Market Overview

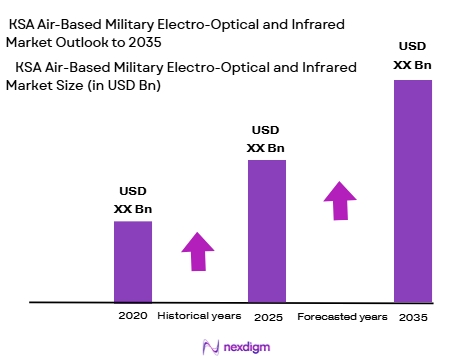

The KSA Air-Based Military Electro-Optical and Infrared Systems market is valued at approximately USD ~billion, based on recent analyses. The market is driven primarily by the growing need for enhanced surveillance, targeting, and reconnaissance capabilities within the region’s defense sector. Rising defense budgets in Saudi Arabia, ongoing military modernization programs, and increasing geopolitical tensions in the Middle East contribute to this demand. As the need for advanced defense technologies grows, the market is expected to continue expanding, supported by investments from the government and private sector.

Saudi Arabia, as the largest economy in the Gulf Cooperation Council (GCC), leads the market for air-based military electro-optical and infrared systems. The country’s strategic location, its significant defense spending, and its continuous investment in military modernization contribute to its dominance. Additionally, cities like Riyadh and Dhahran serve as hubs for defense activities, with many defense contractors operating in these areas. The government’s focus on enhancing surveillance and reconnaissance capabilities to address regional security concerns also strengthens the market’s position in Saudi Arabia.

Market Segmentation

By System Type

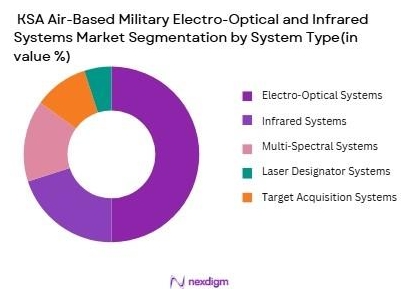

The KSA Air-Based Military Electro-Optical and Infrared Systems market is segmented by system type into Electro-Optical Systems, Infrared Systems, Multi-Spectral Systems, Laser Designator Systems, and Target Acquisition Systems.

Electro-Optical Systems currently dominate the market due to their widespread use in surveillance and reconnaissance operations. These systems are capable of delivering high-resolution imagery in daylight conditions, which is critical for defense applications in the region. The increased adoption of these systems is attributed to their reliability and effectiveness in monitoring air and ground targets. Notable defense contractors in Saudi Arabia have focused on integrating advanced electro-optical systems to enhance military capabilities, which further drives their dominance in the market.

By Platform Type

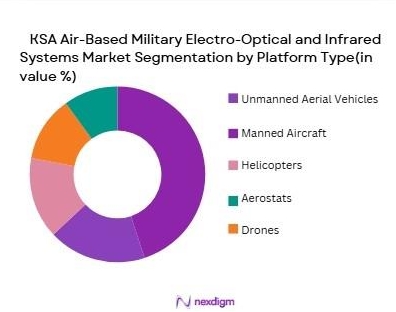

The market is segmented by platform type into Unmanned Aerial Vehicles (UAVs), Manned Aircraft, Helicopters, Aerostats, and Drones.UAVs dominate the platform segment due to their increased use in military surveillance and reconnaissance operations. Saudi Arabia has been investing heavily in UAV technology to enhance border surveillance and intelligence-gathering capabilities. UAVs provide cost-effective and efficient solutions for air-based monitoring, and they can operate in high-risk environments where manned aircraft may not be feasible. As UAV technology continues to advance, it is expected that this platform type will maintain a significant share of the market in the coming years.

Competitive Landscape

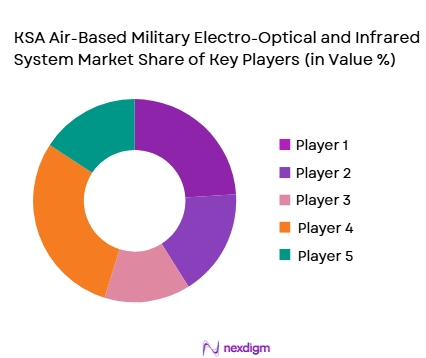

The KSA Air-Based Military Electro-Optical and Infrared Systems market is dominated by both global defense giants and regional players. Major global defense companies such as Lockheed Martin, Northrop Grumman, and Raytheon Technologies have a strong presence in the region, owing to their advanced technologies and established relationships with the Saudi government. Additionally, regional companies like Saudi Arabian Military Industries (SAMI) are becoming increasingly influential by offering localized solutions tailored to the specific needs of the Saudi military.

Competitive Landscape Table

| Company | Year Established | Headquarters | Technology Focus | Military Solutions | Product Portfolio | Strategic Partnerships |

| Lockheed Martin | 1912 | Bethesda, Maryland | ~ | ~ | ~ | ~ |

| Northrop Grumman | 1939 | Falls Church, Virginia | ~ | ~ | ~ | ~ |

| Raytheon Technologies | 1922 | Waltham, Massachusetts | ~ | ~ | ~ | |

| Elbit Systems | 1966 | Haifa, Israel | ~ | ~ | ~ | ~ |

| BAE Systems | 1999 | Farnborough, UK | ~ | ~ | ~ | ~ |

KSA Air-Based Military Electro-Optical and Infrared Systems Market Analysis

Growth Drivers

Urbanization

Indonesia’s urbanization rate has been steadily increasing, with approximately ~of the population residing in urban areas as of 2024. The country is undergoing significant urban growth, which has led to increased industrial activity, vehicular emissions, and pollution levels. This urban expansion creates a greater need for air quality monitoring systems to address the challenges of air pollution in densely populated cities like Jakarta, Surabaya, and Bandung. As cities expand, air quality management becomes crucial for public health and environmental sustainability, driving demand for advanced air quality monitoring technologies.

Industrialization

Indonesia’s industrial sector, which contributed ~of GDP in 2023, continues to grow with increased production activities in sectors such as manufacturing, energy, and construction. This growth has been accompanied by rising pollution levels, particularly in urban and industrial areas. As industries expand, so does the need for effective air quality monitoring to meet regulatory standards and protect public health. With increased energy production, mining, and manufacturing, air quality management systems are critical to monitoring pollutants such as PM~and NOx.

Restraints

High Initial Costs

The high initial costs associated with the installation and maintenance of air quality monitoring systems remain a significant barrier for both government agencies and private companies. These systems, including the sensors, data collection, and real-time reporting infrastructure, can be expensive to deploy, especially in regions outside of major urban centers. The high capital expenditure required for setting up these systems limits the widespread adoption in smaller cities and rural areas. Despite government funding for urban regions, the cost factor continues to restrict broader market growth.

Technical Challenges

Air quality monitoring systems often face technical challenges related to accuracy, calibration, and data integration. In Indonesia, monitoring equipment must function effectively in diverse environmental conditions, including tropical climates, which can impact the long-term reliability of sensors. Additionally, the integration of real-time data with existing infrastructure, such as urban management systems, poses a significant challenge. These technical barriers slow down the seamless deployment of effective monitoring solutions across the country.

Opportunities

Technological Advancements

Recent technological advancements in sensor technology, data analytics, and cloud computing present a significant opportunity for the air quality monitoring market in Indonesia. The cost of sensors has decreased, and their accuracy has significantly improved, making it easier for both private and government organizations to adopt advanced air quality systems. Furthermore, the development of IoT-based monitoring platforms allows real-time air quality data collection and analysis, providing more detailed and actionable insights to both local authorities and the public. These technological advancements create a favorable environment for the growth of the market, enhancing its future potential.

International Collaborations

International collaborations between Indonesia and countries with advanced air quality management systems, such as Japan and the United States, present significant growth opportunities. These partnerships can facilitate the transfer of technology, knowledge sharing, and joint initiatives for air quality management. Collaborative efforts often bring in funding and technical expertise, aiding in the deployment of advanced monitoring solutions in regions with poor infrastructure. Additionally, these collaborations can assist in developing better emission control policies and aligning Indonesia’s air quality standards with global practices.

Future Outlook

Over the next ~years, the KSA Air-Based Military Electro-Optical and Infrared Systems market is expected to witness significant growth. This is driven by the continuous modernization of the Saudi military, increasing regional security concerns, and the growing need for advanced surveillance systems. The Saudi government’s defense budget allocation and its strategic military collaborations with leading global defense contractors will play a critical role in shaping the market’s trajectory. Advancements in system miniaturization and artificial intelligence integration will further fuel demand, creating new opportunities for market expansion.

Major Players

- Lockheed Martin

- Northrop Grumman

- Raytheon Technologies

- Elbit Systems

- BAE Systems

- Leonardo

- Thales Group

- Saab Group

- L3Harris Technologies

- Israel Aerospace Industries

- Harris Corporation

- Leonardo DRS

- General Dynamics

- Rafael Advanced Defense Systems

- Hanwa Systems

Key Target Audience

- Defense Contractors

- Government and Regulatory Bodies

- Military and Security Agencies

- Investments and Venture Capitalist Firms

- Aerospace and Defense OEMs

- Defense Procurement Departments

- Military and Security Technology Integrators

- Armed Forces Leadership

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves identifying the key drivers, restraints, and opportunities influencing the KSA Air-Based Military Electro-Optical and Infrared Systems market. This is achieved through secondary data analysis, focusing on key governmental policies, defense budgets, and technological developments.

Step 2: Market Analysis and Construction

This step includes a comprehensive analysis of historical data regarding the market size, system installations, and technological developments. A detailed market map is created to track the growth and adoption of various system types across different platforms.

Step 3: Hypothesis Validation and Expert Consultation

The research team validates hypotheses through interviews with industry experts, including defense contractors and military officials. These consultations provide real-world insights into market trends, technological innovations, and emerging opportunities.

Step 4: Research Synthesis and Final Output

In the final phase, a synthesis of all gathered data is completed. The research team combines the insights from primary and secondary sources to ensure the accuracy of the market forecast and identifies the critical variables impacting market growth.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing demand for surveillance and reconnaissance capabilities

Rising defense budgets in the KSA region

Technological advancements in electro-optical and infrared systems - Market Challenges

High initial investment and maintenance costs

Limited local manufacturing capabilities

Regulatory and certification hurdles for advanced systems - Market Opportunities

Growing regional geopolitical tensions driving defense investments

Technological innovation creating more compact and affordable solutions

Collaboration opportunities with international defense agencies - Trends

Integration of AI for enhanced image processing

Shift towards multi-sensor systems for broader capabilities

Increased adoption of unmanned aerial platforms in military applications - Government regulations

Export control regulations for military technologies

Compliance with international defense standards

Regulations on the use of EO/IR systems in defense operations - SWOT analysis

Strength: Saudi Arabia’s strong military and defense capabilities

Weakness: High reliance on foreign technology and suppliers

Opportunity: Expanding UAV applications for defense operations

Threat: Rising competition from global defense technology firms - Porters 5 forces

Threat of new entrants: Low

Bargaining power of suppliers: Moderate

Bargaining power of buyers: High

Threat of substitute products: Moderate

Industry rivalry: High

- By Market Value ,2020-2025

- By Installed Units ,2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier ,2020-2025

- By System Type (In Value%)

Electro-Optical Systems

Infrared Systems

Multi-Spectral Systems

Laser Designator

SystemsTarget

Acquisition Systems - By Platform Type (In Value%)

Unmanned Aerial Vehicles (UAVs)

Manned Aircraft

Helicopters

Aerostats

Drones - By Fitment Type (In Value%)

Pod Mounted

Airframe Integrated

Wing Pod

Underbelly Integrated

Tail Mounted - By EndUser Segment (In Value%)

Military Air Forces

Military Naval Forces

Defense Contractors

Government Defense Agencies

Security Forces - By Procurement Channel (In Value%)

Direct Procurement

Defense Contractors

OEM Suppliers

Government Contracts

International Partnerships

- Cross Comparison Parameters (System Performance, Pricing, Market Share, Technological Innovation, Product Portfolio)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Lockheed Martin

Northrop Grumman

Raytheon Technologies

Saab Group

BAE Systems

Elbit Systems

Thales Group

L3Harris Technologies

Leonardo

General Dynamics

Israel Aerospace Industries

Hanwa Systems

Rafael Advanced Defense Systems

Harris Corporation

Sierra Nevada Corporation

- Adoption of advanced electro-optical and infrared systems in defense modernization

- Focus on improving situational awareness for military operations

- Increasing collaboration between regional and international defense forces

- Need for cost-effective and reliable defense solutions

- Forecast Market Value ,2026-2035

- Forecast Installed Units ,2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform ,2026-2035