Market Overview

The KSA Airborne ISR market is a crucial segment within the defense and security domain, valued at USD ~ billion. The market is primarily driven by Saudi Arabia’s ongoing defense modernization efforts, which include substantial investments in advanced military technologies and platforms. The Kingdom’s defense budget for advanced ISR systems has seen a consistent increase, with the integration of new manned and unmanned aerial platforms. A key driving force behind this market’s growth is the rising demand for sophisticated surveillance, reconnaissance, and intelligence collection capabilities in response to regional security threats. The country’s Vision 2030 initiative has accelerated procurement activities, with emphasis on acquiring state-of-the-art ISR systems for border security, maritime surveillance, and counter-terrorism operations.

Saudi Arabia remains the dominant player in the Middle East for airborne ISR capabilities. The country has made significant investments in enhancing its defense infrastructure, which includes both aerial and satellite-based ISR systems. Riyadh, the capital, is the focal point for procurement decisions, government contracts, and military base operations. Additionally, cities like Jeddah and Dhahran, with their strategic proximity to the Red Sea and Arabian Gulf, have military installations that are heavily reliant on advanced ISR systems for regional security and defense initiatives. Saudi Arabia’s partnerships with global defense contractors such as Lockheed Martin, Boeing, and Northrop Grumman have further solidified its position as the leader in airborne ISR solutions in the region.

Market Segmentation

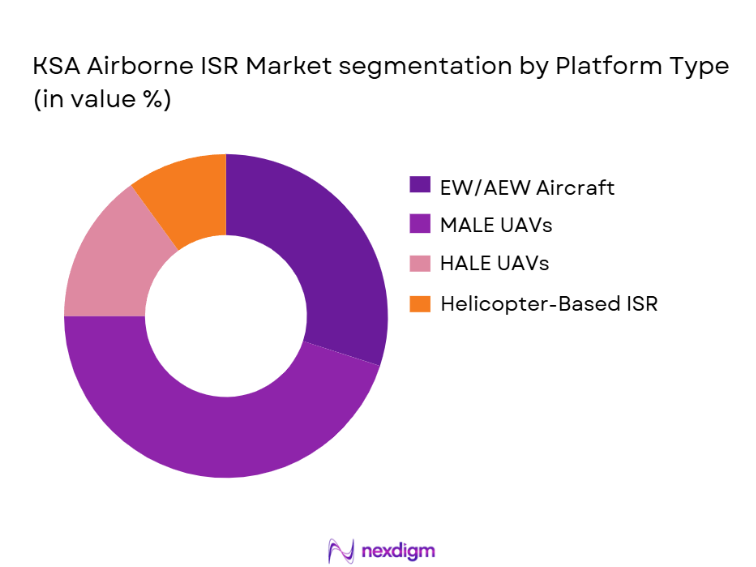

By Platform Type

The KSA Airborne ISR market is segmented by platform type, primarily focusing on manned ISR aircraft, UAVs (Unmanned Aerial Vehicles), and rotary-wing platforms. Among these, UAVs have emerged as the dominant segment due to their operational flexibility, lower operational costs, and suitability for diverse missions such as surveillance, reconnaissance, and electronic warfare. UAVs like the MQ-9 Reaper and the Heron series have become increasingly popular within the Saudi Armed Forces, offering high-altitude, long-endurance capabilities. These platforms are favored for their ability to conduct persistent surveillance over vast areas without the logistical complexities associated with manned aircraft. The affordability and technological advancements in UAVs have led to their widespread adoption, especially for tactical operations across Saudi Arabia’s expansive borders.

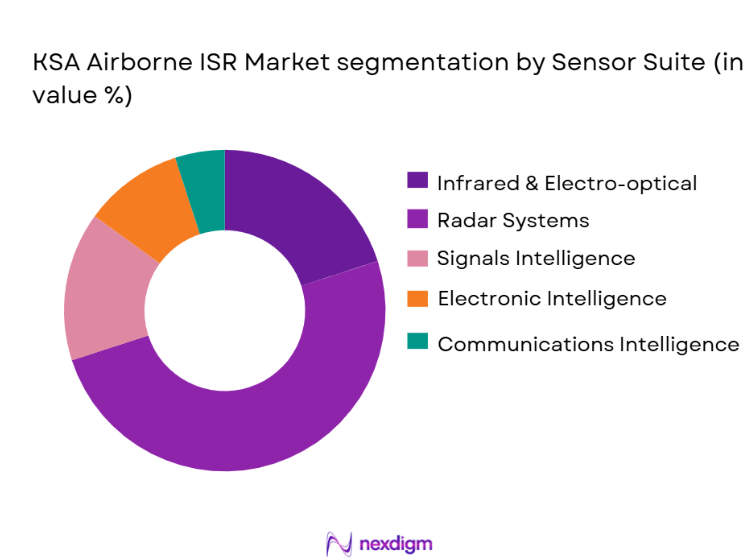

By Sensor Suite

The KSA Airborne ISR market is also segmented by sensor suite, which includes EO/IR (Electro-Optical/Infrared), SAR (Synthetic Aperture Radar), SIGINT (Signals Intelligence), ELINT (Electronic Intelligence), and COMINT (Communications Intelligence). Among these, SAR systems have seen the highest market share due to their ability to provide high-resolution images regardless of weather conditions or time of day. SAR-equipped airborne platforms, like the Boeing 737 with the Hawkeye radar, have become indispensable for surveillance missions over the vast desert landscapes and maritime borders of Saudi Arabia. SAR technology enables continuous, real-time monitoring, making it crucial for the Kingdom’s national defense, especially in counter-terrorism and border surveillance operations.

Competitive Landscape

The KSA Airborne ISR market is highly competitive, with a mix of local players and global defense giants. The market is dominated by a few key companies, including both traditional aerospace manufacturers and specialized ISR solution providers. These players have carved out strong positions due to their advanced technology portfolios, extensive defense contracts, and strong relationships with the Saudi government and military.

| Company | Establishment Year | Headquarters | Platform Expertise | Sensor Suite Offering | Technology Partnership | Local Offset Programs |

| Lockheed Martin | 1995 | USA | ~ | ~ | ~ | ~ |

| Northrop Grumman | 1999 | USA | ~ | ~ | ~ | ~ |

| Boeing Defense | 1916 | USA | ~ | ~ | ~ | ~ |

| Elbit Systems | 1966 | Israel | ~ | ~ | ~ | ~ |

| Israel Aerospace Industries | 1953 | Israel | ~ | ~ | ~ | ~ |

KSA Airborne ISR Market Analysis

Growth Drivers

Increasing Military Modernization Programs

Saudi Arabia is heavily investing in modernizing its defense capabilities as part of its Vision 2030. This includes upgrading its ISR systems, where advanced airborne ISR technologies are essential to enhance its surveillance, reconnaissance, and intelligence capabilities, especially for border security and regional stability.

Rising Geopolitical Tensions in the Middle East

The growing security threats in the region, including conflict in Yemen and concerns over regional dominance, have driven the need for enhanced intelligence, surveillance, and reconnaissance. This has led to a surge in demand for airborne ISR systems to provide real-time, high-quality intelligence and strategic advantage.

Market Challenges

High Integration and Maintenance Costs

The complex integration of advanced ISR systems into Saudi Arabia’s existing defense infrastructure, especially in unmanned and manned aircraft, presents a financial challenge. Additionally, the ongoing operational costs of maintaining these high-tech platforms and ensuring their sustainability in harsh operational environments remain significant.

Regulatory and Export Control Constraints

The KSA Airborne ISR market is impacted by stringent international export regulations, particularly from Western defense companies. These controls can delay or complicate the procurement process and create barriers to acquiring advanced ISR platforms from foreign suppliers.

Opportunities

Technological Advancements in UAVs and AI Integration

The integration of AI-powered analytics into ISR platforms presents a major growth opportunity for Saudi Arabia. AI-driven data analysis will enhance the efficiency of ISR missions, offering real-time intelligence insights and improving decision-making, which can strengthen Saudi Arabia’s defense posture.

Growing Demand for Autonomous Systems

The increasing adoption of autonomous systems in airborne ISR platforms presents significant opportunities for both local manufacturers and international suppliers. UAVs, especially those with autonomous capabilities, are being increasingly deployed to enhance surveillance without risking human lives, opening new procurement and partnership opportunities in the market.

Future Outlook

Over the next 6 years, the KSA Airborne ISR market is expected to experience steady growth, driven by continued advancements in ISR technologies and increased government expenditure on defense modernization. Saudi Arabia’s Vision 2030 emphasizes enhancing the Kingdom’s military capabilities, which will directly fuel demand for state-of-the-art ISR platforms. The growth of unmanned systems, integration of artificial intelligence for data analysis, and the development of more efficient sensor systems will further stimulate market expansion. The Kingdom’s strategic location, coupled with its role as a regional security leader, will continue to prioritize the need for advanced surveillance and intelligence-gathering platforms.

Major Players in the KSA Airborne ISR Market

- Lockheed Martin

- Northrop Grumman

- Boeing Defense

- Elbit Systems

- Israel Aerospace Industries

- General Atomics Aeronautical Systems

- Raytheon Technologies

- Thales Group

- Saab AB

- Leonardo S.p.A.

- L3Harris Technologies

- Textron Inc.

- Bae Systems

- BAE Systems

- KAI (Korea Aerospace Industries)

Key Target Audience

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies

- Military Procurement Units

- Defense Contractors and OEMs

- Aerospace and Defense Manufacturers

- Security & Intelligence Agencies

- System Integrators in Military Technologies

- Private Defense Consultants and Agencies

Research Methodology

Step 1: Identification of Key Variables

The first phase involves identifying the key variables that influence the KSA Airborne ISR market. This step is supported by secondary research, including defense spending data, government defense budgets, and historical market trends. The primary objective is to develop a robust ecosystem map to understand the market’s dynamics.

Step 2: Market Analysis and Construction

In this phase, historical data and defense program spending trends are compiled and analyzed. This includes reviewing the penetration rate of airborne ISR systems across various platforms and the revenue generated from each segment, focusing on the core ISR technologies and their applications in defense.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses developed from the initial research will be validated through expert consultations. Industry professionals, defense contractors, and military procurement officers will provide direct insights into operational strategies and defense spending patterns, helping refine our market data.

Step 4: Research Synthesis and Final Output

The final phase involves synthesizing all collected data and collaborating with multiple stakeholders within Saudi Arabia’s defense ecosystem. This includes product segmentation analysis, sales data, and future procurement plans to ensure the most accurate and comprehensive view of the market.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Data Sourcing Framework, Platform & Payload Classification Criteria, Sensor Categorization Metrics, Defense Budget Alignment Method, Primary Research Structure, Limitations and Future Research Scope)

- Definition and Strategic Scope

- Historical Evolution and Defense Modernization Influences

- KSA Defense Doctrine & ISR Prioritization Drivers

- Operational Value Chain

- ISR Sensor and Payload Ecosystem

- Integration of AI / Autonomous Analytics in ISR Data Processing

- Growth Drivers

Defense Modernization Spend

Regional Security Imperatives - Market Challenges

Integration Complexity

Export Controls

ISR Data Fusion Bottlenecks - Emerging Opportunities

AIEnabled ISR

Autonomous Swarm Systems - Industry Trends

Local Capability Development

Tech Transfers to KSA - Regulatory & Policy Environment

Defense Offset Framework

Export Licensing - SWOT Analysis

- Porter’s Five Forces

- Market Value 2020-2025

- Platform Deployment Volumes 2020-2025

- Average System Cost 2020-2025

- ISR Operational Hours & Mission Payload Utilization 2020-2025

- By Platform Type (In Value%)

Manned ISR Aircraft

MALE UAVs

HALE UAVs

Rotary ISR Platforms

Tiltrotor ISR Assets - By Sensor Suite (In Value%)

ElectroOptical/Infrared

Synthetic Aperture Radar

Signals Intelligence

Electronic Intelligence

Communications Intelligence - By Application (In Value%)

Border Surveillance

CounterDrone ISR

Maritime Domain Awareness ISR

Strategic Reconnaissance

Homeland Security ISR - By End User (In Value%)

Royal Saudi Air Force

Ministry of Interior ISR Units

Border Guard ISR

Joint ISR Forces

Space & Cyber ISR Integration Wings - By Procurement Type (In Value%)

Foreign OEM Supply

Local Tech Transfer / Defense Offset

Joint Ventures/CoDevelopment Programs

- Market Share – ISR OEMs by Contract Value

- CrossComparison Parameters (ISR Platform Reliability, Sensor Performance, Data Fusion & Analytics Capability, Integration with KSA Defense C4ISR Networks, AfterSales Support & Sustainment Footprint in KSA, Local Content / Offset Contribution, Price per Capability Unit, Government / Military Contract Awards & Compliance)

- Major Players

General Atomics Aeronautical Systems

Lockheed Martin Corporation

Northrop Grumman Corporation

Raytheon Technologies

BAE Systems plc

Boeing Defense

Elbit Systems Ltd.

Israel Aerospace Industries (IAI)

Thales Group

Leonardo S.p.A.

L3Harris Technologies

Saab AB

Textron Inc.

CACI International

Kratos Defense & Security Solutions

- Operational Deployment Patterns

- Procurement Decision Drivers

- Mission Performance Requirements

- Integration with C4ISR and National Defense Systems

- Pain Points & Capability Gaps

- Estimated Future Market Size 2026-2035

- Platform & Sensor Adoption Trajectories 2026-2035

- Future Segment Growth 2026-2035

- Impact of AI, Edge Computing, and Autonomous ISR Analytics 2026-2035

- Defense Procurement Funnel & Decision Timelines 2026-2035