Market Overview

The KSA Airborne Radars Market is experiencing significant growth, with increasing demand driven by advancements in radar technology and the strategic importance of defense and surveillance capabilities in the region. The market is influenced by the Saudi government’s defense spending and a growing focus on national security. As of recent data, the KSA Airborne Radars market is valued at approximately USD ~ billion, and the market is expected to grow further due to continuous investments in defense infrastructure. These factors are shaping the development and growth of airborne radar systems, primarily for military and aerospace applications.

The dominance of Saudi Arabia in the KSA Airborne Radars Market can be attributed to its large-scale investments in defense technologies, including airborne radar systems. Saudi Arabia has long been a key player in the Middle Eastern defense market, with robust defense budgets and strategic alliances with global defense contractors. The kingdom’s focus on modernizing its military equipment, coupled with geopolitical considerations, makes it the most influential country in the region for airborne radar procurement.

Market Segmentation

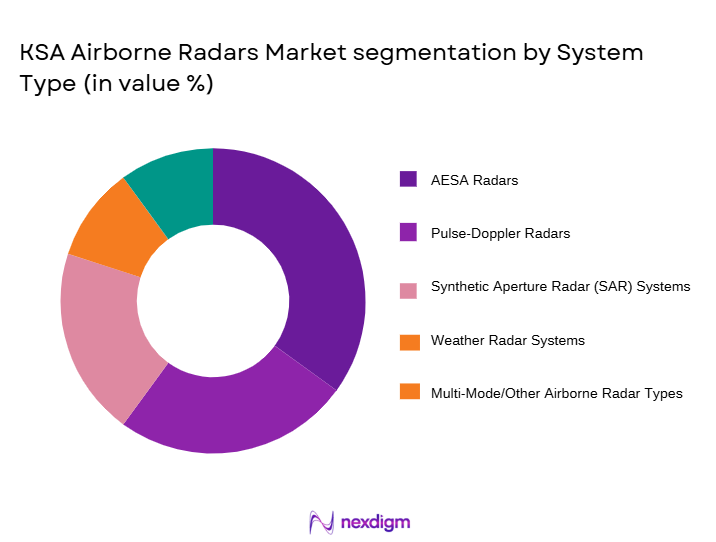

By System Type

The KSA Airborne Radars market is segmented by system type into fixed airborne radars, rotary airborne radars, phased array airborne radars, synthetic aperture radars (SAR), and multi-mode radar systems. Among these, phased array airborne radars dominate the market due to their versatility and ability to track multiple targets simultaneously. Phased array radars are widely used in military and defense applications for their high reliability and advanced detection capabilities. These systems provide superior performance in surveillance and targeting, contributing to their significant market share in KSA. Additionally, advancements in phased array technology, coupled with strategic investments, are boosting the adoption of these systems.

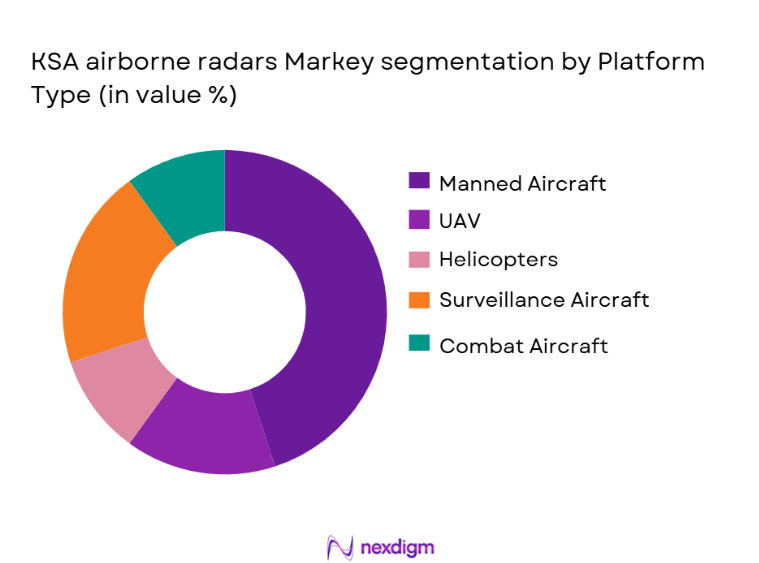

By Platform Type

The KSA Airborne Radars market is also segmented by platform type into manned aircraft, unmanned aerial vehicles (UAVs), helicopters, surveillance aircraft, and combat aircraft. Manned aircraft dominate this segment due to the established use of radar systems in traditional military aircraft. The KSA military has heavily invested in advanced radar-equipped aircraft for surveillance, reconnaissance, and defense operations. Manned aircraft platforms are equipped with multi-role radar systems that enable superior detection, making them highly sought after in the region. This strong demand for radar systems integrated into manned aircraft is expected to continue driving market share for this platform type.

Competitive Landscape

The KSA Airborne Radars market is dominated by a few major players, including both global and local manufacturers. These players have a strong foothold due to strategic defense partnerships with the Saudi government and extensive expertise in radar technology. Companies like Lockheed Martin, Northrop Grumman, and Raytheon Technologies lead the market, benefiting from long-term contracts and a proven track record of supplying sophisticated radar systems. This consolidation highlights the importance of defense contracts and technological partnerships in the market’s competitive dynamics.

| Company Name | Establishment Year | Headquarters | Product Portfolio | Market Reach | Technology Innovation | Strategic Alliances | Pricing Strategy | Manufacturing Capacity | Research & Development Focus | Sales Channels |

| Lockheed Martin | 1912 | United States | ~ | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| Northrop Grumman | 1939 | United States | ~ | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| Raytheon Technologies | 1922 | United States | ~ | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| Thales Group | 1893 | France | ~ | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| BAE Systems | 1999 | United Kingdom | ~ | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

KSA Airborne Radars Market Analysis

Growth Drivers

Increased Defense Spending

Saudi Arabia’s growing defense budget and emphasis on modernizing its military equipment are key drivers for the airborne radar market. The country has consistently invested in advanced technologies to strengthen its national security and defense capabilities, leading to a surge in demand for state-of-the-art radar systems.

Technological Advancements in Radar Systems

Continuous innovations in radar technology, including phased array systems and synthetic aperture radars (SAR), are pushing the demand for more efficient and advanced airborne radar solutions. These advancements enhance the radar systems’ performance, making them crucial for surveillance, reconnaissance, and defense operations.

Market Challenges

High Cost of Advanced Radar Systems

The development and integration of sophisticated radar technologies come with significant costs, which can be a barrier for widespread adoption, especially in a competitive market. High prices for both initial procurement and maintenance create challenges for cost-conscious customers and limit market growth potential.

Regulatory and Geopolitical Hurdles

Export regulations and geopolitical tensions in the Middle East can create uncertainty in the airborne radar market. The complexity of navigating international defense contracts and the need for compliance with both local and global regulations can slow down procurement processes and project timelines.

Opportunities

Demand for Multi-Role Radar Systems

The increasing need for versatile radar systems that can perform multiple functions, including surveillance, navigation, and targeting, presents a significant opportunity. These multi-role systems are especially sought after in military and aerospace sectors, where adaptability and efficiency are critical.

Rising Adoption of Unmanned Aerial Vehicles

The growing use of UAVs in military and commercial sectors provides an opportunity for integrating advanced radar systems into these platforms. As UAVs become more prevalent, the demand for compact and effective radar systems designed for unmanned platforms is expected to rise, opening new market avenues.

Future Outlook

Over the next 5 years, the KSA Airborne Radars market is expected to show steady growth driven by continued defense spending, technological advancements, and increasing demand for surveillance and reconnaissance capabilities. This growth will be supported by the Saudi government’s emphasis on modernizing its military and integrating advanced technologies, including radar systems, into various defense platforms. Furthermore, collaboration with global defense contractors will continue to fuel innovation, providing more advanced and cost-effective solutions for the kingdom’s defense needs.

Major Players

- Lockheed Martin

- Northrop Grumman

- Raytheon Technologies

- Thales Group

- BAE Systems

- Leonardo

- SAAB

- Elbit Systems

- Harris Corporation

- Rockwell Collins

- General Dynamics

- L3 Technologies

- Curtiss-Wright

- Indra Sistemas

- ASELSAN

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Defense contractors

- Aerospace and aviation companies

- Military agencies

- Commercial aerospace firms

- OEMs involved in radar system manufacturing

- Surveillance and reconnaissance service providers

Research Methodology

Step 1: Identification of Key Variables

The first step involves constructing an ecosystem map that includes all major stakeholders in the KSA Airborne Radars Market. This is done through desk research using secondary databases and market reports to collect comprehensive industry information. This process helps in identifying the critical variables that drive the market.

Step 2: Market Analysis and Construction

In this phase, historical data is analyzed, focusing on market penetration, demand drivers, and revenue generation trends. This includes reviewing market data for radar systems, installed units, and pricing across various platforms. The data collected in this phase is essential for constructing the market model and projections.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are tested through consultations with industry experts, including interviews with key players and manufacturers. These consultations provide invaluable insights into operational practices and help validate market assumptions related to technological advancements, consumer preferences, and growth drivers.

Step 4: Research Synthesis and Final Output

The final phase involves synthesizing all gathered data, validating it through direct interactions with manufacturers, and finalizing the market outlook. This phase includes reviewing feedback from stakeholders and integrating it into the final research output to ensure a comprehensive analysis of the KSA Airborne Radars Market.

- Executive Summary

- KSA Airborne Radars Market Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing defense budgets for advanced radar systems

Advancements in radar technology, improving system performance

Growing demand for surveillance and reconnaissance missions - Market Challenges

High cost of advanced radar systems

Regulatory hurdles in radar system deployment

Complex integration with existing aircraft platforms - Market Opportunities

Development of multi-role radar systems for versatile applications

Growth in UAVs and their integration with radar systems

Collaborations between OEMs and governments for defense upgrades - Trends

Adoption of artificial intelligence (AI) for radar signal processing

Miniaturization of radar systems for unmanned platforms

Increased focus on autonomous radar systems

- By Market Value 2020-2025

- By Installed Units 2020-2025

- By Average System Price 2020-2025

- By System Complexity Tier 2020-2025

- By System Type (In Value%)

Fixed Airborne Radars

Rotary Airborne Radars

Phased Array Airborne Radars

Synthetic Aperture Radar (SAR)

Multi-Mode Radar Systems - By Platform Type (In Value%)

Manned Aircraft

Unmanned Aerial Vehicles (UAVs)

Helicopters

Surveillance Aircraft

Combat Aircraft - By Fitment Type (In Value%)

OEM Fitment

Aftermarket Fitment

Retrofit Fitment

Standard Fitment

Customized Fitment - By EndUser Segment (In Value%)

Military & Defense

Aerospace & Aviation

Maritime & Coast Guard

Search and Rescue Operations

Intelligence & Surveillance Agencies - By Procurement Channel (In Value%)

Direct Procurement

Indirect Procurement

Government Procurement

OEM Partnerships

System Integrators

- Market Share Analysis

- CrossComparison Parameters (Product Portfolio, Market Reach, Technology Innovation, Strategic Alliances, Pricing Strategy)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Lockheed Martin

Northrop Grumman

Raytheon Technologies

Thales Group

BAE Systems

Leonardo

SAAB

Elbit Systems

Harris Corporation

Rockwell Collins

General Dynamics

L3 Technologies

Curtiss-Wright

Indra Sistemas

ASELSAN

- Enhanced radar capabilities for military and defense applications

- Rising adoption of radars in aerospace and commercial aviation

- Integration of radars in UAV platforms for surveillance

- Increasing demand for radars in maritime and coastal surveillance

- Forecast Market Value 2026-2035

- Forecast Installed Units 2026-2035

- Price Forecast by System Tier 2026-2035

- Future Demand by Platform 2026-2035