Market Overview

The KSA Air-to-Surface Missiles market is a critical segment of the kingdom’s defense industry, valued at approximately USD ~ billion in 2025. This market’s growth is primarily driven by Saudi Arabia’s efforts to modernize its military forces and improve strategic defense capabilities. The substantial defense budget allocations and the need to enhance precision strike capabilities against various threats, including regional instabilities and terrorist activities, fuel the market’s demand. Additionally, international partnerships with global defense contractors contribute to technology transfer, boosting the development and integration of advanced missile systems into the Saudi Armed Forces.

Saudi Arabia, with its robust defense budget and strategic importance in the Middle East, is the dominant player in the KSA Air-to-Surface Missiles market. Major cities like Riyadh and Dhahran serve as key centers for defense procurement, military training, and technology integration. The country’s geographic location, combined with its political and economic standing in the region, drives its investments in advanced weaponry systems. The government’s Vision 2030 initiatives, aimed at diversifying the defense industry and increasing local manufacturing of military equipment, further bolster Saudi Arabia’s market dominance.

Market Segmentation

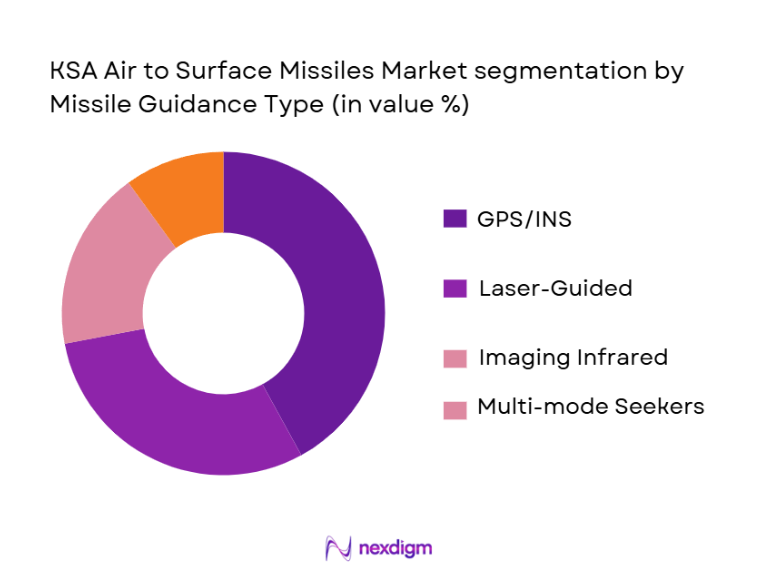

By Missile Guidance Type

The KSA Air-to-Surface Missiles market is segmented by missile guidance type, including GPS/INS, laser-guided, imaging infrared (IIR), and multi-mode seekers. Among these, GPS/INS-guided missiles dominate the market due to their high accuracy and reliability in various weather conditions. This technology enables precision strikes from long distances, which is vital for the Saudi Air Force’s operations. The integration of GPS/INS technology into a wide range of aircraft platforms, including fighter jets and unmanned aerial systems (UAVs), has made these missiles a preferred choice. Furthermore, international defense partnerships and technology transfer agreements have accelerated the deployment of GPS/INS-guided missiles across the Saudi military.

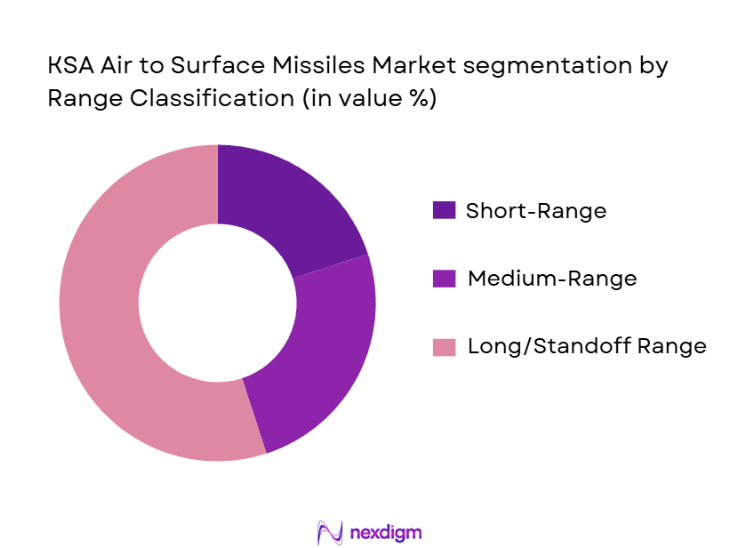

By Range Classification

The market is also segmented based on missile range, including short-range, medium-range, and long/stand-off range missiles. Long/stand-off range missiles hold a dominant market share, primarily due to the Saudi Air Force’s preference for engaging targets from a safe distance, minimizing exposure to enemy air defense systems. These missiles offer enhanced strategic flexibility, allowing for precision strikes on high-value targets such as enemy infrastructure, missile defense sites, and command centers. Additionally, the adoption of stand-off range missiles aligns with Saudi Arabia’s increasing focus on asymmetrical warfare strategies and force projection capabilities in the region.

Competitive Landscape

The KSA Air-to-Surface Missiles market is dominated by several key global players, including Lockheed Martin, Raytheon Technologies, Boeing, and MBDA. These companies lead the market due to their advanced missile technologies, established relationships with the Saudi government, and extensive defense product portfolios. Their competitive advantage lies in their ability to provide integrated missile systems that are compatible with various Saudi Air Force platforms, along with offering comprehensive after-sales support and maintenance services. Additionally, Saudi Arabia is increasingly focusing on local production, with companies like SAMI (Saudi Arabian Military Industries) beginning to play a more prominent role in the market.

| Company | Establishment Year | Headquarters | Key Technologies | Product Portfolio | Defense Contract Engagement | Market Presence |

| Lockheed Martin | 1995 | Bethesda, USA | ~ | ~ | ~ | ~ |

| Raytheon Technologies | 1922 | Waltham, USA | ~ | ~ | ~ | ~ |

| Boeing | 1916 | Chicago, USA | ~ | ~ | ~ | ~ |

| MBDA | 2001 | Paris, France | ~ | ~ | ~ | ~ |

| SAMI (Saudi Arabian Military Industries) | 2017 | Riyadh, Saudi Arabia | ~ | ~ | ~ | ~ |

KSA Air-to-Surface Missiles Market Analysis

Growth Drivers

Geopolitical Instability in the Middle East

Ongoing regional tensions, particularly with neighboring countries and insurgent groups, continue to push Saudi Arabia to modernize its military capabilities. This drives the demand for advanced air-to-surface missile systems to strengthen defense preparedness and deter potential threats.

Saudi Arabia’s Vision 2030 Defense Modernization Plan

Vision 2030 includes strategic initiatives to diversify the economy, which includes enhancing military capabilities and manufacturing defense systems locally. This has led to significant investments in defense technologies, including air-to-surface missiles, to reduce reliance on foreign defense imports and build indigenous defense capacity.

Market Challenges

High Cost of Advanced Missile Systems

The procurement and maintenance of high-tech air-to-surface missile systems involve substantial financial investment. These systems are expensive both in terms of initial cost and ongoing support, which can strain defense budgets, especially in periods of economic fluctuation.

Regulatory and Compliance Barriers

Strict international regulations and export controls (e.g., ITAR in the US) complicate the acquisition of certain advanced missile technologies. These regulations pose a challenge to timely procurement and integration of state-of-the-art systems, impacting the speed at which defense forces can modernize.

Opportunities

Development of Indigenous Missile Systems

The increasing push for local manufacturing and technology transfer, as part of Saudi Arabia’s Vision 2030, presents a significant opportunity for local companies like SAMI (Saudi Arabian Military Industries) to develop and produce air-to-surface missile systems, reducing dependency on foreign suppliers and boosting national defense capabilities.

Advancements in Hypersonic and AI-Driven Missiles

The growing interest in hypersonic technologies and AI-powered missile systems offers an opportunity for manufacturers to develop cutting-edge solutions for the KSA Air-to-Surface Missiles market. These advancements promise enhanced speed, precision, and the ability to counter emerging defense systems, positioning Saudi Arabia at the forefront of missile technology.

Future Outlook

Over the next 5 years, the KSA Air-to-Surface Missiles market is expected to experience substantial growth. This growth will be primarily driven by continued government investment in defense modernization under Saudi Arabia’s Vision 2030, along with the ongoing need to enhance the country’s strategic deterrence capabilities. The integration of advanced missile technologies, such as hypersonic missiles and AI-driven targeting systems, is expected to reshape the market dynamics. Additionally, the growing importance of regional security concerns and the evolving nature of warfare will propel the demand for more precise and effective air-to-surface missile systems.

Major Players

- Lockheed Martin

- Raytheon Technologies

- Boeing

- MBDA

- SAMI (Saudi Arabian Military Industries)

- Northrop Grumman

- BAE Systems

- Thales Group

- Leonardo

- Rafael Advanced Defense Systems

- Elbit Systems

- L3 Technologies

- General Dynamics

- Hanwha Defense

- Saab Group

Key Target Audience

- Saudi Ministry of Defense

- Royal Saudi Air Force

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies

- International Defense Contractors

- Defense Equipment Suppliers

- Aerospace and Defense Manufacturers

- Defense and Security Think Tanks

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map of key stakeholders, including defense ministries, military organizations, and missile technology providers. This is supported by secondary research and proprietary databases to understand the variables influencing the Air-to-Surface Missiles market in Saudi Arabia.

Step 2: Market Analysis and Construction

This phase analyzes historical data, focusing on market growth, procurement trends, and missile deployment across Saudi military platforms. Data from defense contractors, government reports, and market intelligence sources are used to create a comprehensive picture of the market dynamics.

Step 3: Hypothesis Validation and Expert Consultation

Experts within the defense industry will be consulted to validate market assumptions and hypotheses. This includes direct consultations with manufacturers, military strategists, and defense policymakers to refine data and forecast accuracy.

Step 4: Research Synthesis and Final Output

The final phase involves synthesizing the data obtained from multiple sources to present a refined, accurate market outlook for Saudi Arabia’s Air-to-Surface Missiles market. This will also include insights from defense contractors and end-users to provide a complete market picture.

- Executive Summary

- Research Methodology (Market Definitions & Assumptions, AirtoSurface Missile Technologies, Military Procurement Data Sources, Forecast Methodology, Primary Intelligence Framework, Limitation Scope, Defense Contract Intelligence Assumptions)

- Market Definition & Scope

- Historical Genesis & Capacity BuildUp

- Saudi Strategic Security Imperatives

- Force Posture & Missile Employment Doctrine

- Defense Procurement Cycle

- Value Chain & Integration Ecosystem

- Market Drivers

Modernization

Precision Demand

Regional Threats - Market Restraints

Technology Transfer Barriers

Cost & Integration - Market Opportunities

Localization/Offset Growth

CoDevelop Programs - Strategic Defense Trends

Precision

StandOff Capability Prioritization - Government Policy & Procurement Framework

Saudi Ministry of Defense Procurement Regulations

Vision 2030 Localization & Offset Policy

Export Control & Defense Technology Security Compliance

International Procurement Agreements & FMS Mechanisms

- Market Value Estimation 2020-2025

- Procurement Volume 2020-2025

- Unit Cost Benchmarks 2020-2025

- Carrier Platform Deployment Metrics 2020-2025

- By Guidance & Seeker Type (In Value%)

GPS/INS Guided

LaserGuided

Imaging Infrared/(IIR)

MultiMode Seeker - By Range Classification (In Value%)

Short Range

Medium Range

Long/StandOff Range - By Launch Platform (In Value%)

Fixed Wing Combat Aircraft

Rotary Wing Platforms

Unmanned Aerial Systems (UAVs) - By Warhead Configuration (In Value%)

High Explosive

Penetrator/Hard Target Kill

Fragmentation - By Tactical Role / Application (In Value%)

Deep Strike/Strategic Targeting

AntiInfrastructure

Maritime Surface Targeting

Close Air Support (CAS)

- Market Share & Competitive Benchmarking

- CrossComparison Parameters (Guidance System Sophistication, StandOff Range Capability Tier, Integration with RSAF Platforms, Localization / Offset Participation Level, Sustained Support & Maintenance Footprint, Warranty & Lifecycle Cost Metrics, Proven Combat Usage & Reliability Records, OEM Tech Transfer Depth & Licensing)

- Competitive Players

Lockheed Martin Corporation

Raytheon Technologies / RTX Corporation

MBDA Group

Boeing Defense, Space & Security

Northrop Grumman

BAE Systems plc

Leonardo S.p.A.

Thales Group

Elbit Systems Ltd.

SAUDI ARABIAN MILITARY INDUSTRIES (SAMI)

Wahaj / Saudi Advanced Technologies Company

L3Harris Technologies

General Dynamics Ordnance & Tactical Systems

Dassault Aviation / MBDA JV Platforms

Hanwha Defense

- Royal Saudi Air Force Doctrine & Missile Integration Strategies

- Platform Utilization & Mission Deployment Patterns

- EndUser Procurement Decision Framework

- Capability Gap & Tactical Requirements Analysis

- Market Value Projection 2026-2035

- Volume Forecast 2026-2035

- Technology Adoption Trajectory 2026-2035