Market Overview

The Qatar aircraft fuel tanks market is driven by the growing expansion of Qatar’s aviation sector, which has seen rapid growth in recent years. With increased air traffic and the continued development of infrastructure like the expansion of Hamad International Airport, the demand for advanced fuel tanks and systems for aircraft has risen. Additionally, investments by the Qatari government in aerospace and defense infrastructure support this demand, reflecting a strong upward trajectory in the industry. With Qatar’s air traffic expected to increase by over 20 million passengers by 2024, the market for aircraft fuel tanks will continue to thrive.

Qatar and its surrounding Gulf Cooperation Council (GCC) countries dominate the aircraft fuel tank market due to the high volume of air traffic within the region. Qatar Airways has grown to be one of the largest airlines globally, and Qatar’s strategic investments in both the aviation and aerospace sectors, including partnerships with major players in the aviation industry, have bolstered its dominance. The proximity of key airports like Hamad International Airport and Doha’s expanding infrastructure also plays a critical role in Qatar’s position as a hub for aviation-related technologies.

Market Segmentation

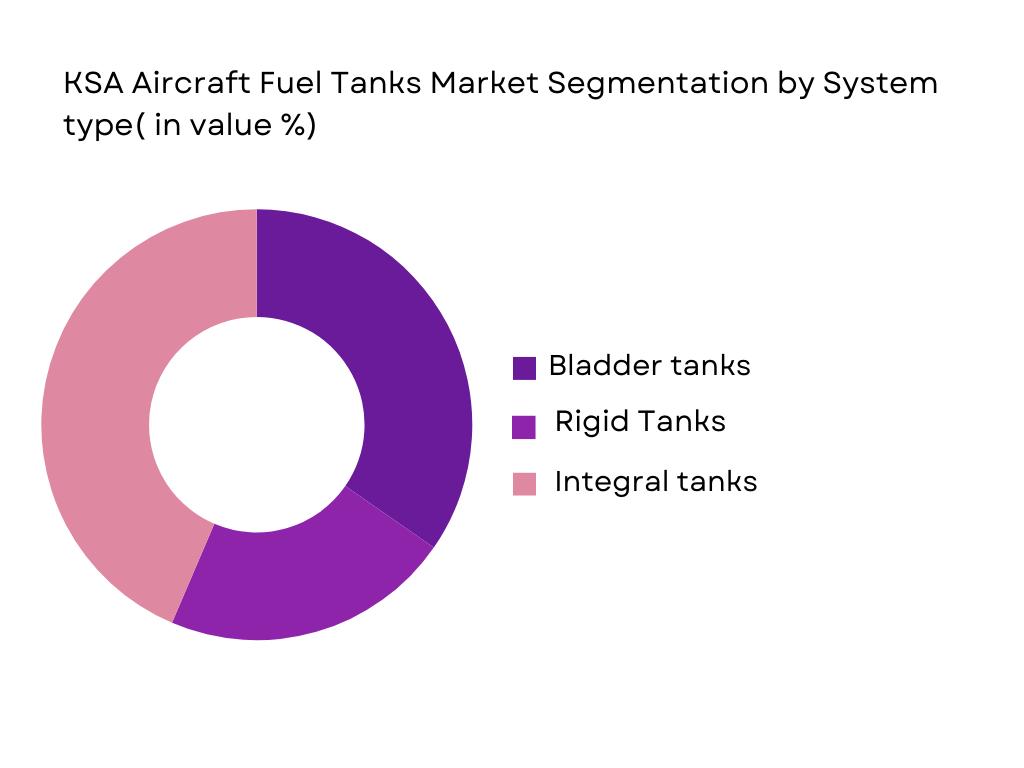

By System Type

The Qatar aircraft fuel tank market is segmented by system type, including bladder tanks, rigid tanks, and integral tanks. Recently, integral tanks have dominated the market share due to their integration into the aircraft structure, providing a significant weight advantage over other system types. This contributes to their increasing demand, especially in long-haul aircraft, where reducing weight is crucial for enhancing fuel efficiency. Aircraft manufacturers, especially those focusing on next-gen fuel-efficient models, prefer integral tanks for their operational efficiency and cost-effectiveness.

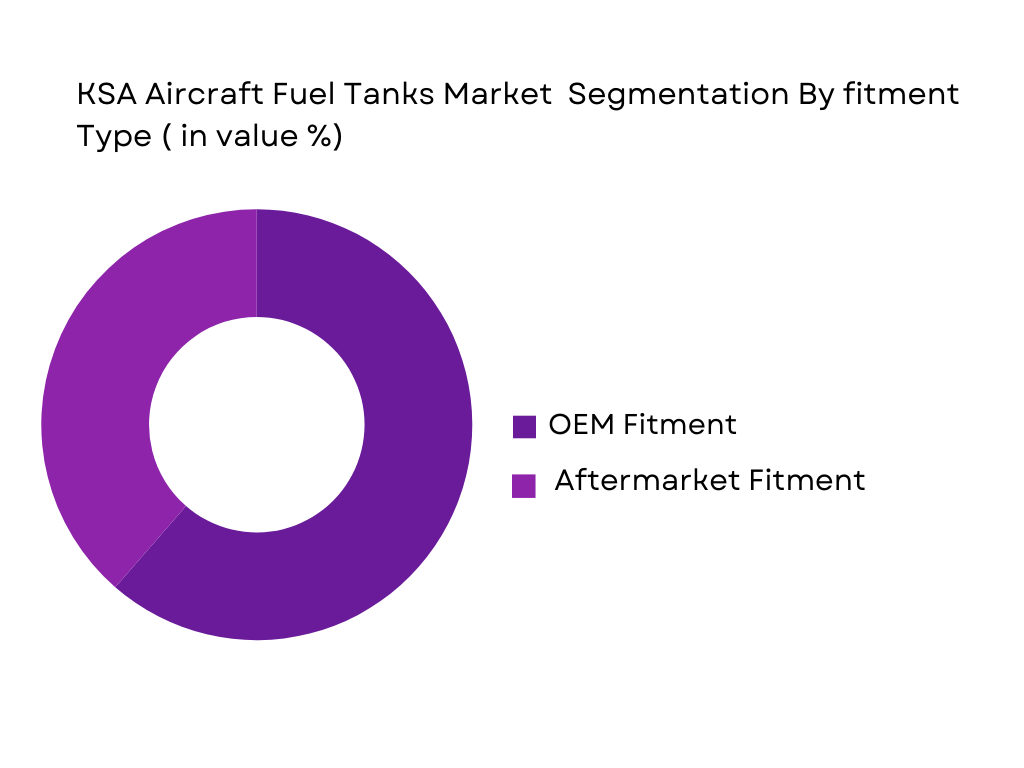

By Fitment Type

Aircraft fuel tanks are further segmented by fitment type into OEM (Original Equipment Manufacturer) fitment and aftermarket fitment. OEM fitment is currently the dominant segment in Qatar due to the expansion of new aircraft fleets within Qatar Airways and other regional airlines. As Qatar continues to grow its fleet, especially with new orders of large passenger jets like the Airbus A350 and Boeing 777, the demand for OEM fuel tanks increases. These OEM fuel tanks are designed to meet specific specifications and compliance standards set by global aviation regulatory bodies.

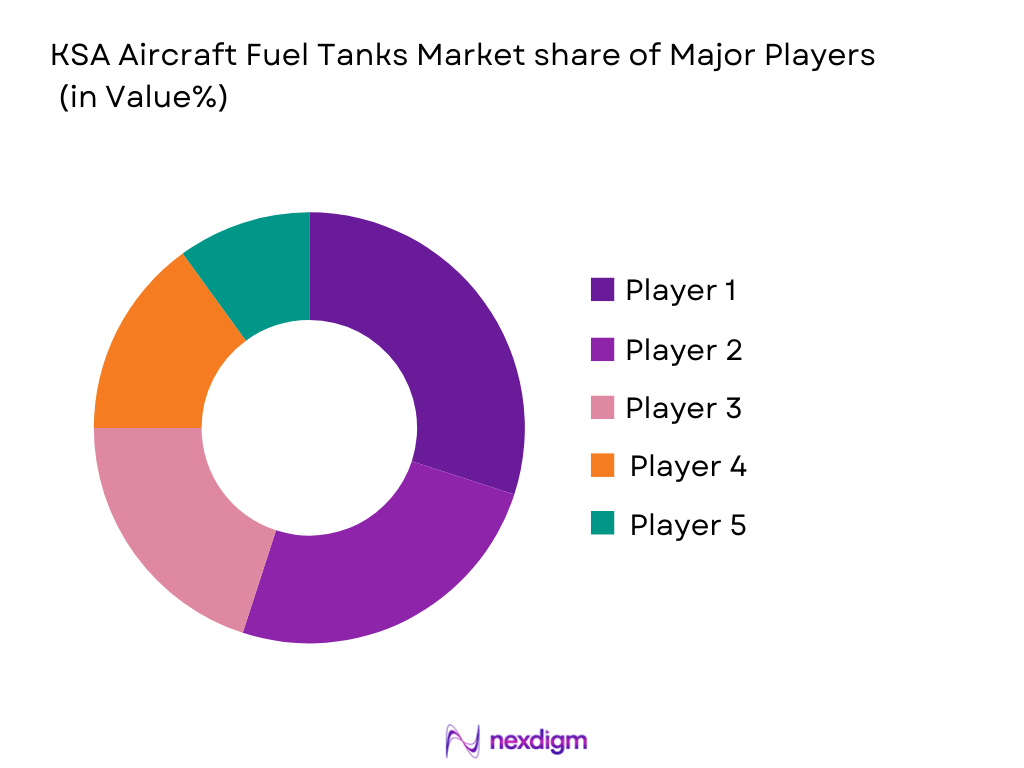

Competitive Landscape

The Qatar aircraft fuel tank market is dominated by a few major players, including companies specializing in the production of advanced fuel systems for aviation. Key companies in the market include Boeing, Safran, Honeywell, UTC Aerospace, and GE Aviation. These players leverage their global presence and technological advancements to maintain a stronghold in Qatar. Their products are increasingly used in both commercial and military aviation, contributing to the competitive nature of the market. The market is marked by significant collaboration between manufacturers and airline companies to develop custom fuel tank solutions that meet the region’s stringent regulatory and operational requirements.

| Company | Establishment Year | Headquarters | Product Focus | Market Reach | Key Partnerships | Manufacturing Capabilities |

| Boeing | 1916 | Chicago, USA | – | – | – | – |

| Safran | 2005 | Paris, France | – | – | – | – |

| Honeywell | 1906 | Charlotte, USA | – | – | – | – |

| UTC Aerospace | 1934 | Connecticut, USA | – | – | – | – |

| GE Aviation | 1917 | Cincinnati, USA | – | – | – | – |

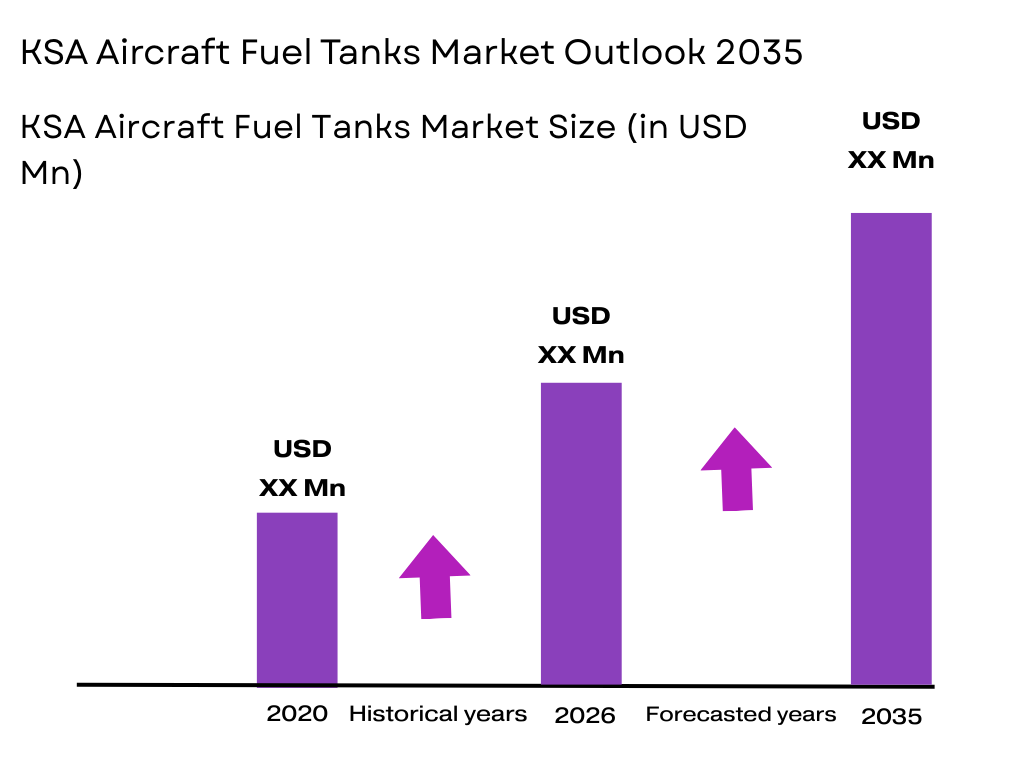

KSA Aircraft Fuel Tanks Market Dynamics

Growth Drivers

Increased demand for fuel-efficient aircraft

The demand for fuel-efficient aircraft is being driven by the need to reduce operational costs and meet sustainability goals. In Saudi Arabia, the government has committed to reducing its carbon emissions, as seen in its Vision 2030 plan, which aims for a 30% reduction by 2030. This initiative is fostering the adoption of next-generation fuel-efficient aircraft, encouraging airlines and military forces to invest in advanced fuel tank systems. With global fuel prices projected to increase, Saudi Arabia’s fleet modernization is expected to focus on fuel-efficient designs. In 2023, global aviation fuel consumption was around 315 million tonnes, and the Middle East is expected to contribute significantly to this demand as a leading region for fleet expansion.

Rising air travel in the Middle East region

Air travel in the Middle East, including Saudi Arabia, continues to rise, supported by booming tourism, economic diversification, and increased business activities. Saudi Arabia’s airports are projected to handle 100 million passengers by 2030, a significant increase from the 45 million passengers recorded in 2022. This growth is attributed to Saudi Arabia’s investment in infrastructure and tourism initiatives, such as the “Saudi Vision 2030” plan. The government’s $100 billion investment in its aviation sector includes upgrading existing airports and developing new ones. As air traffic rises, airlines are increasingly investing in aircraft fuel systems that can support these higher volumes, driving demand for advanced fuel tanks.

Market Challenges

High maintenance and operational costs

The aircraft fuel tank market in Saudi Arabia faces challenges due to the high maintenance costs of advanced fuel systems. Aircraft fuel tanks are subjected to extreme operating conditions, requiring frequent inspections and maintenance to ensure safety and compliance with stringent aviation regulations. In Saudi Arabia, the aviation sector spent approximately $6 billion on maintenance, repair, and overhaul (MRO) services in 2022. As the fleet ages, maintenance costs are projected to increase further, putting pressure on airline profitability and slowing the rate of fuel system upgrades. Airlines in Saudi Arabia must balance the need for advanced fuel tanks with the increasing cost burden of their upkeep.

Stringent regulatory requirements for safety and certification

In Saudi Arabia, as in much of the global aviation industry, aircraft fuel tanks must meet strict regulatory and safety standards. Regulatory bodies, including the Saudi General Authority of Civil Aviation (GACA), enforce safety protocols for fuel tank designs and installations. These regulations require comprehensive testing and certification before a new tank design can be used. The compliance process can take several years and incur high costs. Furthermore, any failure to meet regulatory requirements can result in penalties or grounding of aircraft, a challenge for manufacturers looking to introduce new fuel tank technologies in the region.

Market Opportunities

Expansion of low-cost carriers in the region

The rise of low-cost carriers (LCCs) in Saudi Arabia offers substantial growth potential for the aircraft fuel tank market. Saudi Arabia’s aviation market has seen the rapid expansion of LCCs, including Flynas and SaudiGulf Airlines, which are benefiting from increased demand for affordable travel options. By 2025, the Kingdom’s LCC segment is expected to carry an estimated 15 million passengers, up from 10 million in 2022. As these carriers expand their fleets, they will require advanced fuel tank systems that are lightweight, cost-efficient, and capable of reducing fuel consumption, creating new opportunities for suppliers in this segment.

Adoption of hybrid and electric aircraft requiring specialized fuel tanks

As Saudi Arabia begins to embrace more sustainable aviation practices, the adoption of hybrid and electric aircraft is likely to open new opportunities in the aircraft fuel tank market. The Saudi Arabian government’s Vision 2030 plan emphasizes sustainability and the reduction of carbon emissions, aligning with global trends toward hybrid and electric aviation. Companies are developing specialized fuel tanks for these new aircraft models, which have different operational requirements compared to traditional jet-powered aircraft. In 2022, Saudi Arabia’s aviation sector was exploring funding for electric aircraft projects, and hybrid aircraft are expected to take to the skies by 2025, creating demand for customized fuel tank solutions.

Future Outlook

Over the next decade, the Qatar aircraft fuel tank market is expected to continue its positive growth trajectory. Key factors driving this growth include the continuous expansion of Qatar Airways’ fleet, which is expected to grow further with the airline’s expansion into new international routes. Moreover, technological advancements in fuel tank design, particularly in reducing weight and improving safety, are expected to play a significant role in market development. Qatar’s strategic location in the Middle East and its expanding aviation infrastructure will continue to position the country as a leader in the regional aviation market.

Major Players

- Boeing

- Safran

- Honeywell

- UTC Aerospace

- GE Aviation

- Airbus

- Spirit AeroSystems

- Collins Aerospace

- BAE Systems

- Meggitt

- Dassault Aviation

- Thales Group

- Rolls-Royce

- Lufthansa Technik

- Raytheon Technologies

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Aircraft manufacturers

- Aerospace component suppliers

- Airline operators

- MRO

Research Methodology

Step 1: Identification of Key Variables

The first step involves identifying key stakeholders and mapping out the variables that influence the Qatar Aircraft Fuel Tank Market. We conduct extensive desk research, leveraging secondary sources such as industry reports, government publications, and company filings to understand market forces.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze data on market penetration, including information on installed units, regional expansion, and the demand for OEM versus aftermarket fitments. This phase includes evaluating technological advancements and regulatory frameworks affecting the market.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are validated by conducting interviews with industry experts, including executives from major aircraft manufacturers, aerospace suppliers, and regulatory bodies. This provides real-time insights into the operational challenges, industry trends, and growth opportunities in the market.

Step 4: Research Synthesis and Final Output

The final phase involves synthesizing all gathered data, validating insights with additional expert consultations, and preparing the final report. This ensures a comprehensive understanding of market dynamics, competitive landscapes, and future trends, leading to an accurate analysis of the Qatar Aircraft Fuel Tanks Market.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increased demand for fuel-efficient aircraft

Rising air travel in the Middle East region

Technological advancements in fuel tank materials and designs - Market Challenges

High maintenance and operational costs

Stringent regulatory requirements for safety and certification

Challenges in integrating new fuel tank systems into legacy aircraft - Market Opportunities

Expansion of low-cost carriers in the region

Adoption of hybrid and electric aircraft requiring specialized fuel tanks

Growing demand for military aircraft upgrades and modernization - Trends

Shift towards composite and lightweight materials for fuel tanks

Focus on sustainable aviation fuel (SAF) and its impact on fuel tank design

Increase in military aircraft procurement and upgrades

- By Market Value 2020-2025

- By Installed Units 2020-2025

- By Average System Price 2020-2025

- By System Complexity Tier 2020-2025

- By System Type (In Value%)

Wing Tanks

Fuselage Tanks

Tail Tanks

Auxiliary Fuel Tanks

Bladder Tanks - By Platform Type (In Value%)

Commercial Aircraft

Military Aircraft

Business Jets

Regional Aircraft

Freight Aircraft - By Fitment Type (In Value%)

OEM Fitment

Aftermarket Fitment

Retrofitting

Fuel System Upgrades

Tank Repair & Maintenance - By End User Segment (In Value%)

Airlines

Military Forces

Aircraft Manufacturers

Freight Carriers

Government Agencies - By Procurement Channel (In Value%)

Direct Sales

Distributors

OEM Contracts

Third-party Procurement

Online Channels

- Market Share Analysis

- Cross Comparison Parameters (Price, Innovation, Market Penetration, Customer Service, Regulatory Compliance)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Detailed Company Profiles

Boeing

Airbus

Lockheed Martin

Northrop Grumman

Raytheon Technologies

General Electric

Safran

Collins Aerospace

Honeywell International

Rockwell Collins

Eaton Corporation

EADS

Goodrich Corporation

L3 Technologies

GE Aviation

- Airlines investing in fleet modernization

- Military forces upgrading existing aircraft

- Aircraft manufacturers focusing on fuel tank system innovation

- Freight carriers seeking cost-effective fuel management solutions

- Forecast Market Value 2026-2035

- Forecast Installed Units 2026-2035

- Price Forecast by System Tier 2026-2035

- Future Demand by Platform 2026-2035