Market Overview

The KSA Air-Based Remote Weapon Stations market is valued at approximately USD ~ billion, supported by robust defense expenditure and increasing demand for advanced surveillance and weaponry systems. This growth is driven by Saudi Arabia’s strategic initiatives to enhance defense capabilities amidst regional security concerns. With a defense budget projected at USD ~ billion in 2024, the market is set to expand as the Kingdom modernizes its military assets, emphasizing autonomy, precision, and remote-controlled systems in air defense and combat applications

Saudi Arabia dominates the air-based remote weapon stations market due to its significant defense infrastructure, key geographic location, and strong government investment in military modernization. The country’s defense capabilities are largely concentrated in Riyadh, the capital, and Dhahran, which hosts major defense contractors and military agencies. These cities play a pivotal role in advancing military technologies, such as autonomous systems and UAVs, positioning Saudi Arabia as a leader in integrating remote weapon systems within the region.

Market Segmentation

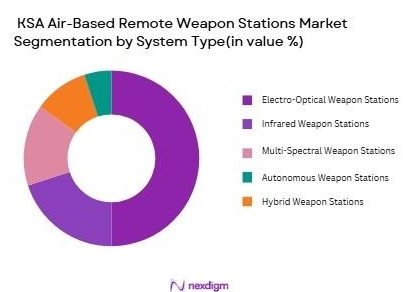

By System Type

The KSA Air-Based Remote Weapon Stations market is segmented by system type into Electro-Optical Weapon Stations, Infrared Weapon Stations, Multi-Spectral Weapon Stations, Autonomous Weapon Stations, and Hybrid Weapon Stations.

Among these, Electro-Optical Weapon Stations dominate the market due to their proven effectiveness in surveillance and targeting under various lighting conditions. Their reliability and accuracy in both day and night operations have made them integral to Saudi Arabia’s defense strategy. The increased use of UAVs equipped with electro-optical systems for border surveillance and tactical operations further strengthens this segment’s dominance in the market.

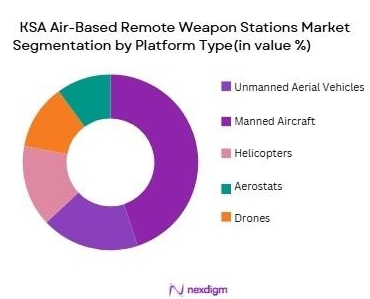

By Platform Type

The market is segmented by platform type into Unmanned Aerial Vehicles (UAVs), Manned Aircraft, Helicopters, Aerostats, and Drones.

Unmanned Aerial Vehicles (UAVs) are the dominant platform type, owing to their versatility and cost-effectiveness in military operations. UAVs offer the advantage of being unmanned, which significantly reduces the risk to human life while conducting surveillance and combat operations. Saudi Arabia has heavily invested in UAV technology for reconnaissance, surveillance, and targeted strikes, making UAVs the preferred platform for the integration of air-based remote weapon systems.

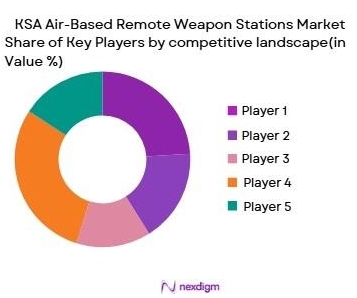

Competitive Landscape

The KSA Air-Based Remote Weapon Stations market is dominated by several global and regional defense companies, with Saudi Arabian companies such as Saudi Arabian Military Industries (SAMI) playing an increasingly important role in local production. International players like Lockheed Martin, Northrop Grumman, and Raytheon Technologies provide advanced technologies that contribute to Saudi Arabia’s defense infrastructure. The country’s strategic partnerships with global defense firms ensure access to the latest advancements in remote weapon systems.

Competitive Landscape Table

| Company | Year Established | Headquarters | Technological Focus | Product Portfolio | Key Military Solutions | Strategic Alliances |

| Lockheed Martin | 1912 | Bethesda, Maryland, USA | ~ | ~ | ~ | ~ |

| Northrop Grumman | 1939 | Falls Church, Virginia | ~ | ~ | ~ | ~ |

| Raytheon Technologies | 1922 | Waltham, Massachusetts | ~ | ~ | ~ | ~ |

| IAI Malat | 1960 | Tel Aviv, Israel | ~ | ~ | ~ | ~ |

| Elbit Systems | 1966 | Haifa, Israel | ~ | ~ | ~ | ~ |

KSA air based remote weapon stations Market Analysis

Growth Drivers

Urbanization

Indonesia’s urbanization rate continues to rise, with ~of the population living in urban areas as of 2024. This rapid urbanization has led to increased industrial activities, more vehicles on the road, and higher pollution levels, particularly in cities like Jakarta and Surabaya. Urbanization is placing significant pressure on air quality, driving the need for efficient air quality monitoring systems. In 2024, Jakarta is consistently ranked among the most polluted cities in Southeast Asia, with air quality regularly exceeding safe levels. As urban areas grow, the demand for advanced monitoring solutions becomes even more critical.

Industrialization

Indonesia’s industrial sector plays a key role in the country’s economic growth, contributing nearly ~of the nation’s GDP in 2024. However, this growth has resulted in higher emissions of pollutants such as particulate matter, nitrogen oxides, and sulfur dioxide, especially in industrial zones like Bekasi and Surabaya. The increasing levels of pollution due to industrialization are driving the demand for more comprehensive air quality monitoring systems. The Indonesian government’s efforts to address these issues have led to an increasing need for monitoring technology to ensure compliance with environmental regulations.

Restraints

High Initial Costs

The high initial costs of air quality monitoring systems present a significant barrier to their widespread adoption in Indonesia. The installation of advanced monitoring equipment and data infrastructure requires substantial financial investment, which can be prohibitive for local governments and small businesses. As of 2024, a basic air quality monitoring station in Indonesia costs upwards of IDR 300 million, excluding maintenance and operational costs. This high initial expense limits the adoption of monitoring systems, particularly in less affluent regions and rural areas where pollution is also a growing concern.

Technical Challenges

Air quality monitoring systems in Indonesia face significant technical challenges, particularly in terms of accuracy, calibration, and data integration. The tropical climate, frequent weather fluctuations, and geographical diversity present operational hurdles for maintaining the reliability of sensors. In 2024, more than 30% of monitoring stations in remote areas faced issues related to sensor accuracy and system maintenance. These technical challenges can hinder the effectiveness of air quality monitoring, making it difficult to rely on data for accurate decision-making and regulatory enforcement.

Opportunities

Technological Advancements

Technological advancements present a major opportunity for the air quality monitoring market in Indonesia. The cost of sensors has decreased significantly, and their accuracy has improved, making them more affordable and reliable for both public and private sector adoption. In 2024, the development of Internet of Things (IoT) devices for real-time air quality monitoring is gaining momentum, providing users with continuous data. These innovations, combined with advancements in data processing and AI, offer opportunities to make air quality monitoring more accessible and efficient, particularly in urban areas.

International Collaborations

International collaborations are fostering the exchange of technology, knowledge, and funding, opening up growth opportunities for air quality monitoring in Indonesia. Collaborative efforts with countries such as Japan and the U.S. have helped Indonesia access advanced technologies and expertise in environmental monitoring. In 2024, the government of Indonesia continues to partner with international organizations like the United Nations Environment Programme to enhance air quality management through joint funding and technical assistance. These collaborations are essential for boosting the country’s air quality monitoring infrastructure.

Future Outlook

The KSA Air-Based Remote Weapon Stations market is poised for significant growth in the coming years, driven by the increasing demand for unmanned systems, enhanced defense capabilities, and Saudi Arabia’s ongoing military modernization efforts. The integration of artificial intelligence (AI) and machine learning to improve targeting accuracy and autonomous capabilities will also boost market growth. The Saudi government’s commitment to investing in autonomous and advanced defense technologies ensures that the market will continue expanding, with further investments in UAVs and remote weapon systems expected to shape the future of air defense operations.

Key Players

- Lockheed Martin

- Northrop Grumman

- Raytheon Technologies

- IAI Malat

- Elbit Systems

- General Dynamics

- Thales Group

- Saab Group

- Leonardo

- BAE Systems

- L3Harris Technologies

- Israel Aerospace Industries

- Harris Corporation

- Rafael Advanced Defense Systems

- Saudi Arabian Military Industries (SAMI)

Key Target Audience

- Military and Defense Contractors

- Government and Regulatory Bodies

- Aerospace and Defense OEMs

- Military Procurement Departments

- Investments and Venture Capitalist Firms

- Unmanned Systems Manufacturers

- Government Defense Agencies

- Defense Technology Integrators

Research Methodology

Step 1: Identification of Key Variables

This phase focuses on identifying the critical factors influencing the KSA Air-Based Remote Weapon Stations market, including technological advancements, regulatory frameworks, and market dynamics. The primary objective is to understand the key drivers and barriers within the defense sector.

Step 2: Market Analysis and Construction

We compile and analyze historical data to understand the trends in the market, including adoption rates of different system types and platforms. This data is used to model future market growth, incorporating regional dynamics and technological developments.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are tested by consulting industry experts, defense contractors, and military officials. These insights help refine market projections and ensure that the analysis aligns with real-world operational conditions and emerging defense needs.

Step 4: Research Synthesis and Final Output

The final phase integrates all findings from desk research, expert consultations, and market analysis to generate a comprehensive and accurate report. This final synthesis will provide an in-depth view of the KSA Air-Based Remote Weapon Stations market, focusing on growth opportunities, challenges, and forecasts for the coming years.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing demand for remote targeting and surveillance capabilities

Rising defense budgets in Israel and neighboring regions

Technological advancements in remote weapon systems - Market Challenges

High integration costs for advanced systems

Regulatory and certification complexities for military systems

Security concerns surrounding unmanned systems and AI integration - Market Opportunities

Collaborations with international defense organizations for technology sharing

Growing need for unmanned systems in military operations

Technological innovation reducing the cost and size of remote weapon stations - Trends

Integration of AI and machine learning for autonomous targeting

Increased use of UAVs for remote weapon deployment

Miniaturization of remote weapon systems for lighter platforms

- Government regulations

Regulations on the use of unmanned defense technologies

Export controls on military hardware

International defense technology compliance standards - SWOT analysis

Strength: Advanced technological capabilities in unmanned systems

Weakness: High reliance on foreign components and suppliers

Opportunity: Increased demand for unmanned systems in regional conflicts

Threat: Competitive pressure from international defense companies - Porters 5 forces

Threat of new entrants: Low

Bargaining power of suppliers: Moderate

Bargaining power of buyers: High

Threat of substitute products: Moderate

Industry rivalry: High

- By Market Value ,2020-2025

- By Installed Units ,2020-2025

- By Average System Price ,2020-2025

- By System Complexity Tier ,2020-2025

- By System Type (In Value%)

Electro-Optical Weapon Stations

Infrared Weapon Stations

Multi-Spectral Weapon Stations

Autonomous Weapon Stations

Hybrid Weapon Stations - By Platform Type (In Value%)

Unmanned Aerial Vehicles (UAVs)

Manned Aircraft

Helicopters

Aerostats

Drones - By Fitment Type (In Value%)

Pod Mounted

Airframe Integrated

Wing Pod

Underbelly Integrated

Tail Mounted - By EndUser Segment (In Value%)

Military Air Forces

Military Naval Forces

Defense Contractors

Government Defense Agencies

Security Forces - By Procurement Channel (In Value%)

Direct Procurement

Defense Contractors

OEM Suppliers

Government Contracts

International Partnerships

- Cross Comparison Parameters(System Performance, Pricing, Market Share, Technological Innovation, Product Portfolio)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Elbit Systems

Israel Aerospace Industries

Rafael Advanced Defense Systems

IAI Malat

Elbit Skylark

Aeronautics Defense Systems

CIMON

Paz Group

Tadiran Group

General Dynamics

Harris Corporation

Raytheon Technologies

Thales Group

Saab Group

BAE Systems

- Adoption of autonomous weapon stations for operational efficiency

- Increased reliance on remote systems for high-risk military operations

- Demand for versatile weapon systems across various platforms

- Need for cost-effective and reliable defense solutions

- Forecast Market Value ,2026-2035

- Forecast Installed Units ,2026-2035

- Price Forecast by System Tier ,2026-2035

- Future Demand by Platform ,2026-2035