Market Overview

The KSA air and missile defense radar market is valued at approximately USD ~billion in 2024. This market is driven by the Kingdom of Saudi Arabia’s substantial investments in national defense and security systems. KSA is investing heavily in missile defense infrastructure due to growing regional security concerns, particularly with neighboring countries. The demand for advanced radar systems is supported by the country’s defense priorities and technological advancements in radar detection systems that ensure the detection of various aerial threats, such as drones, missiles, and aircraft.

KSA’s defense industry is dominated by Riyadh and Dhahran, which are central hubs for the country’s military infrastructure and defense procurement. Riyadh, as the capital, is home to many defense and government agencies that oversee military strategies, while Dhahran houses military facilities and large defense contractors. These cities are strategic for both military operations and technological innovation, contributing significantly to the demand for air and missile defense radar systems.

Market Segmentation

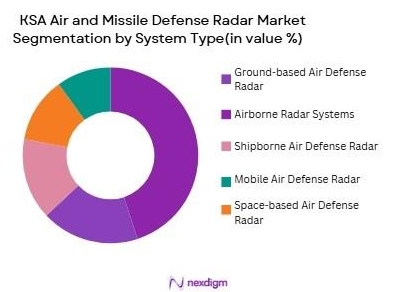

By System Type (In Value%)

The KSA air and missile defense radar market is segmented by system type into ground-based air defense radar, airborne radar systems, shipborne air defense radar, mobile air defense radar, and space-based radar systems. Ground-based air defense radar dominates the market due to its versatility and widespread application in both defensive and monitoring roles. These systems are installed across military bases, critical infrastructure sites, and defense facilities in KSA. Their ability to provide wide-area coverage and detect a broad spectrum of threats, including missiles and drones, makes them a cornerstone of the country’s defense strategy.

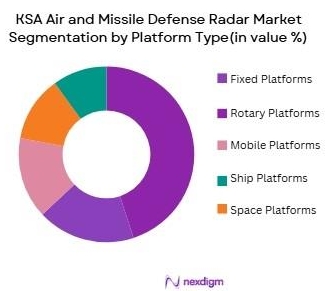

By Platform Type (In Value%)

The platform type segment is divided into fixed platforms, rotary platforms, mobile platforms, ship platforms, and space platforms. Fixed platforms are dominant in the KSA air and missile defense radar market. These platforms are preferred for their ability to offer persistent surveillance and early warning capabilities. Fixed radar platforms are commonly deployed at military bases, borders, and key infrastructure sites to protect vital assets from aerial threats. Their stability, accuracy, and long-range detection capabilities make them the most suitable choice for continuous monitoring.

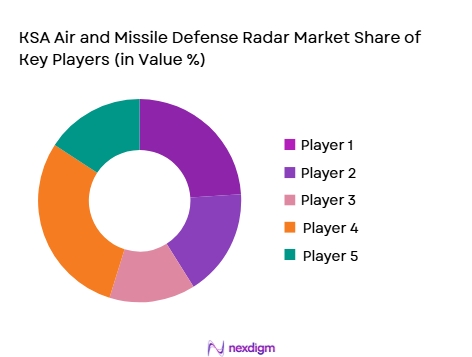

Competitive Landscape

The KSA air and missile defense radar market is dominated by major defense companies, including local and global players like Elbit Systems, Raytheon Technologies, Lockheed Martin, and Saab Group. These players benefit from long-standing relationships with the Saudi Arabian government, which has consistently prioritized defense spending. The market is highly consolidated, with a few key players leading the development and deployment of advanced radar and missile defense systems in the region. Their technological expertise and strong local presence contribute to their dominance in the market.

| Company Name | Year of Establishment | Headquarters | Radar System Expertise | Key Defense Systems | Geographical | Key Partnerships |

| Elbit Systems | 1966 | Haifa, Israel | ~ | ~ | ~ | ~ |

| Raytheon Technologies | 1922 | Waltham, US | ~ | ~ | ~ | ~ |

| Lockheed Martin | 1912 | Bethesda, US | ~ | ~ | ~ | ~ |

| Saab Group | 1989 | Stockholm, Sweden | ~ | ~ | ~ | ~ |

| Israel Aerospace |

1953 | Lod, Israel | ~ | ~ | ~ | ~ |

KSA Air and Missile Defense Radar Market Analysis

Growth Drivers

Urbanization

Indonesia’s rapid urbanization has been a significant growth driver for the air quality monitoring system market. The urban population in Indonesia reached over ~ million in 2024, with cities like Jakarta, Surabaya, and Bandung experiencing high population growth rates. This expansion increases air pollution due to rising vehicular emissions, industrialization, and construction. Urban areas face challenges related to air quality, making it essential to implement monitoring systems. In response, the Indonesian government and private sectors have invested in advanced monitoring systems to safeguard public health.

Industrialization

The industrial sector in Indonesia has grown substantially, accounting for nearly 20% of the country’s GDP in 2024. This growth, especially in manufacturing, energy production, and mining, has led to higher emissions of pollutants, contributing to poor air quality in industrial regions. Cities such as Batam and Surabaya, with high industrial activity, face significant pollution challenges. The need for efficient air quality monitoring systems to manage emissions from industries and meet environmental regulations is increasing, fueling demand for these systems.

Restraints

High Initial Costs

The high initial costs of air quality monitoring systems remain a major restraint to their widespread adoption in Indonesia. Advanced monitoring equipment, including sensors and data management systems, can be prohibitively expensive for small businesses and local governments, especially in rural areas. While the government has initiated funding programs to support such systems, the financial burden remains a barrier for many municipalities and industries. Additionally, the maintenance and operational costs further increase the total cost, hindering broader adoption.

Technical Challenges

The deployment and effective operation of air quality monitoring systems face several technical challenges in Indonesia. Many remote areas still lack the necessary infrastructure to support continuous data transmission, and there are concerns regarding the accuracy of readings due to unreliable calibration methods. Moreover, technical expertise is needed for system setup and maintenance, which is scarce in some areas. The lack of standardized data protocols across the country also limits the consistency and comparability of air quality data, further complicating implementation.

Opportunities

Technological Advancements

Technological advancements in air quality monitoring systems present significant opportunities for growth in Indonesia. In 2024, IoT-based sensors are increasingly used for real-time, cost-effective air quality monitoring in both urban and rural areas. These advancements make it easier to install sensors in previously underserved locations, significantly improving air quality data collection across the country. Moreover, the integration of AI and machine learning into monitoring systems enables more accurate data analysis, enhancing the effectiveness of pollution management strategies.

International Collaborations

International collaborations offer a significant opportunity for the expansion of air quality monitoring systems in Indonesia. In 2024, Indonesia has partnered with global organizations, such as the World Health Organization (WHO) and the United Nations Environment Programmed (UNEP), to improve air quality management. These collaborations bring in financial support, advanced technologies, and expertise that can help Indonesia scale up its monitoring systems and improve air quality across the country, especially in highly polluted areas.

Future Outlook

Over the next decade, the KSA air and missile defense radar market is expected to experience substantial growth, driven by the need for more sophisticated defense systems in the face of regional instability. Saudi Arabia’s continuous investment in military technology, particularly in the realm of air and missile defense, will support the development of next-generation radar systems. The country’s strategic location in the Middle East and its focus on improving its defense capabilities will contribute to a growing demand for these radar systems, particularly as threats such as drones and ballistic missiles continue to rise.

Major Players

- Elbit Systems

- Raytheon Technologies

- Lockheed Martin

- Saab Group

- Israel Aerospace Industries (IAI)

- Northrop Grumman

- Thales Group

- Boeing

- Leonardo

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Defense contractors and system integrators

- Aerospace manufacturers

- Research and development agencies

- International defense organizations

- Military agencies from countries with defense collaborations with KSA

- Homeland security and defense technology companies

Research Methodology

Step 1: Identification of Key Variables

This step involves identifying key drivers influencing the KSA air and missile defense radar market, such as regional security concerns, defense budgets, and technological advancements. Secondary research will be conducted, including analysis of defense reports and government publications, to understand the key market variables.

Step 2: Market Analysis and Construction

In this phase, we will analyze the historical market data, including previous radar system installations, demand for air and missile defense, and technological developments. Data on procurement patterns, defense budgets, and military strategies will also be evaluated to build a market model that incorporates current and future trends.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses will be validated through consultations with defense experts, government defense officials, and military representatives. Insights gathered from interviews will help refine the data analysis and ensure the accuracy of market predictions, particularly regarding radar system developments and procurement strategies.

Step 4: Research Synthesis and Final Output

The final step involves synthesizing data from secondary research, expert consultations, and market trends. This will result in a comprehensive report detailing current market dynamics, future growth projections, and insights into the competitive landscape. The final output will be used to inform stakeholders about emerging opportunities in the KSA air and missile defense radar market.

- Executive Summary

- Research Methodology(Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Technological advancements in radar and missile defense systems

Rising geopolitical tensions and security concerns

Increased defense budgets and investments in national security - Market Challenges

High development and operational costs

Regulatory constraints and export restrictions

Dependence on specialized personnel and skilled workforce - Market Opportunities

Collaborations with international defense organizations

Advancements in radar miniaturization and system integration

Emerging markets in Asia-Pacific and the Middle East - Trends

Development of multi-functional radar systems for air and missile defense

Adoption of artificial intelligence and machine learning for radar system efficiency

Integration of radar systems with next-generation missile defense technologies

Government regulations

International regulations on radar technology export

Defense procurement regulations in Saudi Arabia

Environmental impact regulations for radar system installations - SWOT analysis

Strength: Saudi Arabia’s strong defense capabilities and technological expertise

Weakness: High reliance on international defense contracts

Opportunity: Expansion into new markets with advanced radar technology

Threat: Escalating global tensions leading to unpredictable demand - Porters 5 forces

Threat of new entrants: Low

Bargaining power of suppliers: High

Bargaining power of buyers: Moderate

Threat of substitute products: Low

Industry rivalry: High

- By Market Value ,2020-2025

- By Installed Units ,2020-2025

- By Average System Price ,2020-2025

- By System Complexity Tier ,2020-2025

- By System Type (In Value%)

Ground-based Air and Missile Defense Radar

Airborne Radar Systems

Shipborne Air and Missile Defense Radar

Mobile Air and Missile Defense Radar

Space-based Air and Missile Defense Radar - By Platform Type (In Value%)

Fixed Platforms

Rotary Platforms

Mobile Platforms

Ship Platforms

Space Platforms - By Fitment Type (In Value%)

Standalone Radar Systems

Integrated Radar Systems

Upgraded Radar Systems

Modular Radar Systems

Compact Radar Systems - By EndUser Segment (In Value%)

Government Defense

Commercial Defense Contractors

Private Sector Defense

International Defense Organizations

Research and Development Agencies - By Procurement Channel (In Value%)

Direct Procurement from Manufacturers

Government Procurement

Private Sector Procurement

International Defense Procurement

Leasing and Third-party Procurement

- CrossComparison Parameters(Market Share, Service Type, Technology Adoption, Geographic Presence, Customer Base)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Elbit Systems

Rafael Advanced Defense Systems

Israel Aerospace Industries (IAI)

Lockheed Martin

Thales Group

Northrop Grumman

Raytheon Technologies

BAE Systems

Leonardo

Saab Group

Boeing

General Dynamics

L3 Technologies

Harris Corporation

Kongsberg Gruppen

- Government defense agencies expanding missile defense systems

- Private defense contractors involved in radar system integration

- International defense organizations enhancing global radar coverage

- Research and development agencies investing in advanced radar technologies

- Forecast Market Value ,2026-2035

- Forecast Installed Units ,2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform ,2026-2035