | Regulatory Readiness | Local Partnerships |

| Epic Systems | 1979 | USA | ~ | ~ | ~ | ~ | ~ |

| Cerner | 1979 | USA | ~ | ~ | ~ | ~ | ~ |

| IBM Watson Health | 2015 | USA | ~ | ~ | ~ | ~ | ` |

| Philips Healthcare | 1891 | Netherlands | ~ | ~ | ~ | ~ | ~ |

| Siemens Healthineers | 1847 | Germany | ~ | ~ | ~ | ~ | ~ |

KSA AI in Clinical Decision Support Market Analysis

Growth Drivers

National healthcare digital transformation programs

The expansion of AI in clinical decision support is strongly aligned with national healthcare digital transformation initiatives aimed at improving care quality, efficiency, and clinical governance. Large-scale investments in electronic medical records, unified health data platforms, and digital hospitals have created the foundational infrastructure required for AI-driven decision tools. Clinical leaders increasingly rely on AI to translate expanding datasets into actionable insights at the point of care. These programs emphasize standardization of clinical outcomes, reduction of medical errors, and support for outcome-based care models, all of which directly benefit from AI-enabled decision support. As hospitals mature digitally, AI tools transition from add-ons to core decision engines embedded within clinical workflows, accelerating institutional adoption.

Clinical complexity and workforce productivity pressure

clinical complexity, driven by aging populations and higher chronic disease burden, is placing sustained pressure on clinician productivity. AI-based decision support systems help clinicians manage information overload by prioritizing alerts, supporting differential diagnosis, and guiding treatment pathways. In high-acuity environments such as emergency departments and intensive care units, these tools improve response speed and consistency of care. Workforce shortages and reliance on multinational clinical teams further increase demand for standardized, guideline-driven decision support. AI systems act as clinical force multipliers, enabling hospitals to maintain quality and safety while managing growing patient volumes and constrained specialist availability.

Challenges

Clinical trust and explainability requirements

One of the primary challenges in the market is clinician trust in AI-generated recommendations, particularly when algorithms lack transparent reasoning. Physicians are accountable for clinical decisions and require clear, evidence-based explanations to confidently rely on AI outputs. Systems perceived as black boxes face resistance, especially in diagnostic and therapeutic decision-making where patient risk is high. Building explainable AI models that align with clinical logic and local practice guidelines is essential for deeper adoption. Without sufficient interpretability and validation, AI tools tend to remain advisory rather than decisive, limiting their impact on core clinical workflows.

Integration and workflow disruption risks

Integrating AI decision support systems into existing hospital information systems and EMR platforms remains complex. Many providers operate heterogeneous IT environments with varying data standards, making seamless integration challenging. Poor integration can disrupt clinical workflows, increase documentation burden, and reduce clinician acceptance. Implementation timelines may extend due to customization requirements and interoperability issues. Hospitals also face operational risk during transition periods when AI systems are introduced into live clinical environments. Overcoming these barriers requires modular architectures, strong vendor implementation support, and close collaboration with clinical and IT stakeholders.

Opportunities

Precision medicine and advanced specialty care

AI-driven clinical decision support presents a major opportunity in precision medicine across oncology, cardiology, and rare disease management. By combining clinical records, imaging, laboratory results, and genomic data, AI systems can support highly personalized diagnostic and treatment decisions. As the healthcare system expands advanced specialty services, demand for decision support capable of managing complex, multi-variable clinical scenarios will grow. Providers increasingly view precision-oriented AI as a strategic differentiator that improves outcomes while optimizing resource utilization in high-cost specialty care pathways.

Critical care and emergency decision automation

Emergency and critical care settings represent a high-impact opportunity for AI-enabled decision support due to time sensitivity and data intensity. AI systems can assist with early risk detection, patient triage, deterioration prediction, and protocol-driven interventions. In large tertiary hospitals managing high emergency volumes, these tools enhance patient safety and clinical efficiency. Automation of decision support in critical care environments enables faster responses, supports less experienced clinicians, and reduces variability during peak demand periods. This positions emergency and critical care as key growth segments for advanced clinical AI deployment.

Future Outlook

The KSA AI in Clinical Decision Support market is expected to evolve toward deeper clinical integration, with AI systems transitioning from advisory tools to embedded decision partners within core care workflows. Emphasis will shift toward explainability, regulatory alignment, and outcome-based adoption, as providers demand measurable clinical and operational value. Integration with national health data platforms and expansion into advanced specialties will further strengthen the market’s strategic importance within the healthcare ecosystem.

Major Players

- IBM

- Oracle Health

- Cerner

- Epic Systems

- Siemens Healthineers

- GE Healthcare

- Philips Healthcare

- Microsoft

- Google Health

- SAP

- Optum

- Medtronic

- Change Healthcare

Key Target Audience

- Public hospital administrators

- Private hospital groups

- Academic medical centers

- Specialty care providers

- Health IT system integrators

- Medical AI solution providers

- Investments and venture capitalist firms

- Government and regulatory bodies of KSA

Research Methodology

Step 1: Identification of Key Variables

Key variables included clinical use cases, care settings, technology platforms, deployment models, end-user types, and regional adoption patterns within KSA.

Step 2: Market Analysis and Construction

Market structure was analyzed through value-chain mapping, adoption intensity assessment, and segmentation-based revenue attribution logic.

Step 3: Hypothesis Validation and Expert Consultation

Insights were validated through structured discussions with clinicians, hospital IT leaders, AI solution providers, and healthcare administrators.

Step 4: Research Synthesis and Final Output

Findings were triangulated and synthesized into a coherent market model aligned with client decision-making requirements.

- Executive Summary

- Research Methodology (Market Definitions and Inclusions/Exclusions, Abbreviations, Topic-Specific Taxonomy, Market Sizing Framework, Revenue Attribution Logic Across Use Cases or Care Settings, Primary Interview Program Design, Data Triangulation and Validation, Limitations and Data Gaps)

- Definition and Scope

- Market Genesis and Evolution

- AI in Clinical Decision Support Usage and Care-Continuum Mapping

- Business Cycle and Demand Seasonality

- KSA Healthcare Delivery and Digital Architecture

- Growth Drivers

National digital health transformation agenda

Clinical workforce capacity constraints

Rising chronic disease complexity

Standardization of clinical quality and outcomes

Expansion of health data availability - Challenges

Clinical trust and explainability gaps

Integration with legacy HIS and EMR systems

Data quality and interoperability constraints

Regulatory clarity on AI liability

Change management and clinician adoption - Opportunities

AI-enabled precision medicine pathways

Emergency and critical care decision automation

Arabic-language clinical AI development

Public–private AI platform partnerships

Predictive population health management - Trends

Embedded AI within EMR workflows

Real-time bedside decisioning

Multimodal data fusion adoption

Shift toward outcome-linked AI contracts

Clinical governance-driven AI design - Regulatory & Policy Landscape

- SWOT Analysis

- Stakeholder & Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competitive Intensity & Ecosystem Mapping

- By Platform Revenue, 2019–2024

- By Deployment Model, 2019–2024

- By End User, 2019–2024

- By Clinical Use Case (in Value %)

Diagnosis support

Treatment recommendation

Medication management

Clinical risk scoring

Workflow and alert management

Population health decisioning - By Care Setting (in Value %)

Tertiary hospitals

Secondary hospitals

Primary care centers

Specialty clinics

Telemedicine providers - By Technology / Platform Type (in Value %)

Rule-based clinical engines

Machine learning models

Deep learning and imaging AI

Natural language processing systems

Predictive analytics platforms - By Deployment Model (in Value %)

On-premise

Private cloud

Public cloud

Hybrid deployment - By End-Use Customer Type (in Value %)

Public hospitals

Private hospital groups

Academic medical centers

Specialty care providers

Integrated health systems - By Region (in Value %)

Central Region

Western Region

Eastern Region

Southern Region

Northern Region

- Competition ecosystem overview

- Cross Comparison Parameters (clinical accuracy validation depth, EMR integration breadth, Saudi clinical localization, explainability framework, regulatory readiness, deployment flexibility, data security architecture, implementation timelines, clinician training support)

- SWOT analysis of major players

- Pricing and commercial model benchmarking

- Detailed Profiles of Major Companies

IBM

Oracle Health

Cerner

Epic Systems

Siemens Healthineers

GE Healthcare

Philips Healthcare

Microsoft

Google Health

SAP

Optum

Medtronic

Oracle AI

Change Healthcare

NVIDIA

- Buyer personas and decision-making units

- Procurement and contracting workflows

- KPIs used for evaluation

- Pain points and adoption barriers

- By Platform Revenue, 2025–2030

- By Deployment Model, 2025–2030

- By End User, 2025–2030