Market Overview

As of 2024, the KSA air ambulance market is valued at USD ~ million, with a growing CAGR of 6.3% from 2024 to 2030, driven by a combination of increasing healthcare expenditures and a rising demand for rapid medical response services. The growing prevalence of medical emergencies and the necessity for prompt transportation of patients have intensified the need for air ambulance services. Investments in healthcare infrastructure have further enhanced service accessibility, ensuring that sophisticated medical care is available at critical times.

Key regions dominating the KSA air ambulance market include Riyadh, Jeddah, and Dammam. These cities facilitate a blend of advanced healthcare services and well-established air transport networks, making them integral to the air ambulance ecosystem. The high population density and strategic locations of healthcare facilities in these regions contribute to a consistent demand for air ambulance services, thereby propelling market growth.

Market Segmentation

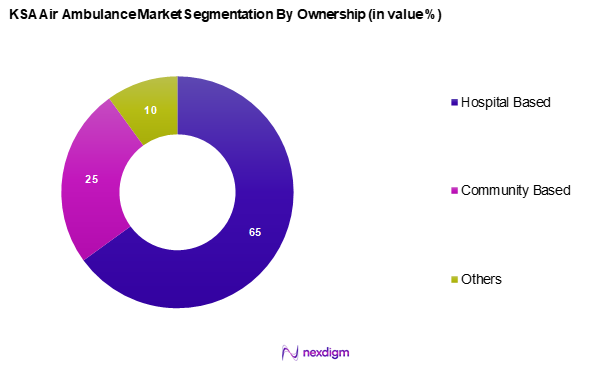

By Ownership

The KSA air ambulance market is segmented into Hospital-Based, Community-Based, and Others. Hospital-based services dominate this segment as they offer integrated care that facilitates better communication between medical teams and emergency responders. Hospitals often have the resources to operate advanced air ambulance services equipped with specialized medical care, allowing them quicker and more effective patient transfers compared to community-based services.

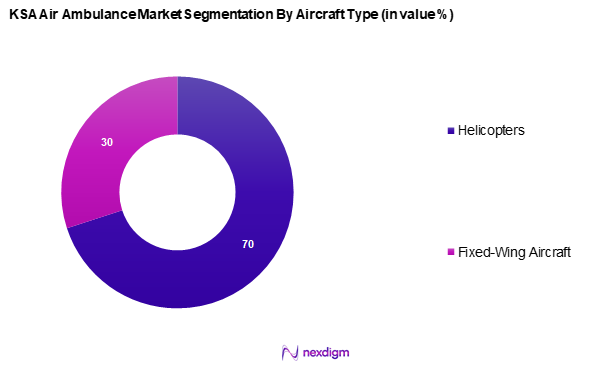

By Aircraft Type

The KSA air ambulance market is segmented into helicopters and fixed-wing aircraft. Helicopters have a significant edge in this segment due to their ability to reach remote and hard-to-access locations quickly. The versatility and speed of helicopters allow for timely interventions critical in emergency scenarios, making them the preferred choice for air ambulance services across diverse terrains in the KSA.

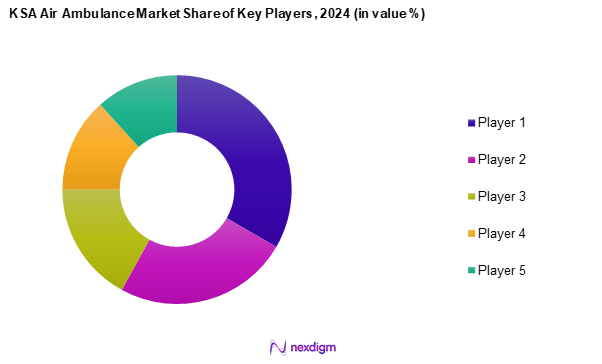

Competitive Landscape

The KSA air ambulance market is dominated by key players, including local providers and well-established international companies. This consolidation underscores the significant influence of these companies in driving market innovation and improving service quality.

| Company | Establishment Year | Headquarters | Market Share (Value) | Number of Aircraft | Annual Revenue | Medical Personnel | Service Coverage |

| International SOS | 1985 | London | – | – | – | – | – |

| SalamAir | 2017 | Muscat | – | – | – | – | – |

| Flymed GmbH | 1995 | Germany | – | – | – | – | – |

| Saudi Red Crescent Authority (SRCA) | 1963 | Riyadh | – | – | – | – | – |

| Global Medical Response | 2018 | USA | – | – | – | – | – |

KSA Air Ambulance Market Analysis

Growth Drivers

Increasing Health Care Expenditure

Saudi Arabia’s healthcare sector continues to witness significant financial support, reflecting the government’s commitment to enhancing medical services and accessibility. This increasing investment is directed toward upgrading healthcare infrastructure, including emergency medical services, which positively impacts the air ambulance market. Greater financial allocations facilitate the acquisition of advanced aircraft, state-of-the-art medical equipment, and highly skilled personnel, thereby improving service efficiency and availability. Furthermore, these enhancements align with national initiatives aimed at economic diversification and overall quality-of-life improvements.

Rising Demand for Quick Medical Response

The growing need for urgent medical response solutions is driven by rapid urbanization, population growth, and a rising number of medical emergencies. Limited availability of emergency medical vehicles and an increasing rate of road accidents further accentuate the necessity for efficient air ambulance services. Studies indicate that air ambulances significantly reduce transport time to definitive care, highlighting their importance in providing swift medical assistance across the Kingdom.

Market Challenges

Regulatory and Compliance Issues

Stringent regulatory frameworks surrounding air ambulance operations present a considerable challenge. Compliance with evolving aviation and healthcare regulations requires operators to navigate complex licensing processes and operational standards. Frequent updates to protocols and training requirements for medical personnel and pilots contribute to increased operational costs and potential delays in service availability.

High Operational Costs

The financial burden associated with air ambulance operations remains a key concern. Expenses related to aircraft maintenance, pilot salaries, and advanced medical equipment pose significant challenges for service providers. Additionally, fluctuating fuel prices contribute to rising operational costs, especially as air ambulances are expected to provide round-the-clock service across various regions, sometimes under demanding conditions. Managing these expenses while maintaining service quality and accessibility remains a challenge for market players.

Opportunities

Expansion of Healthcare Infrastructure

The ongoing development of healthcare facilities across Saudi Arabia presents substantial growth opportunities for the air ambulance market. Government investments in new hospitals and upgrades to existing medical centres are strengthening the overall healthcare system. As medical facilities expand into suburban and rural areas, the demand for efficient patient transport solutions, including air ambulances, is set to increase. This growing infrastructure development is expected to drive the need for air medical services, ensuring timely and effective medical care delivery.

Technological Advancements in Aviation

Innovations in aviation technology are playing a transformative role in the air ambulance sector. Enhanced aircraft efficiency, integration of telemedicine capabilities, and improvements in on-board medical equipment are revolutionizing patient care during transit. Real-time consultations with specialists via telemedicine-enabled air ambulances enhance medical decision-making, ensuring better patient outcomes. These advancements are expected to attract investment, streamline operations, and improve the overall effectiveness of air ambulance services in the Kingdom.

Future Outlook

Over the next few years, the KSA air ambulance market is anticipated to witness robust growth propelled by continuous advancements in healthcare technology, expanding healthcare infrastructure, and a rising awareness of rapid medical transport services’ importance. Increasing partnerships between government entities and private operators are expected to enhance service quality, ensuring timely medical responses in life-threatening situations.

Major Players

- International SOS

- SalamAir

- Flymed GmbH

- Saudi Red Crescent Authority (SRCA)

- Global Medical Response

- Air Methods

- SkyLink

- Plures Healthcare

- Fakeeh Care

- Air Ambulance Worldwide

- AirMed International

- Medical Rescue SAUDI ARABIA

- com

- AirLink

- Aevitas

Key Target Audience

- Hospitals and Healthcare Providers

- Private and Public Health Organizations

- Insurance Companies

- Emergency Response Agencies

- Corporations (HR and Health Benefits Departments)

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (Ministry of Health, Civil Defense Authority)

- Non-Governmental Organizations (NGOs) involved in Health Services

Research Methodology

Step 1: Identification of Key Variables

This phase focuses on mapping the ecosystem of the KSA air ambulance market, identifying all key stakeholders and understanding their roles. Extensive desk research is employed, utilizing both secondary and proprietary databases to gather comprehensive industry-level information. The goal is to pinpoint and define the crucial variables that drive the dynamics of the market.

Step 2: Market Analysis and Construction

During this step, historical data pertinent to the KSA air ambulance market is compiled and analyzed. This includes evaluating market penetration rates, analyzing the interplay between service providers and operational models, and the resultant revenue generation. A critical aspect is to assess service quality metrics to ensure the veracity of revenue estimates, providing a solid foundation for projections.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are rigorously developed and validated through a series of consultations via Computer-Assisted Telephone Interviews (CATIs) with industry experts across various companies. These experts provide operational insights and financial data critical for validating assumptions and refining the marketplace knowledge base.

Step 4: Research Synthesis and Final Output

In the final phase, direct engagement with numerous air ambulance service providers is undertaken to glean detailed insights into product offerings, sales figures, customer preferences, and other vital statistics. This interaction serves to corroborate and complement the data derived through top-down and bottom-up analysis methods, ensuring a thorough, accurate, and validated overview of the KSA Air Ambulance Market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Market Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain & Value Chain Analysis

- Growth Drivers

Increasing Health Care Expenditure

Rising Demand for Quick Medical Response - Market Challenges

Regulatory and Compliance Issues

High Operational Costs - Opportunities

Expansion of Healthcare Infrastructure

Technological Advancements in Aviation - Trends

Integration of Telemedicine in Air Ambulance Services - Government Regulations

Aviation Authority Regulations

Health Care Policies - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Cost of Service, 2019-2024

- By Ownership, (In Value %)

Hospital Based

Community Based

Others - By Aircraft Type, (In Value %)

Helicopters

Fixed-Wing Aircraft - By End-User, (In Value %)

Government

Private

Corporations - By Region, (In Value %)

Riyadh

Jeddah

Dammam

Khobar

Makkah - By Service Type, (In Value %)

Domestic

International - By Application Type, (In Value %)

Inter-Facility

Rescue Helicopter Service

Organ Transplant Logistics

Infectious Disease Service

Neonatal and Pediatric Transport

Others

- Market Share of Major Players on the Basis of Value/Volume, 2024

Market Share of Major Players by Type of Ownership Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strengths, Weaknesses, Organizational Structure, Revenues, Number of Ambulances, Medical Staff Availability)

- SWOT Analysis of Major Players

- Pricing Analysis Basis SKUs for Major Players

- Detailed Profiles of Major Companies

International SOS

SalamAir

Flymed GmbH

Saudi Red Crescent Authority (SRCA)

flyairlink.com

Plures Healthcare

SkyLink

Air Methods

Global Medical Response

Fakeeh Care

Air Ambulance Worldwide

AirMed International

Medical Rescue SAUDI ARABIA

Others

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Cost of Service, 2025-2030