Market Overview

The KSA Air-Based C4ISR market is valued at approximately USD ~billion in 2024. This market is primarily driven by Saudi Arabia’s robust defense expenditure, which has been increasing in recent years. As of 2023, the country’s defense budget is one of the largest in the Middle East, with investments in advanced air defense systems, radar, surveillance, and communication systems. Saudi Arabia’s geopolitical situation, surrounded by regional instability, further boosts the demand for sophisticated air-based C4ISR solutions. Saudi Arabia’s commitment to strengthening national defense, as well as strategic alliances with global defense players, continues to drive the growth of this market.

The KSA Air-Based C4ISR market is predominantly influenced by cities like Riyadh, Jeddah, and Dhahran, as well as its defense partnerships with global leaders like the United States and the United Kingdom. Riyadh, as the capital, is home to military decision-making and defense procurement activities. Jeddah hosts key military and aerospace contractors, while Dhahran’s proximity to the oil industry provides critical infrastructure for military operations. The Saudi government’s ongoing defense modernization plans, including collaboration with international defense technology firms, further solidify the country’s dominance in this sector.

Market Segmentation

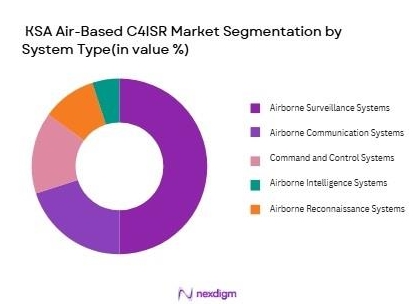

By System Type (In Value%)

The KSA Air-Based C4ISR market is segmented by system type into airborne surveillance systems, airborne communication systems, command and control systems, airborne intelligence systems, and airborne reconnaissance systems. Airborne surveillance systems hold the largest share in this market, driven by Saudi Arabia’s need for early warning and situational awareness in its airspace, especially considering regional threats. Surveillance systems that use radar and advanced sensors are indispensable for air defense, enabling the detection of aerial threats at long distances. Their central role in national security efforts ensures their dominance in the market.

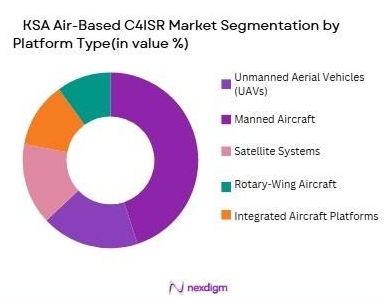

By Platform Type (In Value%)

The platform type segment in the KSA Air-Based C4ISR market includes unmanned aerial vehicles (UAVs), manned aircraft, satellite systems, rotary-wing aircraft, and integrated aircraft platforms. UAVs dominate the segment due to Saudi Arabia’s strong focus on unmanned systems for surveillance and reconnaissance, particularly in high-risk areas. UAVs offer flexibility, cost-effectiveness, and reduced risk compared to manned systems, making them an ideal solution for modern air defense strategies. The increasing deployment of UAVs like the Wadi and Shaheen platforms supports the substantial market share of this segment.

Competitive Landscape

The KSA Air-Based C4ISR market is highly competitive, with key players including both domestic and international companies. Local firms such as Saudi Advanced Electronics Company (SAEC) work alongside global giants like Lockheed Martin, Thales Group, and Raytheon Technologies. Saudi Arabia’s defense contracts are typically awarded to companies with a strong technological offering, proven integration capabilities, and an ability to meet the nation’s specific air defense requirements. The cooperation between the Saudi government and defense contractors like Boeing, IAI, and others underpins the market dynamics, ensuring the country has access to cutting-edge technologies in the air-based C4ISR space.

| Company Name | Year of Establishment | Headquarters | Core Offerings | Technology Focus | Geographic Presence | Key Contracts |

| Saudi Advanced Electronics Co. (SAEC) | 1988 | Riyadh, Saudi Arabia | ~ | ~ | ~ | ~ |

| Lockheed Martin | 1912 | Bethesda, USA | ~ | ~ | ~ | ~ |

| Thales Group | 2000 | Paris, France | ~ | ~ | ~ | ~ |

| Raytheon Technologies | 1922 | Waltham, USA | ~ | ~ | ~ | ~ |

| Israel Aerospace Industries (IAI) | 1953 | Lod, Israel | ~ | ~ | ~ | ~ |

KSA Air-Based C4ISR Market Analysis

Growth Drivers

Urbanization

Urbanization is a key driver for the air quality monitoring system market in Indonesia, as over ~ of the population resides in urban areas as of 2024. Major cities such as Jakarta, Surabaya, and Bandung are facing increasing air pollution due to industrial emissions, transportation, and construction activities. The rapid expansion of urban infrastructure puts further pressure on air quality, increasing the demand for monitoring systems to track pollution levels and ensure public health. This urban growth accelerates the adoption of air quality management technologies.

Industrialization

Indonesia’s industrialization has been a driving force behind the increasing demand for air quality monitoring systems. As of 2024, the industrial sector contributes approximately ~ to the nation’s GDP, with key industries in manufacturing, energy, and mining significantly contributing to pollution levels. Regions like Batam and Surabaya, which are heavily industrialized, experience poor air quality due to emissions from factories and power plants. The government’s stricter emission standards and industrial regulations drive the need for robust monitoring systems to comply with environmental regulations.

Restraints

High Initial Costs

The high initial costs associated with air quality monitoring systems present a barrier to their widespread adoption in Indonesia. In 2024, advanced systems equipped with IoT sensors, data management software, and installation fees remain expensive, particularly for local municipalities and industries in rural areas. While the government has introduced funding programs to offset some of these costs, the significant upfront investment required for the installation and setup of air quality monitoring infrastructure continues to hinder adoption.

Technical Challenges

Technical challenges, including system calibration, data accuracy, and lack of standardization, remain a significant hurdle in Indonesia’s air quality monitoring efforts. As of 2024, many monitoring systems in use are prone to inaccuracies due to poor calibration or inconsistent maintenance. Additionally, the integration of newer systems with existing infrastructure poses technical challenges, limiting the efficiency and reliability of these systems. This has made it difficult for local authorities to rely on the data, hampering effective air quality management.

Opportunities

Technological Advancements

Technological advancements in IoT and AI present significant opportunities for the expansion of air quality monitoring systems in Indonesia. As of 2024, IoT-based sensors are becoming more affordable, portable, and capable of providing real-time data. These technological improvements have made it easier to deploy monitoring systems in remote areas and allow for continuous monitoring. AI and machine learning are also improving the predictive capabilities of air quality systems, enabling authorities to forecast pollution levels and take proactive measures.

International Collaborations

International collaborations provide Indonesia with opportunities to improve its air quality monitoring capabilities. As of 2024, the country is working with organizations such as the World Health Organization (WHO) and the United Nations Environment Programme (UNEP) to implement global best practices and advanced air monitoring technologies. These partnerships help secure technical expertise, funding, and access to the latest innovations in environmental monitoring, facilitating the expansion of air quality management programs across Indonesia.

Future Outlook

Over the next decade, the KSA Air-Based C4ISR market is poised for substantial growth, driven by the country’s ongoing investments in modernizing its air defense infrastructure. The strategic importance of air-based C4ISR solutions in addressing regional security threats, coupled with technological advancements in UAVs, radar systems, and command and control networks, will fuel the demand for these systems. Moreover, Saudi Arabia’s defense cooperation with international partners and the expansion of its air surveillance capabilities will support market growth, ensuring the country remains at the forefront of defense innovation.

Major Players

- Saudi Advanced Electronics Company

- Lockheed Martin

- Thales Group

- Raytheon Technologies

- Israel Aerospace Industries

- Boeing

- Northrop Grumman

- Elbit Systems

- Rafael Advanced Defense Systems

- Leonardo

- Saab Group

- General Dynamics

- L3 Technologies

- Harris Corporation

- Kongsberg Gruppen

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Aerospace manufacturers

- International defense organizations

- Military agencies from countries with defense collaborations with Saudi Arabia

- Aerospace contractors

- Homeland security and defense technology companies

- Private sector defense contractors

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves identifying the key drivers such as defense spending, technological advancements, and the geopolitical landscape in Saudi Arabia. This phase includes desk research from government publications and defense industry reports to establish the market dynamics.

Step 2: Market Analysis and Construction

Data related to C4ISR systems deployed in KSA’s air defense sector is collected and analyzed. Historical data on procurement, system deployment, and system performance is compiled to construct a market model.

Step 3: Hypothesis Validation and Expert Consultation

The hypotheses developed from secondary research will be validated through expert interviews with military officials, defense contractors, and technology developers in the air-based C4ISR sector. This will ensure accuracy and relevance.

Step 4: Research Synthesis and Final Output

In this phase, the research findings are synthesized, and expert insights are integrated to provide a comprehensive overview of the KSA Air-Based C4ISR market. The final output will include market trends, competitive landscape, and growth projections, offering stakeholders a clear view of the market’s future.

- Executive Summary

- Research Methodology(Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Technological advancements in communication and surveillance systems

Increasing geopolitical tensions and security concerns

Rising defense budgets and investments in air-based defense systems - Market Challenges

High operational and maintenance costs

Regulatory constraints and export restrictions

Dependence on highly skilled personnel for operation and maintenance - Market Opportunities

Technological innovations in miniaturized C4ISR systems

Collaboration with international defense organizations

Growing demand for enhanced surveillance capabilities in air defense - Trends

Integration of artificial intelligence in C4ISR systems

Increased adoption of UAVs for reconnaissance and intelligence gathering

Shift towards multi-functional and scalable C4ISR systems - Government regulations

Export control regulations for defense systems

Aviation safety and airspace usage regulations

International cybersecurity standards for C4ISR systems - SWOT analysis

Strength: Strong government backing for defense technology

Weakness: Dependence on foreign technology and suppliers

Opportunity: Increasing need for high-tech defense solutions in the Middle East

Threat: Potential security breaches and cyber vulnerabilities - Porters 5 forces

Threat of new entrants: Low

Bargaining power of suppliers: High

Bargaining power of buyers: Moderate

Threat of substitute products: Moderate

Industry rivalry: High

- By Market Value ,2020-2025

- By Installed Units ,2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier ,2020-2025

- By System Type (In Value%)

Airborne Surveillance Systems

Airborne Communication Systems

Command and Control Systems

Airborne Intelligence Systems

Airborne Reconnaissance Systems - By Platform Type (In Value%)

Unmanned Aerial Vehicles (UAVs)

Manned Aircraft

Satellite Systems

Rotary-Wing Aircraft

Integrated Aircraft Platforms - By Fitment Type (In Value%)

Standalone Systems

Integrated Systems

Modular Systems

Upgraded Systems

Compact Systems - By End User Segment (In Value%)

Defense Ministries

Private Sector Contractors

International Military Agencies

Aerospace Contractors

Research and Development Agencies - By Procurement Channel (In Value%)

Direct Procurement from Manufacturers

Government Procurement

Private Sector Procurement

International Defense Procurement

Leasing and Third-party Procurement

- Cross Comparison Parameters(Market Share, Service Type, Technology Adoption, Geographic Presence, Customer Base)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Elbit Systems

Israel Aerospace Industries (IAI)

Rafael Advanced Defense Systems

Lockheed Martin

Thales Group

Northrop Grumman

Raytheon Technologies

BAE Systems

Leonardo

Saab Group

Boeing

General Dynamics

L3 Technologies

Harris Corporation

- Defense ministries expanding air surveillance capabilities

- Aerospace contractors incorporating advanced C4ISR technologies

- International military agencies integrating Saudi technology into defense strategies

- R&D agencies developing next-generation surveillance systems

- Forecast Market Value ,2026-2035

- Forecast Installed Units ,2026-2035

- Price Forecast by System Tier ,2026-2035

- Future Demand by Platform ,2026-2035