Market Overview

The KSA Air Defense Systems market is valued at USD ~ billion, driven by the country’s strategic importance as a regional security powerhouse. The market is propelled by increasing defense budgets, particularly the Saudi Ministry of Defense’s focus on modernizing its air defense systems in light of evolving regional threats. Factors such as the proliferation of advanced missile technologies and the ongoing modernization of defense platforms underscore the demand for next-generation air defense systems. In addition, the ongoing integration of cutting-edge systems like THAAD and Patriot with indigenous technologies continues to fuel market growth, positioning the Kingdom as a leading player in the Middle East’s defense market.

Saudi Arabia, particularly Riyadh and Jeddah, dominates the air defense systems market in the region. Riyadh, as the capital, hosts key defense contractors and is the central hub for the Ministry of Defense’s procurement operations. Jeddah’s proximity to the Red Sea and its strategic port further enhances its importance in regional defense. Saudi Arabia’s dominance is bolstered by its robust defense spending, ongoing military modernization efforts, and its participation in regional defense coalitions like the Arab Coalition. Additionally, the Kingdom’s geopolitical stance and its security challenges, such as missile attacks from neighboring Yemen and tensions with Iran, position it as a significant market player in the air defense sector.

Market Segmentation

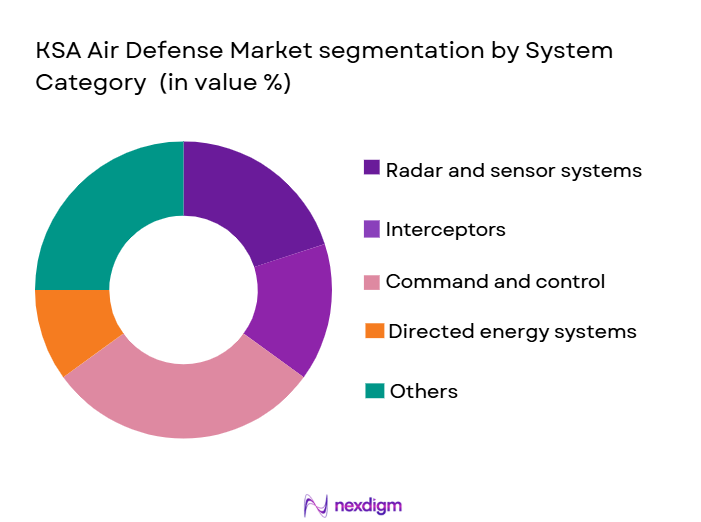

By System Category

The KSA Air Defense market is segmented into missile defense systems, anti-aircraft guns, counter-UAS systems, C-RAM, and directed energy systems. Among these, missile defense systems hold the dominant market share, primarily due to their critical role in addressing evolving missile threats from regional adversaries. Saudi Arabia has focused heavily on procuring advanced missile defense systems like the THAAD and Patriot systems, which are integral to its defense strategy. The increasing threats from ballistic and cruise missiles, coupled with Saudi Arabia’s efforts to enhance its missile defense capabilities, contribute significantly to the dominance of this segment.

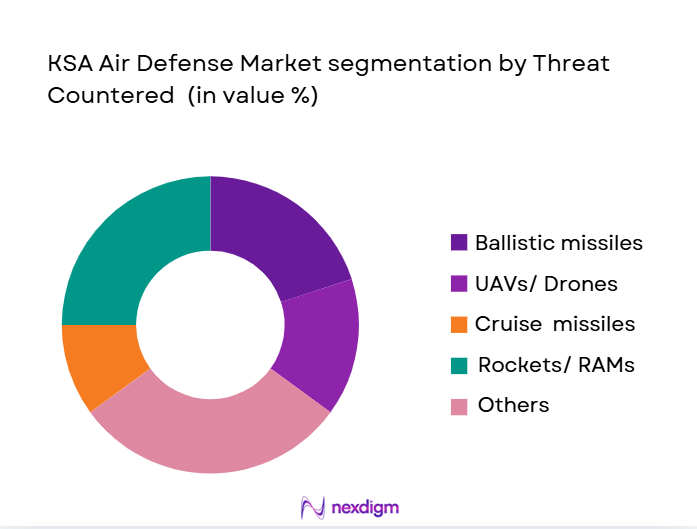

By Threat Countered

The air defense market in Saudi Arabia is segmented into land-based, naval, and airborne platforms. The land-based air defense systems dominate the market, driven by Saudi Arabia’s substantial investments in both fixed and mobile ground-based missile defense platforms. These systems, such as the Patriot and THAAD, offer versatile defense coverage, which is essential for protecting critical infrastructure. The shift towards more integrated systems that combine radar, command and control, and missile defense components further solidifies the land-based segment’s dominance in the Kingdom’s air defense strategy.

Competitive Landscape

The KSA Air Defense Systems market is dominated by several key global players, with a few local manufacturers also making inroads. Major international players include Raytheon Technologies, Lockheed Martin, and MBDA, which have strong ties with Saudi Arabia through long-term contracts and military sales agreements. The competitive landscape highlights the dominance of both well-established defense contractors and regional defense firms. These companies benefit from ongoing defense procurement programs and technology transfer agreements with the Saudi Ministry of Defense.

| Company Name | Establishment Year | Headquarters | Market Share (2024) | Revenues (USD) | Production Capacity | R&D Investment | Defense Contracts | Key Technologies | Strategic Partnerships | Export Markets |

| Raytheon Technologies | 1922 | USA | ~ | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| Lockheed Martin | 1912 | USA | ~ | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| MBDA | 2001 | France | ~ | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| Saab Group | 1937 | Sweden | ~ | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| BAE Systems | 1999 | UK | ~ | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

KSA Air Defense Market Analysis

Growth Drivers

Escalating Regional Air & Missile Threats

Saudi Arabia faces increasing air and missile threats, particularly from neighboring Yemen, Iran, and other regional actors. The conflict in Yemen has seen missile and drone attacks against Saudi Arabia’s infrastructure, prompting the Kingdom to prioritize advanced air defense systems. In 2024, Saudi Arabia allocated significant portions of its defense budget, amounting to approximately USD ~ billion for defense expenditures, as per the Saudi Ministry of Finance, with a particular focus on missile defense technologies. This is in line with growing missile and drone threats that have intensified the need for robust countermeasures.

Vision 2030 Localization & SAMI Incentives

As part of Saudi Arabia’s Vision 2030, the Kingdom is focusing on defense sector localization through the establishment of the Saudi Arabian Military Industries (SAMI). SAMI’s strategic objective is to reduce the Kingdom’s reliance on foreign military supplies, with a target of increasing domestic defense manufacturing to ~% by 2030. In 2024, SAMI has been actively engaging with foreign contractors to facilitate technology transfers and local manufacturing of missile defense systems, radar equipment, and integrated defense solutions. This will significantly enhance the Kingdom’s capability to produce its own air defense systems.

Market Challenges

High Entry Barriers and Long Procurement Cycles

Saudi Arabia’s defense procurement cycles are characterized by lengthy approval processes and complex regulatory frameworks. These factors pose high entry barriers for new entrants and suppliers, particularly in the air defense systems sector. The procurement process for advanced air defense systems typically involves multi-year negotiation and approval timelines, as well as intricate contracts requiring compliance with specific offset programs. In 2024, the Kingdom is focused on improving transparency in defense procurement, but challenges remain due to bureaucratic hurdles and complex contractual arrangements. This often delays the acquisition of critical systems, affecting the pace of technological upgrades.

Geopolitical Supply Chain Fragility

Geopolitical tensions in the Middle East, particularly with Iran and the ongoing conflict in Yemen, exacerbate vulnerabilities in defense supply chains. Saudi Arabia’s reliance on foreign suppliers for advanced air defense systems makes its defense procurement susceptible to disruption. In 2024, the global defense supply chain faces additional challenges, with risks of delays in key components and technologies, such as radar systems and missile parts, being exacerbated by international sanctions and trade restrictions. Saudi Arabia has taken steps to mitigate these risks by fostering domestic manufacturing partnerships through SAMI, but geopolitical instability continues to threaten supply chain security.

Market Opportunities

C-UAS & C-RAM Expansions for Homeland Security

Counter-Unmanned Aerial Systems (C-UAS) and Counter-Rocket, Artillery, and Mortar (C-RAM) technologies are becoming essential components of Saudi Arabia’s defense strategy. In 2024, the country faces a growing threat from small drones and missiles, as seen in the 2019 drone attack on Saudi oil facilities. The demand for C-UAS systems, capable of detecting and neutralizing small drones, is expanding rapidly. Saudi Arabia has already made significant strides in the development of C-RAM systems to safeguard critical infrastructure. This technology is seen as a priority for homeland security, as it enhances defense capabilities against unconventional air threats.

AI and Autonomous Defense Solutions Integration

Saudi Arabia is increasingly integrating Artificial Intelligence (AI) and autonomous systems into its air defense strategies. These advanced technologies enable faster decision-making processes, real-time threat assessments, and autonomous interception of incoming missiles or drones. In 2024, the Kingdom is investing in AI-driven air defense systems to automate threat detection and response. The use of AI in air defense systems allows for improved operational efficiency, reducing the reliance on manual intervention and enabling faster responses to threats. This integration is expected to become a significant area of growth in the coming years, driving innovation and boosting defense capabilities.

Future Outlook

Over the next decade, the KSA Air Defense market is expected to witness significant growth, driven by the country’s commitment to modernizing its military capabilities in response to evolving regional threats. The integration of AI, enhanced missile defense systems, and the increasing emphasis on counter-UAS technologies will play a pivotal role in shaping the future of the air defense market. Saudi Arabia’s ambitious Vision 2030 goals, which include greater domestic production of defense systems, will further accelerate the market’s expansion. The Kingdom’s strategic alliances with major defense manufacturers and ongoing defense procurement programs will ensure sustained growth in this sector.

Major Players in the Market

- Raytheon Technologies

- Lockheed Martin

- MBDA

- Saab Group

- BAE Systems

- Thales Group

- Northrop Grumman

- Leonardo S.p.A.

- Elbit Systems

- General Dynamics

- Rheinmetall

- L3Harris Technologies

- Kongsberg Gruppen

- Hanwa Systems

- AeroVironment

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies (Saudi Ministry of Defense, Royal Saudi Air Force, National Guard, Ministry of Interior)

- Military contractors

- Air defense systems OEMs

- Defense technology firms

- System integrators

- International defense suppliers

- Saudi-based defense manufacturers

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves identifying critical factors that influence the KSA Air Defense market, including government policies, defense budget allocation, regional security challenges, and technological advancements. This is accomplished through secondary research using government publications, defense spending reports, and global market databases.

Step 2: Market Analysis and Construction

This phase entails gathering and analyzing historical data related to air defense procurement and spending by Saudi Arabia. We assess the volume of systems procured, types of defense technologies in demand, and the evolution of the air defense market in the Kingdom.

Step 3: Hypothesis Validation and Expert Consultation

Expert consultations, including interviews with military professionals, defense analysts, and manufacturers, are conducted to validate market assumptions. This step helps refine data accuracy and confirm market trends and projections.

Step 4: Research Synthesis and Final Output

The final output consolidates the data gathered from multiple sources, including interviews with defense manufacturers, industry reports, and market analyses. This step ensures the report provides a holistic view of the KSA Air Defense market, validated by both top-down and bottom-up research approaches.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions , Data Sourcing and Validation Framework Defense Procurement & Military Budget Analytics Approach, Primary Research Forecasting Models Used , Limitations and Quality Control)

- Definition and Scope of KSA Air Defense Systems

- Saudi Defense & Security Context

- Air Threat Landscape & National Security Drivers

- Saudi Air Defense Doctrine and Strategic Priorities

- Air Defense Governance and Procurement Architecture

- Growth Drivers

Escalating Regional Air & Missile Threats

Vision 2030 Localization & SAMI Incentives

Radar Modernization & Sensor Network Expansion - Market Challenges

High Entry Barriers and Long Procurement Cycles

Geopolitical Supply Chain Fragility

Complex Interoperability Requirements with Coalition Forces - Market Opportunities

C‑UAS & C‑RAM Expansions for Homeland Security

AI and Autonomous Defense Solutions Integration

Air Defense Modernization for Interoperability - Market Trends

Convergence of Air, Land, and Maritime Defense Systems

Growth of Hypersonic Missile Defense Programs

Defense R&D Focus on Directed Energy Weapons - Government Regulations

Defense Budgeting and Capex Allocation Policies

Regulatory Mandates on Domestic Manufacturing & Technology Transfer

Defense Offset & Localization Requirements - SWOT Analysis

- Porter’s Five Forces

- By Revenue (USD), 2020-2025

- By System Volume, 2020-2025

- By Average System Value, 2020-2025

- By Segment Share, 2020-2025

- By System Type (In value %)

Missile Defense Systems (Long, Medium, Short Range)

Anti‑Aircraft Gun & Missile Platforms

Counter‑UAS Systems

C‑RAM & Directed Energy Systems

Integrated Battle Management & Sensor Fusion - By Component (In value %)

Weapon Engagement Layer (Missiles, Guns)

Radar & Sensor Suites

Fire Control & Targeting

Command, Control, Communications, Computers, Intelligence - By Platform (In value %)

Land‑Based Batteries

Naval Air Defense Suites

Airborne Early Warning & AEW&C - By End User (In value %)

Royal Saudi Air Defense Forces

Royal Saudi Air Force

Ministry of Interior / Homeland Security

National Guard Air Defense - By Procurement Model (In value %)

Direct Government Contracts

Foreign Military Sales (FMS)

Public‑Private Defense Partnerships

Indigenous Production/Transfer Agreements - By Technology Level (In value %)

2nd Generation (Legacy Systems)

3rd/4th Gen Integrated Systems

Next‑Gen AI‑Enabled ISR/Defense

- Market Share of Major Players by Value/Volume

- Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strengths, Weaknesses, Organizational Structure, Revenues, Revenues by System Type, Number of Touchpoints, Distribution Channels, Number of Dealers and Distributors, Margins, Production Plant, Capacity, Unique Value Offering)

- SWOT Analysis of Key Players

- Pricing Analysis of Major Players

- Detailed Profiles of Major Companies

Al‑Jazira Defense Systems

Raytheon Technologies

Lockheed Martin

Saab Group

Thales Group

MBDA

BAE Systems

L3Harris Technologies

Kongsberg Gruppen

Hanwa Systems

Elbit Systems

Rheinmetall Air Defence

Northrop Grumman

General Dynamics

AeroVironment

- Market Demand and Utilization by Key End Users

- Purchasing Power and Budget Allocations by Ministry/Force

- Regulatory and Compliance Requirements for Air Defense Procurement

- Needs, Desires, and Pain Point Analysis from End Users

- Decision-Making Process for Air Defense Acquisitions

- By Revenue (USD) 2025-2035

- By System Volume 2025-2035

- By Average System Value 2025-2035

- By Segment Share 2025-2035