Market Overview

The Saudi Arabia airbags market is valued at approximately USD ~ million in 2024, reflecting its critical role within automotive safety systems across passenger and commercial vehicles in the Kingdom. This valuation is supported by industry research which tracks the adoption of airbag systems as mandatory safety features in new vehicle models and rising consumer preference for advanced passenger protection systems. Strong emphasis on road safety regulations, increased vehicle ownership, and integration of airbags with advanced driver-assistance systems (ADAS) are key factors propelling this growth, as airbags become standard in both high-end and mid-segment vehicles.

In Saudi Arabia, Riyadh, Jeddah, and Dammam dominate the airbags market due to concentrated vehicle registrations, dense urban mobility, and robust aftermarket networks. These cities are primary automotive hubs where passenger and commercial vehicle sales, service stations, and fleet operations are highest. Additionally, the presence of regional headquarters for multinational auto manufacturers and parts distributors enhances access to advanced safety system components, fostering faster adoption in these urban centers.

Market Segmentation

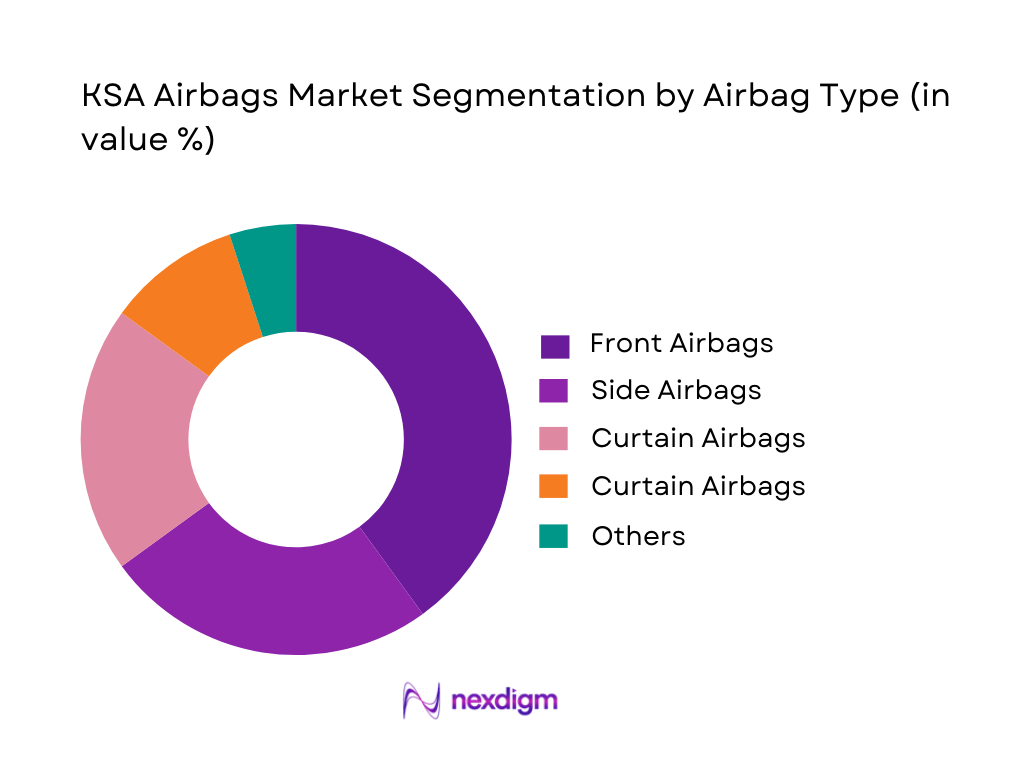

By Airbag Type

Front Airbags are the most dominant segment due to regulations and vehicle safety standards that make front occupant protection mandatory across virtually all passenger cars and light commercial vehicles. These airbags are installed as standard equipment in a vast majority of new vehicles sold in Saudi Arabia, reflecting OEM safety compliance and consumer expectations for baseline passive safety features. Side and curtain airbags follow as complementary protection systems, often included in higher trim levels and luxury models, where comprehensive occupant protection is a market differentiator. Knee airbags are emerging in premium and mid-segment cars as manufacturers seek to enhance lower-limb protection, but they hold a smaller share due to incremental adoption cycles. The diversified portfolio of airbag types reflects both regulatory imperatives and evolving consumer safety preferences across vehicle classes.

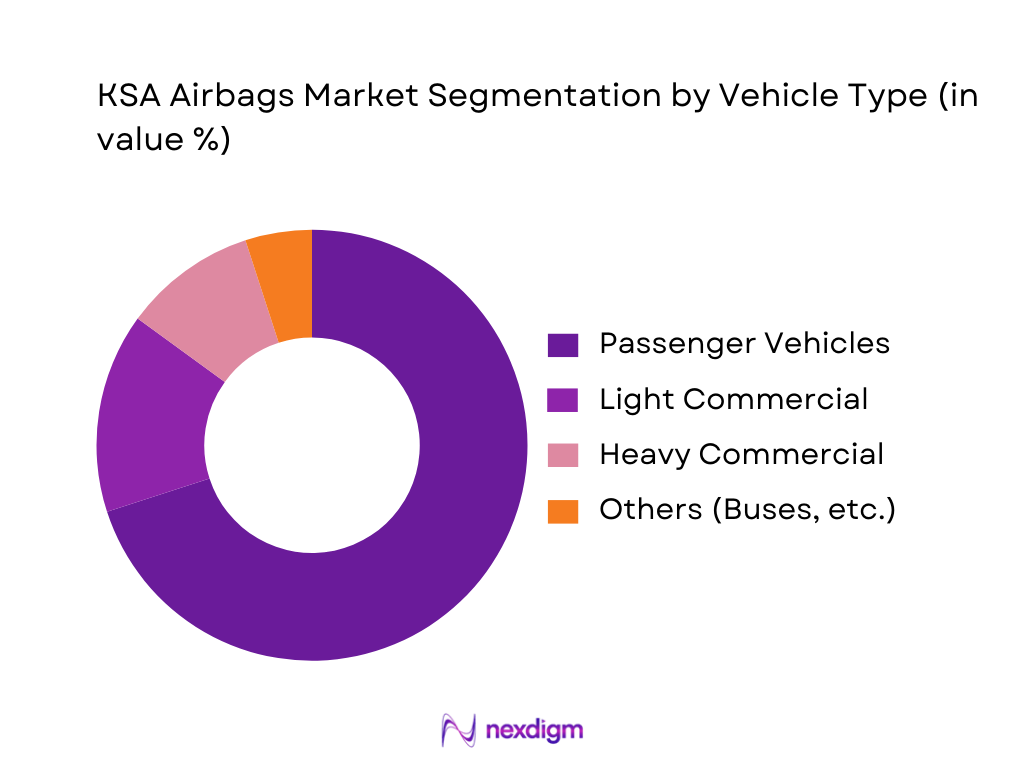

By Vehicle Type

Under the vehicle type market segmentation, Passenger Vehicles hold a commanding share of the airbags market because of higher passenger car sales and private ownership levels in major urban regions. Passenger vehicles often equip multiple airbags even in base trims, driven by stringent safety criteria and consumer expectations for occupant protection systems. Light and heavy commercial vehicles have lower penetration levels of advanced airbag systems due to cost considerations and differing safety requirements, though fleets are gradually requiring more comprehensive safety solutions. The broader passenger vehicle fleet size and higher new vehicle registrations amplify the demand for airbags in this segment relative to commercial vehicles.

Competitive Landscape

The Saudi airbags market is led by a mix of global automotive safety systems specialists and international Tier-1 component manufacturers. These companies maintain strong relationships with vehicle OEMs operating in Saudi Arabia and the broader GCC region, reflecting their influence on passive safety system adoption across passenger cars, light commercial vehicles, and trucks. Consolidation around established suppliers underscores the technical complexity and safety criticality inherent in airbag systems, while local aftermarket distributors play an essential role in ensuring replacement and retrofit availability.

| Company | Establishment Year | Headquarters | Airbag Module Portfolio | OEM Integration Experience | Distribution Network | Technical Certification | Regional Support Footprint | Aftermarket Reach |

| Autoliv | 1953 | Sweden/USA | ~ | ~ | ~ | ~ | ~ | ~ |

| ZF Friedrichshafen | 1915 | Germany | ~ | ~ | ~ | ~ | ~ | ~ |

| Joyson Safety Systems | 2018* | China/USA | ~ | ~ | ~ | ~ | ~ | ~ |

| Hyundai Mobis | 1977 | South Korea | ~ | ~ | ~ | ~ | ~ | ~ |

| Continental AG | 1871 | Germany | ~ | ~ | ~ | ~ | ~ | ~ |

KSA Airbags Market Analysis

Growth Drivers

Crash Fatality Reduction Targets

Crash-reduction commitments under Vision 2030 are a structural driver for the KSA airbags market. General Authority for Statistics data show ~ road-traffic deaths and ~ injuries in the Kingdom in 2022, with official traffic-safety dashboards indicating around ~ deaths in 2023, still thousands of fatalities on a population base of ~ million people from the most recent census. This scale of harm keeps occupant-protection technologies such as multi-stage frontal, side and curtain airbags central to policy and OEM discussions, as regulators push OEMs and importers to help drive down severe-injury burden while the vehicle fleet and mobility intensity continue to grow.

FMVSS-Based Safety Convergence

KSA’s move to align with advanced global vehicle-safety rules anchors demand for compliant airbag systems. The Saudi Standards, Metrology and Quality Organization enforces Gulf Technical Regulation 42, which requires safety features such as driver and front-passenger airbags, ABS, ESC and brake-override systems on new light vehicles sold into the Kingdom, with conformity certificates issued at import. In parallel, Saudi Arabia’s GDP in current prices stands above USD ~ trillion, giving strong purchasing power for high-spec vehicles whose designs already follow UN/ECE and FMVSS airbag requirements, effectively locking in frontal and side airbag content for nearly every new passenger vehicle entering the Saudi market.

Challenges

Inflator Recall Sensitivities

Global and local recall activity around airbag-related hazards creates reputational and cost challenges across the KSA airbags value chain. The Saudi Ministry of Commerce reported 23 recall campaigns in just one quarter of 2023, covering ~ faulty products, including over ~ vehicles of various brands, while broader product-safety actions have continued into 2024. Internationally, a single OEM’s airbag-sensor issue triggered a global recall of ~ million vehicles in 2023, underscoring how inflator or sensor defects can scale. For KSA distributors and workshops, managing owner outreach, parts logistics and workshop capacity for even tens of thousands of affected vehicles in a parc nearing ~ million units raises execution and customer-trust risks whenever inflator-safety questions surface.

Import Reliance

The KSA airbags market is structurally exposed to external supply shocks because the Kingdom depends almost entirely on imported vehicles and components. Sector analysis shows that nearly all light vehicles circulating on Saudi roads are imported rather than locally produced, while customs statistics record around ~ imported cars from top partners in 2022. More broadly, Saudi Arabia’s total merchandise imports were valued at roughly USD ~ billion in 2022 and USD ~ billion in 2023, with transport equipment and parts a large category. Any disruption in supplier countries’ airbag-inflator plants, logistics corridors or trade policy can therefore ripple straight into KSA’s dealership inventories and collision-repair pipelines, complicating recall rectification or replacement cycles across a ~-million-vehicle parc.

Opportunities

Smart / Adaptive Airbags

The shift towards premium vehicles and connected mobility opens a strong runway for smart and adaptive airbag systems in KSA. Census data confirm a young and urbanised population of ~ million people, with 63% of Saudis under 30 and heavy concentration in large metro regions such as Riyadh, Jeddah and Dammam, where new-vehicle demand and higher trim mixes are strongest. At the same time, GDP in current prices stands above USD ~ trillion, while the Public Investment Fund manages about USD ~ billion in assets, backing large transport and smart-city projects that favour advanced safety content. As OEMs push multi-sensor occupant classification, far-side protection and integrated curtain-airbag architectures globally, KSA’s high-income buyer base and regulatory support create a natural testbed for wider penetration of adaptive airbag control units tailored to local crash patterns and seating practices.

EV-Specific Safety Modules

Electrification and new-energy mobility in the Kingdom create a forward opportunity for EV-specific airbag and restraint modules. Customs and trade-promotion data show that imports of battery-electric and plug-in hybrid vehicles into Saudi Arabia climbed from ~ units in one year to ~ units the next, with EV imports valued at around SAR ~ million at customs in that later year. In parallel, overall passenger-car sales in the Kingdom rose towards ~ units annually, while total registered vehicles approached ~ million. As EV adoption accelerates under energy-transition and fuel-efficiency policies, cabin layouts, battery-floor structures and under-bonnet packaging all change crash dynamics, creating demand for redesigned knee, thorax and curtain airbags, high-voltage isolation strategies and specialised sensing algorithms calibrated to the EV crash pulse across Saudi driving conditions.

Future Outlook

The Saudi airbags market is expected to expand as the Kingdom continues its automotive sector transformation under economic diversification strategies. Future growth will be supported by stricter vehicle safety regulations, consumer demand for advanced crash protection, and integration with intelligent vehicle systems, including ADAS and connected safety frameworks. Increasing local assembly and potential regional manufacturing initiatives may enhance supply chain responsiveness and reduce import dependency. The adoption of smart airbag systems and multi-stage deployment technologies will further elevate the safety equipment landscape.

Major Players in the Market

- Autoliv

- ZF Friedrichshafen

- Joyson Safety Systems

- Hyundai Mobis

- Continental AG

- Toyota Boshoku

- TRW Automotive

- Denso Corporation

- Takata

- Robert Bosch GmbH

- Delphi Automotive

- Key Safety Systems

- Toyoda Gosei

- Nippon Seiki

Key Target Audience

- Automotive OEMs with Safety Systems Procurement Teams

- Tier-1 and Tier-2 Passive Safety Suppliers

- Automotive Parts Importers & Distributors

- Fleet Operators & Vehicle Safety Managers

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies

- Automotive Aftermarket Retail Chains

- Automotive Engineering & Testing Laboratories

Research Methodology

Step 1: Market Definitions & Variable Identification

The initial phase involved mapping key variables associated with the airbags market, including product types, vehicle segments, deployment technologies, and safety standards. This step leveraged authoritative secondary data sources, industry publications, and standardized market terminology to ensure comprehensive coverage.

Step 2: Data Collection & Historical Analysis

Historical data related to vehicle sales, passive safety mandates, and airbags adoption were compiled from proprietary industry databases. This included quantitative analysis of market valuations and segmentation trends relevant to Saudi Arabia.

Step 3: Primary Consultations and Industry Expert Validation

Insights were validated through consultations with industry professionals — including OEM safety engineers, Tier-1 supplier representatives, and aftermarket distributors — ensuring that qualitative inputs corroborate historical and forecast patterns.

Step 4: Forecast Modelling & Synthesis

Forecast projections were generated by integrating bottom-up market sizing with macroeconomic indicators tied to the Saudi automotive industry, including projected vehicle sales growth, consumer preferences on safety adoption, and regulatory safety evolutions to deliver a validated outlook.

- Executive Summary

- Research Methodology (Market Definitions & Assumptions, Airbag System Classification, Terminology Mapping, Market Sizing & Forecasting Logic, Triangulation via OEM–Tier-1–Tier-2 Inputs, Primary Respondent Mix, Import/Customs Dataset Analysis Approach, Vehicle Parc Validation, Safety Regulation Benchmarking Model, Limitations & Sensitivity Testing Framework)

- Definition & Scope

- Evolution of Vehicle Passive Safety Systems in KSA

- Introduction of Airbag Mandates & Compliance Roadmap

- Business Cycle

- Supply Chain & Value Chain Analysis

- Growth Drivers

Crash Fatality Reduction Targets

FMVSS-Based Safety Convergence

Import Surge of High-Spec SUVs

Vehicle Parc Expansion

Mandatory Fitment Policies - Challenges

Inflator Recall Sensitivities

Import Reliance

Low Replacement Compliance

Counterfeit Risks - Opportunities

Smart/Adaptive Airbags

EV-specific Safety Modules

Off-Road & Fleet Safety Upgrades

Aftermarket Digitization - Trends

Multi-Airbag Architecture

Side-Impact Testing Adoption

Inflator Material Transition

Advanced Sensor Integration - Government Regulation

- SWOT Analysis

- Stake Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- Airbags per Vehicle Ratio, 2019-2024

- Installed Base of Airbags in KSA Vehicle Parc, 2019-2024

- Average Realization per Airbag Module, 2019-2024

- By Airbag Type (in Value %)

Driver Airbags

Passenger Airbags

Side Airbags

Curtain Airbags

Knee Airbags - By Vehicle Type (in Value %)

Passenger Cars

SUVs & Crossovers

Pick-Up Trucks

LCVs

HCVs - By Technology (in Value %)

Single-Stage Airbags

Multi-Stage Airbags

Adaptive Airbags

Smart/Occupant Classifying Airbags

Sensor-Driven Airbag Systems - By End-User (in Value %)

OEM Fitment

Aftermarket Replacement

Crash-Repair Centers

Dealer Retrofit Channels - By Region (in Value %)

Central Region

Western Region

Eastern Region

Northern Region

Southern Region - By Inflator Type (in Value %)

Pyrotechnic

Hybrid

Stored Gas

- Market Share of Major Players

Market Share by Airbag Type - Cross Comparison Parameters (Airbag Deployment Architecture, Inflator Material Technology, Sensor Integration Capability, OEM Alignment & Localization, Recall Management Track Record, Multi-Airbag Module Expertise, EV-Safety Alignment, Aftermarket/Crash-Repair Reach)

- SWOT Analysis of Major Players

- Pricing Analysis Basis Airbag Module Type

- Detailed Profiles of Major Companies

Autoliv

ZF Friedrichshafen

Joyson Safety Systems

Hyundai Mobis

Toyoda Gosei

Daicel Corporation

Nihon Plast

Continental Safety Division

Ashimori Industry

Takata

Bosch Safety Systems

TRW Automotive

Delphi Passive Safety

Yanfeng Automotive Interior & Safety Systems

- Demand & Utilization Patterns across Vehicle Categories

- Purchasing Power & Budget Allocation

- Regulatory Compliance Requirements

- Pain Points & Unmet Needs

- Decision-Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- Airbags per Vehicle Ratio, 2025-2030

- Installed Base of Airbags in KSA Vehicle Parc, 2025-2030

- Average Realization per Airbag Module, 2025-2030