Market Overview

The KSA airborne countermeasure system market is a vital component of the broader defense and security sector, valued at approximately USD ~ billion. The market’s growth is driven by increasing defense budgets, with a focus on enhancing aerial defense systems amidst rising regional security threats. The demand is fueled by the growing need for advanced electronic warfare (EW) capabilities, including systems designed to protect military aircraft from modern missile threats. The Saudi Arabian government’s Vision 2030 defense diversification plans, as well as international defense collaborations, further accelerate investments into cutting-edge countermeasures and defense technology advancements. A combination of procurement programs, local production requirements, and strategic alliances with leading global defense firms drives market expansion.

Saudi Arabia, particularly its capital Riyadh, plays a dominant role in the airborne countermeasure system market. The country’s robust defense strategy, bolstered by substantial military expenditure, ensures a steady demand for advanced airborne defense systems. Saudi Arabia’s focus on defense modernization through government-led initiatives like the Saudi Arabian Military Industries (SAMI) has also spurred local production and integration of advanced countermeasures. Key cities like Riyadh, Jeddah, and Dhahran serve as hubs for defense procurement and integration activities. The country’s strategic location, coupled with ongoing regional security concerns, including military conflicts and threats from neighboring states, strengthens the demand for sophisticated airborne countermeasures.

Market Segmentation

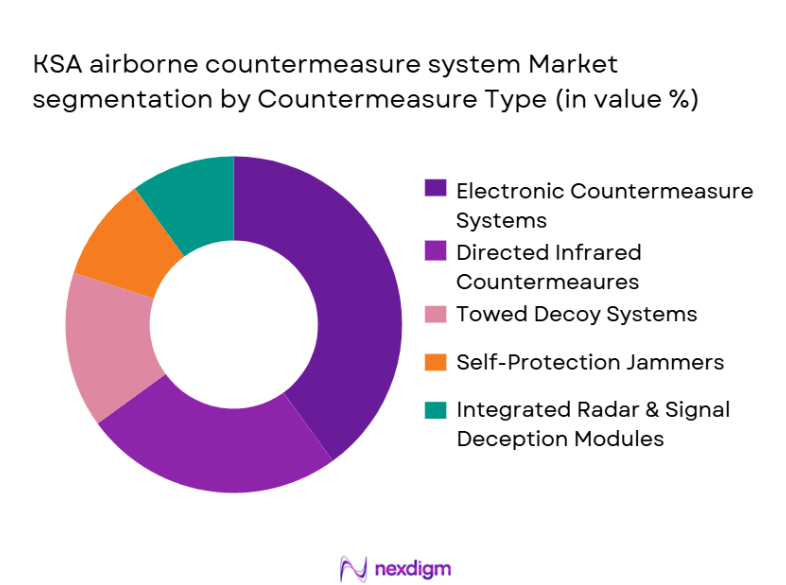

By Countermeasure Type

The KSA airborne countermeasure system market is segmented by countermeasure type into electronic countermeasure systems (ECM), directed infrared countermeasures (DIRCM), towed decoy systems, selfprotection jammers, and integrated radar & signal deception modules. Among these, the ECM segment dominates the market due to the increasing demand for systems that can jam or deceive enemy radar and communication systems. ECM is critical for protecting military aircraft against advanced radar-guided and guided missile threats. The growing threat of asymmetric warfare and regional missile defense initiatives by adversaries has driven procurement of ECM systems by Saudi defense forces. This segment benefits from the integration of next-generation radar jammers and signal manipulators, which are essential for the defense of high-value platforms.

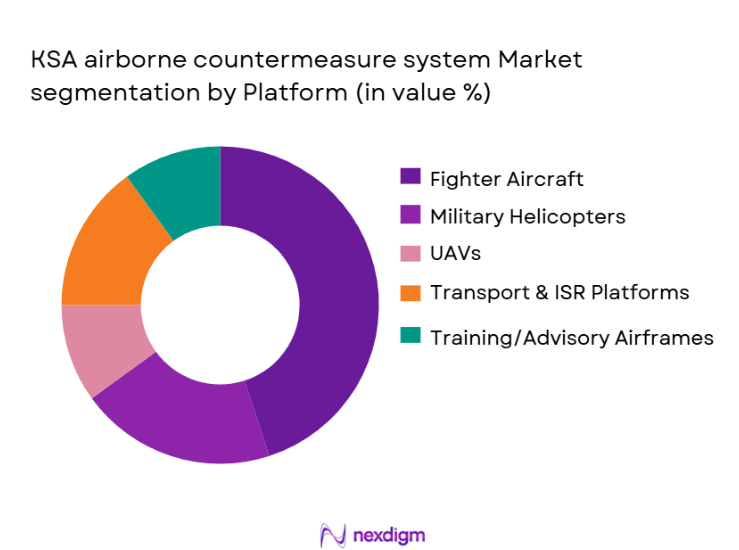

By Platform

The airborne countermeasure system market in Saudi Arabia is also segmented by platform, including fighter aircraft, military helicopters, UAVs, transport & ISR platforms, and training/adversary airframes. Among these, fighter aircraft platforms take the lead due to the growing emphasis on enhancing the survivability of advanced fighter jets, including the F-15, Typhoon, and F-16 platforms. As part of Saudi Arabia’s Vision 2030 and ongoing defense procurements, the RSAF (Royal Saudi Air Force) has prioritized upgrading its fighter fleets with state-of-the-art countermeasure systems to protect against emerging threats like advanced air defense systems and missiles. This segment is expected to continue driving the market due to the critical nature of fighter aircraft in national defense strategies.

Competitive Landscape

The KSA airborne countermeasure system market is highly competitive, with several global defense players vying for contracts in Saudi Arabia. The market is dominated by international defense giants, such as Lockheed Martin, Raytheon, BAE Systems, and Elbit Systems, alongside local entities like Saudi Arabian Military Industries (SAMI). These companies are involved in the development, supply, and integration of advanced countermeasure systems tailored to Saudi Arabia’s specific defense requirements. The consolidation of leading players reflects the high entry barriers, which include complex technological requirements, lengthy procurement processes, and offset arrangements that mandate local production. Moreover, companies that provide comprehensive solutions, including hardware, software, and system integration, hold a competitive edge in this market.

| Company Name | Establishment Year | Headquarters | Product Range | Technological Edge | Government Collaborations | Annual Revenue |

| Lockheed Martin | 1912 | USA | ~ | ~ | ~ | ~ |

| Raytheon Technologies | 1922 | USA | ~ | ~ | ~ | ~ |

| BAE Systems | 1999 | UK | ~ | ~ | ~ | ~ |

| Elbit Systems | 1966 | Israel | ~ | ~ | ~ | ~ |

| Saudi Arabian Military Industries (SAMI) | 2017 | Saudi Arabia | ~ | ~ | ~ | ~ |

KSA Airborne Countermeasure System Market Analysis

Growth Drivers

Increasing Regional Security Concerns

The ongoing geopolitical instability in the Middle East has led to a heightened demand for advanced defense systems, including airborne countermeasures. Saudi Arabia’s strategic position and involvement in regional conflicts drive the need for enhanced air defense systems to protect military aircraft from missile threats and electronic warfare.

Defense Modernization under Vision 2030

Saudi Arabia’s Vision 2030 initiative has catalyzed a major push for defense diversification and local manufacturing of defense technologies, increasing investments in indigenous defense systems like airborne countermeasures. This drive towards self-sufficiency and technological advancement is fueling the growth of the market.

Market Challenges

Integration Complexity and High Costs

Airborne countermeasure systems are complex and require high integration levels with existing platforms, making them expensive and challenging to implement. The cost of these advanced systems, coupled with the need for long-term maintenance and training, can be a barrier to widespread adoption.

Regulatory and Compliance Hurdles

Procurement of advanced defense systems is highly regulated, with strict compliance requirements for both local and international manufacturers. These regulations, including offset obligations and export controls, can slow down the market’s growth and complicate procurement processes.

Opportunities

Technology Upgradation and System Integration

As technology evolves, there is an opportunity to integrate artificial intelligence (AI) and machine learning (ML) into airborne countermeasures. These technologies can enhance the effectiveness of systems like electronic countermeasures (ECM) and directed infrared countermeasures (DIRCM), providing more adaptive solutions for defense forces.

Local Production and Offsets

Saudi Arabia’s focus on local defense production, encouraged by offset agreements with international manufacturers, creates an opportunity for domestic players to expand their market share. Collaborative ventures between foreign and local defense manufacturers present new avenues for growth and innovation in airborne countermeasure systems.

Future Outlook

Over the next few years, the KSA airborne countermeasure system market is expected to witness robust growth driven by increasing demand for advanced defense technologies and an expanded focus on aerial security. Saudi Arabia’s strategic priority to enhance the survivability of its air platforms, particularly fighter jets and military helicopters, will fuel continuous procurement of advanced countermeasure systems. The government’s commitment to modernizing its defense capabilities through programs like Vision 2030 and defense collaborations with global players is set to play a significant role. Additionally, the rise of asymmetric threats and regional geopolitical instability will further necessitate the integration of cutting-edge countermeasures across Saudi Arabia’s aerial platforms.

Major Players in the Market

- Lockheed Martin

- Raytheon Technologies

- BAE Systems

- Elbit Systems

- Saudi Arabian Military Industries (SAMI)

- Northrop Grumman Corporation

- Israel Aerospace Industries

- Thales Group

- Leonardo S.p.A

- L3Harris Technologies

- Saab AB

- Collins Aerospace

- Rafael Advanced Defense Systems

- ASELSAN A.Ş

- General Dynamics

Key Target Audience

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies

- Defense OEMs

- Aerospace and Defense Integrators

- Military Procurement Officers

- Aerospace R&D Institutions

- Airborne Electronic Warfare Solution Providers

- Defense Contractors

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves mapping out all relevant stakeholders in the KSA airborne countermeasure system market, including government bodies, military contractors, and defense OEMs. Data is gathered through secondary research and proprietary databases, identifying key technological advancements, procurement trends, and market dynamics.

Step 2: Market Analysis and Construction

This phase involves analyzing historical data related to defense budgets, procurement contracts, and market penetration of airborne countermeasure systems. In-depth studies are conducted to assess the market’s growth drivers, including technological advancements in EW systems, government policies, and regional security factors.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses developed regarding market trends and projections are validated by consulting with industry experts, defense procurement officers, and suppliers. In-depth telephone interviews and roundtable discussions help refine the market model and confirm the accuracy of initial assumptions.

Step 4: Research Synthesis and Final Output

In the final phase, consultations with major industry players are conducted to understand product performance, technological trends, and customer demands. The gathered insights from both primary and secondary research are integrated into a comprehensive market report, ensuring robust analysis and actionable conclusions.

- Executive Summary

- Research Methodology (Market Definitions & Assumptions, Abbreviations, Data Sources, Primary & Secondary Research Coverage, Defense Procurement Intelligence Assessments, Forecast Modelling Techniques, Limitations)

- Definition and Scope

- KSA National Defense Modernization Strategy Context

- Airborne Countermeasure System Architectural Breakdown

- Integration with Electronic Warfare (EW) & C4ISR Architecture

- Global vs KSA Market Dynamics & Unique Market Attributes

- Growth Drivers

Defense Budget Trajectory

Regional Threat Perception

EW Convergence - Challenges & Barriers

Technical Integration Complexity

Supply Chain

Export Control Compliance - Opportunities

AIEnabled EW

Local Manufacturing

UAV Countermeasure Adoption - Market Trends

Modular Open Systems

Spectrum Warfare Integration - Policy & Regulation Landscape

GAMI Offset Obligations

Procurement Laws

- By Value 2020-2025

- By System Install Base 2020-2025

- By Technology Tier 2020-2025

- By Countermeasure Type (In Value%)

Electronic Countermeasure Systems (ECM)

Directed Infrared Countermeasures (DIRCM)

Towed Decoy Systems

SelfProtection Jammers

Integrated Radar & Signal Deception Modul - By Platform (In Value%)

Fighter Aircraft

Military Helicopters

Unmanned Aerial Vehicles (UAVs)

Transport & ISR Platforms

Training/Adversary Air Platforms - By Technology Capability (In Value%)

RF Based Systems

Infrared/Optical Countermeasure Systems

AIAugmented EW Algorithms

Open Architecture & Software Defined EW

MultiSpectrum Integration Suite - By Procurement Type (In Value%)

Linefit OEM Integration

Retrofit & Upgrade Programs

Foreign Military Sales (FMS) & Direct Purchase

OffsetLinked Local Production Contracts

Technology Transfer Programs - By EndUser Segment (In Value%)

Royal Saudi Air Force (RSAF) Combat Units

Border Security Aviation Units

VIP/Transport Security Fleets

R&D & Test Integration Facilities

Foreign Defense Partners

- Market Share Analysis

- Cross Comparison Parameters (Contract Backlog, Technology Readiness Level (TRL), Local Content %, Integration Footprint, EW Capability Breadth, Platform Support Coverage, Spectrum Response Speed, Export Eligibility)

- Key Players

Lockheed Martin Corporation

Raytheon Technologies Corporation

Northrop Grumman Corporation

BAE Systems plc

Elbit Systems Ltd

Israel Aerospace Industries Ltd

Leonardo S.p.A

Thales Group

Saab AB

L3Harris Technologies Inc

ASELSAN A.Ş

Collins Aerospace

Rafael Advanced Defense Systems

Saudi Arabian Military Industries

Saudi Advanced Technologies Company

- KSA Defense Force Procurement Behaviors

- Operational Requirements & Performance Priorities

- Defense Capability Maturity Assessments

- PainPoints & Required Capability Enhancements

- DecisionMaking Process

- Forecasted Market Value Growth 2026-2035

- Forecasted Installed Base Growth 2026-2035

- Forecast by Countermeasure Technology Adoption 2026-2035

- Forecast by Platform Category 2026-2035

- Forecast by Procurement Type 2026-2035